|

| - | - | - | - | - |

|

|

|

|---|

| DON'T believe the fake ads on Facebook |

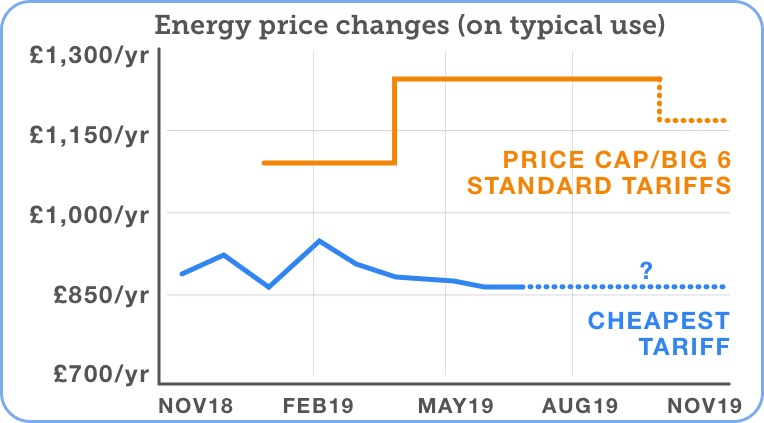

| Martin's warning. Is yours one of 11m UK homes on your energy provider's standard tariff? The GOOD news: from Oct the price cap's likely to be £80/yr cheaper The BAD news: even then you're still being RIPPED OFF by £300/yr 2. The price cap ISN'T a price cap and isn't cheap, but is changing. The price cap is currently set at '£1,254/yr', but that isn't the max anyone will pay - it's just the cap for someone on 'typical' use. The cap is actually on rates per unit, not prices, so use more and your cap's higher; use less and your cap's lower. 3. Big names let you LOCK IN for a year at super-cheap rates - but only if you ask. All Big 6 firms now charge exactly the price cap. Yet many also offer much cheaper deals for switchers. The current standout is an EDF 1yr fix (which lets existing customers switch as well as new), which is just £910/yr for typical use (incl MSE cashback) - so £345/yr cheaper than the current cap, £260/yr cheaper than the new one. And as it's a fix the rate's locked in. Use our big name-only comparison to see others. 5. Don't stress over switching - it doesn't change much (except the price). It's the same gas, same electricity, same safety. The only changes are the price and customer service (which is why it's important to check a firm's rating first). If you're really scared off, as a min just find your supplier's cheapest tariff. More help and hand-holding in our Cheap Gas & Elec guide. |

| New. Martin: 'Lost a spouse/parent in the last 20yrs? You can still reclaim their PPI.' A PPI claim doesn't die with the person. Millions who've passed away are owed money, and their relatives can get justice for them. Like Mands who tweeted: "@martinslewis Just been offered £2,000 for my deceased husband's PPI. Thank you. He died 13yrs ago." Yet the deadline's weeks away, so act fast. See Martin's PPI reclaiming for deceased relatives blog. Related: Reclaim PPI for free. Amazon 'Prime Day' starts on Mon yet rival deals already on, eg, £24 Google Home Mini (norm £49). We've full analysis & tips in our Amazon Prime day predictions and alternatives. New. 13 Eurocamp tricks, incl save £100s booking via Euro sites & late summer 2019 deals. Don't think lumpy groundsheets & grotty communal washrooms - these days Eurocamp (and other Euro holiday park firms) offer well-equipped mobile homes and other comfy camping options. See how to cut the cost in our new 13 Eurocamp tricks blog. Related: 16 Center Parcs Tricks. £50 summer activity break for 16-17-year-olds (or free for some). Govt-backed Eng & NI scheme incl nights away and activities such as abseiling, canoeing and life skills during the summer hols. National Citizen Service Cheap Ray-Ban tips, incl how to avoid fakes & code to get £70 sunnies. Full info in our spec-tacular new blog. Urgent. Sort your tax credit renewal NOW. Nearly 5m renewals have been sent out. You MUST check it - if details are wrong you could have the nightmare of being forced to repay cash you've already spent. The deadline's 31 July, but do it now - if you need to call, phone lines can get clogged up. See full Tax credit renewal help. PS: To avoid overpayment hell, always TELL 'EM IF ANYTHING CHANGES (eg, moving in/out with partner, working hours, kids). |

| |

|---|

|

If you're struggling and none of these solutions work, find out how to get free one-on-one debt crisis help. |

| Ditch Club Lloyds & Bank of Scotland Vantage - they're cutting interest in Oct.The new rate's beaten by the top easy-access savings deals, so if you're with these accounts for high interest, get ready to ditch & switch. Rate cut 2 planted hanging baskets £22 del. MSE Blagged. Incl begonia, petunia or fuchsia. Jersey Plants Direct Warning. Banks refusing to refund scam victims £10,000s... how to make sure they obey the rules. In May many banks agreed to give victims more protection - yet two MoneySavers were refused refunds until MSE stepped in. See their stories & find out how to fight for your scam rights. Hot Diamonds extra 35% off sale code, eg, £26 earrings (were £80). MSE Blagged. £5 del. Hot Diamonds TV licence sales down for first time in 10yrs - do you need one? Some can watch & (legally) not pay. Do you qualify? (Plus if you're over 75 and wrongly paid for your TV licence, you may have less than a year to reclaim.) Ends Fri. Hot Three Sim deal with a decent 8GB data for £9/mth. MSE Blagged. Newbies to Three* can get 8GB data + unltd mins & texts for £9/mth over a 12mth contract. Full details and more deals in Top Sims. |

| AT A GLANCE BEST BUYS

|

| Now 2yr mortgages down to 1.35% - we've not seen cheaper in 2019 Of course there's always a chance rates will drop further - then again there's even more room for them to rise, so this is a safe time to check if you can save by remortgaging. Many can save £1,000s, as Bryan on Facebook found: "Sorted our remortgage. Fixed for 5yrs at 1.9% - £300/mth better off." Here are our quick tips:

|

| Coast 25% off, incl on 'up to 70% off' sale. MSE Blagged. Good if you've a summer wedding/party coming up. Coast STUDENT LOAN RECLAIM - SUCCESS OF THE WEEK: "Read your article on student loan overpayments and wanted to let you know I got a refund of £487 because I repaid despite earning less than the threshold. Thank you to MSE." (Send us yours on this or any topic.) Aldi '£4.50' school uniform - in store from Thu. Incl 2 polos, sweatshirt & trousers/skirt. See all Cheap Uniform deals. |

| THIS WEEK'S POLL Where are you going on holiday this summer (if at all)? The big summer getaway is on. So are you planning to head abroad or are you set for a summer staycation? Where are you going on holiday? Most MoneySavers are proud of their work and enjoy it. Last week, we asked about your job satisfaction and 3,400+ responded. The results were positive: in every income bracket for those employed and self-employed, the answer "I'm proud of what I do, enjoy what I do, but the work is hard" came top. See full poll results. |

| MONEY MORAL DILEMMA Should we go back and pay for our meal? We recently went for a meal in our local family-run pub. While waiting for dessert, the owner announced they were closing due to an emergency (their dog had had a seizure). At the time they insisted what we'd eaten was on the house - but should we go back and offer to pay? Enter the Money Moral Maze: Should we go back and pay for our meal? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Can inheritance help with debt situation before it comes through? |

|

| |

|---|

| MARTIN'S APPEARANCES (WED 10 JUL ONWARDS) MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 10 Jul - BBC Radio Cumbria, Money Talks with Neil Smith, from 6pm |

| QUESTION OF THE WEEK Q: I recently attempted to travel from Newcastle to London King's Cross, but my train was delayed and then cancelled. Can I claim compensation? Carlotta, via email. If instead you travelled on a different service, but your arrival was delayed as a result, you may still be entitled to compensation. How much you'll get depends on the length of delay and which firm you travelled with - most now offer compensation for delays of 30+ mins, and many for delays of 15+ mins. For full help, see our Train Delays guide. Please suggest a question of the week (we can't reply to individual emails). |

| THE DEVIL WEARS PRIMARK, AND OTHER MONEYSAVING BLOCKBUSTERS That's it for this week, but before we go... we decided to have a little fun and asked users to give the title of their favourite movie a MoneySaving twist. We've been deluged with brilliant suggestions, from 'Tight Club' and 'ISA Wonderful Life' to 'Saving for Private Ryan' and 'Harry Potter and the Half-Price Prince'. Our favourite though? That well-known Audrey Hepburn classic 'Breakfast at H Samuel'. See the full list and add your own in our MoneySaving films Facebook post. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin Lewis What is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email skyscanner.net, kayak.co.uk, travelsupermarket.com, carrentals.co.uk, halifax.co.uk, starlingbank.com, holidayextras.co.uk, looking4.com, skyparksecure.com, bookfhr.com, trivago.co.uk, travelsupermarket.com, tripadvisor.co.uk, three.co.uk, capitalone.co.uk, aquacard.co.uk, virginmoney.com, moneysupermarket.com, confused.com, gocompare.com, directline.com, aviva.co.uk, ybonline.co.uk, cbonline.co.uk, bank.marksandspencer.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |