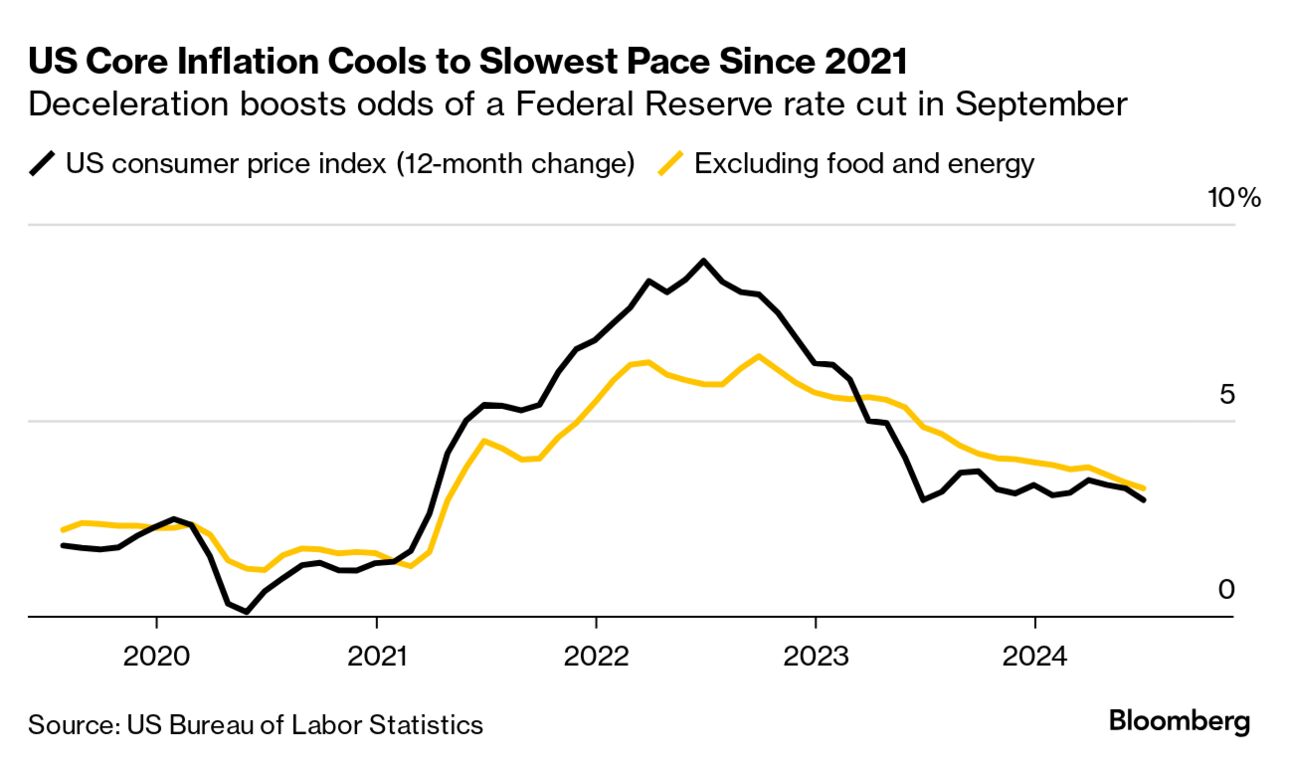

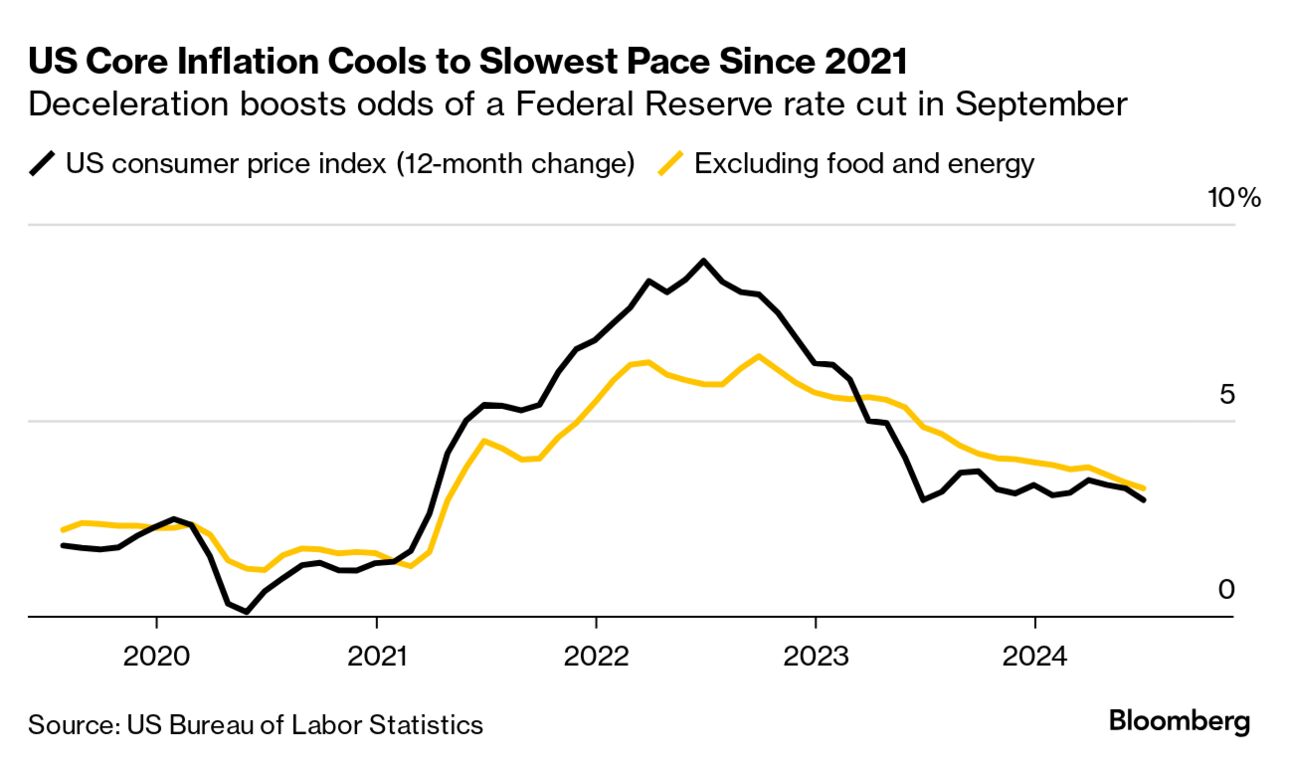

| Expectation is growing on Wall Street, and not the usual parsing of bits of data and the wishful thinking that follows. The numbers are really looking solid—rate cuts may be coming soon. US inflation cooled broadly in June to the slowest pace since 2021 on the back of a long-awaited slowdown in housing costs. The so-called core consumer price index (which excludes food and energy costs) climbed 0.1% from May, the smallest advance in three years. The overall measure fell for the first time since the onset of the pandemic, dragged down by cheaper gasoline.  With Federal Reserve Chair Jerome Powell expressing optimism that the uptick in inflation earlier this year was just a speed bump, the June reading will likely go a long way toward giving him and his colleagues the confidence they need to cut rates, likely starting in September. Policymakers will have a chance to signal such a move when they meet later this month, especially since unemployment has now risen for three straight months. “We are sufficiently confident—even if the Fed is not yet ready to admit they are—that inflation is on the way back to the 2% target,” Joseph Brusuelas, chief economist at RSM US, said in a note. “The road is now open to a rate cut.”—David E. Rovella Inside Ken Griffin’s Citadel Securities, a new strategy for handling even more of Wall Street’s trading is starting to take shape—with implications for struggling banks and brokerages around the world. The goal is to offer such firms a white-label trading service: They can deal with their customers while Citadel manages the guts of their trading desks, including technology, analytics and order execution. The nascent plan could be pitched as a solution for units where profits are getting eroded by stiffer capital rules, competitive pressures to lower fees and the need to make costly upgrades. Firms including Deutsche Bank have responded to narrowing margins in stock trading in recent years by shuttering some desks, ceding