| | | | Welcome to Deep Dives, where we explore interesting companies in the alt investment space. | Today’s deep dive is on Arta Finance. | In this issue, I'll analyze Arta’s offerings for accredited investors, and compare their services to traditional private banks and family offices. | Check out the full issue even if you’re not accredited. It’s free and you'll learn a ton |

| |

| | |

|

Last month at Alts, we explored Lombard loans — a form of private lending used to craft tax strategies for the ultra-wealthy. |

Although Lombard loans are popular, they’re just a small part of the wider universe of sophisticated financial services available to wealthy investors. |

While retail banks serve just about anyone, places like private banks and family offices only serve wealthy clients, providing expert guidance on money matters and offering a suite of sophisticated financial products. |

| Retail banking is like buying clothes from a department store – accessible, but limited quality. Private banking is like getting a suit from a tailor – exclusive and expertly crafted. |

|

These services are enormously valuable – but the vast majority of people (even rich ones) can’t get access to them. |

To make sure private wealth services stay lucrative & exclusive, Wall Street banks and old-school financial firms set enormously high wealth requirements to qualify. |

That’s where Arta Finance comes in. |

Arta is a digital private wealth service synthesizing technology and finance to offer access to the type of services and products that private banks and family offices have to a much wider pool of investors. |

If you’re an accredited investor in the US, you can sign up with Arta to unlock financial tools once reserved for the ultra-wealthy, including: |

Blue-chip private market offerings from firms like KKR and Carlyle, Direct indexing to facilitate tax-loss harvesting, And advisory services like estate planning & investment advisory.

|

You can express interest in these offerings and let us know which ones we should explore in more depth. |

Let's go 👇 |

The Private Wealth Ecosystem |

Companies offering private wealth services exist to achieve one simple goal: to help wealthy clients enjoy their current assets and make even more money in the future. |

Depending on how they brand themselves and who they serve, players in this ecosystem might call themselves |

Private banks Private wealth managers Family offices, or Multi-family offices

|

Whatever they call themselves, all these firms rely on two main tools to achieve their mission: |

1) Exclusive financial products |

Private wealth firms offer their clients access to the type of financial products they won’t find elsewhere. |

They get clients “in” to exclusive financial products that the average person can’t access - but typically at the cost of high fees and high investment minimums. Stuff like: |

Exclusive private investments across private equity, venture capital, real estate, and private credit Unique public market products with the potential for high returns. Specialized insurance products that can protect what’s most important and deliver investment benefits in the near term.

|

2) Specialized financial experts |

In addition to products, private wealth firms also offer a team of professionals to consult with: |

Accountants to advise on advanced tax optimization strategies, Lawyers to handle estate planning, trust creation, & deal due diligence, And investment advisors to manage the client’s portfolio.

|

The true power of private wealth services isn’t just having access to the financial professionals who can put these strategies into practice (although that’s a big part of it). |

It’s also having these professionals working together under one roof to coordinate these strategies and maximize their impact. |

But private wealth has an access problem… |

Historically, the private wealth ecosystem has been completely inaccessible to all but the wealthiest investors. |

Private banking arms of Wall Street institutions, for instance, typically have minimum investable asset requirements of about $10 million. |

| JPMorgan Private Bank, along with Goldman Sachs Private Wealth Management and Citi Private Bank, all have $10 million minimums - not exactly open access. Image: Private Banker International |

|

That means private wealth services are for the 1% (quite literally, since the 99th percentile US household wealth is about $11.5 million.) |

It’s hard to argue with the idea that there should be some sort of wealth requirement for these services – but this $10 million cutoff is a relic. |

There are nearly 20 million accredited households in the US, very few who can meet that requirement! |

As a result, there’s a phenomenal gap between the investors who can benefit from private wealth services and those who can actually access it. |

And it’s this exact gap that Arta Finance was built to address. |

What is Arta Finance? |

Arta Finance was launched with the aim of dramatically expanding access to private wealth services. |

How? By being the world’s first digital private wealth service, leveraging advanced technology to dramatically improve operational efficiency. |

|

As a high-touch industry, private wealth necessarily has a human element – and Arta is no exception. Through their platform, you can easily talk to real human beings like investment advisors and tax professionals. |

But Arta’s key differentiator is blending this human element with advanced software, allowing the company to serve a greater pool of investors than old-school Wall Street firms. |

Prior to emerging from stealth, Arta raised more than $90 million in venture capital from funds including Ribbit Capital & Coatue. |

And in just a few short years, they’ve grown to more than $100 million in assets under management. |

Today, Arta is open to accredited investors and qualified purchasers in the US with a variety of products and services available to both audiences. |

Most of Arta’s offerings are open to all members, although you’ll need to be a qualified purchaser to access some of Arta’s private fund offerings. |

To ensure you only pay for what you actually use, Arta’s fee structure works on an individual product and service basis. |

Plus, fees for many of Arta’s offerings are significantly lower than what you’ll find at traditional private wealth firms. |

