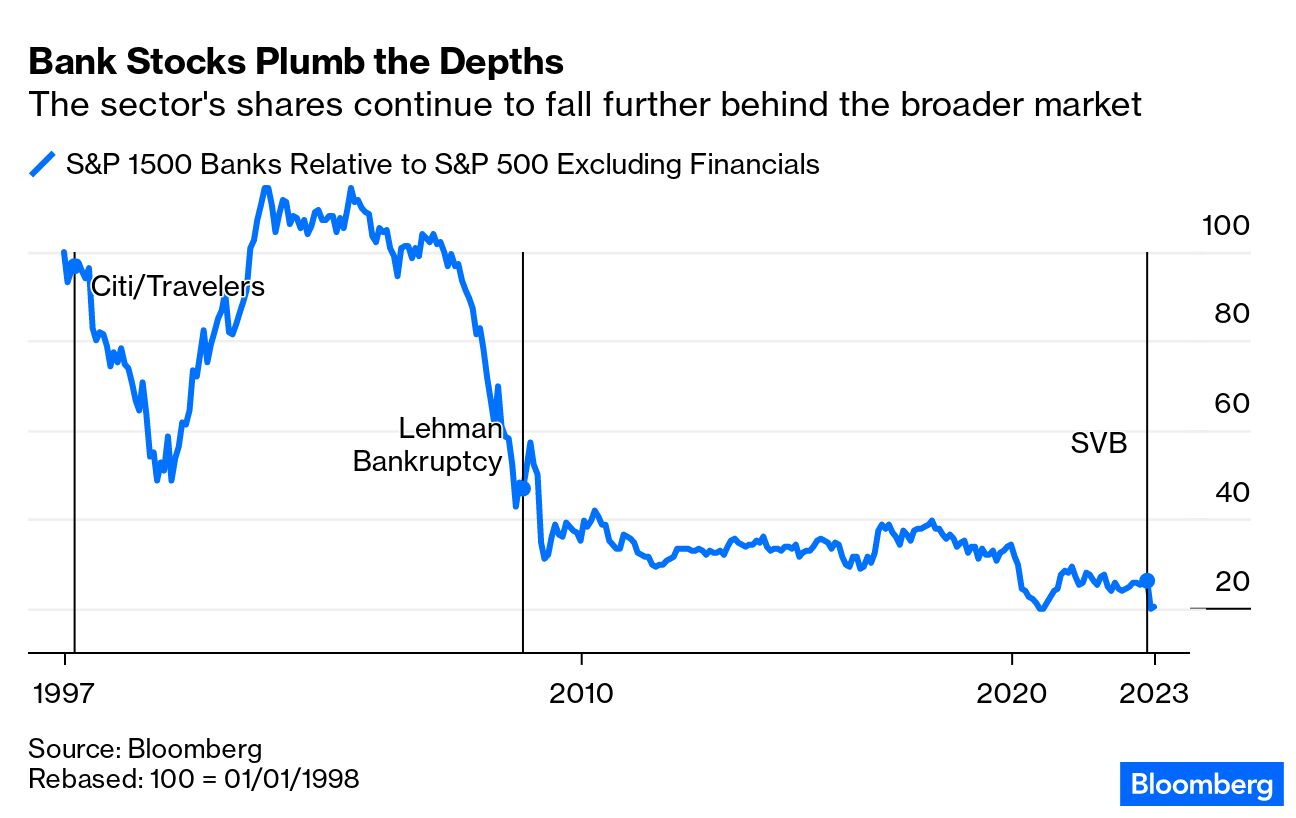

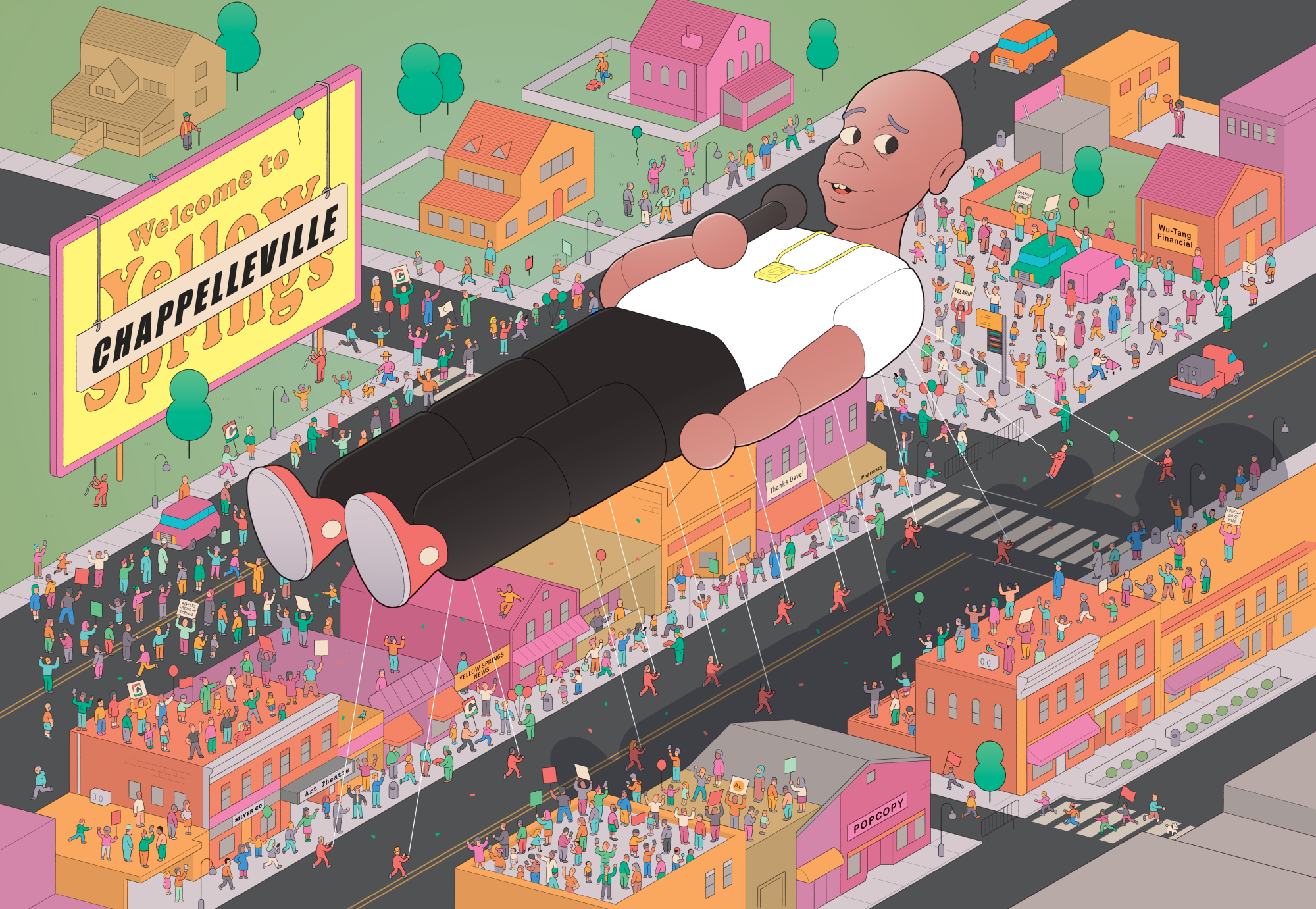

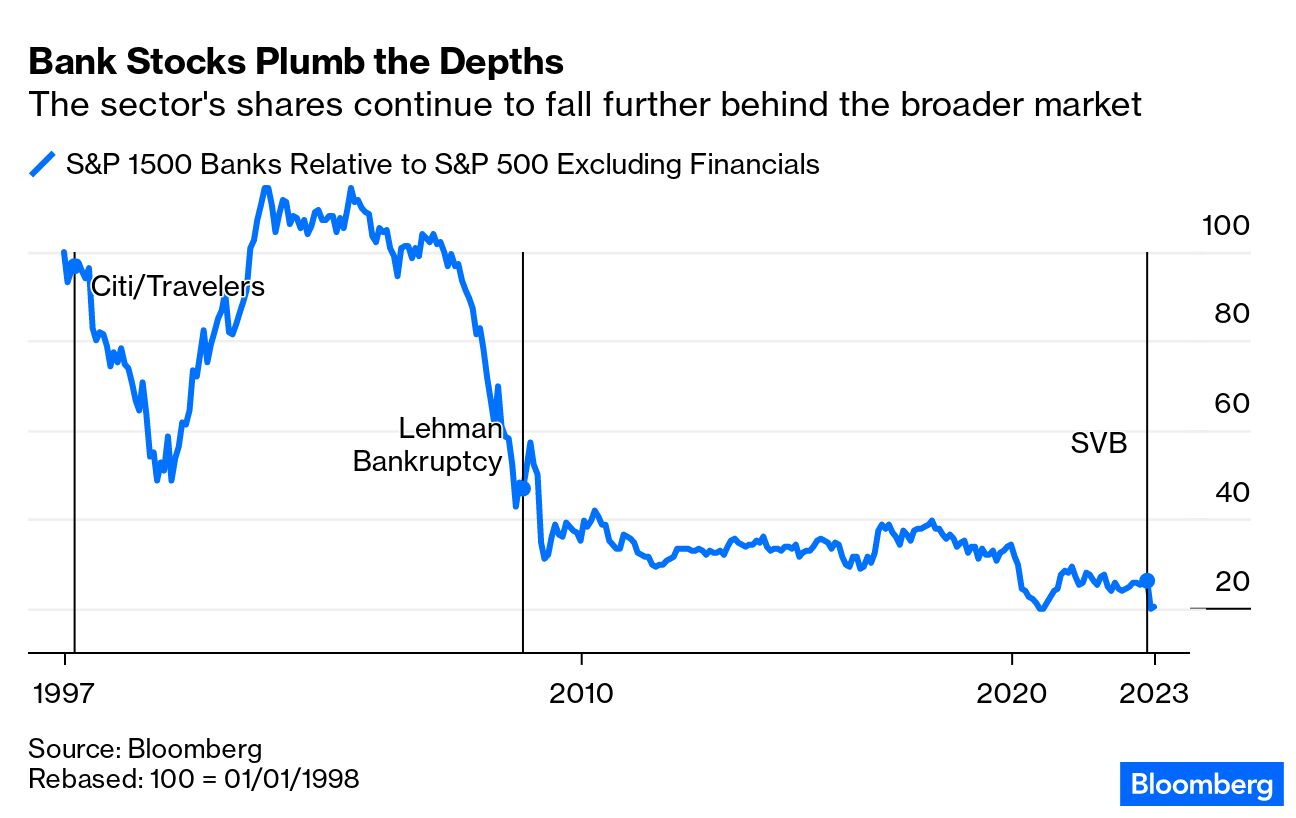

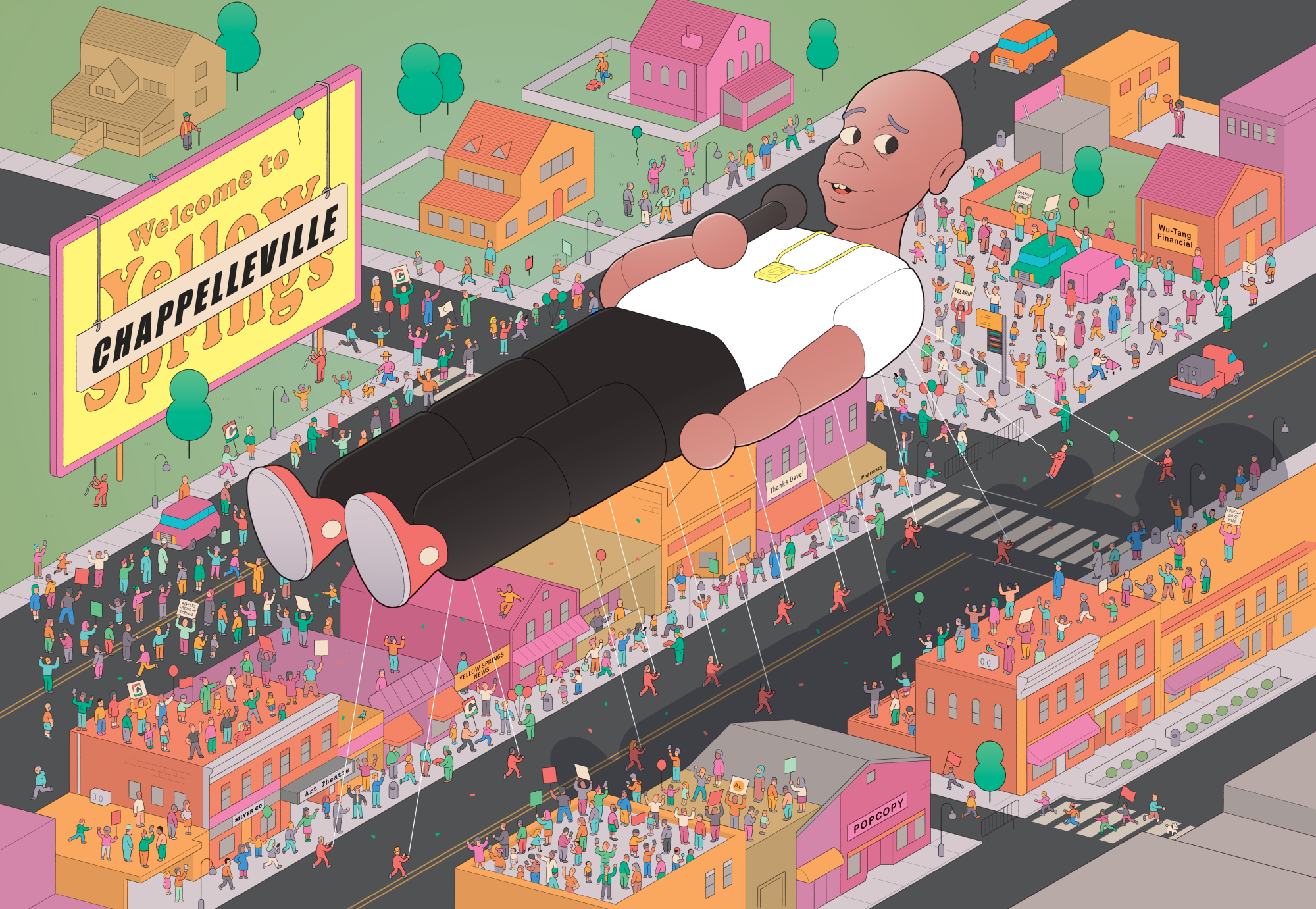

| First Republic Bank shares took another nosedive Friday, falling a whopping 43% in regular trading. Then, as a news report foretold a potential future in receivership for the ailing California lender, its shares collapsed again. For a while now, US officials have been coordinating talks to rescue First Republic, with the Federal Deposit Insurance Corp., the Treasury Department and Federal Reserve said to be orchestrating meetings about throwing it a lifeline. But some of the biggest US banks, which have already contributed $30 billion in deposits to prop up First Republic, have balked at the prospect of throwing good money after bad. —David E. Rovella But maybe you shouldn’t care that much. Confidence in First Republic looks shot and soon it may be put out of its misery, John Authers writes in Bloomberg Opinion. The banking problem remains unfixed, and yet, this coming weekend is inspiring relatively little tension. Why? Authers says the bank is small enough to fail and the risk looks priced in: “For now, the logic is that the only banks that might fail are the ones that can safely be allowed to do so.” Plus, banks don’t matter as much as they used to.  