| Blah blah blah? Climate talks kicked off this week in Glasgow, Scotland, with some notable omissions. The leaders of China and Russia didn’t show up. A pact to phase out coal and bring in clean energy didn’t include the U.S. or China, though Italy agreed at the last minute to end overseas fossil fuel funding. Talks on carbon markets stumbled over how much of the $100 billion offset market should be funneled toward countries that need money to adapt to climate change. Pollution-cutting pledges—if met—would put the world on track for 1.8 degrees Celsius of global warming, still above the goal of 1.5 degrees. Activist Greta Thunberg (and thousands of protesters) weren’t impressed. It’s not all bad news, though: India’s surprise pledge to transition to carbon neutrality by 2070 means countries responsible for almost two-thirds of greenhouse-gas emissions now have a net-zero target. But as the 2015 Paris climate accord showed, promises are one thing. Action is another. U.S. President Joe Biden accumulated some more problems this week with the upset of Democratic Governor Terry McAuliffe in Virginia. Winner Glenn Youngkin embraced Donald Trump enough to win the Republican primary, but kept away from him during the general election. Meanwhile, OPEC+ ignored calls to bring down oil prices with a large output hike, leaving Biden with few good options to tame energy prices that are helping fuel inflation. At least the labor market is back on track with stronger-than-expected job creation in October.

Central bankers haven’t pulled the trigger on higher rates yet, moving more slowly than many investors expected. The Bank of England surprised markets by keeping rates on hold, sending bond yields lower around the world. Investors are entitled to be annoyed with Andrew Bailey, the bank’s latest “unreliable boyfriend,” Bloomberg Opinion’s John Authers writes. Fed Chair Jerome Powell said officials can be patient after announcing a start to reducing their bond purchases. On the Stephanomics podcast, host Stephanie Flanders debates with three esteemed economists whether central banks should be responsible for saving the world. Tesla shares keep rising, hitting a new record after the electric carmaker reached $1 trillion in market value. The breathless rally created the stock’s biggest-ever spread over Wall Street analysts’ average price target. Several other clean-energy stocks are up more than 100% since the start of 2020. Meanwhile outside Austin, Texas, where Tesla is building a Gigafactory, trailer parks and tiny homes are experiencing a boom, too.  Pricey little homes in Texas Photographer: JamesBrey/E+ Barclays replaced CEO Jes Staley after he abruptly stepped down over his ties to the late financier and sex offender Jeffrey Epstein. Half of Europe’s top 20 listed banks have now replaced their top executives in the past two years. Credit Suisse, which got a new boss last year, said it’s largely getting out of the business of serving hedge funds. U.S. banks are poised to pick up the crumbs.

A new generation of sweeteners derived from natural substances stand a better chance of unseating sugar in a consumer market increasingly focused on healthier eating. The world’s addiction to palm oil, another common ingredient of packaged food, is only getting worse. Volunteers are using apps to help supermarkets and cafes reduce food waste, which accounts for as much as 10% of global greenhouse gas emissions.  - Inflation in the U.S. might just accelerate.

- China’s Communist Party holds a closed-door meeting.

- Singles’ Day may reflect how things have changed for Alibaba.

- U.S. Vice President Harris meets French President Macron.

- Can ABBA compete in the streaming world?

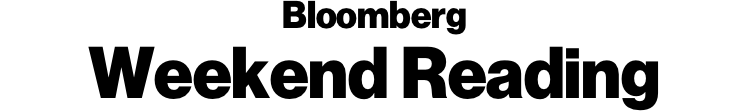

“It was a crucifixion,” complained John Schnatter, the dethroned founder of Papa John’s International, in his own emotional account of a spectacular fall from grace three years ago. Schnatter admits he uttered a racial slur on a corporate conference call (a call with his ad agency about a strategy to counter the perception that he’s racist). But he says there’s so much more to the story.  A 2018 open forum at Ball State University’s student center on the topic of Schnatter’s use of a racist slur. Like getting Weekend Reading? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg Green at COP26: Join us Nov. 8-11 as we convene executives and thought leaders including Unilever CEO Alan Jope and U.S. climate envoy John Kerry to focus on local and tactical solutions with global impact. Topics include achieving net-zero, investing in climate tech, cutting greenhouse gas emissions, accelerating the adoption of renewable energy and transition to green transportation. To learn more about the week of events and join virtually or in person, click here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |