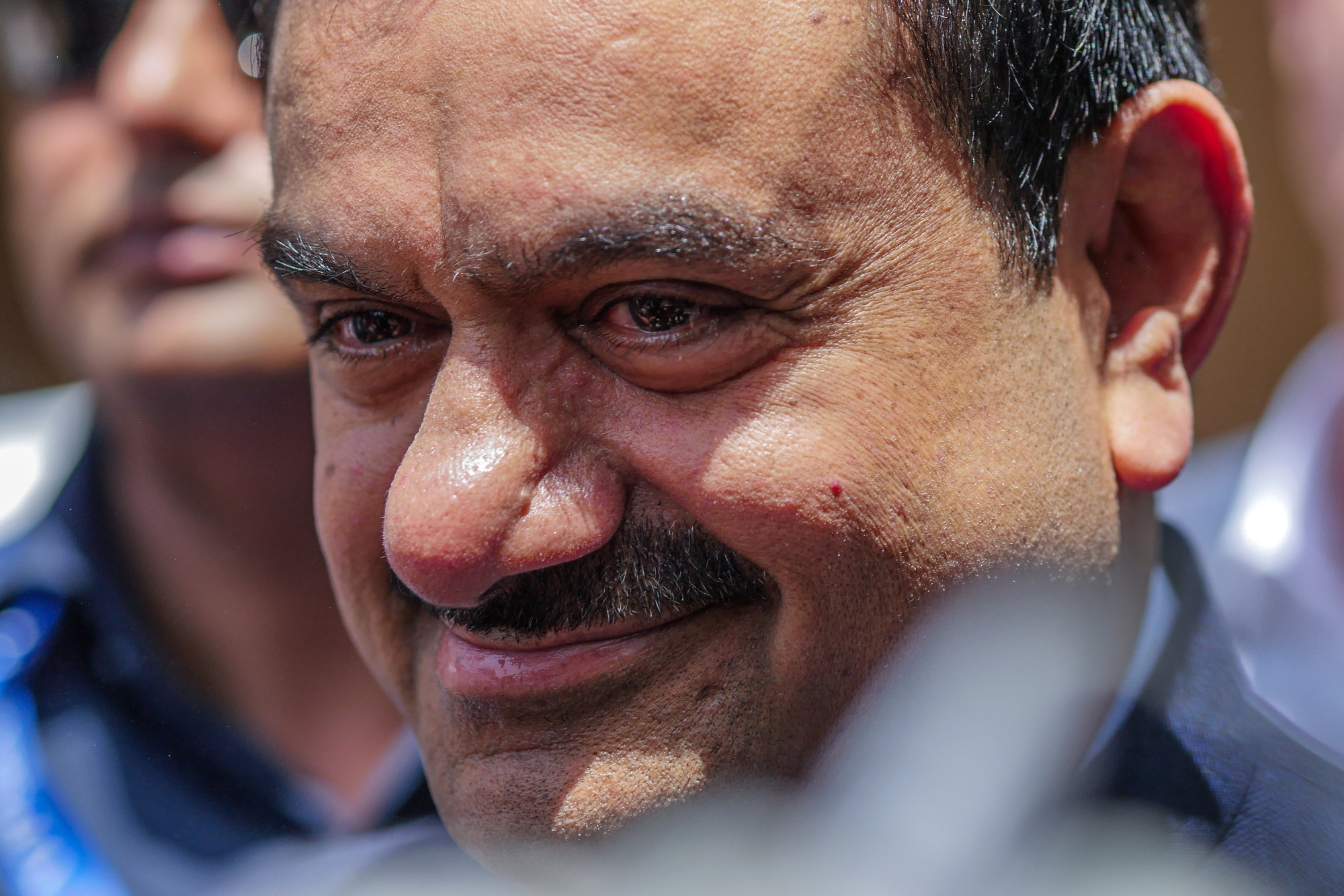

| Dear Evening Briefing readers: Our email domain is changing, which means the briefing will arrive in your mailbox from a different address, noreply@news.bloomberg.com. Please update your contacts to ensure you continue to receive it—see the bottom of this newsletter for details. A renewed bout of volatility hit financial markets as nervous chatter about a US recession—widely seen as premature—spurred warnings that this year’s sizzling stock rally has gone too far. From New York to London and Tokyo, equities got pummeled. Just as markets started celebrating signals from the Federal Reserve about a first rate cut next month, they were hit by a perfect storm of weak economic data, underwhelming corporate earnings, stretched positioning and poor seasonal trends. By the end of the day, the S&P 500 suffered its biggest drop in about two years. As for the tech-heavy Nasdaq 100, it saw its worst start to a month since 2008. Wall Street’s “fear gauge” at one point registered its biggest spike going back to 1990. Traders who have been clamoring for a rate cut since spring are hoping the market’s nervousness will bully the Fed into easing policy aggressively, rather than sticking to an expected quarter-point cut next month. Indeed, the swap market earlier assigned a 60% chance of an emergency rate cut by the Fed over the coming week. Those odds, unsurprisingly, soon ebbed. —Natasha Solo-Lyons Before all the unpleasantness struck London and New York, Japanese markets took the first hit. Turmoil in Tokyo boiled over Monday as the yen extended its rebound against the dollar to about 13% from July’s low, and stocks tumbled into a bear market. Yields on benchmark Japanese government bonds slid by the most in more than two decades. The accelerating moves continued to take investors by surprise, hurting everyone from mom-and-pop traders of shares and currencies to large hedge funds and institutions. The slump in bond yields triggered record declines in the shares of Japan’s three biggest banks, wiping 12 trillion yen ($85 billion) from their market value in the past two trading days. Goldman Sachs economists said there are several reasons not to fear a US slump even as unemployment rises amid the central bank’s effort to achieve a soft landing. “We continue to see recession risk as limited,” Goldman economists led by Jan Hatzius said in a report to clients on Sunday. The economy continues to look “fine overall,” there are no major financial imbalances and the Federal Reserve has a lot of room to cut interest rates and can do so quickly if needed, they said. All this talk about an emergency rate cut after the Fed passed up the opportunity to ease policy last week is misplaced. So says Marcus Ashworth, who writes in Bloomberg Opinion that such a move would be counterproductive. And any interest rate cut isn’t going to make it easier for Americans to buy a new house anytime soon, according to a majority of the respondents in the latest Bloomberg Markets Live Pulse survey. Vice President Kamala Harris met Sunday with at least three possible running mates: Arizona Senator Mark Kelly, Pennsylvania Governor Josh Shapiro and Minnesota Governor Tim Walz. The meetings were part of Harris’ final stretch before selecting who will join her on the 2024 Democratic presidential ticket, which she is expected to announce in coming days.  US Senator Mark Kelly, left, Governor Josh Shapiro, center, and Governor Tim Walz, right. Photographer: Al Drago, Hannah Beier, Eva Marie Uzcategui/Bloomberg A judge approved SVB Financial Group’s restructuring deal but dealt it a setback in its fight with federal regulators to recover $2 billion it had at its Silicon Valley Bank subsidiary when it collapsed last year. Judge Martin Glenn on Friday backed SVB’s plan to distribute assets to creditors and preferred equity holders, largely resolving its bankruptcy. The group includes funds managed by Citadel Advisors LLC, Hudson Bay Capital, King Street Capital Management LP and other Wall Street heavyweights, according to court documents. But the ruling leaves unresolved its fight with the Federal Deposit Insurance Corp. over roughly $1.93 billion in deposits held by the former Silicon Valley Bank. Iran reiterated it wants to avoid all-out war with Israel even as it threatened to retaliate for last week’s assassination in Tehran of a leading Hamas figure. Iran, which had already vowed revenge for the killing of Ismail Haniyeh, said it aimed to deter Israel from repeating similar strikes. (Israel has neither confirmed nor denied being responsible for his killing.)“Reinforcing stability and security in the region will be achieved by punishing the aggressor and creating deterrence against Israel and its adventurism,” a spokesperson for Iran’s foreign ministry said Monday. Bangladesh’s army chief and president are working to install an interim government and calm deadly protests that forced the nation’s increasingly autocratic prime minister, Sheikh Hasina, to flee the country. President Mohammed Shahabuddin said in a televised address that he ordered the release of jailed protesters as well as ex-prime minister and opposition leader Khaleda Zia. He also said elections will be held “as soon as possible.”  Sheikh Hasina. Photographer: Christopher Pike/Bloomberg Indian billionaire Gautam Adani—Asia’s second richest man with a fortune of more than $100 billion—and his heirs have revealed plans for one of the world’s largest wealth transfers. Adani says he’ll shift control to his scions in the early 2030s. But controversy over the Hindenburg short-seller attack and a US Justice Department bribery probe still looms over the business.  Gautam Adani Photographer: Dhiraj Singh/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. |