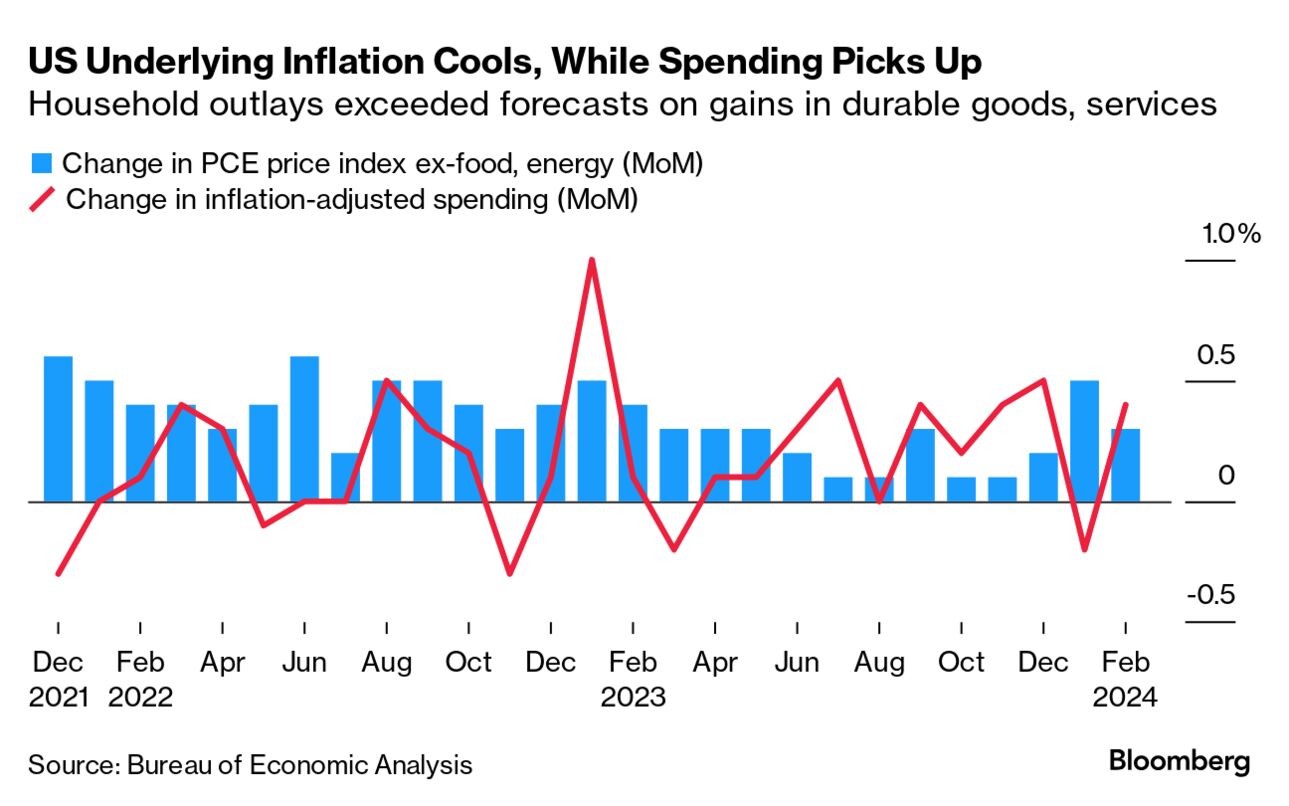

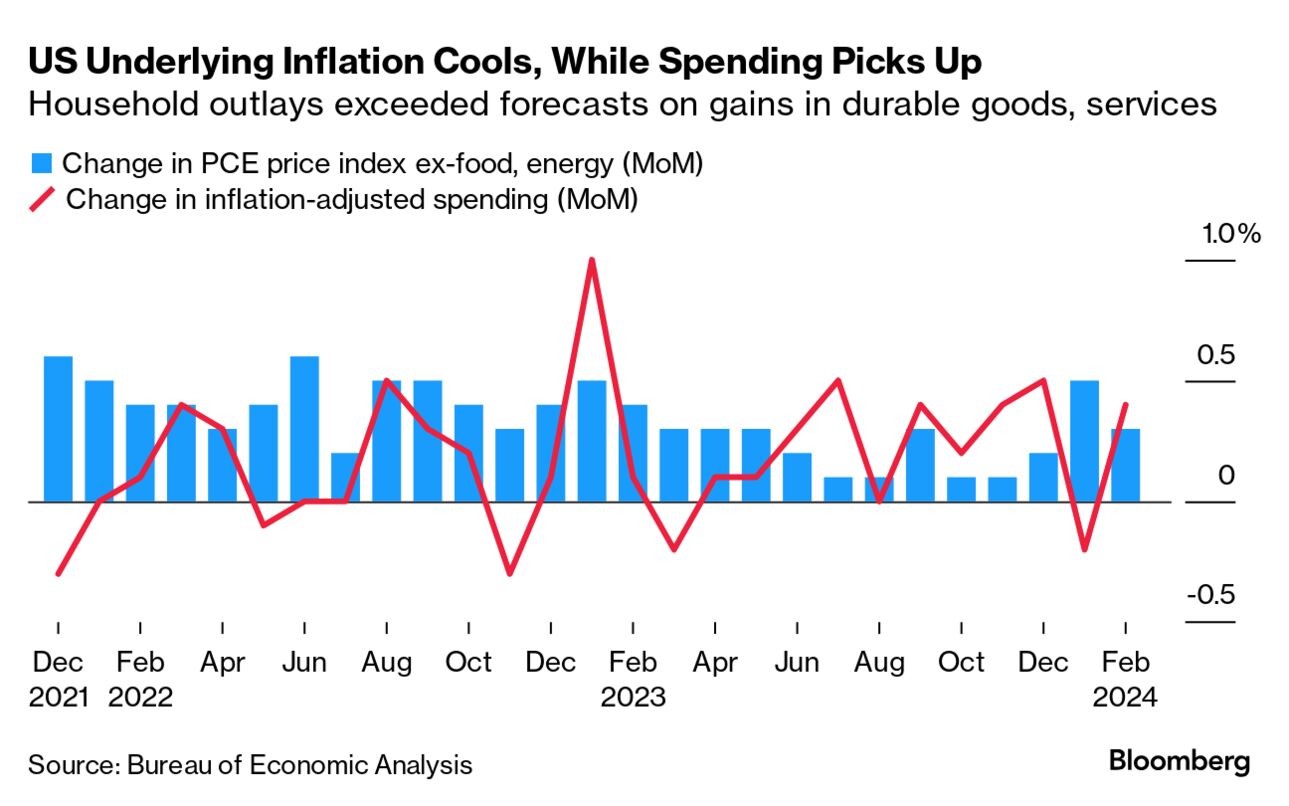

| Wall Street may be impatient for interest rates to start falling, but the messaging from US Federal Reserve officials has been consistent. “We don’t need to be in a hurry,” Fed Chair Jerome Powell reiterated Friday. He spoke right after the central bank’s preferred gauge of underlying inflation showed prices continuing to cool—0.3% in February—while remaining high enough to keep Powell tied to his favorite strategy: caution. “The fact that the US economy is growing at such a solid pace, the fact that the labor market is still very, very strong, gives us the chance to just be a little more confident about inflation coming down before we take the important step of cutting rates,” Powell said. Indeed, the latest numbers are reassuring strategists that the American economy is holding up just fine after a two-year rate-hiking campaign. Inflation-adjusted consumer spending exceeded all estimates on the heels of the biggest gain in wages in over a year, according to the report from the Bureau of Economic Analysis. “Central bankers can afford to wait before reducing benchmark interest rates,” Jonathan Levin writes in Bloomberg Opinion.  When it comes to stocks, traders this week continued to ignore warnings of a growing artificial intelligence-fueled tech bubble that could pop at any time. Equities kept moving higher this week, hitting a record in the final stretch of a quarter that saw the market surge more than 10%. “The S&P 500 continues to defy all of the naysayers,” said Chris Zaccarelli at Independent Advisor Alliance. “Investors are more impressed with the state of the economy and the resilient consumer than they are worried about Fed rate cuts being pushed of farther into the future.” Who will pay for the billions of dollars in damage caused by the container ship crash that toppled Baltimore’s Francis Scott Key Bridge, killing six people? The first order of business will be a salvage operation to refloat and remove the ship, the Dali. US President Joe Biden said the federal government should rebuild the bridge and directed authorities to “move heaven and earth” to reopen Baltimore’s port as soon as possible. The price tag—rerouting cargo to other ports as well as the cost of loss of life, property and business—could be among the largest-ever marine insurance payouts, according to Lloyds of London. John Authers writes in Bloomberg Opinion that the accident has underscored the difficulty of paying for infrastructure, in particular the longstanding problem of attracting private investors to big projects.  Collapsed sections of the Francis Scott Key Bridge rest on the Dali in Baltimore harbor. Photographer: Scott Olson/Getty Images North America Xi Jinping met with American business leaders in Beijing this week, including Blackstone’s Stephen Schwarzman and Qualcomm’s Cristiano Amon, as the Chinese leader scrambles to restore confidence in his faltering economy. China’s protracted property downturn is eroding the balance sheets of the nation’s largest state banks as their bad loans pile up. And in some ways Xi is hurting his own cause: His attacks on bankers as “hedonists” because of their lavish lifestyles are fueling a brain drain. FTX co-founder Sam Bankman-Fried was sentenced to 25 years in prison for stealing billions of dollars from customers, one of the largest frauds in history and a case that came to symbolize the malfeasance many see at the heart of the crypto craze. Evidence from his trial suggests fraud was built into FTX from the very beginning. The court’s sentence may also set the tone for others accused of crimes involving digital assets, such as former Celsius Network Chief Executive Officer Alex Mashinsky, Terraform Labs co-founder Do Kwon and Binance Holdings founder Changpeng Zhao. The three former associates of Bankman-Fried who turned on him will soon learn their fates as well.  Sam Bankman-Fried Photographer: Angus Mordant/Bloomberg New York City’s planned surcharge for cars entering Manhattan’s central business district won a key approval. The congestion pricing plan, the first in the US, would charge most cars $15 for entering the borough south of 60th Street during peak times. Private bus operators, including those that travel to the wealthy summer enclave of the Hamptons, would be exempt. But Governor Phil Murphy of New Jersey, who calls the plan a “blatant cash grab” that will cost his constituents dearly, said the fight over the toll is far from over. Luxury watchmaker Favre Leuba plans to unveil more than two dozen timepieces later this year, priced as much as $26,489, as part of a brand relaunch that seeks to expand beyond its majority Indian consumer base. Major hotel chains including Marriott International and Hilton Worldwide Holdings are on track to more than double their footprint across Africa amid a boom in tourism on the continent. And here’s the good, the bad and the robotic when it comes to the $345,000McLaren 750S Spider.  The 2024 McLaren 750S Spider Photographer: Hannah Elliott/Bloomberg In this mini-documentary by Bloomberg Originals, we travel to a bellwether county in Pennsylvania to ask officials, business leaders and voters what effects if any they’ve seen from Biden’s landmark legislative accomplishments—the Inflation Reduction Act, Infrastructure Act and Chips Act—and whether the biggest investment of federal dollars since President Franklin Roosevelt’s New Deal will help earn the Democratic president a second term. The responses may surprise you.  Watch The Race to Prove Bidenomics Is Working Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what’s next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |