If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

To investors,

I’ve been traveling today so my apologies on sending this letter later than usual.

The entire crypto market has been glued to their computers and phones as they watch the volatility and drama unfold related to Terra, LUNA, and the UST stablecoin. As many of you are already aware, the UST stablecoin lost the $1 peg earlier this week and the LUNA token has fallen more than 99% in value.

I figured it would be helpful to share a few thoughts about these events.

First, there is a large number of people kicking the team behind this technology while they are down. No true builder is going to do that, because they understand how hard it is to create anything of value from scratch. Punching down when a team is struggling isn’t how I roll, it isn’t how I expect any founders that I invest in to act, and that isn’t how any well-respected entrepreneur or investor who has a long career in this game will act either.

Second, the idea of “never invest more than you are willing to lose” gets shared around the bitcoin and crypto industry often, but many people assume it is just a meme. There is real money at stake in these nascent technologies and there is real risk. Amazon once drew down 95%, Bitcoin has drawn down ~ 85% multiple times, and there is a laundry list of shitcoins that have lost 99.9% of their value. Just because something goes down in value a substantial amount during bear markets or liquidity crisis doesn’t mean they have no future value. With that said, it’s likely that 99% of non-bitcoin projects will go to zero for various reasons. Understanding the risks that you take in allocating capital to an industry that is brand new must be part of your diligence process.

Third, most of the people screaming “I was right!” on the internet weren’t actually right. The majority of these people were yelling about how LUNA/UST was a scam or future rug pull. Rather than having the intellectual rigor to identify structural challenges around the peg and articulate those risks (like @FreddieRaynolds did so well here), these individuals resorted to the same trite attacks (Scam!) that bitcoin critics have used for years. It doesn’t appear that UST was some sophisticated scam or rug pull. Rather, it was a badly designed technology product that was exposed by intelligent market participants who had a lot of capital at their disposal.

Needless to say, this doesn’t excuse the carnage that LUNA / UST caused.

Fourth, the UST peg was broken, which to the average person sounds ridiculously scary. This isn’t the first time that the industry has seen this occur though. USDT (Tether), which is the largest stablecoin by market cap, has had the $1 peg break multiple times before. Just a few recent ones include a drop to $0.85 in 2018 and a drop to $0.90 last year. Even though the USDT stablecoin asset has been depegged numerous times before, it still boasts a market cap of $82 billion currently. I’m not making an argument that Terra’s UST stablecoin will survive or comeback, but rather a mention of historical facts that most of the current crypto users were not around for in past market cycles.

Fifth, there are a lot of people who are inaccurately claiming that I was “promoting” LUNA or UST. I spend hours a day writing, interviewing, and recording content to better understand what is happening in the bitcoin ecosystem. If there is someone buying up $3-10 billion of bitcoin, I am going to talk about it. In the letter that I wrote, the podcast that I did with Do Kwon, and other conversations that I had with folks like Peter McCormack, there were always conversations around risks. As I stated over and over again, this was an experiment that was worth paying attention to.

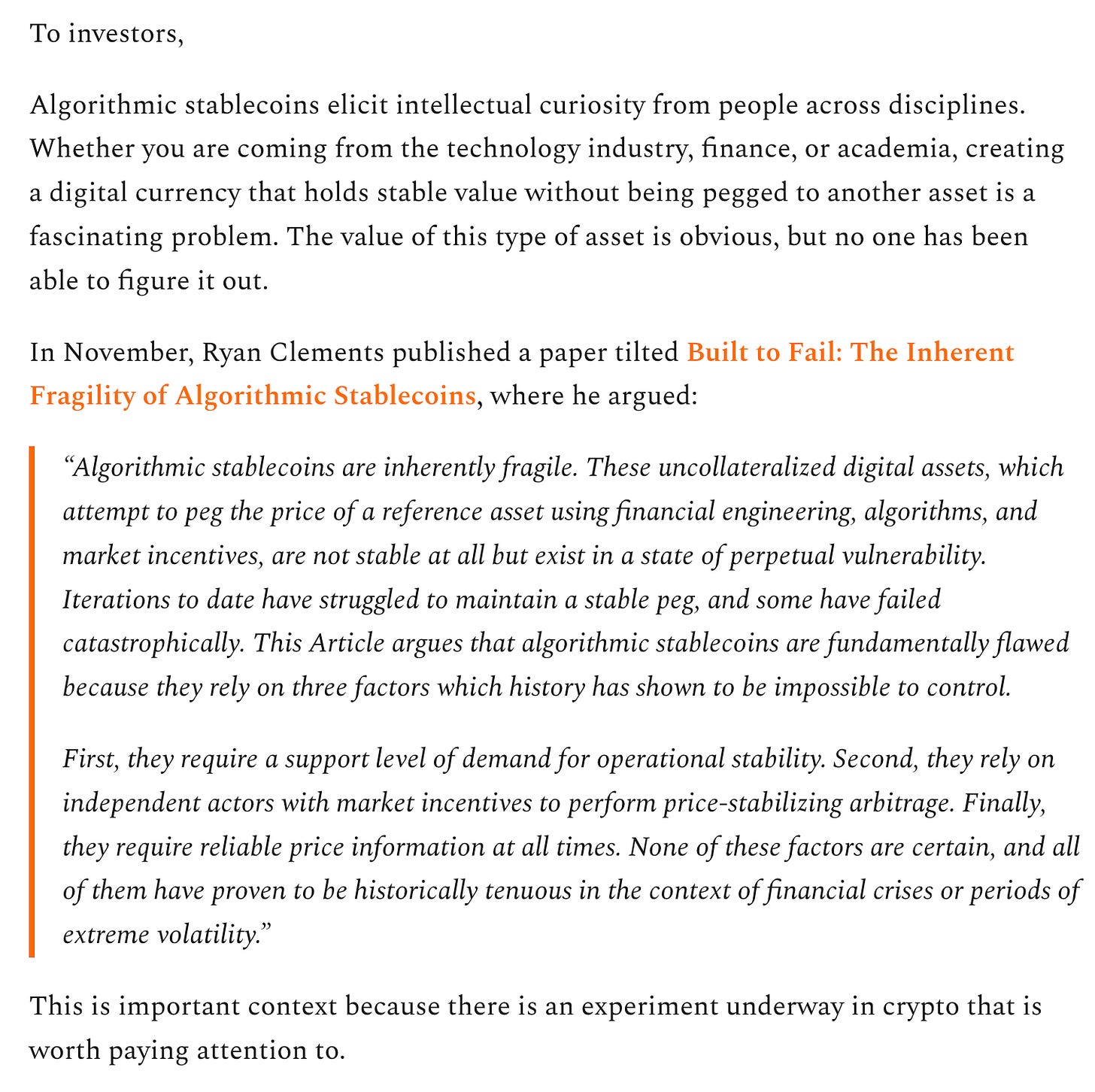

For example, in the piece that I wrote about the LUNA / UST experiment in March 2022, I started it off with acknowledgement that no one has been able to figure out the algorithmic stablecoin problem, included a link to an entire 15-page white paper about why algorithmic stablecoins fail, presented the naysayers argument, and explicitly called out that this was an experiment.

Here is a screenshot:

As if this wasn’t enough, I then went on to mention that there were lots of risks in one of the closing paragraphs:

“Regardless of how this situation unfolds, Terra’s move to back UST with bitcoin is worth paying attention to. There are lots of risk, but if they successfully pull this off then they will be creating a playbook for other stablecoins and/or central banks to follow. Bitcoin is a decentralized, digital currency that has successfully achieved the properties necessary to serve as superior collateral.”

Which brings me to my sixth point — experimentation is imperative when you are trying to build new, innovative technology. It doesn’t matter if past experiments have failed or not, you can’t innovate without trying new things. The same intellectual curiosity and fascination with innovation that brought me to bitcoin will continue to drive me forward as I seek to understand what various technologists and entrepreneurs are working on.

