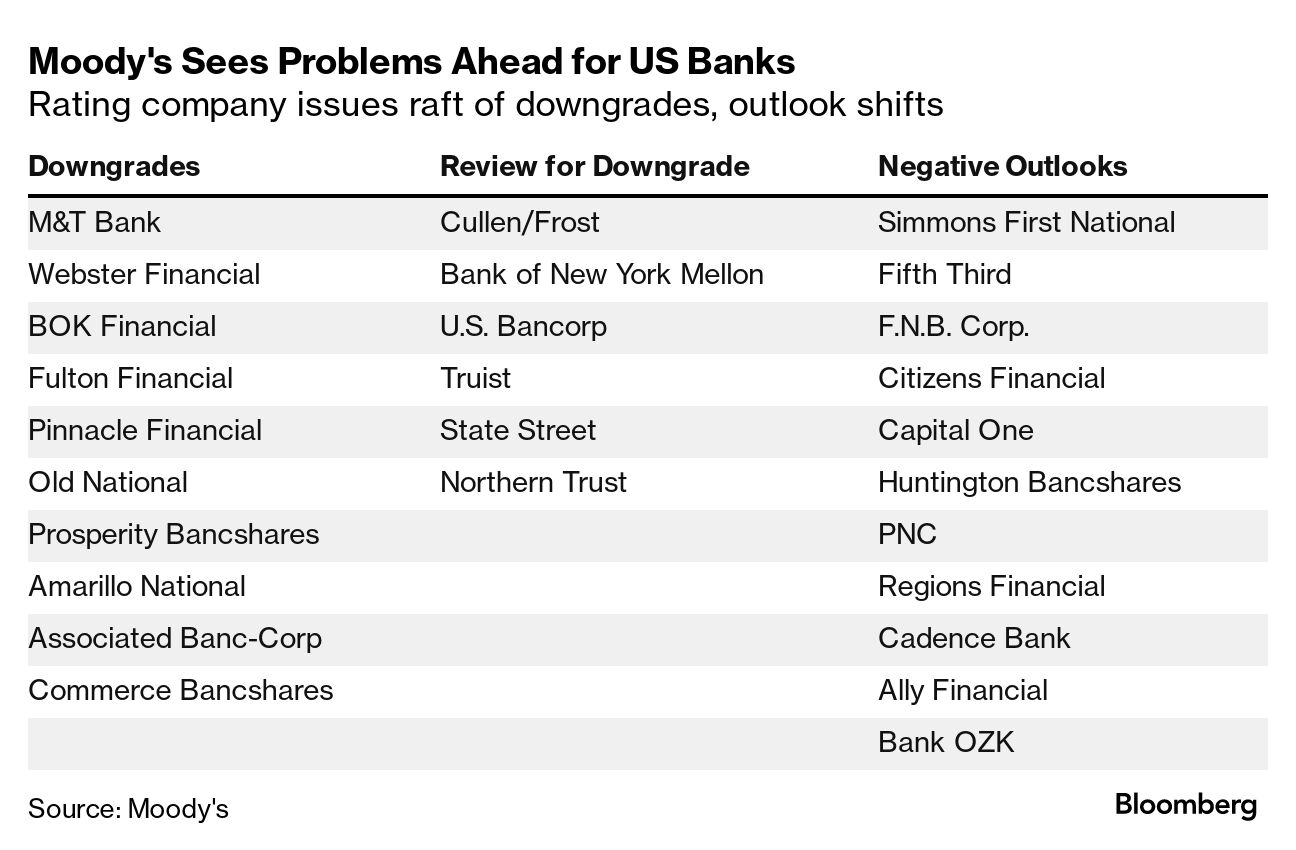

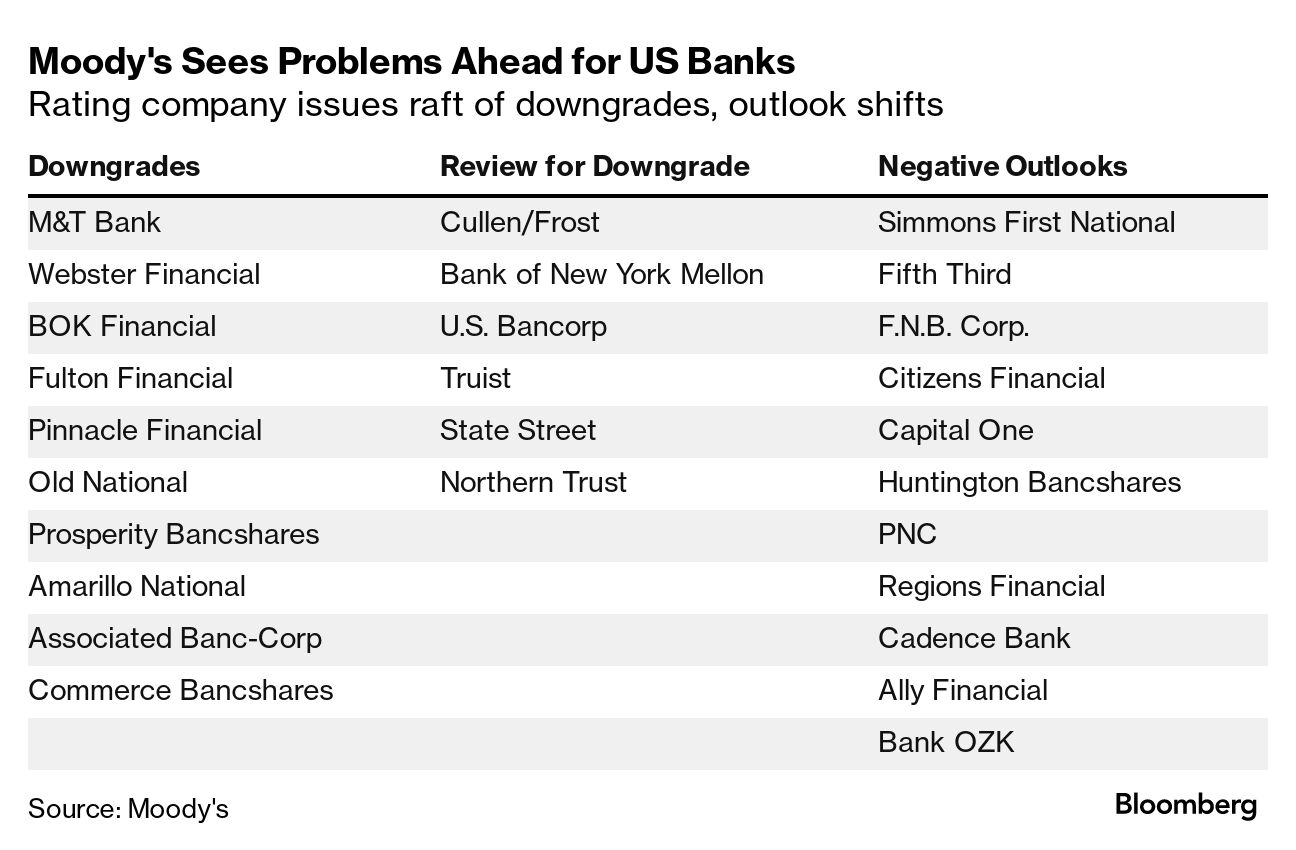

| Bank stocks fell early on Tuesday after Moody’s Investors Service announced it had downgraded 10 small and midsize American lenders, and that it may do the same with a handful of major firms. Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate are among the strains that prompted a review, Moody’s said.  Rattled by a calamitous spring that saw the quick implosion of several regional banks, investors have been watching closely for signs of stress in the industry as high interest rates force firms to pay more for deposits while boosting the cost of funding from alternative sources. At the same time, those elevated rates are eroding the value of bank assets and making it harder for commercial real estate borrowers to refinance their debt, potentially weakening lender balance sheets. “Rising funding costs and declining income metrics will erode profitability, the first buffer against losses,” Moody’s wrote. “Asset risk is rising, in particular for small and midsize banks with large CRE exposures.” Nevertheless, despite all that bad news for breakfast, the end of the day saw the broader market and some of those banks finish off on an upward trajectory as dip buyers swooped in. Here’s your markets wrap. —David E. Rovella You can think of the unfolding disaster in Niger in four ways, from embarrassing to ominous, catastrophic and apocalyptic, Andreas Kluth writes in Bloomberg Opinion. Embarrassing, because the country’s coup on July 26 is blowback for a clueless West. Ominous, because it’s a windfall for Russia and China as they vie for influence in the region and world. Potentially catastrophic, because it’s a setback in the struggle against jihadist terrorism and uncontrolled migration. And possibly apocalyptic: With Moscow lining up behind each new anti-democratic putsch, it could eventually mark a slide into world war.  Millions of Americans have a higher rate on their savings account than they’re paying for their mortgage. Marcus by Goldman Sachs recently raised the interest rate on its high-yield accounts to an all-time high of 4.3%, following the latest hike in the Federal Reserve’s key benchmark rate. The discrepancy illustrates an unusual situation in the US economy. During the early years of the pandemic with its rock-bottom rates, millions of homeowners refinanced or took out mortgages below 4%. Now, after several hikes by the Fed, borrowing costs have surged to nearly 7% for a 30-year, fixed rate loan. Homeowners are reluctant to move and give that up. So what does that mean? A US housing market stuck in park. In one of the tightest labor markets in decades, UPS may have hit upon a strategy to attract workers: boost starting wages for part-timers and improve working conditions, including adding air conditioning in new vehicles. In other words, come to an agreement with the union. Online jobs board Indeed saw a more than 50% increase in searches with “UPS” or “United Parcel Service” the week after the Teamsters announced its deal with the carrier. Even UPS agreed: “We have seen strong interest in UPS jobs as a result of media coverage of the tentative agreement,” spokesperson Jim Mayer said. Wells Fargo and BNP Paribas are among financial firms that will pay hundreds of millions of dollars in penalties for employees using unofficial communications like WhatsApp, personal texts or email to conduct business—the latest in US regulators’ crackdown on Wall Street’s failure to keep records. Late last year, Stability AI and its Chief Executive Officer, Emad Mostaque, were at the center of the hype cycle thanks to the massive success of Stable Diffusion, an artificial intelligence model that enables users to create uncanny and sometimes startlingly realistic images based on just a few words. Since March, however, a lot of things have changed for the London AI upstart—and not necessarily for the better. Novo Nordisk said its obesity medicine