| Shocking Underperformance Leads to a New Stealth Bull Market | | By Dr. Steve Sjuggerud | | Thursday, February 2, 2017 |

| A "stealth" bull market is now underway in Europe – and your potential upside is far greater than you can imagine.

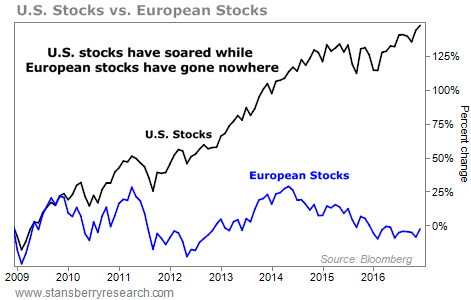

Since the end of 2008, U.S. stocks are up roughly 150%… But European stocks have been completely left behind.

You might ask, "If that's the case, then why should we care about owning European stocks today? Why shouldn't we just buy U.S. stocks and forget about Europe?"

It's because the situation today is so extreme…

We've never seen European stocks left so far behind the U.S. And based on history, this extreme underperformance sets us up for significant upside.

Let me explain…

----------Recommended Link---------

---------------------------------

To set the stage, take a look at just how dramatically Europe has underperformed the U.S.:

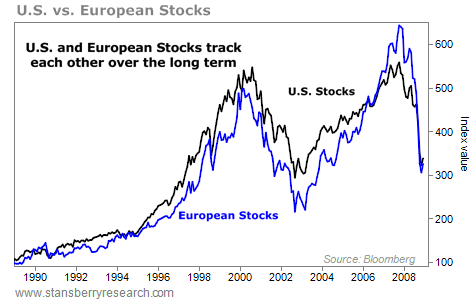

This underperformance is even more shocking when you realize that U.S. and European stocks basically tracked each other for the preceding 20 years:

But does this matter? Is there a path to profit from this? Yes… because after extremes much smaller than this one, history shows that huge gains have followed.

Take a look…

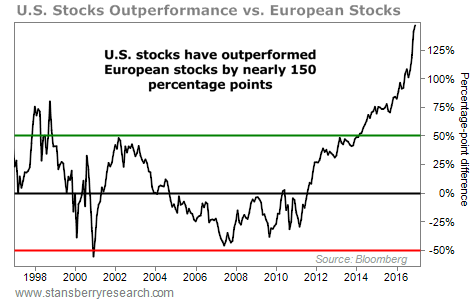

This next chart shows the rolling eight-year performance difference between U.S. and European stocks.

Here's how it works: If U.S. stocks return 100% over eight years and European stocks return 50%, the chart would show a 50% reading… And U.S. stocks would have outperformed by 50 percentage points in that case.

History shows that a 50 percentage-point difference is a typical extreme. But today, U.S. stocks are outperforming by roughly 150 percentage points…

We're in uncharted territory today. The outperformance in U.S. stocks has never been anywhere near this large. But history's less-extreme examples point to big gains ahead in European stocks.

For example, the last time the U.S. outperformed by nearly 50 percentage points over eight years was in 2002. What happened next? A massive multi-year bull market in European stocks…

If you'd waited for the uptrend before buying, then you would have bought European stocks in mid-2003. By late 2007, you would have made 172% gains. U.S. stocks returned just 74% over the same period.

A similar opportunity appeared in late 1998… That time, European stocks jumped 64% in 18 months.

Today's opportunity is more extreme than either of those cases. Europe is starting from a lower base, so your upside could be greater.

European stocks don't have to soar for this extreme to go away. Europe just needs to outperform the U.S.

That could happen one of two ways… 1) if Europe soars higher, or 2) if Europe simply falls less than the U.S. falls.

We don't want to buy European stocks solely because they've underperformed. When you dig a bit deeper, you realize that Europe offers exactly what I want to see in a trade… European stocks are 1) cheap, 2) hated, and 3) in the start of an uptrend.

With the setup we have today, we could potentially see a mid-2000s type of bull market – when European stocks soared 172% in just a few years.

Europe is not on most people's radar – and that's just the way I like it. Don't wait… Consider taking a position in European stocks today.

Good investing,

Steve |

Further Reading:

"Yet another stealth bull market is underway right now... And it's one you don't want to miss," Steve writes. In a recent essay, he explains why investing in China could lead to hundreds-of-percent gains – and why now is the best time to get in. Learn more about the safest way to take advantage of this opportunity right here. "The British pound is hated today," Steve writes. "And now, after a huge one-day move, it looks like we may have the start of an uptrend... " It can take time, but when a hated investment starts turning around, you can set yourself up for the perfect opportunity. Read more about this low-downside, high-upside trade right here. |

|

A TECHNOLOGY THAT CHANGED OUR LIVES

Today's chart highlights a technology that powers our interconnected world... Regular readers know we are always looking for big secular trends to invest in. Since the invention of the personal computer and the cellphone, the need for semiconductors has been growing... These little devices power most of the electronics we use today. And with the rapid growth of smartphone users around the world, it's clear that "semis" are fueling a dominant, thriving tech trend... You can see this concept at work with the iShares PHLX Semiconductor Fund (SOXX). The fund tracks a basket of semiconductor stocks like Nvidia (NVDA), Broadcom (AVGO), and Micron Technology (MU). SOXX shares have soared in recent years. As you can see in the chart below, they're up more than 160% since 2012, and they just hit new all-time highs. Secular shifts aren't easy to spot early on... But if you find a game-changing technology or a big new trend, hold on for the ride... |

|

| What's driving the markets in 2017... Dave Eifrig was bullish on stocks in 2016. Here is his take on today's market... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

For New Year's, the OneBlade 2.0 is here. Get 30% OFF the OneBlade Luxury Shave Set... including FREE shipping, a 100% money-back return policy – plus nearly $200 worth of FREE gifts! Get the details here. |

| How to Make Your Most Important Wealth Decision in Minutes | | By Dr. David Eifrig | | Wednesday, February 1, 2017 |

| | Asset allocation can seem boring and complex (though it doesn't need to be). But it's the most important factor in your retirement-investing success... |

| | Why You (Unfortunately) Can't Trust Your Broker | | By Dr. Steve Sjuggerud | | Tuesday, January 31, 2017 |

| | This makes me so mad, I want to scream... I recommended a simple investment. Nothing exotic about it at all... |

| | Dow 20,000 – Don't Chicken Out! | | By Dr. Steve Sjuggerud | | Monday, January 30, 2017 |

| | Don't make a big mistake, my friend. Don't chicken out! |

| | Stocks Around the World Are Soaring to New Heights | | By Justin Brill | | Saturday, January 28, 2017 |

| | After several weeks of unsuccessful attempts, the Dow Jones Industrial Average finally broke 20,000... |

| | Yet Another Great Opportunity That Nobody Is Talking About | | By Dr. Steve Sjuggerud | | Friday, January 27, 2017 |

| | Yet another stealth bull market is underway right now... And it's one you don't want to miss... |

|

|

|

|