In the coming days, we will be combining the Aviation Week Network content sites into one powerful new website. One location, all tied to a single login and password, with improved access to prime Air Transport publications including ATW and Aviation Daily.

We are in the final stages of migrating our websites, so today’s Air Transport Digest does not include full story links. Here are our editors’ picks of top stories.

We look forward to welcoming you to our new and improved website very soon. |

|

|

|

Southwest Airlines, Boeing reach deal on partial MAX damages | Sean Broderick

Southwest Airlines will share $125 million with employees as part of a deal struck with Boeing that covers part of what the airline is losing because of the 737 MAX groundings, the carrier said Dec. 12. |

|

|

|

“The company continues to engage in ongoing discussions with Boeing regarding compensation for damages related to the MAX groundings,” Southwest said. “The details of these discussions and the settlement with Boeing are confidential.”

The Dallas-based airline had the largest MAX fleet—34 aircraft when the model was grounded in mid-March following two fatal accidents—and was supposed to receive 41 more before 2020. Not having the MAX has cost the carrier $435 million through the first nine months of the year, CEO Gary Kelly said in October.

Southwest said the $125 million will be part of its 2019 profit-sharing distribution, which will be made next year. It will announce total profit-sharing, including the percentage eligible employees will get “early next year,” it said.

The carrier said it is “still evaluating” how to record the Boeing payments, it “expects to account for substantially all of the compensation as a reduction in cost basis of both existing and future firm aircraft orders, which will reduce depreciation expense in future years.”

The Southwest agreement is among the first reported by the airlines and lessors that have been without MAXs since the 387-aircraft fleet was grounded. In September, Boeing and Icelandair reached an interim agreement on MAX compensation.

Boeing, which halted MAX deliveries and reduced monthly 737 production to 42 from 52, announced a second-quarter charge of $4.9 million to help cover anticipated compensation agreements, and did not add to it the third quarter. But that figure assumed Boeing would complete its mandated changes to the MAX “in the September timeframe,” clearing the way for initial regulatory approvals this year.

The timeline continues to drag on, however, as regulators, led by the FAA, scrutinize Boeing’s proposed flight control system and training changes.

The FAA refuses to project when it will lift the MAX flying ban, saying only that the aircraft will not fly until the agency is confident it is safe. The amount of work remaining learning up to an approval, including simulator sessions and flight tests by line pilots and reviews of final software documentation, suggest that the FAA’s review will not be complete until early 2020 at least. This could mean initial revenue MAX flights at US airlines would not start until the second quarter. The three major US airlines that had MAXs when the fleet was grounded. American Airlines, Southwest, and United Airlines, each have the aircraft removed from its schedule through early March.

Boeing has remained confident that initial regulatory approvals would come in late 2019 or early 2020, paving the way for deliveries to resume and production to increase. But it has cautioned that a significant deviation from its presumed timeline—which no regulator endorsed—could lead to further production cuts or, worst case, stopping the 737 line.

It also has said that it anticipates compensation deals to include several elements besides cash payments, such as swapping delivery positions and aircraft types.

“Our discussions with our customers and methodology, their expectations ... continues to be a regular dialogue,” Boeing president Dennis Muilenburg said on the US manufacturer’s third-quarter earnings call Oct. 23. “We assess [the total calculated costs] every quarter.” |

|

|

|

| | | |  | Electric cars, electric trucks … why not electric airplanes? A Colorado company is betting their “eFlyers” will change the aviation industry for the better. Click to read more. |

|

|

|

Delta pilots ask DOT to put conditions on proposed WestJet JV | Ben Goldstein

Delta Air Lines pilots are urging the US Department of Transportation (DOT) to place conditions on the carrier’s proposed transborder joint venture (JV) with Calgary-based WestJet, expressing concerns about how Delta has divided flying opportunities under its immunized alliance with Virgin Atlantic. |

|

|

|

In comments filed with DOT Dec. 12, the Delta Master Executive Council (MEC) of the Air Line Pilots Association (ALPA) urged the department to put conditions similar to those recently imposed on Delta’s transatlantic JV with Virgin Atlantic and Air France-KLM.

Those conditions, set forth in November, require the carriers to periodically assess the JV’s impact on their pilots’ balance of flying and job growth, while also requiring DOT to incorporate those factors into its own comprehensive review of the alliance’s public benefits.

Atlanta-based Delta maintains that its alliances have provided valuable benefits to the general public, including its pilots and crew. “We have hired approximately 4,000 pilots since 2013 and plan to hire thousands more during the next decade,” Delta spokeswoman Lisa Hanna said in response to the filing. “Our proposed joint venture with WestJet will bring more choice, connectivity, and competition to consumers in the US and Canada.”

In their joint application for antitrust immunity, Delta and WestJet said the proposed JV will enable them to “deliver robust consumer and competitive benefits, including enhanced consumer convenience and choice, increased competition in thousands of city-pairs, and substantial economic benefits for communities across the networks of the two airlines.”

Delta pilots have grown increasingly skeptical of the benefits of immunized joint ventures following the DOT’s approval of the Delta-Virgin Atlantic JV in 2013. In the years since, Virgin’s total block hours between the US and UK increased 33%, while Delta’s increased just 2%, according to the Delta MEC’s filing.

The pilots also cited American Airlines’ actions in the aftermath of its abrupt divorce with Chile’s LATAM—following Delta’s acquisition of a 20% stake in the Chilean airline group—as evidence that US airlines are using JVs to effectively outsource growth to foreign carriers. In the days following LATAM’s cancellation of its relationship with American Airlines in October, American announced expanded offerings to several South American countries, which the Delta pilots say demonstrates the carrier viewed its LATAM alliance as a means to avoid organically expanding into the region.

“Delta pilots have been adamant that airline management must meaningfully commit to equitable growth with its joint venture partners. Without an equitable growth commitment, job growth and career opportunities for Delta pilots are limited,” said Ryan Schnitzler, chairman of ALPA’s Delta MEC. |

|

|

|

| | | |  | Would you like to improve cabin security and reduce the number of passenger items left on board the aircraft? Would speeding up cabin checks improve your efficiency? KomyMirror can help you do that. Flat and ultra-lightweight, KomyMirror provides a wider field of view than other mirrors. |

|

|

|

FAA moves toward space-based ADS-B to track aircraft | Bill Carey

FAA is considering expanding its use of space-based surveillance to track aircraft and maintain separations in oceanic airspace beyond an operational trial slated to begin in the Caribbean region in March. |

|

|

|

The agency is developing a 1-to-3-year roadmap “to expand our use of this promising technology,” FAA Deputy Administrator Dan Elwell informed the NextGen Advisory Committee on Dec. 12.

It also has developed a prototype automation system capable of displaying aircraft targets generated by space-based automatic dependent surveillance-broadcast (ADS-B) to controllers, Elwell said.

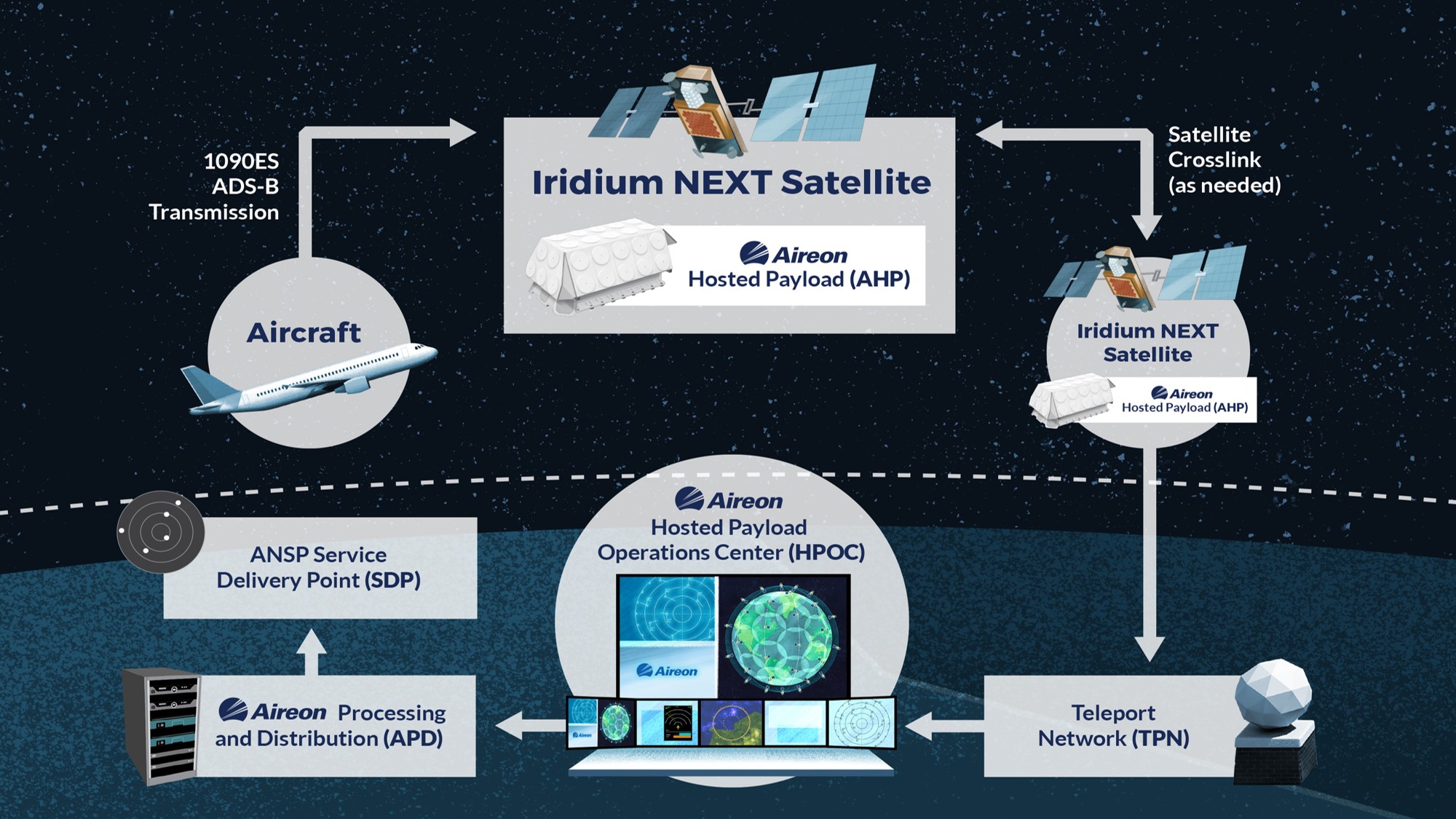

With the agency’s ground-based ADS-B system set to become its primary means of surveillance in domestic airspace as of Jan. 1, space-based ADS-B would make use of the system provided by the Aireon joint venture of Iridium Communications and five air navigation service providers (ANSP), which began operating earlier this year.

The Aireon system uses ADS-B receivers on Iridium Next satellites to capture signals from aircraft transmitting by ADS-B Out, then routes the data through a ground teleport network to ANSPs that subscribe to the service.

Aireon and the FAA have negotiated an agreement to conduct a one-year operational evaluation of space-based ADS-B in Caribbean oceanic airspace, covering the flight corridor between Miami and Puerto Rico. That trial, managed by the FAA’s Miami en route center, will use the center’s modified ERAM automation system to display aircraft targets to controllers.

On Dec. 18, the FAA will demonstrate a prototype version of the Advanced Technologies and Oceanic Procedures (ATOP) automation system used at its New York, Oakland and Anchorage oceanic control centers that is capable of integrating the space-based ADS-B data feed, Elwell said.

Expanded use of space-based ADS-B could include coverage of Bermuda in the North Atlantic Ocean, airspace that is managed by the New York oceanic center.

In a July report to Congress, the Government Accountability Office (GAO) said the FAA had decided to reduce aircraft separations in oceanic airspace using more frequent, satellite-routed position reports from automatic dependent surveillance-contract (ADS-C) for the near term, and to continue studying space-based ADS-B.

One of the reasons the GAO cited for the FAA’s choice of the ADS-C surveillance method was the cost associated with upgrading the ATOP platform to accept space-based ADS-B transmissions.

The Air Line Pilots Association (ALPA) has called for more timely adoption of space-based ADS-B to separate aircraft in oceanic airspace.

“Space-based ADS-B is already a reality and is being used to separate traffic today, with the same performance as domestic en-route radars,” the pilots’ union states in a white paper released Oct. 31. “ALPA recommends that the FAA incorporate space-based ADS-B in their infrastructure plans for oceanic airspace.” |

|

|

|

| | Southwest Airlines Strikes Deal With Boeing For Partial MAX Damages | Korean Air Names Woo As Airline President | Delta Pilots Push DOT To Place Conditions On Proposed WestJet JV | IATA Foresees Cargo Return To Modest Growth In 2020 |

|

|

|

January 22-23, Cartegena, Colombia

February 4-6, Indianapolis, IN |

February 4-5, Miami, FL

February 24-26, Dubai, UAE |

|

|

|

|