There’s a lot of carnage out there.

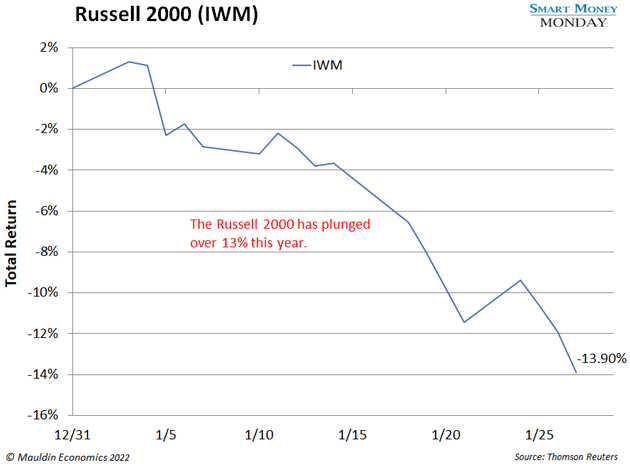

The S&P 500 has sunk 10% since the start of the year. And the Russell 2000, our hunting ground for small-cap stocks, has plunged 13%.

Investors are understandably worried. The market is throwing the baby out with the bathwater. And it’s hurting everyone in the process.

Still, I’m not the least bit worried. For bottoms-up stock pickers like us, market-wide selloffs are an opportunity to buy quality businesses—strong companies with solid fundamentals run by smart management—at cheap prices. Because those stocks will eventually turn around and march higher.

How do I know?

When a stock is super cheap relative to the profits and cash flow of the underlying business, someone is going to buy it.

That someone is often an active fund manager who can quickly pour many millions into a stock. See, despite the rise of passive investing, active fund managers still control over $5 trillion in US equity funds. These managers pick stocks based on old-fashioned fundamentals. Specifically, whether a stock is cheap relative to profits and cash flow.

When they spot one of these stocks, they buy it for their clients. That helps support the stock’s valuation floor—and eventually helps push the stock price back up.

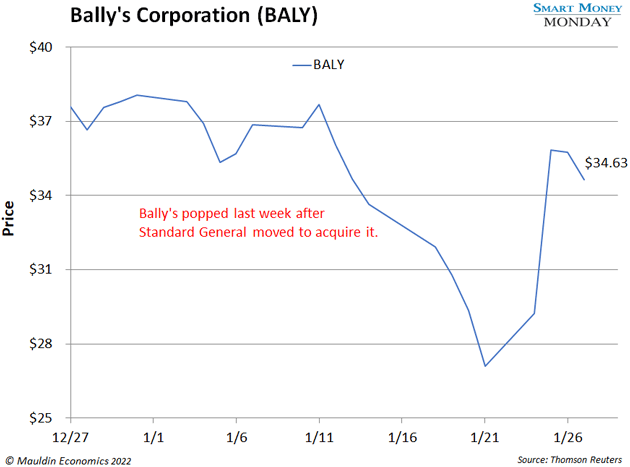

A competitor or large shareholder might try to buy it outright. This also supports the stock’s valuation floor, as we’re seeing in real time with casino operator Bally’s (BALY).

Bally’s has tumbled 35% in the past year. Shares reached a 52-week low of $27.11 earlier this month. The company says it’s capable of generating $5 per share in free cash flow. On $27, that’s under 6 times free cash flow, which is far too cheap. As one of my successful investing buddies likes to say, a business with a pulse should trade for at least 10 times free cash flow.

So now one of Bally’s largest shareholders, the hedge fund Standard General, wants to buy the whole company. Bally’s shares have popped 24% since Standard General offered to acquire Bally’s for $38 per share last Tuesday.

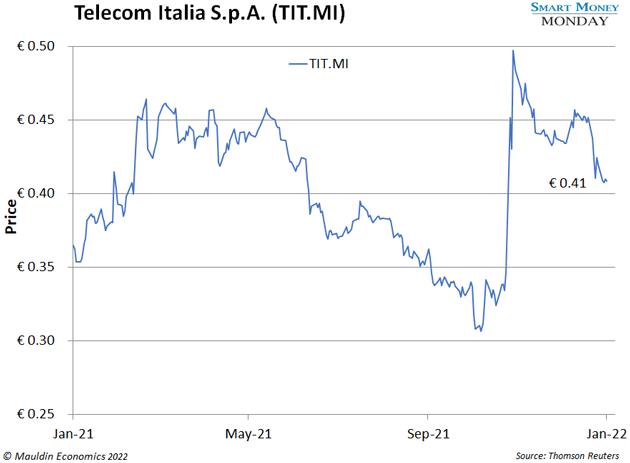

Again, this is playing out in real time with Telecom Italia, Italy’s largest phone company. The stock has fallen 40% over the past five years, slipping under $4 last November. At that price, it was too cheap for a big player to pass up. So, US private equity firm KKR pounced.

In November, KKR offered to buy Telecom Italia for $12 billion. The deal is still pending. But shares immediately jumped 40% on the offer alone.

KKR has over $100 billion ready to deploy on deals like this. Altogether, US private firms have $714 billion on hand according to data provider Preqin. All this money, and the potential it creates for private equity to scoop up quality businesses at cheap valuations, keeps those stocks from sinking below a certain point.

That depends. We’re stock pickers here at Smart Money Monday . We buy individual companies—not the broader market. And we’re looking at opportunities with time horizons of a year or longer. So, for us, there are plenty of bargains worth buying right now.

Specifically, we’re looking for quality business trading at or near their valuation floors. That means stocks like AT&T (T) . It has a 6% dividend yield. And the spinoff/merger of its Warner Media assets with Discovery (DISCA) should serve as a positive catalyst for the stock price.

Or stocks like Cleveland-Cliffs (CLF) , which trades at a single-digit earnings multiple and generates gobs of free cash flow. Or Franchise Group (FRG), which still trades at a low-teens earnings multiple, even after a nice runup since I first recommended it . All three of these stocks are still buys at current prices.

Monday Mailbag

Edward wrote in:

I wanted to ask Thompson why Cleveland-Cliffs is falling like a stone… And why is Deutsche Bank falling when interest rates are rising?

Great questions. Cleveland-Cliffs (CLF) has pulled back for two reasons. First, the selloff in the broader market, which we’ve already covered today.

Second, the price of hot-rolled coil steel (HRC), which Cleveland-Cliffs produces, has been on a wild ride. It surged from $580 in March 2020 to a high of nearly $2,000 in August 2021. Today, it’s at $1,200.

Cleveland-Cliffs has already locked in HRC pricing for many of its customers for 2022. So, despite the recent pullback, it expects to sell HRC at a higher average price this year than it did last year.

That said, Cleveland-Cliffs is not a bet on HRC prices. It’s a bet on CEO Lourenco Goncalves. He’s made multiple smart acquisitions and paid down the company’s debt. I still like the stock here.

As for Deutsche Bank (DB) , the company has outlined a plan to return over $5 billion to shareholders. That’s over 20% of the current market cap. It’s still cheap, and I still like it here.

Please send me your questions about the market selloff or any of the companies we’ve covered today. You can reach me at subscribers@mauldineconomics.com .

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday