|

|

To investors,

Now that the recession has been cancelled, all eyes are on what will happen to asset prices through the end of the year. I previously predicted in April, at the depths of the fear-mongering, we would see new all-time highs across assets by the end of 2025.

We have seen bitcoin, gold, and the Nasdaq 100 each reclaim a new high since then. Next it will be the S&P 500’s turn.

Four different assets. All the same outcome. And the good news doesn’t stop there.

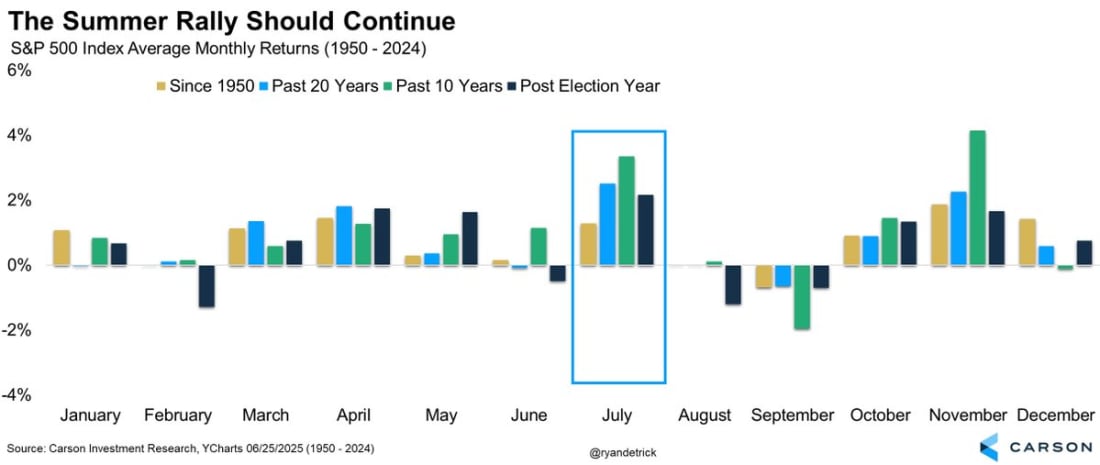

Carson Group’s Ryan Detrick highlights “July is the best month of the year in a post-election year and the past 20 years. It is the 2nd best the past decade.”

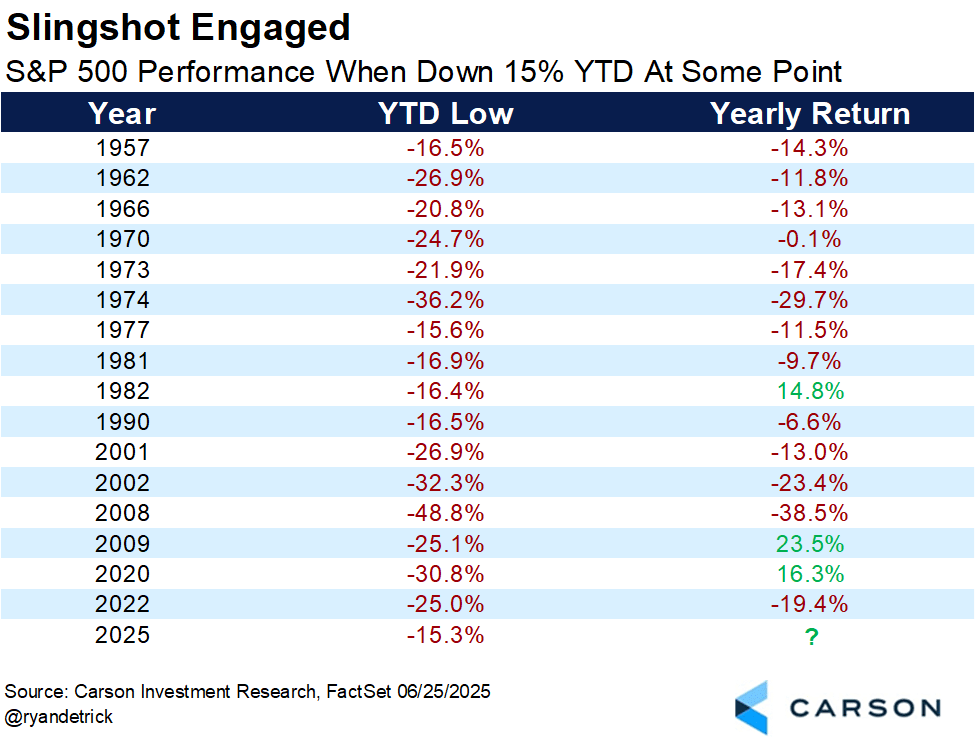

Not a bad thing to look forward to, right? Ryan goes on to point out there is a good chance stocks could actually post a double-digit return for 2025, which would surprise many of the doomsday predictors from earlier in the year.

Remember…study reflexivity. The faster something falls, the faster it can recover. We are living through volatile times. The speed of information, and therefore emotional reactions, has never been possible before now. Up, down. Up, down. And over a long enough timeline every asset is going up and to the right if it is priced in dollars.

Just take a look at the US dollar index for another data point. It has lost more than 10% in the first half of this year. Barchart points out this is the worst start to a year in four decades.

Nowhere is this more obvious than bitcoin. The 80 vol asset has appreciated hundreds of percent and then violently ripped down 80% or more multiple times. That volatility scares some people away, but it is the solution to another group of investors’ problems.

As many in the bitcoin world have pointed out, volatility is vitality. Take a look at the bitcoin price overlaid with the M2 money supply.

If bitcoin continues to follow money supply growth, we could see $150,000 per coin before year end. That would be volatility that would make bitcoiners very happy. But no coiners have no one to blame but their government.

Bitcoin will keep going up until the government stops printing money. If you want to bet on the national debt U-turning, be my guest. I am convinced that will never happen in our lifetime now. So you have to position yourself to benefit, rather than be punished, by the corresponding dollar debasement.

Stocks, gold, and bitcoin are all going higher. We will blow through new all-time highs. And pessimists will once again have sounded smart, but they will struggle to make money.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

How Geopolitics Are Making Bitcoin Stronger

Polina Pompliano and Anthony Pompliano discuss what is going on with bitcoin, bitcoin treasury companies, impact of geopolitical conflicts, stock market, and a little behind the scenes of announcing a bitcoin treasury company.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.