Below, we walk through the most compelling features that Arta offers. |

Interested in discussing any of these with the Arta team directly? Express interest at the end of each section. |

Blue Chip Private Markets |

These days, getting access to alternative investments and private markets isn’t that challenging. |

We’ve covered many of the online brokers, marketplaces, and platforms that offer such deals. |

What remains challenging, though, is getting access to the type of blue chip private market offerings that the ultra-wealthy invest in. |

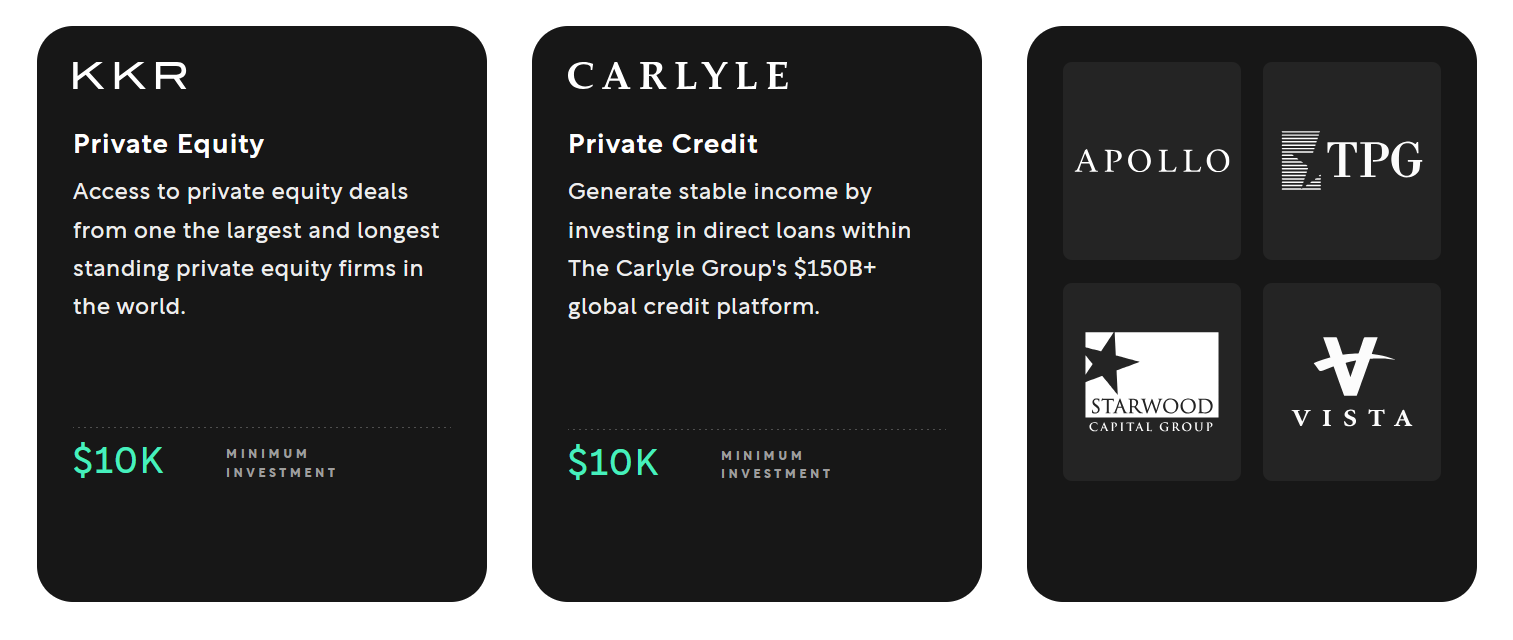

As a private wealth provider, this is exactly the type of access that Arta provides, offering the opportunity to invest in funds managed by firms like KKR in private equity and Carlyle in private credit. |

| Some of the blue chip private market managers Arta offers on their platform. |

|

The key thing to understand about Arta’s private investment model is that they aren’t trying to be a marketplace. You won’t be able to find every fund under the sun on Arta. |

Instead, their aim is to tailor and curate the funds on their platform to focus solely on the highest quality offerings. |

Details |

Arta Fees: Starting from 0.5% Qualification: Fund dependent, Accredited Investors and/or Qualified Purchasers Investment Minimum: Starting from $2,500

|

|

GP Stakes Investing |

Similarly to the idea that Arta offers access to exclusive funds, they also offer access to exclusive strategies – including GP stakes investing, an intriguing way to invest in the private equity market. |

To understand GP stakes investing, here’s a basic reminder about how PE funds work: |

Private equity managers (general partners, GPs) raise money from investors (limited partners, LPs). LP commitments are pooled into a fund along with capital provided by the GP itself (the sponsor commitment). LPs pay fees to the GP for managing the fund, including fixed management fees and variable performance fees.

|

The traditional way to invest in PE is as an LP in a specific fund. |

But GP stakes investing offers the opportunity to hold minority, passive shares in the GP itself. |

The main benefit here is that GP stakes have more diversified revenue streams than basic LP investing: |

GP stakes are entitled to a share of the distributions from underlying PE funds (LPs only get this) GP stakes also get a share of the fees paid by LPs Finally, the value of a GP stakes investment can increase based on growth of the GP itself (just like owning shares in any other company)

|

The other big benefit is diversification. |

As an LP, you might invest in just a single fund. But GPs have exposure to funds across many different sectors and vintages. |

Details: |

Arta Fees: 0.9% (Currently discounted to 0.65%) Qualification: Qualified Purchasers Investment Minimum: $100,000

|

|

Direct Indexing |

Index investing might not exactly sound like the realm of private banks – but there’s one specific indexing strategy that comes with unique benefits over the classic approach. |

Direct indexing is the practice of individually purchasing the underlying assets of an index rather than purchasing them as a portfolio through a mutual fund or ETF. |

Why would you bother doing this? Given the rock-bottom fees on ETFs, it might not seem worth the bother. |

There’s one big reason why: taxes. |

Suppose you’ve invested in a standard index fund that tracks the S&P 500. |

If the S&P 500 goes up, that doesn’t necessarily mean that all the stocks in the index did – some of them probably fell sharply even though the overall basket rose. |

But since you’re invested through a fund, you can’t realize the losses associated with those losing stocks. You only have the option of selling the entire basket as a whole! |

In other words, you have economic exposure to losing stocks while sacrificing the tax benefits associated with that economic exposure. |

Now, if you purchase all the individual stocks in the S&P 500 directly, you preserve the option to realize tax benefits by selling individual stocks – and if you only sell a few, you largely maintain exposure to the overall index. |

Direct indexing might sound complicated to execute, but that’s where Arta’s advanced tech comes into play. |

The platform automatically identifies tax-loss harvesting opportunities and lets you know when the 30-day wash sale window has passed and you can repurchase the shares. |

There are two other ancillary benefits to direct indexing worth mentioning: |

If you already hold a sizable number of shares of a company in an index (perhaps because you’re an employee), direct indexing allows you to exclude that company from the direct index so that you’re not overexposed. If you currently have a portfolio of stocks that you don’t want to sell (perhaps because you don’t want to realize taxable gains), direct indexing allows you to maintain those positions while assembling the rest of the index around them over time.

|

Details: |

|

|

Structured Products |

Structured products are a type of financial instrument that feature risk & reward profiles that are far more nuanced than what you can achieve with typical assets. |

If you invest in the right structured product, for instance, it’s possible to: |

Participate in stock market gains – but only if the market goes up. Institute a 10% buffer before you’re exposed to market losses. Earn a fixed rate of return in certain cases and a variable one in others.

|

While plenty of private banks offer structured products, Arta does them a little bit differently. |

Rather than simply selling off-the-shelf products to investors, Arta offers products that are tailor-made for the current market environment on a rolling basis. |

On the back of strong tech performance early this year, for example, Arta offered a (now-closed) structured product called Rally Nasdaq with the following return profile: |

If the Nasdaq is up after 1 year, a fixed return of 13.6%. If the Nasdaq is down after 1 year, the investment keeps going and returns:

|

|

In other words, this product offers a strong guaranteed return if the Nasdaq rises in the near future – and magnifies the long-term gains if it doesn’t. |

Here’s the thing about structured products: with the right mix of stocks, bonds, and options, you can actually recreate many of them in your own portfolio. |

But the complexity of the DIY approach (along with the high transaction fees you’ll probably pay as a retail investor) tend to make this unrealistic. |

Arta partners with global, systemically important banks (firms like JPMorgan and Goldman Sachs) to underwrite and oversee the precise asset mix in these products – meaning you don’t have to do it yourself. |

Details: |

|

|

Advisory Services |

Earlier, I described how private banks provide value through both products and people. |

Arta is no exception, offering the guidance of a specialized team of financial experts under their advisory division. |

And this guidance is much more widely encompassing than just investment advice (although that’s definitely part of it). You can also speak with: |

Insurance specialists to learn how to use life insurance to build wealth in a tax-efficient manner Options experts to understand how to hedge your portfolio against undesirable outcomes Tax professionals to discuss how to optimize your tax strategy (including navigating tax-sensitive areas like real estate)

|

And access guidance in many other areas, like estate planning to structure your legacy and finding a personal assistant to reclaim some of your time. |

|

Despite what the name suggests, you don’t need to be a rich family or have generational wealth to take advantage of family office services. This guidance is open to all Arta users. |

And here’s the great news: your initial consultation for these advisory services is complimentary, followed by a fee-based relationship if you continue to work with Arta on an ongoing basis. |

If you’re looking for guidance on any of the above areas, this might be one of your best opportunities to get some. |

Details: |

|

|

|

That's it for today. Reply with comments, we read everything. |

See you next time,

Brian |

Disclosures |

This issue was sponsored by Arta Finance Neither the author, nor the ALTS 1 Fund, nor Altea holds any interest in Arta or any Arta offerings

|

|

|