market share to top players such as JPMorgan and Goldman Sachs. US and German security services foiled a Russian plot to assassinate the chief executive of Rheinmetall, a German arms manufacturer producing weapons for Ukraine. US intelligence officials who uncovered the scheme informed German security services, which thwarted it. Rheinmetall CEO Armin Papperger was given special protection as a result.  Armin Papperger Photographer: Liesa Johannssen/Bloomberg Pfizer is moving forward with a weight-loss pill of its own as it seeks to mount a comeback from its post-pandemic slump. On Thursday, Pfizer reported long-awaited results from a 20-person study of an anti-obesity pill that previously ran into trouble because of side effects. In the new study, Pfizer tested four versions of the treatment as a once-daily pill instead of twice-daily, with the aim of finding one that generates sufficient weight loss without the side effects that caused people to stop taking it. Sally Jewell, who served as US Interior secretary from 2013 to 2017, said the climate stakes of the election in November “could not be higher” and that she’s “afraid for the future of our planet” should Donald Trump return to the White House. “I can’t say enough about the importance of continuing the progress that has been made over the last three years” on climate change, Jewell told attendees at the Bloomberg Green Festival in Seattle on Thursday. She noted specifically passage of President Joe Biden’s massive Inflation Reduction Act and the bipartisan infrastructure bill.  Sally Jewell at the Bloomberg Green Festival on July 11. Photographer: Jason Redmond With Biden still under scrutiny two weeks after his disjointed performance on the debate stage, the maelstrom is beginning toengulf his wife. Jill Biden has gone beyond the role of protector-in-chief, Mary Ellen Klas writes in Bloomberg Opinion. With the 81-year-old Biden’s physical decline and his resistance to calls that he drop out of the race against Trump, 78, the first lady has become the most important