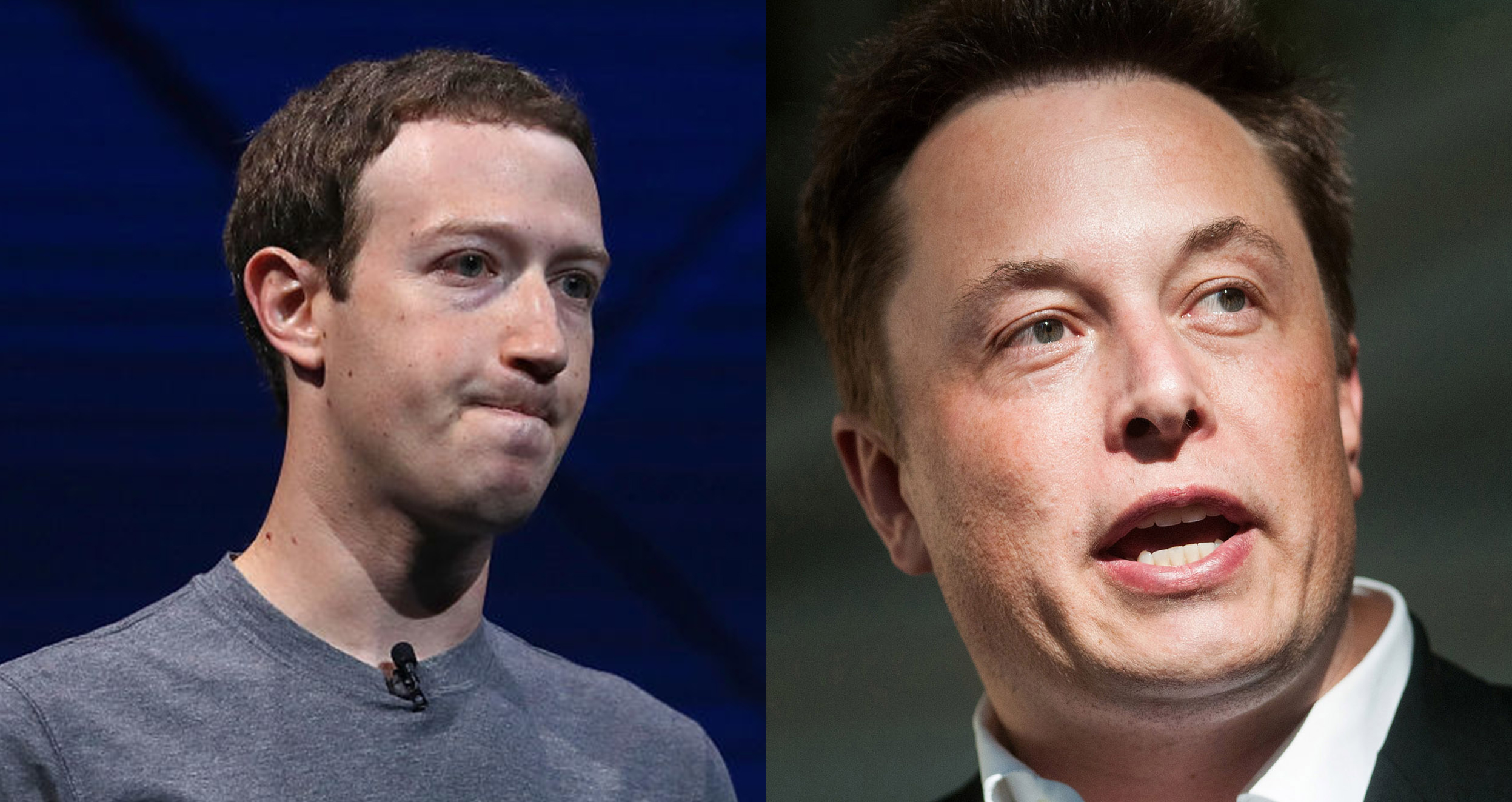

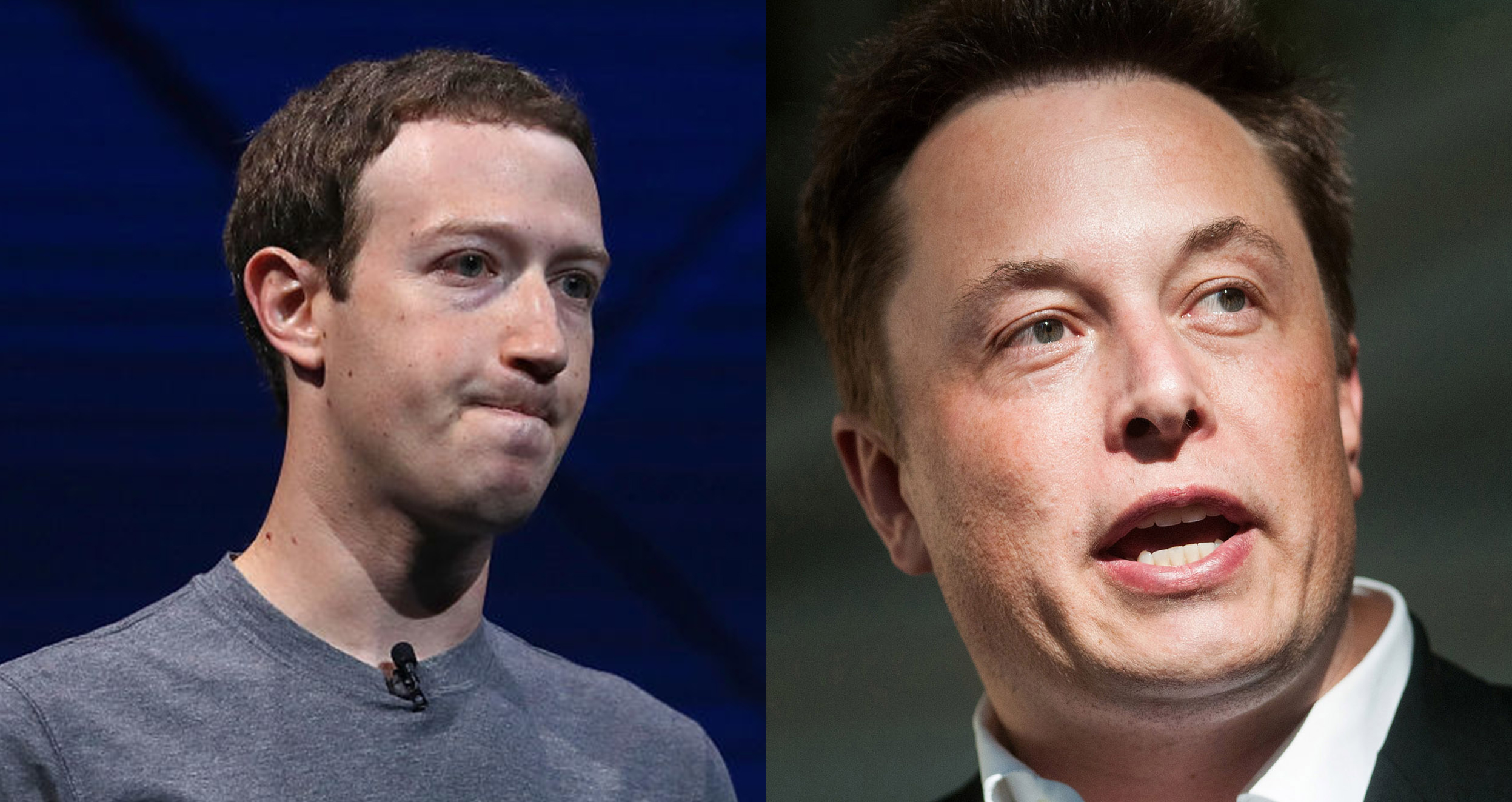

| It was just 24 hours ago when US House Speaker Kevin McCarthy and his adjutants were making positive sounds about negotiations to settle the potentially catastrophic standoff over raising the federal debt limit. He even said an agreement may be in sight. But on Friday, McCarthy’s negotiators turned tail and walked out on the talks, despite there not having been an obvious blowup, and the Speaker poured water on prospects for a deal while blaming President Joe Biden (who is in Japan at the Group of Seven summit). So what happened? No one can say for sure, but in between the two events, far-right members of McCarthy’s party (whose assent landed him his current post after 15 ballots) called for him to stop negotiating. Meanwhile, at the G7 meeting and around the world, concern is again mounting about the fallout that will result if the world’s largest economy succeeds in sabotaging itself. —David E. Rovella Unsurprisingly, the S&P 500 halted a two-day rally, failing to stay above the closely watched level of 4,200. Meanwhile the $3.2 billion SPDR S&P Regional Banking exchange-traded fund slumped almost 2% on a news report that Treasury Secretary Janet Yellen told the chiefs of large lenders that more mergers may be needed. Here’s your markets wrap. A recession will torpedo stocks. Or banking turmoil. Or a government default, or falling earnings, or a too-aggressive Federal Reserve. Doom-saying is never in short supply when stocks are rallying. Lately, it’s reached fevered levels. Could all the pessimism be revving up price action that just pushed the S&P 500 to its highest level in nine months? In the sometimes contrarian world of investing, stranger things have happened. James Gorman, who transformed Morgan Stanley after it nearly collapsed during the global financial crisis, plans to step down as chief executive officer within the next year and assume the role of executive chairman. Now comes the succession race. Gorman’s