*We expect the Fed to keep monetary policy unchanged, maintaining its Federal funds rate target at 0-0.25% at its September 15-16 FOMC meeting and reiterating that it will continue to purchase $80 billion per month in Treasury securities and $40 billion per month in mortgage-backed securities (MBS) to sustain smooth market functioning.

*We expect the Fed to revise its Policy Statement to reflect its longer-run strategy shift to “a flexible form of average inflation targeting” and a maximum employment goal that is broad-based and inclusive, reinforcing monetary ease for a prolonged period (Fed Shifts to “Flexible Form of Average Inflation Targeting”, August 27, 2020).

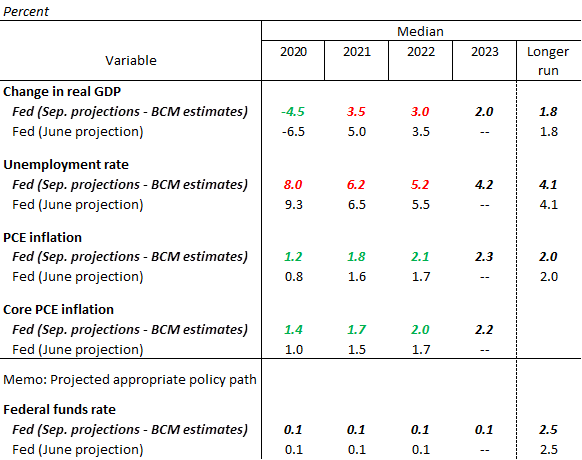

*The economy has rebounded more strongly than the Fed had earlier projected, and this will be reflected in modified language in its Policy Statement and in upward revisions in its updated quarterly Summary of Economic Projections (SEPs). The SEPs, which will be extended by one year to 2023, will include upward revisions for real GDP, higher inflation, and a lower unemployment rate. The median forecast for the appropriate Fed funds rate is likely to remain at 0.125% throughout 2023.

*No changes to the Fed’s Lender of Last Resort Facilities (LLRF), which are scheduled to operate through December 31, are expected.

Regarding the economy: Real GDP is rebounding faster than forecast in the June SEPs, so we expect the median FOMC forecast for 2020 (Q4/Q4) real GDP to be revised to a 4.5% decline from its June forecast of a 6.5% decline. The Fed’s forecasts for 2021 will be lowered to 3.5% from 5.0% and to 3.0% from 3.5% in 2022 (Table 1). These forecasts would imply that the Fed expects real GDP to attain its Q4 2019 level in 2022. We expect Fed officials to pencil in real GDP growth near its longer-run trend at 2.0% in 2023. Fed Chair Powell, in his press conference, will continue to emphasize the heightened uncertainties surrounding the economic outlook because of the virus and express support for additional fiscal support from the Congress.

Regarding unemployment: The unemployment rate has fallen from 13.3% to 8.4%, already below the Fed’s June SEP projection of 9.3% at year-end, so we expect the median FOMC unemployment rate forecasts for year-end 2020, 2021, and 2022 to be lowered materially to 8.0%, 6.2%, and 5.2%, respectively. We expect the Fed to forecast an unemployment rate of 4.2% at the end of 2023.

The Fed significantly reinterpreted its employment mandate in its updated “Statement on Longer-Run Goals and Monetary Policy Strategy” to be broader, asymmetric, and dovish. The Fed’s goal is now “maximum inclusive employment,” and it seeks to mitigate “shortfalls” of employment from its assessment of the maximum level compared to its previous goal to mitigate “deviations” of employment from the maximum level. The Fed continued to reiterate that employment is influenced by many factors that are beyond the Fed’s control. The Fed acknowledged that the Phillips Curve is flat — that is, there is no trade-off between employment and inflation (the Fed is decades late in making this observation). Since the Financial crisis of 2008-2009, the decline in the unemployment rate to a 50-year low, and historically low unemployment rates for minority groups, while inflation remained sub-2%, contributed to this change in the Fed’s objective. The Fed’s acknowledgment of a flat Phillips Curve also led the Fed to abandon its historic approach to pre-emptive monetary tightening in anticipation of higher inflation. This is a significant change in the Fed’s conduct of monetary policy.

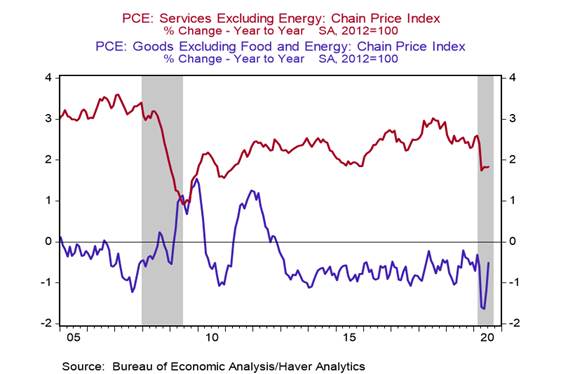

Regarding inflation: Headline and core PCE inflation (yr/yr) have already risen to 1.0% and 1.3%, above the Fed’s Q4 2020 forecasts of 0.8% and 1.0%, respectively. Core goods deflation has moderated and returned to its prior average, while core services inflation remains depressed, mirroring economic trends (Chart 1). Accordingly, we expect the updated SEPs to project gradually rising inflation in 2020, 2021, and 2022, with headline PCE inflation forecasts of 1.2%, 1.8%, and 2.1%, and core PCE inflation forecasts to increase to 1.4%, 1.7%, and 2.0%. These are all material increases from the June SEPs, but they remain moderate, and do not test the Fed’s new flexible average inflation targeting in which the Fed aims for above 2% inflation following a period of inflation shortfall. We expect the Fed to project increases in headline and core PCE inflation to 2.3% and 2.2%, respectively, at year-end 2023. Since the Fed established 2% as its inflation target in January 2012, inflation has been mostly below 2%. The Fed’s new flexible form of average inflation targeting is a “make-up strategy,” which suggests it favors inflation above 2% for years to come. The Fed is likely to project inflation slightly above 2.0% in its updated forecasts, in support of this new strategy.

