| Industry experts never anticipated it..

But as stock market volatility raged, the VIX recently soared above the bitcoin volatility index.

Translation: the traditional safety of the traditional markets may be ancient history.

Leaving more and more savvy investors looking for potential solutions outside of traditional markets.

And we think we've found one…

Real assets like blue-chip art

And we're not alone.

Some of the biggest financial institutions in the world, (Think Goldman Sachs, JP Morgan, and Bank of America) are turning to real assets like blue-chip art..

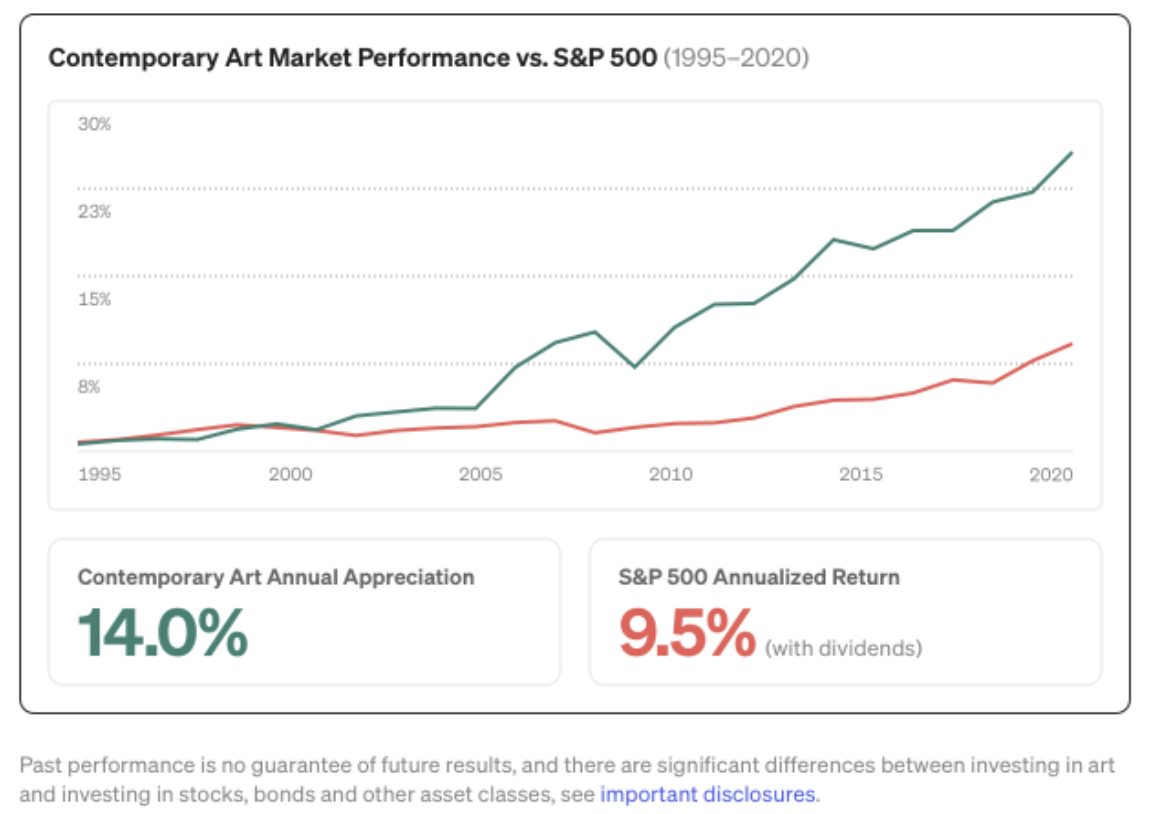

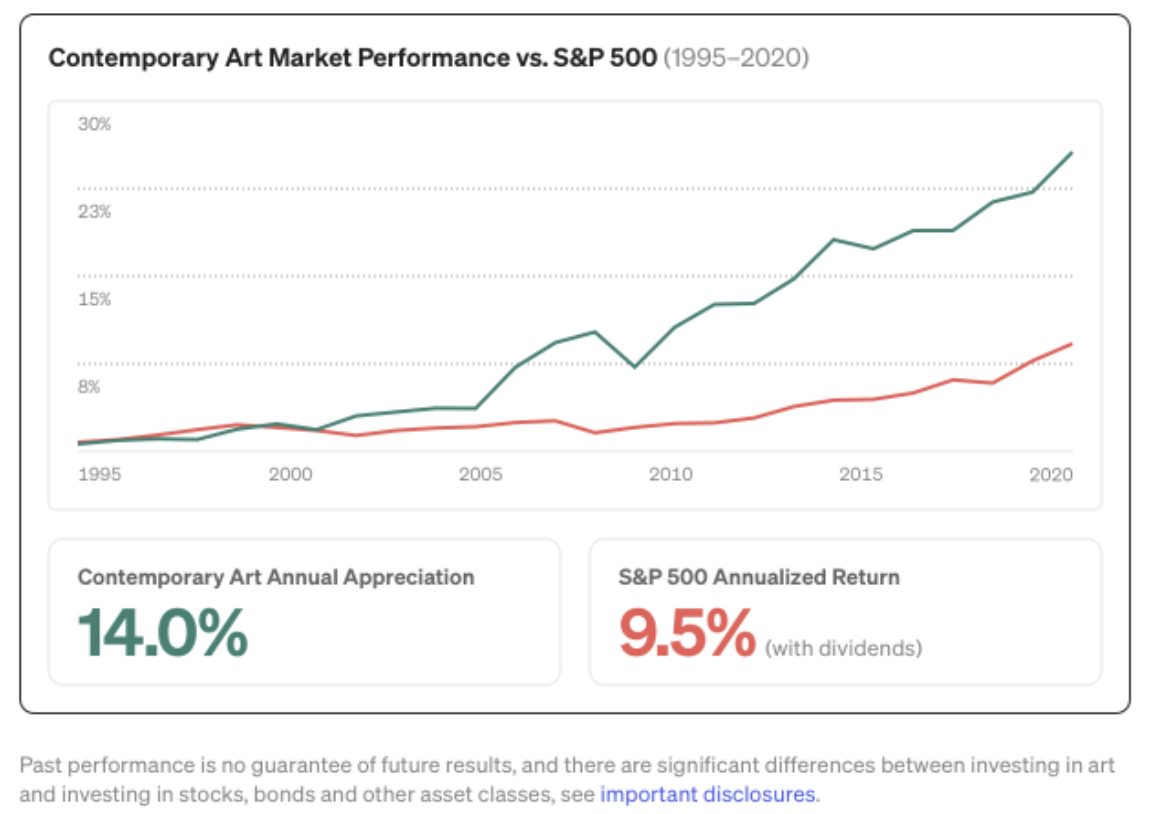

Over the last 26 years, through three recessions, three bear markets and 10 corrections, contemporary art price appreciation (+14%) outpaced the S&P 500 (+9.5%), real estate (+8.9%), and gold (+7.2%).

It's no wonder 550,000 members have joined the art investing platform Masterworks.

Masterworks makes it simple to invest in blue-chip art. The same art you see in galleries and museums across the world.

Their members enjoy unrivaled access to investments in institutional-grade works (think Picasso, Basquiat, and Banksy).

So, while others are panic selling crypto, real estate and AMZN, seven of Masterworks' last eight strategic exits each realized a net return of +17.8%.

That's not cherry picking. That's a track record.

The only problem? Shares in each offering are limited and can sell out in minutes.

But Stock Ticker News readers can skip the 2,342 person waitlist here.

*Net est. returns for all offerings from inception through 6/30/22. See important Reg A and performance disclosures: masterworks.com/cd

|