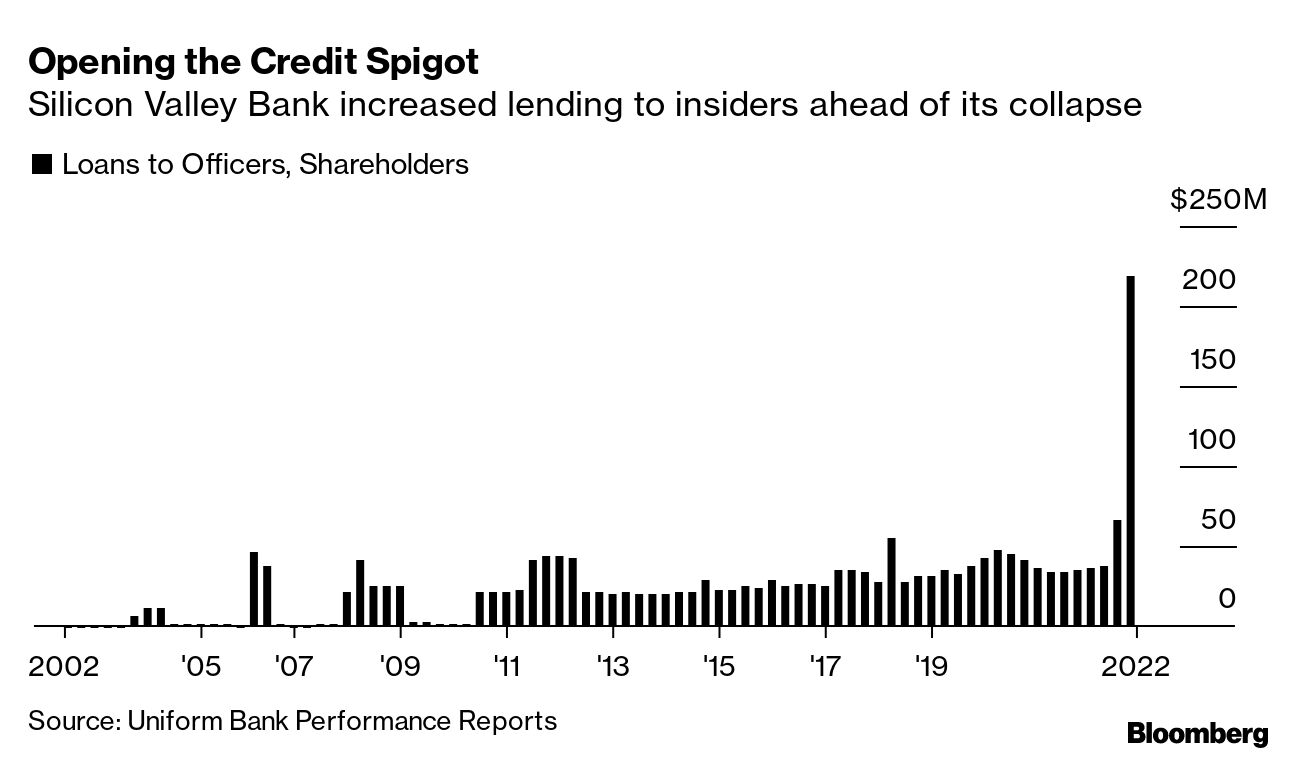

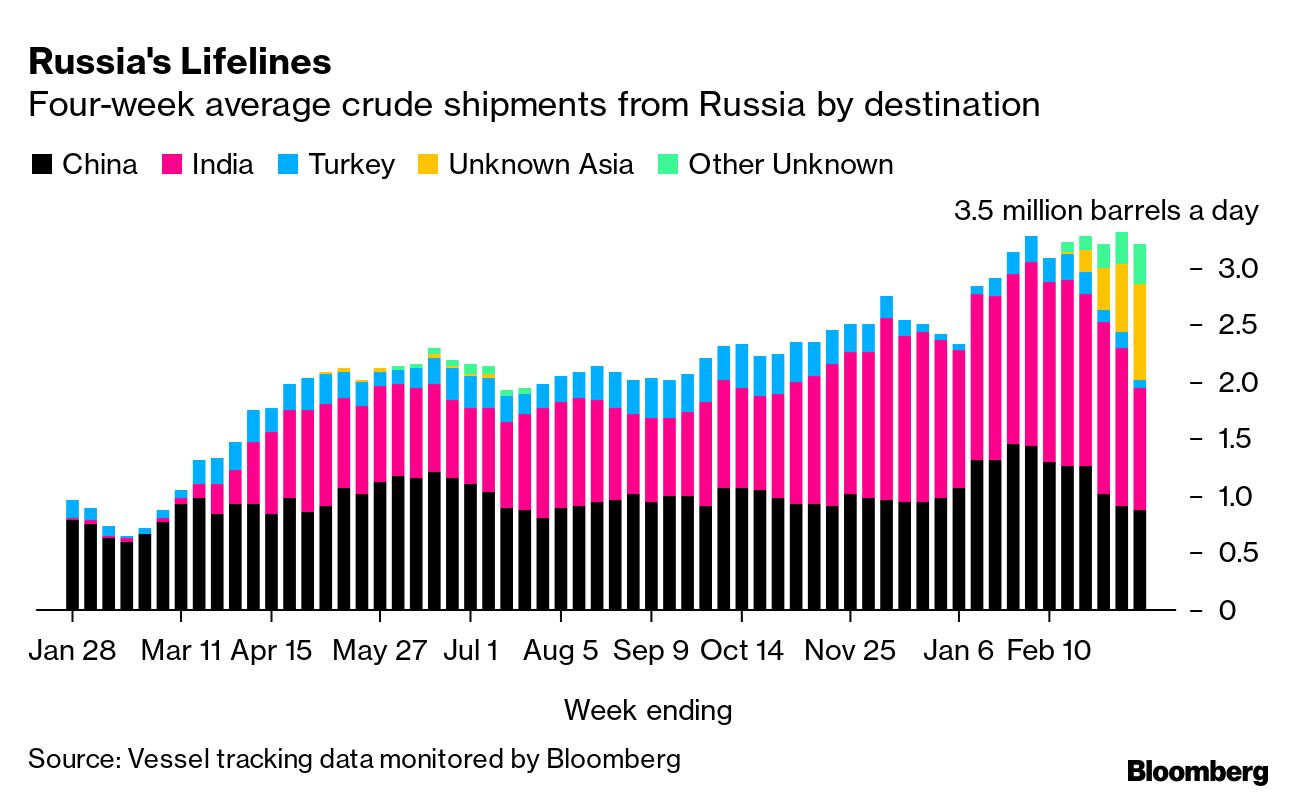

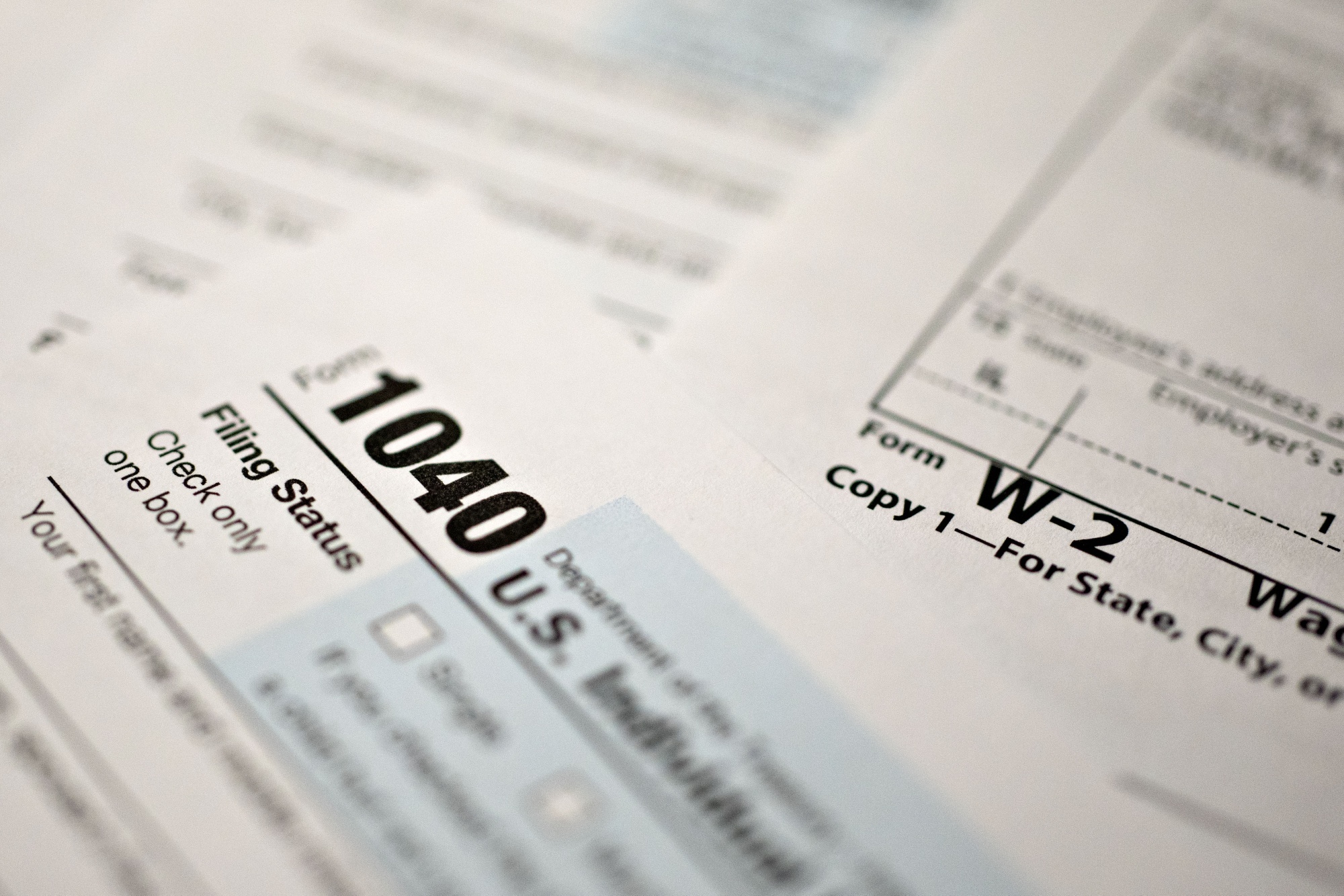

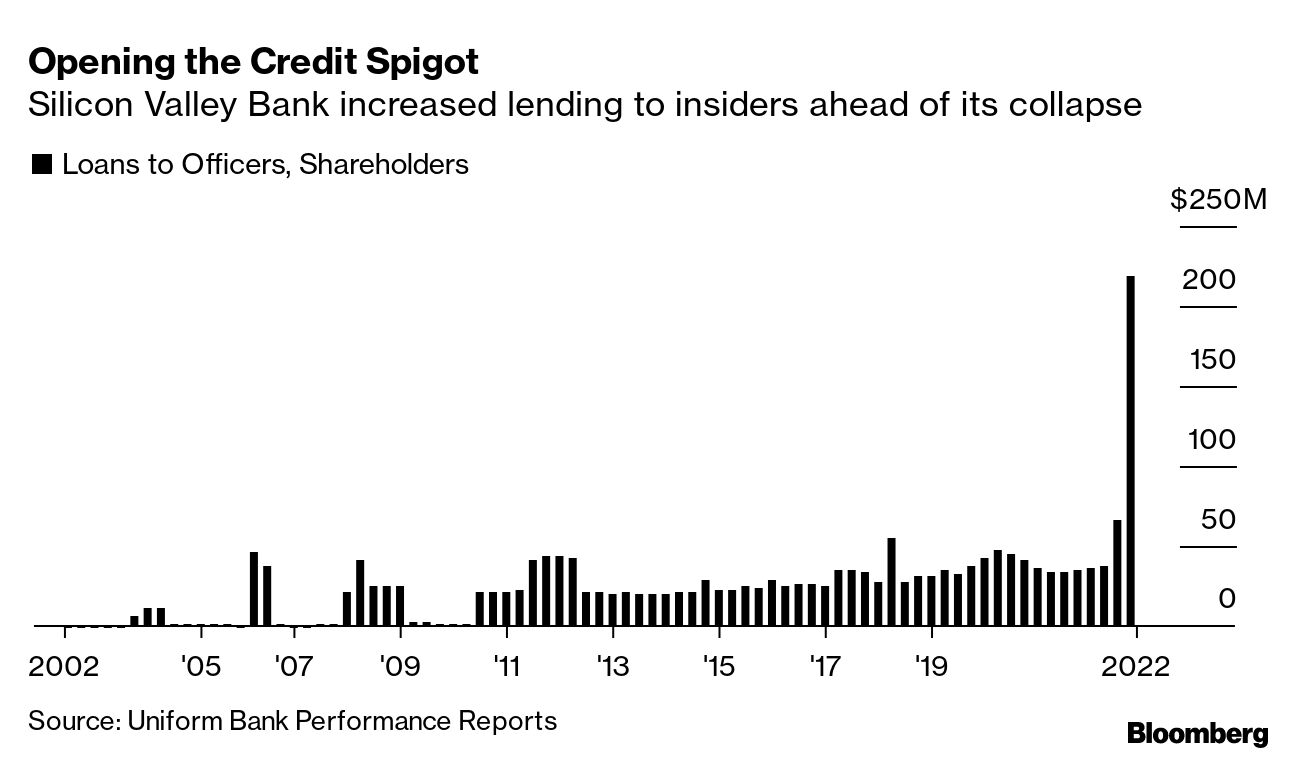

| Beleaguered First Republic Bank is refusing to be the fifth victim of the banking crisis, surging by a record and leading a rally in US lenders Tuesday. Behind the seeming turnaround were discussions aimed at offering further support to the regional bank, and a backup strategy should that fall through. The California lender’s stock jumped 30%, bouncing off the record-low level it closed at Monday, with fellow mid-size banks including Western Alliance and PacWest also staging double-digit moves higher. The KBW Regional Banking Index surged by 4.8% for its biggest gain since January 2021. —David E. Rovella But for others, things still look grim. Pacific Investment Management and Invesco are among the largest holders of Credit Suisse’s so-called Additional Tier 1 bonds that were wiped out after the bank’s takeover by UBS. Inside Credit Suisse, things aren’t much better: The Swiss government said it’s temporarily suspending some bonus payments. Currently the focus of a few investigations, it turns out now-deceased Silicon Valley Bank got very generous in its final months. As the lender deteriorated and regulators began detecting flaws in its risk management, SVB nevertheless opened up credit to one group: insiders. Loans to officers, directors and principal shareholders, and their related interests, more than tripled from the third quarter last year to $219 million in the final three months of 2022. That’s a record dollar amount of loans issued to insiders, going back at least two decades.  Wall Street’s favorite volatility gauge tumbled as a rebound in stocks continued Tuesday. Coordinated actions to restore order had the market’s so-called fear barometer, or VIX, taking its biggest two-day dive since May. In the run-up to the coming US Federal Reserve rate decision, traders are betting on another 25 basis-point hike as angst over what the central bank will do seems to be receding. “This is an easier market backdrop,” said Nicholas Colas, co-founder of DataTrek Research. “Expectations of a dramatic about-face for monetary policy are diminishing. Market expectations for near-term Fed rate decisions are now within the realm of the possible. That is good news.” But then again, the past two weeks have shown a lot can happen in a few days. Here’s your markets wrap. Ukraine won backing for some $15.6 billion in financing from the International Monetary Fund as part of a large-scale aid package, the first time the institution has agreed to lend to a nation at war in its 77-year history. Ukraine is also getting some US main battle tanks sooner. Six little-known companies emerged as new kings of Russian oil in December, collectively handling enough of the country’s exports to catapult them into the leagues of the world’s largest commodity traders. US sales of previously owned homes rose in February by the most since mid-2020, snapping a record year-long slide tied to rising interest rates and affordability constraints. Google is granting the public access to its competitor to ChatGPT, the conversational AI service it calls Bard. Bard is Google’s effort to make up ground lost to OpenAI in the artificial intelligence race. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. What’s worse than watching your mutual fund investments decline in value? Getting hit with a big tax bill for them. That’s the reality some Americans are facing this year as the deadline to file taxes approaches. “It’s the double whammy,” said Ben Johnson, head of client solutions for asset management at Morningstar. Here’s why your mutual funds may give you indigestion this tax season. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Transformation in a Time of Uncertainty: Join us in a city near you for Bloomberg’s Intelligent Automation briefing. Top business and IT executives are gathering to explore ways to offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. Roadshow cities include Chicago on April 13; New York on May 4; San Francisco on June 20; London on Sept. 20; and Toronto on Oct. 19. Register here. |