While the Fed has adopted its new flexible average inflation targeting (AIT), its framework is lacking sufficient details to understand how far above 2% inflation the Fed aims to achieve or for how long. Moreover, while the Fed has abandoned the Phillips Curve, it has not replaced it with any framework for forecasting inflation. Accordingly, while the Fed’s inflation framework involves a “make-up strategy,” it does not indicate how it intends to raise inflation (or why its aggressive monetary easing following the financial crisis failed to lift inflation to 2%).

Fed Vice Chair Richard Clarida tried to clarify the Fed’s strategy on inflation in a recent speech: “To be clear, ‘inflation that averages 2 percent over time’ represents an ex ante aspiration, not a description of a mechanical reaction function — nor is it a commitment to conduct monetary policy tethered to any particular formula or rule.” According to this interpretation, the Fed aspires to achieve 2% inflation —and presumably anchor inflationary expectations to 2% — but the mechanics of the AIT does not provide any numeric guidelines for achieving that aspiration.

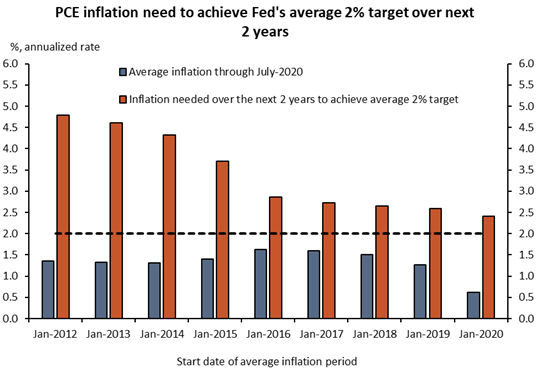

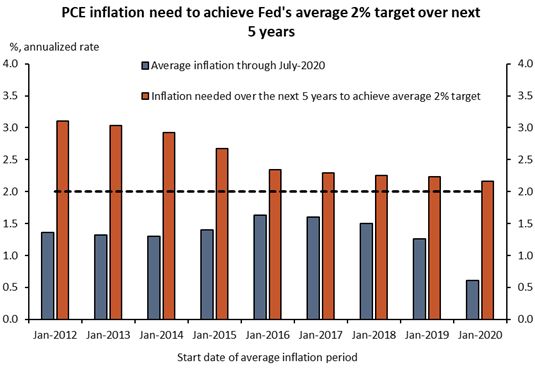

Indeed, calculations of the rate of future inflation needed to achieve a 2% average “over time” yields varying results, depending on the start and end dates for the period in which inflation is being averaged. For example, headline PCE inflation would need to average 4.8% annualized over the next two years in order to achieve 2% average inflation between the January 2012 to July 2022 period. It would need to average 3.1% annualized over the next five years in order to achieve 2% average inflation between the January 2012 to July 2025 period. In reality, would the Fed tolerate inflation above 3% to fulfill its make-up strategy? How would markets respond? The Fed’s policy is very discretionary, but its new approach makes clear that it wants inflation forecasts to exceed 2% in the coming years. See Charts 2 and 3 below.

The Fed funds rate: Consistent with the Fed’s shift to a flexible form of average inflation targeting, we expect the median Fed member forecast for the Fed funds rate to remain at 0.125% through the end of 2023. The Fed’s monetary policy will remain ultra-easy in an attempt to support maximum and inclusive employment, until — and after — inflation and inflationary expectations rise well above 2%: that is, until they become a problem. Again, it is important to emphasize that the Fed has formally abandoned pre-emptive monetary tightening in response to forecasts of higher inflation.

Policy statement. The Fed will need to revise portions of its Policy Statement to reflect its updated longer-run strategy. Given that the Fed now perceives the Phillips Curve as flat until proven otherwise, and its focus on mitigating shortfalls of employment from its maximum level, the Fed funds rate will likely remain at its effective lower bound (ELB) beyond the point where it appears the Fed is “on track” to achieve its dual mandate employment and inflation goals. As such, we expect the Fed to revise the phrase highlighted below:

“The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

Additionally, the Fed will replace the phrase “symmetric 2 percent inflation objective” with some variation of “inflation that averages 2 percent over time.”

“In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.”

We do not expect the Fed to tie the Federal funds rate to specific inflation outcomes, unemployment rate outcomes, or calendar-based guidance in its September FOMC Post-Meeting Statement.

Table 1: Expected Changes in the FOMC’s median economic projections (SEPs) and Appropriate

Federal Funds Rate in September from June

Sources: Federal Reserve Board and Berenberg Capital Markets

Chart 1:

Chart 2:

Sources: Bureau of Economic Analysis and Berenberg Capital Markets

Chart 3:

Sources: Bureau of Economic Analysis and Berenberg Capital Markets

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com