| The surge in Nvidia shares on Thursday has left short sellers with about

$3 billion in paper losses, according to an analysis by S3 Partners LLC, which called it an “AI generated nightmare” for bearish traders. The mark-to-market losses are another blow for contrarians who argued that Nvidia’s sky-high valuations and speculative fever had all the makings of a market bubble. The chipmaker is the third-largest US short with $18.3 billion of shares that have been borrowed and sold. For a lesson in the perils of being a skeptic on Wall Street when everyone else is a buyer, consider Rob Arnott, who made the case five months ago that Nvidia had become a bubble. “A textbook story of a Big Market Delusion” is how the founder of Research Affiliates called it, citing extreme valuations after the shares quadrupled in just a year. Since his September warning, however, that “bubble” has gotten around $800 billion bigger—and the greatest risk right now is getting left behind in its wake. —David E. Rovella Nvidia is on track to become the first semiconductor firm with a

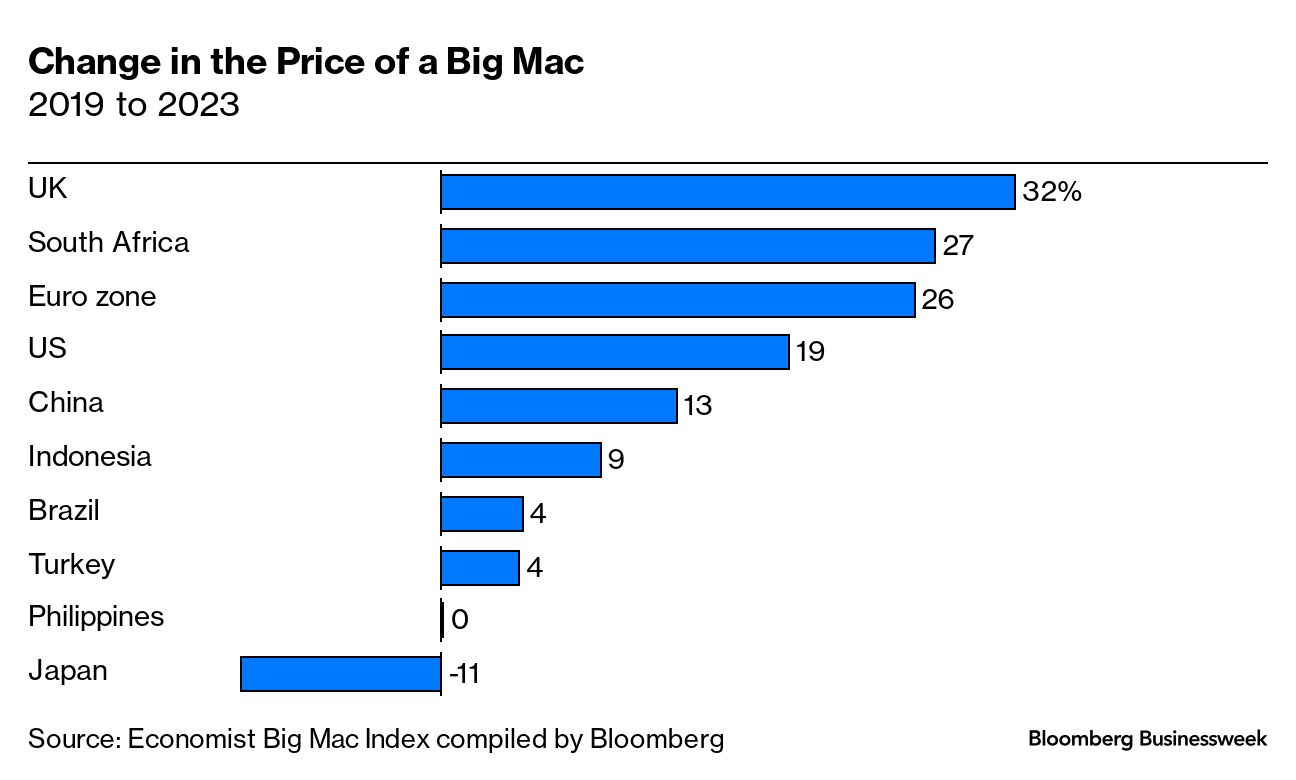

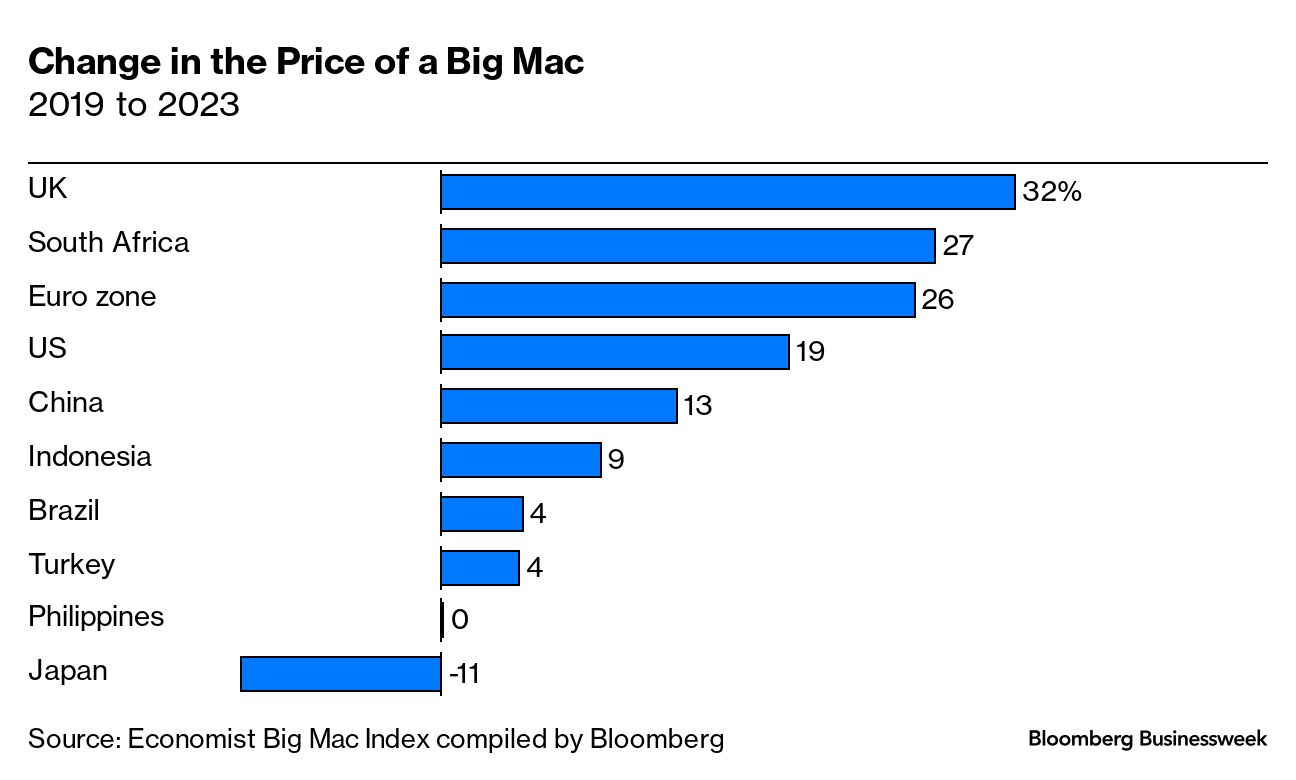

$2 trillion valuation, another milestone in its ascendancy as the biggest beneficiary of a rush into AI-related stocks over the past year. The chipmaker’s shares rose 0.4% Friday to close at a $1.97 trillion valuation after briefly topping the $2 trillion mark in intraday trading. Ten years after Russia first invaded Ukraine, and two years after it launched a full-on but ultimately botched attempt to take the entire country, the US imposed its biggest one-day sanctions package on the Kremlin. The Biden administration targeted more than 500 people and entities in a fresh bid to squeeze Russia’s economy and send a message over the death of dissident Alexey Navalny, which President Joe Biden blamed on Vladimir Putin. The Kremlin’s calculation has been that it would outlast US resolve, a bet that appears to be paying off as Republicans block billions of dollars in aid, leaving Ukrainian troops short of shells they need to hold off Putin’s forces.