|

Today’s letter is brought to you by REX Shares!

Whether you're bullish 🐂 or bearish 🐻 on MicroStrategy, T-REX ETFs are your gateway to dynamic market plays. Get exclusive access to leveraged exposures with the first ETFs designed specifically for MicroStrategy stock.

To investors,

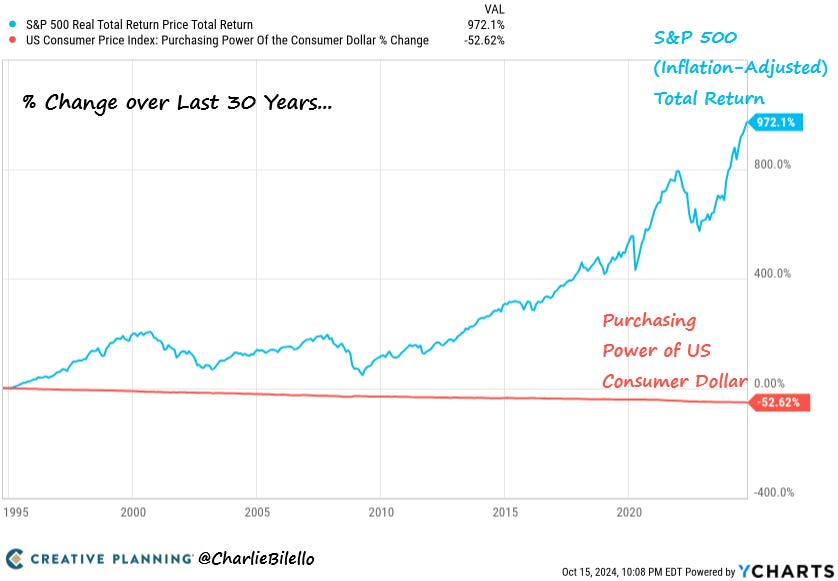

Creative Planning’s Charlie Bilello posted this eye-opening chart earlier this week. It is probably one of the most important visualizations in finance.

“Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the S&P 500 has gained 972% (8% per year) after adjusting for inflation.”

This is insane to think about — a 50% drop in the US dollar purchasing power in a single generation. It is obviously difficult for anyone to protect their hard-earned economic value if the native currency is devalued at such a rapid pace.

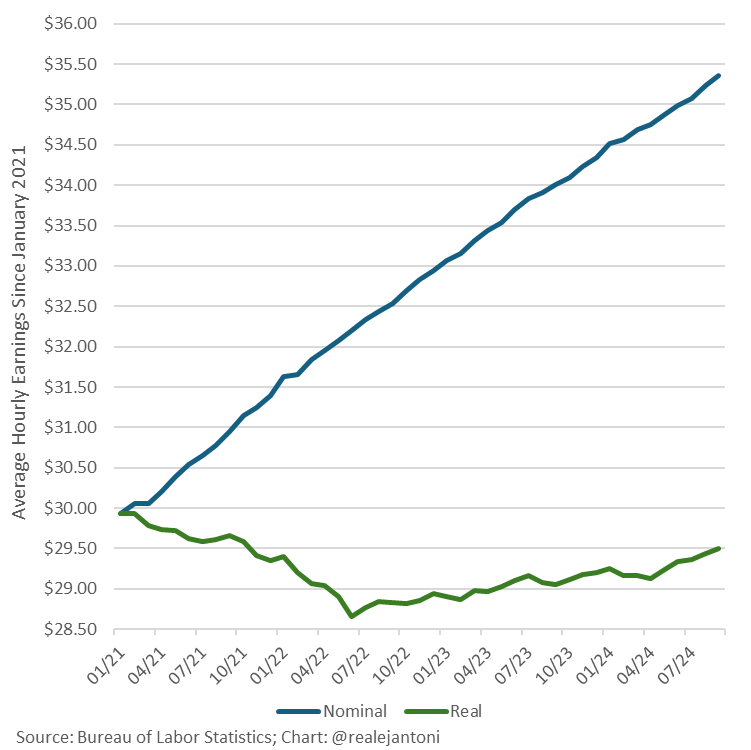

As if that was not bad enough, Heritage’s EJ Antoni explains what is happening on an hourly wage basis:

“The average hourly wage has risen $5.30 since Jan '21 but has fallen 49 cents after adjusting for inflation; you're getting paid more but can buy less - consider the $5.79 difference to be your hourly “inflation tax.”

Add in the fact that some goods and services are still skyrocketing and you can see why the problem is getting worse for many people. Ivory Hill’s Kurt Altrichter highlights the following increases:

Sunflower Oil: +30%

Natural Gas +25%

Propane: +25%

Iron Ore: +23%

Sugar: +20%

Beef: 19%

Rubber: +16%

Steel: +15%

Oats: +14%

Palm Oil: +13%

Zinc: +13%

Naphtha: +12%

Nickel: +12%

Tin: +10%

Aluminum: +9%

These data points are hypothetical sucker punches to the financial health of every American citizen. It shouldn’t surprise anyone that tens of millions of these people are seeking out a different store of value.

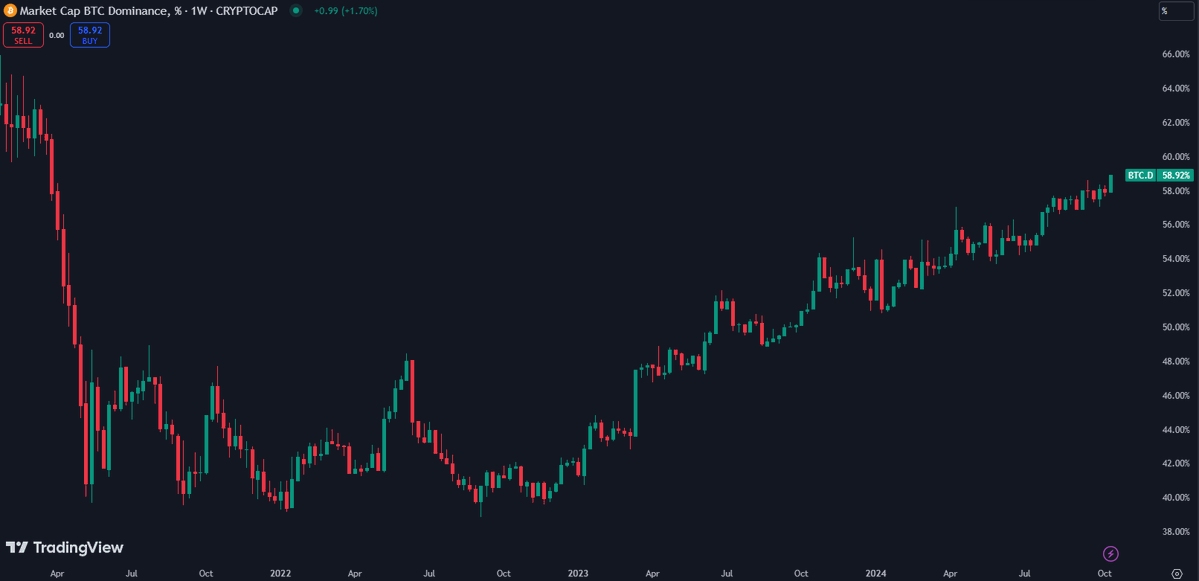

Bitcoin’s market dominance just hit a new cycle high of nearly 59%. This reiterates the point that investors are choosing to pour more capital into bitcoin than other crypto assets.

