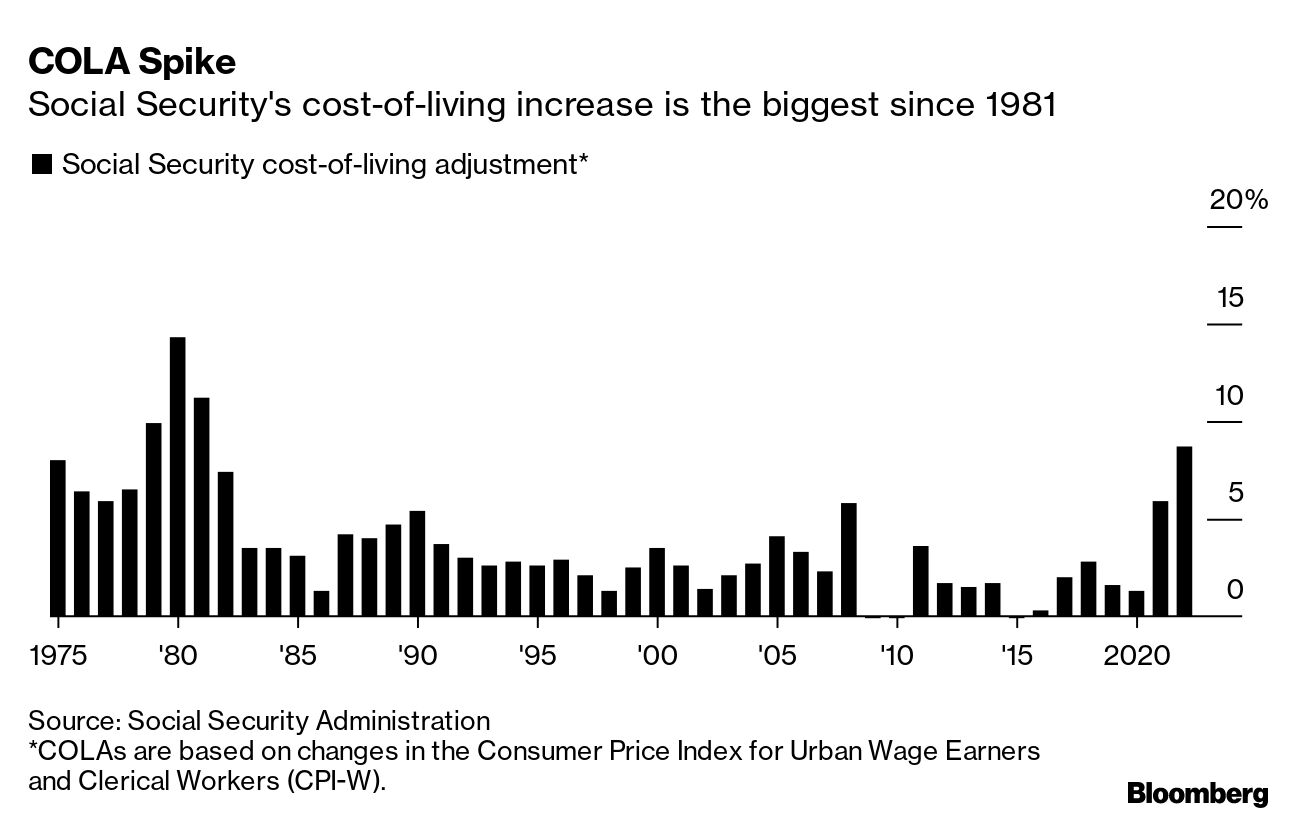

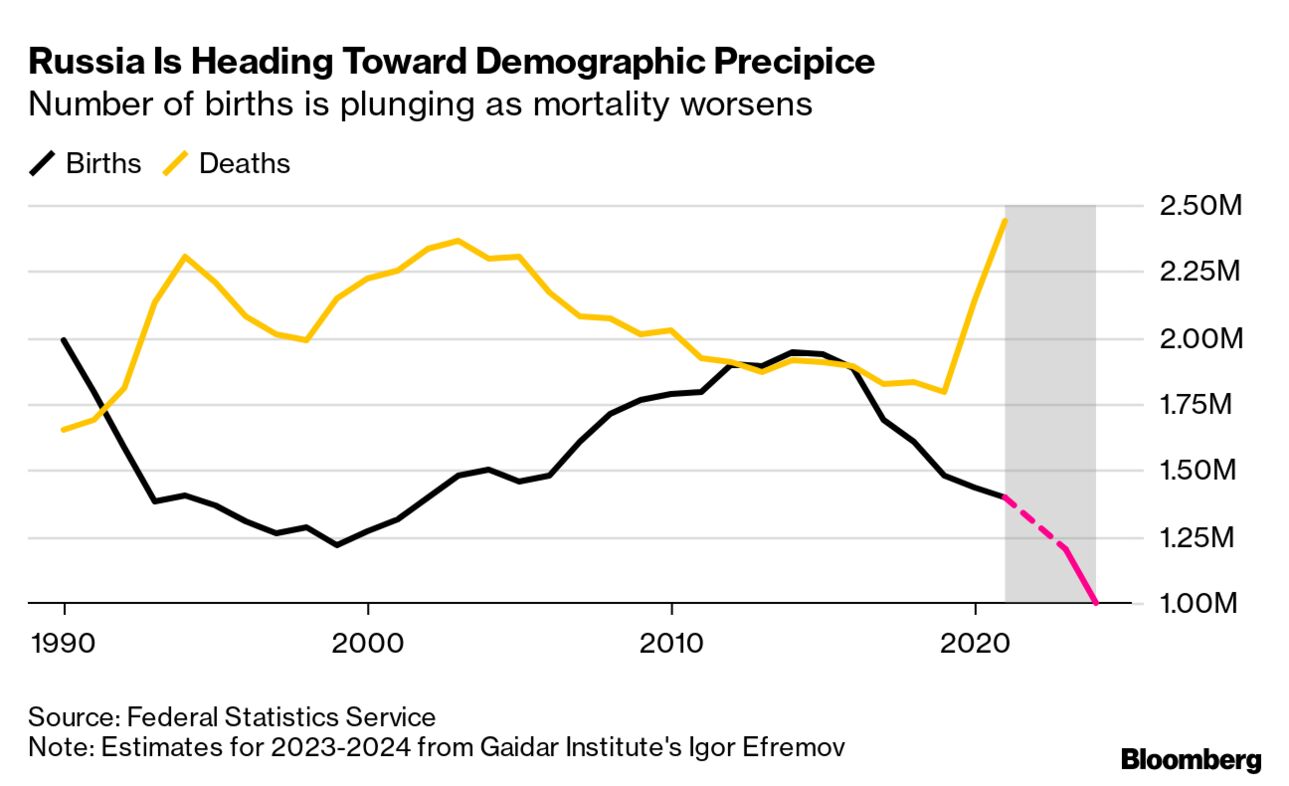

| Sometimes giving up is a good thing. The sentiment on stocks and global growth among fund managers surveyed by Bank of America “screams” what Wall Street tends to call full capitulation. As disquieting as the phrase may sound, it actually means the way will be open for an equities rally come 2023. The bank’s monthly global fund manager survey “screams macro capitulation, investor capitulation, start of policy capitulation,” strategists wrote in a note on Tuesday. They expect stocks to bottom in the first half of 2023 after the Federal Reserve finally pivots away from raising interest rates. —David E. Rovella Many Wall Street economists are still betting that US inflation will slow substantially over the next year even as they’ve been forced to keep raising their predictions in the near-term. With most having shared the Fed’s failure to predict the stubbornness of last year’s price pressures, these experts continue to be surprised by how much inflation is spreading. The US Senate plans to hold a hearing next month on Kroger’s planned $24.6 billion takeover of rival supermarket chain Albertsons. Minnesota Senator Amy Klobuchar and Utah Senator Mike Lee, the top Democrat and Republican on the Senate Judiciary antitrust panel, expressed “serious concerns about the proposed transaction.” Someone has to pay. The biggest increase to Social Security checks since 1981 was good news for US retirees. But it also served as a stark reminder that the program is expensive, with cuts to the critical American safety net looming unless it’s soon retooled. But alongside news of the benefit increase last week was a tax hike to pay for it, with the wages subject to the Social Security payroll tax set to rise almost 9% next year. Bill Gross pioneered the “total return” strategy in the 1980s that revolutionized the once-sleepy bond market. Now the co-founder of Pacific Investment Management, who was ousted in 2014, says many of the funds bearing the name are failing to live up to their mission after suffering heavy losses this year. Individual investors choose these funds for their 401K retirement accounts, “believing that they will produce a defensive return in times of stress,” Gross said. “They have been misled.” Ukrainian President Volodymyr Zelenskiy said almost one third of the country’s power stations have been destroyed in Russian strikes since Oct. 10, triggering blackouts, while a report showed the nation’s power