Seventh, it takes a special skill to be optimistic about technological experiments, but simultaneously a rational skeptic that can publicly present every risk. The more technical the nature of the experiment, the less qualified majority of market participants are to underwrite complex risk. One of my personal takeaways from this situation is that although I spend a considerable amount of time highlighting risks and trying to present both sides of an argument (as outlined in the example of the letter above), I am going to work on more effective ways to highlight the voice of skeptics on a variety of topics in the future.

Lastly, point number eight, can be summarized with the following idea: Bitcoin has survived Silk Road, Mt Goxx, nation state attacks, and much more. The decentralized, digital currency isn’t going anywhere. Bitcoin is the most resilient technology in the world and it is backed by the strongest computer network that has ever been created. There is fear and chaos everywhere, but don’t lose sight of the fact that bitcoin continues to produce block after block after block of transactions without caring about any of it.

Hope each of you has a great day. I’ll talk to everyone tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

SPONSORED: Over $9 trillion has been erased from U.S. equities and the Nasdaq is down 25% in 2022. But listen up: smart investors know how to allocate to sell-offs carefully, using rules-based (aka "quant") strategies to buy the dip. But quant investing historically required a degree in Python and Excel. Until now.

Composer gives you the power to invest like a quant, no PhD required.

Think tech has bottomed? Jump into Big Tech Growth Momentum. Think Inflation is heating up? Dive into Hot Inflation Summer Hedge. Want to stay in stocks with more security? Try Paired Switching: S&P 500 and Gold.

Composer is the next generation of active investing. No code, no spreadsheets, no Robos and no YOLOs. Just smart investing for smart investors.

Pomp Letter subscribers get premier access to Composer with this private link.*

THE RUNDOWN:

Grayscale Had ‘Productive’ Meeting With SEC on Bitcoin ETF Conversion: Grayscale Investments LLC recently met with the Securities and Exchange Commission to better make its case for turning the Grayscale Bitcoin Trust into a spot bitcoin exchange-traded fund. “Following a productive meeting, we remain encouraged by our ongoing engagement with the SEC,” a Grayscale spokesperson told CoinDesk. “At Grayscale, we intend to maintain an open dialogue with regulators and policymakers as we look ahead to July 6.” Read more.

EU Commission Favors Ban on Large-Scale Stablecoins, Document Shows: The European Commission is considering hard curbs on the ability of stablecoins to become widely used in place of fiat currency, according to a document seen by CoinDesk. Officials appear to be siding with the views of European Union finance ministers, who have proposed tough measures aimed at stopping the likes of Facebook's now-abandoned libra stablecoin from replacing the euro, and require issuance to halt if transactions top 1 million per day. Two individuals familiar with discussions confirmed the details. Read more.

Student Loan Debt Hits Another Record High Despite Payment Forbearance: Student debt hit another all-time high in the first quarter of 2022, reaching $1.59 trillion, according to data released by the Federal Reserve Bank of New York on Tuesday. This debt category accounts for just over 10% of total household debt, which is nearing a whopping $16 trillion. This is the second-largest category of consumer debt, behind home mortgages. Read more.

El Salvador Buys More Bitcoin: Bitcoin's price has plunged in recent days, briefly falling below $30,000 on Monday evening and again on Wednesday morning. Nayib Bukele, the bitcoin-boosting president of El Salvador, sees bitcoin's low price as a buying opportunity. He announced on Monday that El Salvador had purchased another 500 bitcoin. With one bitcoin worth around $31,000, this represented a $15.5 million bet. Read more.

Chris Powers is the Founder & Chairman at Fort Capital

In this conversation we talk about real estate, interests rates, the macro environment and how to build a great asset management firm.

Listen on iTunes: Click here

Listen on Spotify: Click here

Bitcoin Is Crashing To The Realized Price

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domainhere today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

BetOnline allows you to use Bitcoin and other altcoins to bet on sports, casino games, horse racing, poker and more. Click here and use PROMO CODE: POMP100 to receive a 100% matching bonus on your first crypto deposit.

Abra lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abra and get $15 in free crypto when you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/Pompcc

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visit http://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

*See important disclaimer

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.