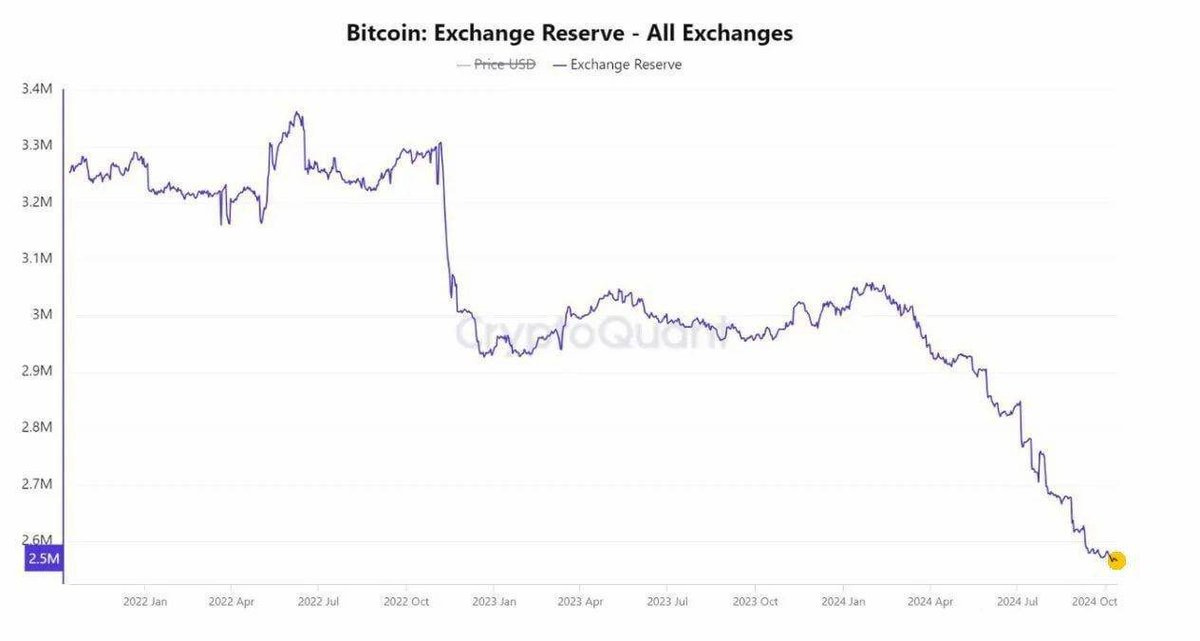

Investors are not only buying bitcoin, but they are taking the bitcoin off exchanges. Marty Party explains that “bitcoin reserves on centralized exchanges hits all-time low.”