First Republic has spent the past month struggling to avoid the doom suffered by three other mid-sized lenders last month. On Friday, the Federal Reserve’s bank-supervision chief called for an extensive reevaluation of requirements for US financial firms, as regulators said the failures of two of those banks, Silicon Valley Bank and Signature Bank, exposed lapses in oversight. The central bank will revisit the range of rules that apply to firms with more than $100 billion in assets, including stress testing and liquidity requirements, a Fed official said. Yes, a May rate hike is probably coming. Two key gauges showed persistent US inflation pressures in recent months, buttressing the case for another Fed bump next week. The personal consumption expenditures price index excluding food and energy—the Fed’s preferred measure of underlying inflation—rose 0.3% in March from the prior month and 4.6% from a year earlier, a Commerce Department report showed Friday. Argentina is moving closer to a breaking point as desperate government measures fail to halt a plunge in the peso. The risk of a currency devaluation President Alberto Fernandez pledged would never happen is rising.  Argentina Economy Minister Sergio Massa informed the International Monetary Fund that the government plans to intervene in local financial markets. Photographer: Anita Pouchard Serra/Bloomberg Inequality across Latin America has triggered a wave of progressive political upheaval. But as every major country in Latin America shifts to the left, the rich are bailing. In the region’s five largest economies, the wealthy and even middle-class investors—along with corporations—pulled roughly $137 billion out of their countries in 2022. Vladimir Putin’s forces killed two dozen civilians in missile strikes across Ukraine Friday as Kyiv’s forces ready a long-planned counteroffensive. Czech President Petr Pavel said his nation now has six projects to jointly produce and repair weapons with Ukraine. They will produce weapons and ammunition, repair tanks and potentially manufacture training aircraft, he said. Here’s the latest on the war.  A damaged residential building in Uman, Ukraine, on April 28 following Russian strikes on residential areas. Source: Department of Communication of Interior Ministry of Ukraine In North Carolina, the state supreme court—having switched its majority from Democratic to Republican—swiftly reinstated a voter ID law and reversed a ruling throwing out gerrymandered-districts that favor GOP candidates. That sudden shift may also moot a US Supreme Court case of national importance. America’s most reclusive comedian isn’t hard to find. Dave Chappelle hangs around downtown, buys coffee and shops like any other resident of Yellow Springs, Ohio. He smokes cigarettes and chats with passersby. “Growing up here, literally on any given Saturday or Sunday, in any house that you walked into, there was going to be someone who was Jewish, someone who was an atheist, someone from a different country, somebody who was a person of color,” says Carmen Brown, a Black village council member whose family has lived in the town for 150 years. Chappelle himself has called Yellow Springs, population 3,700, “a Bernie Sanders island in a Trump sea. But all is not well on this blue island.  Illustration: Giacomo Gambineri Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Wealth Asia Summit returns on May 9. Join us in Hong Kong or online as we sit down with the region’s leading investors, economists and money managers to discuss the mindset of next generation investors, Web3 and investing in art. Speakers include top executives from Amundi, Hong Kong Monetary Authority and Sotheby’s. Register here. |