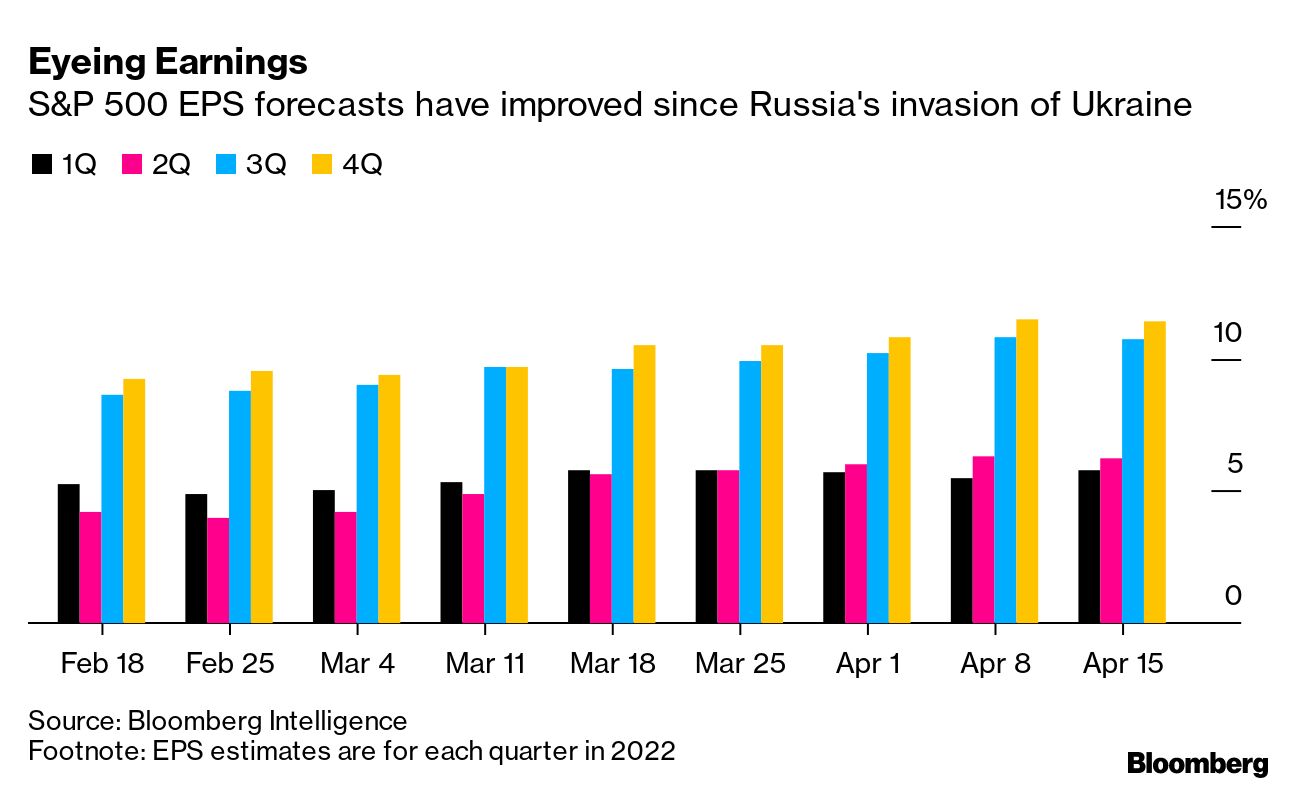

| Vladimir Putin announced that Russia had seized the strategic port city of Mariupol, having spent almost two months leveling much of it and killing as many as 20,000 of its inhabitants, according to Ukraine estimates. Putin’s adjutants said more than 2,000 Ukrainian soldiers remain inside a massive steel complex there, holding out in a seemingly lost cause. Mariupol would be the biggest city taken by Russia so far in its botched war on Ukraine, but Ihor Zhovkva, deputy chief of Ukraine’s presidential staff, said it’s “premature” to say the city has fallen. Around 100,000 civilians remain there, with some hiding in bunkers inside the steel mill, according to Mayor Vadym Boychenko. Around 40,000 have been taken to Russia or territory it controls, he said. The mayor has previously accused Putin’s forces of trying to conceal civilian deaths by trucking corpses to mass graves west of the city.  A Russian tank near the Azovstal steel plant in Mariupol, Ukraine. Local officials say Kremlin forces are operating several “filtration camps” west of the city, where Mariupol officials and city workers are imprisoned. Photographer: Maximilian Clarke/SOPA Images/Getty Images U.S. President Joe Biden said he will send $1.3 billion in additional aid to Ukraine, including $800 million in military support (which includes “ghost drones”) and vowed to ask Congress for more funding. Rebuilding Ukraine after the Russian invasion will cost $600 billion, the nation’s prime minister told the International Monetary Fund and World Bank spring meetings. U.S. Treasury Secretary Janet Yellen wants Russia to pay for at least some of it. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. America’s job market is red hot. Initial U.S. unemployment claims keep falling, dropping to 184,000 in the week ended April 16, data from the Labor Department showed. Currently, there are fewer Americans claiming unemployment benefits than at any time since 1970. Here’s your markets wrap. Utah’s governor and its Congressional delegation (all Republicans) are objecting to S&P Global’s move to publish ESG scores for U.S. states, claiming it’s politicizing the ratings process. After weeks of questions over whether Elon Musk is truly serious about acquiring Twitter, his takeover bid just got a lot more real. The Tesla mogul lined up about $25.5 billion in debt financing from Morgan Stanley and other financial institutions as well as pledging to contribute an additional $21 billion of his own money through equity financing. He also formed a trio of holding companies as part of the bid, potentially giving the billionaire a path to bring all of his ventures under a single parent. What recession? JPMorgan said it expects corporate America to easily trounce Wall Street’s earnings forecasts. Consensus earnings estimates for the S&P 500 are “overly pessimistic” for the first quarter and companies in the index are poised to deliver a surprise of 4% to 5% on “better-than-feared margins,” the bank’s strategists said. Federal Reserve Chair Jerome Powell blessed a half-point interest-rate hike next month and signaled support for further aggressive tightening to curb inflation by noting that he saw merit in “front-end loading” policy moves. Shanghai reported a sharp increase in its number of seriously-ill Covid-19 patients, raising concerns that the Chinese financial hub is likely to record more fatalities even as its worst virus outbreak appears to be coming under control. President Emmanuel Macron brushed back far-right candidate Marine Le Pen, pointing out her warm ties to Russia in a debate Wednesday night just four days before the final round of the French presidential election. There were no big surprises and the debate appeared unlikely to change a trend that’s seen Macron’s advantage in polls widen to almost 12 points.  Emmanuel Macron, France’s president, center right, at a campaign event in the Seine Saint Denis district of Paris on Thursday. Macron said Sunday’s election will be a referendum on the European Union, French-German relations and climate policies. Photographer: Benjamin Girette/Bloomberg Not long ago, real estate brokers said they couldn’t give away houses in a remote section of Greenwich. Now that area is the hottest spot in town. Buyer appetites for mansions on multiacre lots is driving deals in a swath of Greenwich known as Back Country.  435 Round Hill Road sold for $17.6 million earlier this month. Source: Brian Milton of Compass Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg Green Summit: Returning to New York on April 27, the summit brings climate solutions to life through conversations with leaders at the crossroads of sustainability, design, culture, food, technology, science, politics and entertainment. Speakers include climate leaders from Google Earth and QuantumScape. Learn more here. |