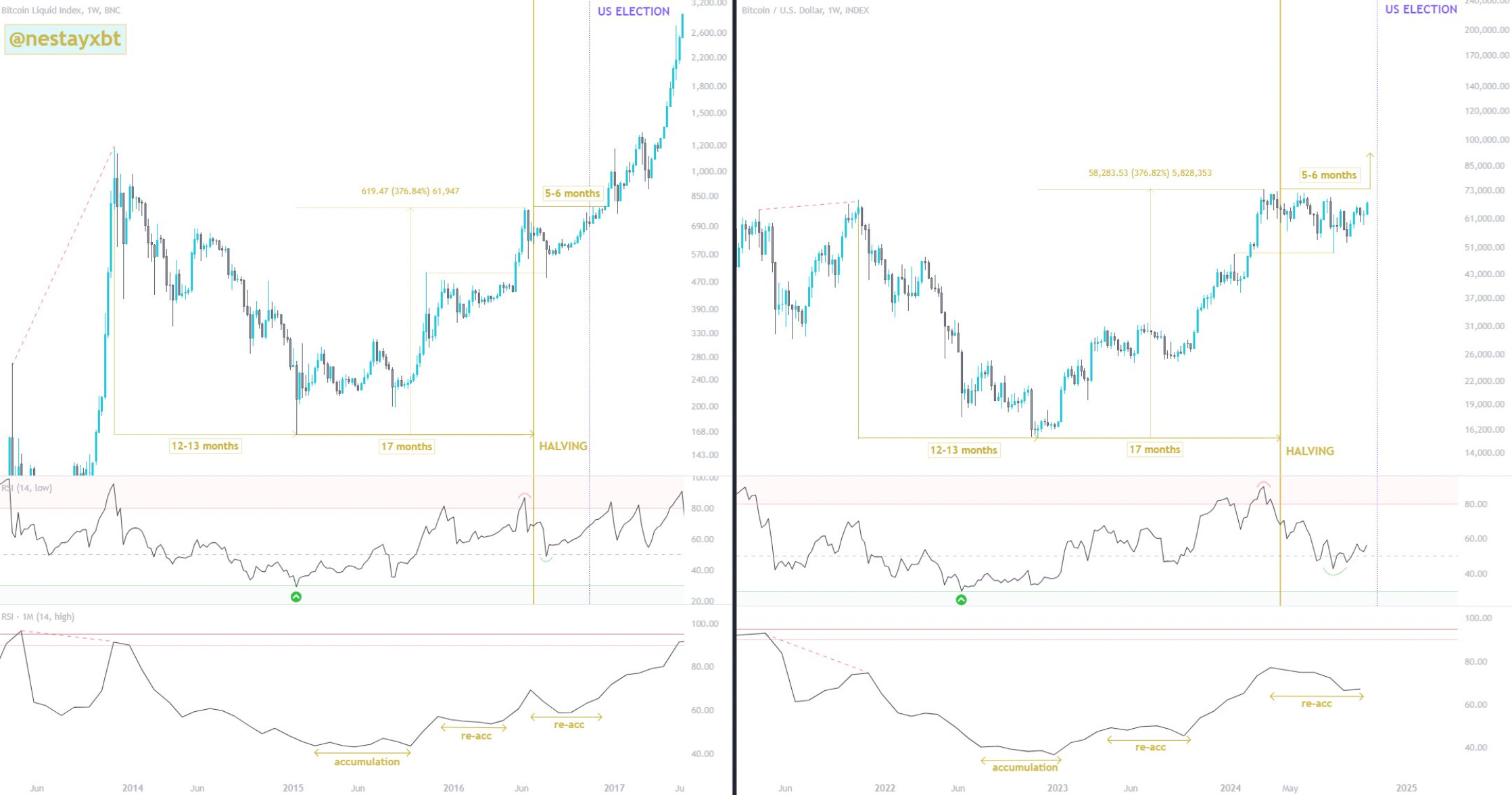

Lastly, Nestay and other crypto analysts have been pointing out the similarities between the 2016-2017 bull market and the current 2024-2025 bull market.

I am highly skeptical of these chart comparisons, especially when they selectively pick different bull markets to compare to each other. I do think they are important to be aware of though because they suggest what is possible more than what is actually going to happen.

We are entering a very interesting time for bitcoin — the asset is starting to price in the bitcoin halving that occurred earlier this year, interest rates are being slashed around the world, M2 money supply is expanding, investors are becoming more bullish, and there is a 50/50 chance that former President Trump comes into office to enact various policies aimed at pushing asset prices higher.

Put all this on the backdrop of where we started this letter — the US dollar has lost 50% of its purchasing power over the last 30 years and the average hourly wage is down after adjusting for inflation — and it becomes easy to see why bitcoin is the trade for an entire generation.

The next few weeks should be fun.

Hope everyone has a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 Talk or Hang Out With Anthony Pompliano 🚨

I want to meet you.

In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

Buy 25 Books: We will have a 30 minute video call to discuss anything you want.

Buy 100+ Books: I will speak virtually at your event or company meeting.

Buy 500+ Books: I will speak in-person at your event or come to your office.

Buy 1000+ Books: You get to spend an entire day with me in-person, including breakfast, lunch, and dinner. I will also speak at your event or to your team.

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books.

Here is how it works:

You reply to this email with the receipt or screenshot.

I will send you potential days/times for the call, meeting, or visit.

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well.

My CNBC Appearance From This Morning

I spoke to CNBC’s Squawk Box about bitcoin being the modern savings account and stablecoins being the modern checking account. This framework will make it easier to see why bitcoin and the US dollar complimentary moving forward. All boats rise together in this scenario.

Enjoy!

Podcast Sponsors

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.