Wegovy reduces the risk of heart attacks and strokes, buoying shares of the Danish drugmaker and Eli Lilly, the US maker of a potential rival treatment. People with obesity or who are overweight and have a history of heart issues who took the Novo drug were 20% less likely to suffer a cardiovascular event than those who took a placebo, the Danish drugmaker said a study found. The latest spat between China and the Philippines in the South China Sea has an unlikely object at its center: a World War II-era ship that’s gotten pretty rusty after being stranded in contested waters.  The Philippine Navy ship LT 57 Sierra Madre is in the shallow waters of Second Thomas Shoal in the South China Sea. Photographer: Bullit Marquez/AP Photo The average weight of a new vehicle sold in the US last year was a whopping 4,329 pounds. That’s more than a 1,000 pounds higher than the average in 1980, and up about 175 pounds in just the last three years. Essentially, more than a third of the average American car has been added in the past 40 years—and it’s not just suburban dads playing at tough with steroidal pickup trucks. The trend is now exacerbated by the switch to electric models. “[Cars] that used to weigh a ton and a half are now three tons,” Ned Curic, chief technology officer of automaker Stellantis said in a recent interview. “It’s not good for the environment, it’s not good for resources, it’s not good for efficiency.” Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Intelligent Automation—Transformation in a Time of Uncertainty: Top business and IT executives will gather in a city near you to explore ways in which intelligent automation can offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. We'll feature in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management about investing in transformation. For Mumbai on Aug. 18, Register here; For London on Sept. 19, Register here; For Toronto on Oct. 19, Register here; And for Seattle on Nov. 8, Register here. |