grid has managed to hold steady. Kyiv’s mayor, Vitali Klitschko, said power and water supplies were partially restored. Earlier, he urged residents in the capital to conserve use as more critical infrastructure was damaged by Kremlin forces. In America, Republicans led by House GOP leader Kevin McCarthy say they plan to cut aid to Ukraine should they regain control of the chamber in the coming elections. Vladimir Putin spent years racing against Russia’s looming demographic clock, only to order an invasion of Ukraine that augurs another historic decline for his country. Besides Russian casualties mounting to potentially tens of thousands, a draft of several hundred thousand more and an even bigger flight of men seeking to avoid fighting have derailed Putin’s goal of stabilizing Russia’s population. Crippling disruptions from the war are converging with a 30-year-old demographic crisis for “a perfect storm.” Slogans attacking President Xi Jinping featured on banners draped over a Beijing bridge last week have spread to other Chinese cities. Phrases from the original handwritten signs criticized the strict lockdowns and restrictions that have defined Xi’s “Covid zero” policy, while also calling for his removal in favor of democracy. “We want food, not PCR tests. We want freedom, not lockdowns and controls. We want respect, not lies,” one of the banners read. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates.  |

Covid-19 has changed everything: how we live, work and play, educate our kids. And, it turns out, how vast wealth can be made—and lost—faster than anyone might’ve thought possible. The rollout of Moderna’s vaccine propelled scientist Stephane Bancel’s net worth to $15 billion. Eric Yuan watched his fortune hit $29 billion as Zoom became the world’s go-to video-conferencing tool. And the father-son duo behind online used-car seller Carvana amassed a $32 billion fortune. These men belong to an exclusive club of 58 billionaires whose wealth multiplied at an eye-popping pace thanks to the pandemic and cheap money—only to plummet even more quickly.  A Carvana Vending Machine location in Novi, Michigan Photographer: Emily Elconin/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg CEO Forum: CEOs and business leaders will convene on the sidelines of the G20 on Nov. 11 to discuss actionable solutions to the most pressing issues the world now faces to ensure responsible, inclusive and sustainable growth. Register here to secure your spot and join us in Bali or virtually. |