person in the White House next to her husband, Klas writes. Tesla is postponing its planned robotaxi unveiling to October to allow teams working on the project more time to build additional prototypes, in yet another setback for the company’s co-founder Elon Musk. The voluble billionaire had set the initial Aug. 8 date for the event months ago, and optimism about the spectacle has contributed to an 11-day streak of gains that added more than $257 billion to Tesla’s market capitalization. So much for that: The stock closed 8.4% lower on Thursday, its largest drop since January. Saudi Arabia is likely to cut billions of dollars in spending on some of its biggest development projects as the kingdom grapples with the scale of its vast economic makeover. A government committee led by the de facto Saudi ruler, Crown Prince Mohammed Bin Salman, is close to completing a sweeping review of mega projects including the sprawling desert development known as Neom. Being developed on the Red Sea coast, Neom is expected to be allocated 20% less than its targeted budget.  Neom project renderings Photographer: Stefan Wermuth/Bloomberg The Mezz.1 putter from LAB Golf isn’t a thing of beauty—it looks like a trapezoid in the midst of an identity crisis. Maybe something a designer might have dreamed up after an especially fruitful visit to a dispensary. But don’t be fooled: This ugly duckling is responsible for one of the most innovative changes in the game since metal drivers. Here’s why.  The Mezz.1 putter from LAB Golf Photographer: Joyce Lee Bloomberg Power Players: Bringing together leaders at the intersection of sports, business and technology, this half-day experience at Bloomberg headquarters in New York on Sept. 5 will deliver exclusive perspectives on innovations and strategies disrupting the industry landscape. Join us for forward-thinking conversations, forge strategic partnerships and gain insight that will empower you to stay ahead of the game. Get your discounted passes now. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |