| |

|

| Follow Us | Get the newsletter |

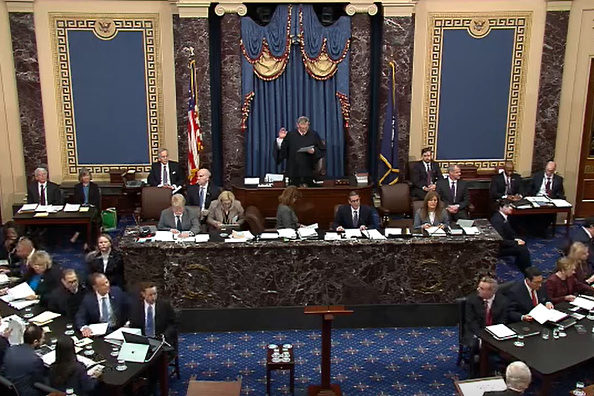

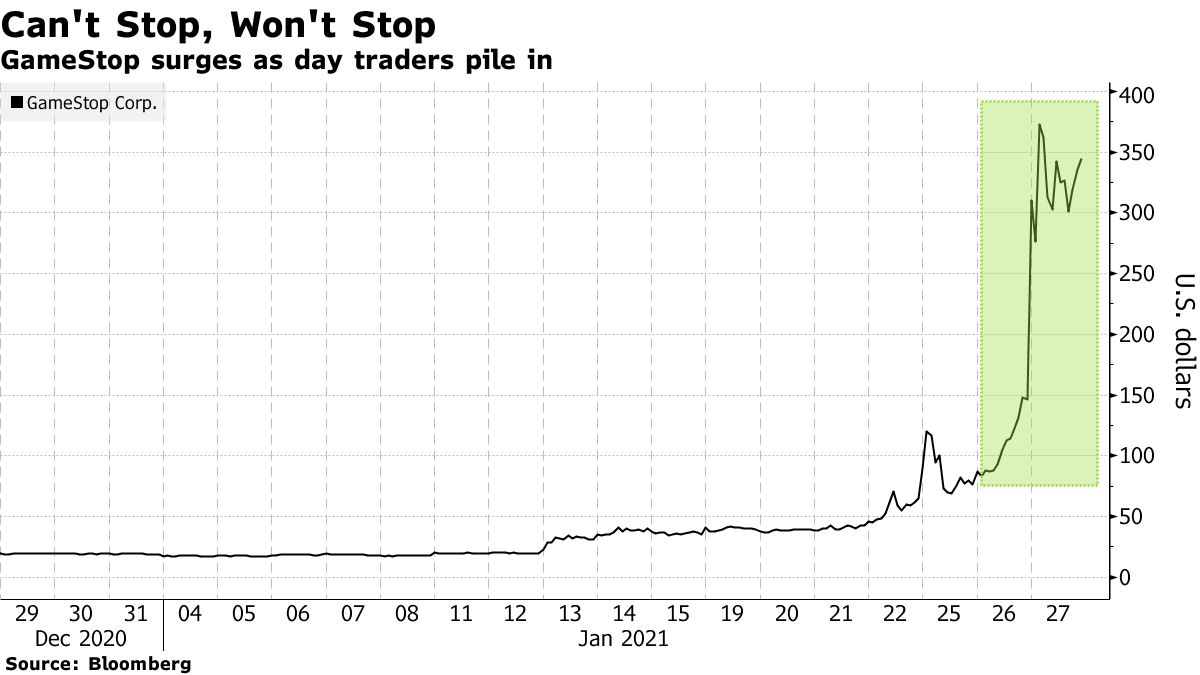

| The Fed had a rate decision Wednesday (they held), but all anyone wants to talk about is the crazy ascent of video game store GameStop. The rise of homebound amateur traders is forcing Wall Street, especially short sellers, to pay attention as established players are squeezed by an army of Reddit bros. Robinhood faced disruptions while TD Ameritrade curbed GameStop trades. Other retail stocks are getting a boost from this effect, like AMC, bankrupt Blockbuster and Tootsie Roll. The White House says it’s monitoring the situation, but there may be bigger, related fish to fry. In a stock market where every day seemed to bring new records, there now seems to be concern that equities are—wait for it—overvalued. The S&P 500 fell by more than 2.5% while the Dow slid by 2%. Could this be GameStop and fear of a “squeeze contagion?” Here’s your markets wrap. —Margaret Sutherlin Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today’s top storiesApple raked in $100 billion last quarter. So naturally, its shares fell. The reason? A cautious outlook from the iPhone maker’s executives. The stock declined almost 3% in extended trading. President Joe Biden announced executive actions aimed at curbing drilling (after approving dozens of drilling projects) and reining in fossil-fuel subsidies. The Democrat pitched his climate policies as an employment plan for the decimated U.S. labor market. New climate czar and former Senator John Kerry, just one leader of a sprawling climate team, spoke at the World Economic Forum, calling for “scrutiny and measurement” of global climate pledges to make sure they’re sufficiently robust. He used the opportunity to take a swipe at China.  John Kerry, special presidential envoy for climate, speaks during a news conference at the White House on Jan. 27. Photographer: Stefani Reynolds/Bloomberg A new poll shows more Americans want to get a Covid-19 vaccine than did just a few months ago. Biden pledged another 200 million more doses in shortish-order, but to inoculate everyone 16 and older, the U.S. needs 500 million doses. The best chance for a dramatic supply increase may come from Johnson & Johnson. In the U.K., Prime Minister Boris Johnson indicated the strict lockdown to control the variant there may go through at least March. AstraZeneca plans a global trial studying the time between the initial Covid-19 vaccination and the booster shot. But its vaccine has yet to be approved in the U.S., while the European Union failed to resolve its dispute with the drugmaker over its supply. Here’s the latest on the pandemic. Global debt exploded by $19.5 trillion last year. In a world where rock-bottom interest rates have kept debt costs manageable, borrowing isn’t just necessary but affordable. But if rates rise faster or higher than expected, the end of the Covid-19 crisis could mark the beginning of a reckoning. Here’s what could happen when the bill comes due. Supreme Court Chief Justice John Roberts’ refusal to preside over the second impeachment trial of former President Donald Trump is giving Republicans cover for opposing the proceedings, in which Trump is accused of inciting a deadly insurrection.  U.S. Supreme Court Chief Justice John Roberts presiding over the first impeachment trial of Donald Trump on Jan. 21, 2020. Photographer: Handout/Getty Images North America A $1.9 trillion Covid relief package is stalled in Congress as Republican support dwindles, potentially forcing Democrats to push on alone. Biden, who wanted a bipartisan bill, plans to assess “the impact of delay” for further Covid relief. House Democrats plan to activate a budget process next week to fast-track votes on parts of Biden’s plan. Tesla shares slid 4.3% in post-market trading after the electric carmaker reported a lower-than-expected profits (though it was its sixth consecutive quarter of making those profits). What you’ll need to know tomorrow

What you’ll want to read in Bloomberg InvestingShould You Also Be Buying GameStop?You know hype can be dangerous. You know stock picking is risky, and you’re unlikely to beat the market consistently. So you maxed out your 401(k) contributions, you bought some low-cost index funds. And you’re socking away cash for a rainy day. And yet... hang on. Read this first.  Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Road to Net Zero: Many corporations and investors are seeking to align with the Paris Agreement’s goal of becoming carbon neutral by 2050. Join us Feb. 16 as we examine the major industries taking action, how they will finance the transition and how we can work together to achieve net zero. Sponsored by TD Bank. Register here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| You received this message because you are subscribed to Bloomberg's Evening Briefing newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |