I cannot tell you how many times friends, relatives, and readers complain to me about the recent proliferation of new streaming services. It’s not that folks mind the choices; they just aren’t that into having to pay for a dozen different services, resulting in a monthly tab similar to an old-fashioned cable bill. This week’s Buffering takes a look at how a bunch of newer streamers are trying to tackle that problem, at least in the short-term, by deeply discounting their product in order to drive sign-ups. It’s a smart play for now, but not without some risk. Also ahead: Tubi goes to Sundance, Disney prepares to report its earnings, and the Roku Channel adds even more live channels. Thanks for reading, and hope your Valentine’s/Galentine’s/President’s Day Weekend is a sweet one. –Joe Adalian |

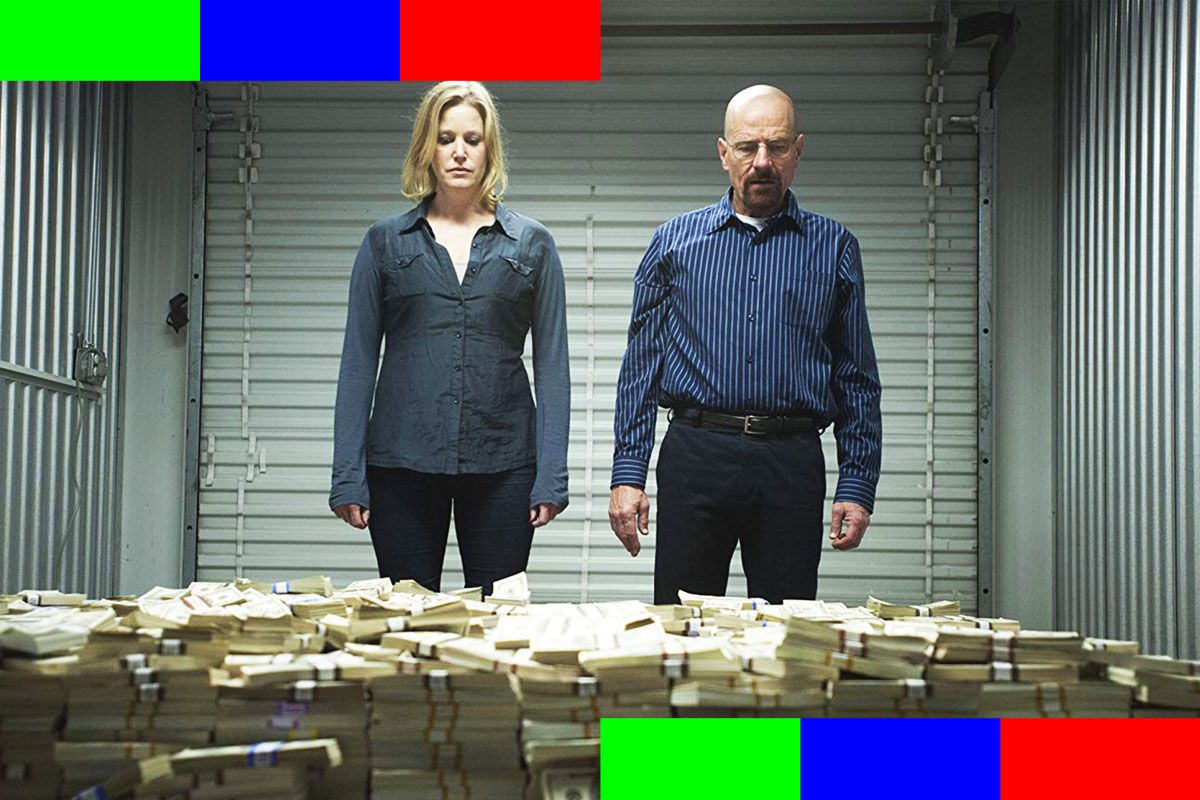

|  | | Photo-Illustration: Vulture and AMC | | |

| Worried about how to beat the increasingly high cost of streaming? Good news: Even as Netflix recently upped its monthly fee — and Disney+ is about to do the same — a price war has broken out among several of the newer platforms. As they battle to get cost-conscious consumers to notice them, baby streamers have been serving up some particularly attractive deals in recent weeks. The savings can be substantial — particularly if you’re willing to make a long-term commitment. |

| • Ahead of next month’s transformation of CBS All Access into Paramount+, owner ViacomCBS is letting consumers sign up for a year of the platform for a whopping 50 percent off the usual price tag. Committing to an annual plan currently costs as little as $30 (or $2.50 per month) for the ad-supported version of the streamer. The ad-free version of the service can be had for $50 per year, or $5 per month. The $30 plan is similar, though not quite as attractive, as Hulu’s recent Black Friday offers, which slashed the price of the service to just under $2 per month with a one-year commitment. Hulu, however, didn’t offer the deep discount for its ad-free plan. |

| • Just-launched Discovery+ has trimmed prices for two of its ad-free plans by 30 percent, at least through Sunday. As part of a Valentine’s Day promotion, a six-month subscription is down to $29 (instead of the normal $42) while a year currently costs $59 (versus the usual $84). Caveats: The discounts don’t apply to the ad-supported version of Discovery+ (which remains $5 per month), and remember, if you’re a Verizon subscriber, you may be eligible for a free six- or 12-month trial subscription. |

| • HBO Max has extended a holiday promotion that trims a little more than 20 percent off the cost of a subscription, reducing the streamer’s usual $15 per month price tag to $70 if you prepay for six months (that’s $11.67 per month). It follows a September promotion that let customers lock in savings for a full year. (HBO Max is still being offered for free to many AT&T wireless and phone customers.) |

| Given the number of major streamers that have bowed over the past 18 months, it is not all that surprising that companies are having to hustle to get consumers to check them out. The pandemic has folks streaming more TV shows and movies, but unemployment remains high and millions are likely looking to cut costs for nonessential budget items. Plus, the proliferation of new platforms means getting Jane Q. Streamer to add another $5, $10, or $15 for yet another service is a big ask — particularly when Netflix, Hulu, Amazon, and now Disney+ are so firmly established. Making streaming more affordable can be an easy way to get cost-conscious potential customers to smash that subscribe button. “It’s all about grabbing land share,” explains LightShed partner and media analyst Rich Greenfield, who says Wall Street wants to know these new services are at least getting sampled beyond a one-week (or one-month) trial period. “Investors are rewarding companies for subscriber [tallies].” |

| Most of the current deals keep the base monthly rate unchanged, instead offering a break only if a consumer is willing to make a minimum commitment of six months or more. That is no accident. “They’re trying to lock people in order to avoid churn,” Greenfield says. Indeed, unlike cable TV — where getting rid of an HBO or Showtime add-on requires calling in, waiting for a customer-service rep, and then hoping you’re not assaulted by a desperate plea not to downgrade — it is very easy for someone to cancel a streaming service. A couple clicks, and you’re good to go. Longer-term plans give new services breathing room as they work to build their subscriber base and their programming libraries. (That last point is key right now, given the pandemic’s continuing effect on the production pipeline.) |

I Want My Bundle Back (Bundle Back Bundle Back) |

| Avoiding churn may also be why we have seen more streaming bundles pop up of late. Disney, for example, offers Disney+ packaged with Hulu and ESPN+ for a discounted price of $13 per month (vs. $18 per month if purchased separately). While the bundle isn’t a great deal unless you are a frequent user of all three services, it gives consumers the perception of value and expanded choice. That in turn reduces churn, since someone who’s not feeling Disney+ for a few months will likely stick around if they are being served well by Hulu and ESPN+. |

| Disney, by the way, has been something of a pioneer in offering deep discounts in exchange for loyalty: It has offered a cheaper annual plan for Disney+ since it began signing up customers, even giving its best superfans the chance to lock in a low price for a whopping three years. (Given next month’s planned price hike, that turned out to be a very good deal for consumers.) Disney’s streaming strategy takes a page from its consumer parks division, which for decades has let California and Florida residents buy annual passes to build up loyalty to the Disney brand (and keep the parks full when it’s not tourist season). |

| Bundles are also a great way for companies to maximize the value of smaller platforms. AMC Networks, for instance, has assembled an impressive collection of niche streamers such as Shudder, Sundance Now, and IFC Films Unlimited. They’re all quality platforms, but separately, they have limited appeal. So the company recently decided to put the full library of content from all three services on to a new supersize app dubbed AMC+, throwing in a selection of shows from AMC proper and BBC America as a bonus. The whole package is priced at $9 per month, which isn’t cheap, but is also less than half of what the three speciality streamers cost on a stand-alone basis. |

| ViacomCBS has also been testing out a bundle of sorts. It is selling Showtime and the ad-free version of CBS All Access/Paramount+ — $21 if bought à la carte — for just $10 per month. The only hitch: You have to also be an Apple TV+ subscriber. Still, given Apple’s own commitment to discounting right now — most of its current users are getting the service for free as a bonus for buying Apple products — the ViacomCBS bundle is a particularly sweet deal, at least if you’re a fan of CBS and Showtime programming. |

Will All This Actually Work? |

| Of course, anyone signing up for these offers needs to know we are quite possibly living through what will soon be known as the good old days of streaming discounts. Much the way Netflix eventually got rid of its once-standard 30-day free trials, as these new streamers mature, they will almost surely ditch the deals. Luring new subscribers is paramount (pun intended) right now for newbie services, but as Greenfield points out, “The question is eventually going to be, what is the profitability of these subscribers.” It’s great to have 50 million subscribers, but if they’re only paying a few dollars per month, they’re likely not making a service a ton of money. |

| In India and a few other countries, for instance, Disney offers Disney+ bundled with its general entertainment Hotstar for something like $20 per year. That gives it broad reach (and helps boost those global Disney+ subscriber tallies) but results in Disney bringing in less revenue per subscriber than it does in other countries. While newer streamers aren’t offering Hotstar-like discounts in the U.S., they’re definitely selling their goods well below sustainable long-term cost. That won’t last. “At some point, if your service is good enough, it has to be good enough to warrant subscribing” at a non-discounted rate, Greenfield says. What’s more, even if something is (relatively) cheap, consumers won’t remain signed up forever if they don’t feel a service is worth it. “People aren’t going to stay on if they’re not engaged.” |

| Enjoying Buffering? Share this email with your network or subscribe now to get the newsletter in your inbox every week. |

| Is Disney+ about to cross the 100 million subscriber mark? Probably not, but I wouldn’t be shocked if the Mouse House still stuns when it reports its fourth-quarter earnings — and its current subscriber tallies — later today. December’s investor presentation (you know, the one where the company said it would be mining something like 5,000 new shows from its IP library) not only wowed Wall Street; it also served as a brilliant marketing stunt aimed at wooing holiday shoppers to give the gift of Disney+. That, combined with the strong numbers for Pixar’s Soul, could in theory have driven a slew of sign-ups and put the Big D over the magic milestone. It’ll be close: Disney+ was at 87 million at the start of December, and analysts such as JPMorgan’s Alexia Quadrani are very optimistic (she’s predicting 95 million). We’ll get the news after the stock market closes this afternoon. |

| Devour pop culture with us. |

| Random fact: I have never listened to that “Baby Shark” song all the way through. My personal boycott aside, folks whose kids can’t get enough of the musically monotonous fish now have a reason to check out the Roku Channel. Roku’s free, ad-supported streamer is adding a live, linear channel devoted to nothing but Baby Shark content, giving parents another way to keep their kiddos occupied. The Baby Shark channel is one of 13 virtual channels joining Roku’s live lineup as of today. Other new options: |

| • Six channels devoted to various music video genres, including ’80s and ’90s music for us olds (plus channels playing hip-hop, country, and party jams.) Programming will come from Loop, a new-ish company that serves up on-demand video playlists via its mobile and TV apps, and is already doing the live linear thing on Roku Channel competitor Plex. This is very good news for those of us who still remember when MTV played music videos (but when is somebody going to bring back VJs?). |

| • K-Pop stans can get Korean variety and reality shows, music specials, and drama on K-ID, and Korean dramas such as Secret Garden on Kocowa Classic. |

| • Hallmark Movies & More aggregates content from the Hallmark Channel library. |

| • Bloomberg Quicktake serves up news for millennial audiences (see also: Cheddar). |

| • CineVault Westerns will feature oaters from the Sony library, while Cine Romántico will play Spanish-language romance movies. |

| While we’re on the topic of ad-supported VOD, it’s a big week for the Fox-owned Tubi. The streamer is in the middle of a massive promotional push it’s dubbed Free Like Tubi week, which basically consists of lots of targeted promotional stunts and giveaways across social media (including Fox’s various show handles). This morning, it unveiled plans for a massive expansion of its already impressive News On Tubi hub, announcing it will add live news feeds from over 80 local TV stations around the country over the next few months. And perhaps most interestingly, on Monday Tubi said it had acquired director Danny Madden’s Sundance selection Beast Beast and will begin streaming the feature film Friday. While it no doubt paid nowhere near the $25 million or so Apple TV+ threw down for the much bigger Sundance sensation CODA, that Tubi spent any money at all on a feature film is a sign of how serious it — and other companies — are about the free on-demand streaming space. Amazon’s IMDb TV is already producing original shows, Roku recently invested serious coinage for the remains of the Quibi and I’m expecting we’ll see even more ambitious plays to come as 2021 goes along. The race to turn AVOD into the new broadcast TV is on. |

|  | | |

| |

|