“We can’t walk away now,” Biden said. “That’s what Putin is betting on.” Putin wants the world to believe that Russia’s economy is doing fine, and that he has the wherewithal to prosecute the war in Ukraine indefinitely. But Bloomberg’s Editorial Board says he’s bluffing. His aggression is costing him dearly, the board writes, and the West should exploit this vulnerability to the fullest.  Ukrainian soldiers carry artillery shells at their fighting position near Bakhmut, Ukraine, on Thursday. Photographer: Anadolu US Secretary of State Antony Blinken said Israeli settlements are “inconsistent with international law,” putting new pressure on Prime Minister Benjamin Netanyahu and marking a return to a 1978 finding by the State Department’s legal adviser that also found the settlements violate the Geneva Conventions. The conclusion marks a fresh break from Netanyahu for the Biden administration, which has grown increasingly concerned about the high Palestinian civilian death toll in Israel’s military campaign in Gaza since Hamas launched its Oct. 7 attack on Israel. Biden has also sought to restrain settler violence in the West Bank. Jeff Bezos, Nvidia and other big technology names are said to be investing in a business that’s developing human-like robots, part of a scramble to find new applications for AI. The startup Figure AI—also backed by OpenAI and Microsoft—is raising about $675 million in a funding round that carries a pre-money valuation of roughly $2 billion. Through his firm Explore Investments, Bezos has committed $100 million. Microsoft is investing $95 million, while Nvidia and an Amazon-affiliated fund are each providing $50 million. A Texas man made almost $2 million by illegally trading on his wife’s conversations with her BP colleagues, according to the US Securities and Exchange Commission in its latest case about couples eavesdropping while working from home. For months, Tyler Loudon bought shares in TravelCenters of America, the SEC said, liquidating his brokerage and retirement accounts. In February 2023, when BP announced it was buying TravelCenters at a 74% premium, he made a $1.76 million profit. His wife, the SEC said, had been working on the deal in a home office 20 feet away. Restaurants have had a steep climb back from the pandemic. Growth of same-store sales slowed across the industry in 2023, with high costs and changed eating habits keeping many customers home. But fast food—the most prevalent dining option across the US—has seen profit margins improve compared with those at sit-down, non-chain eateries, despite its price increases outpacing those of table service. A Big Mac is pricey, but fast-food profit margins keep improving.  A sprawling penthouse at a new Miami Beach condo tower with Ritz-Carlton amenities is expected to be marketed at $125 million, putting it on par with some of New York City’s ritziest buildings. Broker Fredrik Eklund expects the 30 condos to sell for a combined $450 million, with prices ranging from $3.9 million to $125 million for a possible combination of the building’s two duplex penthouses. It’s the latest project from developers seeking to seize on rising demand from the world’s richest homebuyers. A sale at a $125 million price would put a transaction close to levels normally seen for the most luxurious apartments on Manhattan’s Billionaire’s Row.  Rendering of the 15-story luxury condo tower in South Beach. Source: Boundary Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players Jeddah: Set against the backdrop of the Formula One Saudi Arabian Grand Prix, Bloomberg Power Players Jeddah on March 7 will bring together some of the most influential voices in sports, entertainment and technology as we identify the next potential wave of disruption for the multibillion dollar world of sports, media and investment. Join powerbrokers, senior executives, leading investors and world-class athletes who are transforming the business of sports. Learn more. |