big strength when he became Morgan Stanley’s CEO was in setting small targets, Paul J. Davies writes in Bloomberg Opinion. More than a decade later, as he prepares to step back from the role, it is the bank’s steady progress from modest early steps that has made Morgan Stanley an investor favorite.  James Gorman Photographer: Hollie Adams/Bloomberg Bank of America strategist Michael Hartnett says sell US stocks. Tech and artificial intelligence are forming a bubble and the Fed’s rate hikes may not be over, he warns. Hartnett, who correctly predicted last year that recession fears would fuel a stock exodus, recommended selling the S&P 500 at 4,200—the index’s current level. Alibaba Group’s surprise move to fully spin out a potentially transformative $12 billion cloud business is stirring speculation about whether the Chinese e-commerce leader bowed to market or political realities. Italy won’t lose its investment-grade status at Moody’s Investors Service for now after the company chose not to issue a new assessment on one of Europe’s most indebted countries. It was a boost to Premier Giorgia Meloni’s government.  Giorgia Meloni, Italy’s prime minister, center, greets Japanese Prime Minister Fumio Kishida and his wife Yuko Kishida at the Hiroshima Peace Memorial Park during the Group of Seven leaders’ summit May 19. Photographer: Franck Robichon/EPA Instagram is planning to release a text-based app that will compete with Elon Musk’s troubled Twitter. The company, part of Mark Zuckerberg’s Meta, is currently testing the project with celebrities and influencers. The app, which will be separate from Instagram but will allow people to connect accounts, may debut as soon as June.  Mark Zuckerberg and Elon Musk Photographer: Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Invest Summit returns to New York, June 6-8. We will have influential leaders from Nasdaq, JPMorgan, the SEC, Franklin Templeton, the WMBA, Charles Schwab, Blackrock, Goldman Sachs and many more. Register now to secure your spot. |