|

| U.S. antitrust officials are preparing a second monopoly lawsuit against Google over the company’s digital advertising business, Bloomberg News has learned, stepping up the government’s claims that Google is abusing its dominance. The Justice Department has accelerated its investigation of Google’s practices and may file its complaint as soon as the end of the year. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic worldwide.

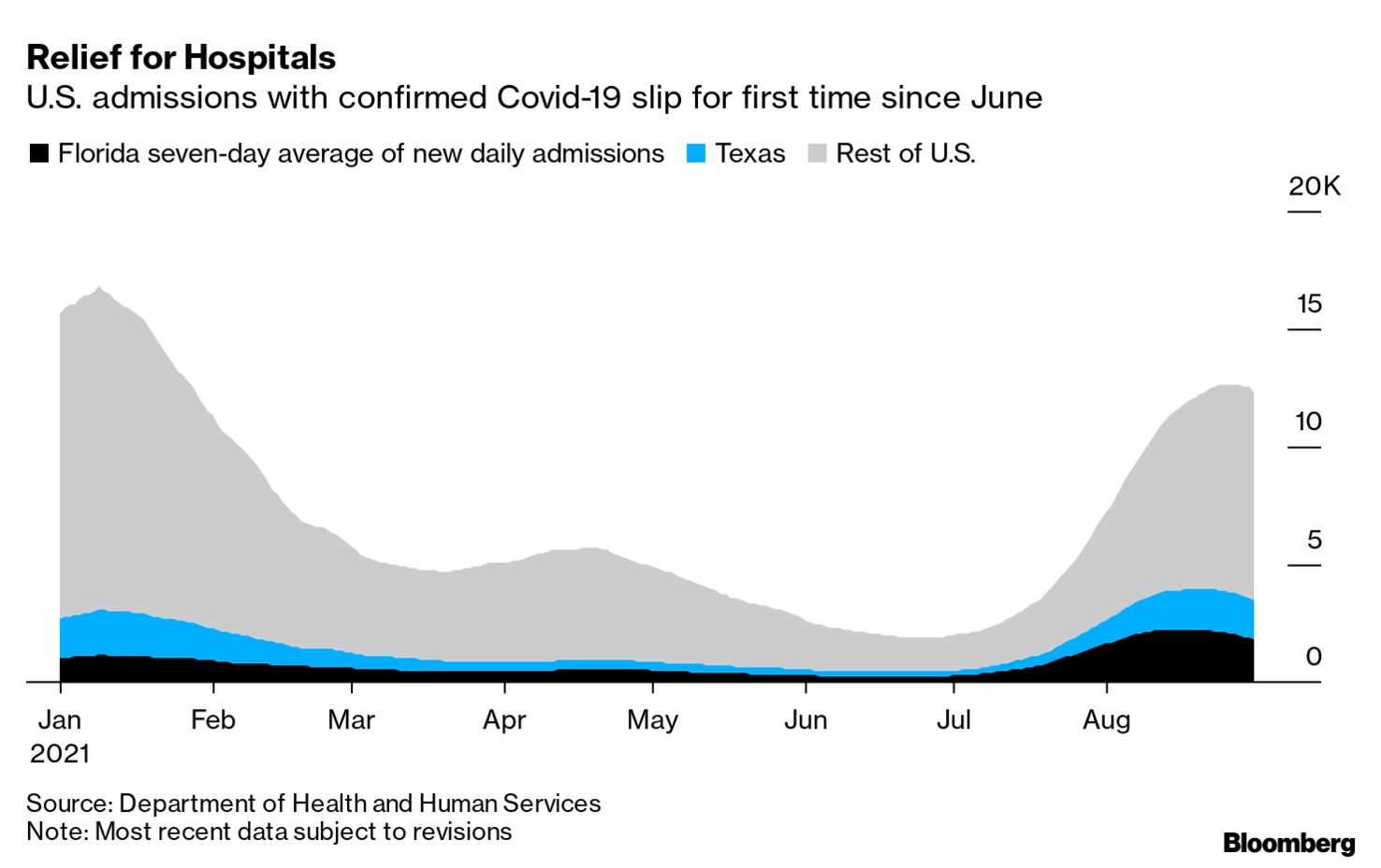

As Goldman Sachs and other big finance firms move more operations to Florida, developers there plan a Manhattan-style makeover for West Palm Beach, hoping to lure young professionals. Wall Street isn’t just building a Wall Street South, it’s helping build a Manhattan South, too. Taiwan warned that China could electronically “paralyze” its defenses in a conflict, a stark new assessment expected to fuel calls in Washington for more support for the democratically ruled island.  Fighter jets on China’s aircraft carrier, the Liaoning, during a 2018 drill. Taiwan had a stark warning this week about its disadvantage in any military conflict with China. Photographer: AFP A security guard stands at the entrance to every mall in Saudi Arabia’s capital, ready for a pandemic routine shoppers are getting used to: proving their vaccination status on a government phone app that tracks their location at all times. Saudi Arabia has enacted one of the strictest immunization regimes in the world. Kidney damage is painless, silent, and the latest potential consequence of contracting Covid-19. Injury to the blood-filtering organ can escalate depending on the severity of the infection. Even non-hospitalized patients with no renal problems have almost a twofold higher risk of developing end-stage kidney disease, compared with someone who never had Covid. There was however some good news Wednesday after a study showed the Pfizer-BioNTech booster provides added protection against the coronavirus during a delta variant outbreak. In the U.S., there’s some indication that the nation’s delta-fueled, fifth infection wave may be peaking. Here’s the latest on the pandemic.  Democrats on the U.S. House committee in charge of turning President Joe Biden’s tax plan into legislation are at odds over how high to increase levies on investment gains, a key part of Biden’s agenda. Most support his plan to raise the capital gains rate on those earning above $1 million to 39.6%. But more than a few Democrats want to tax them less. A federal bankruptcy judge said he would approve Purdue Pharma’s settlement of opioid-related civil claims, paving the way for the company and its owners, members of the Sackler family, to pay billions of dollars. In exchange, they walk away with immunity from litigation tied to the deadly opioid epidemic that’s killed a half million Americans—a facet of the deal that’s fueled outrage by critics and will likely trigger an appeal.  David Sackler Source: House Television/AP Abortion services largely shut down in Texas after a night of silence from the Republican-appointee dominated U.S. Supreme Court. The lack of action on an emergency appeal allowed a new law to take effect that outlaws most abortions after the sixth week of pregnancy.

About 40% of U.S. department store outlets have closed over the past five years. Many of the large, boxy structures that house them, where prom dresses were purchased and perfume sampled, will be demolished. But some will be put to new uses. Bloomberg Businessweek reports on how property owners and designers see cost savings and environmental benefits in adapting older buildings rather than tearing them down. Imagine your former retail haunt as a school, or even a library.  Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Ninth Annual Bloomberg Canadian Fixed Income Conference: As world economies plan how to rebuild after the Covid-19 pandemic, top investors, analysts, CEOs, CFOs, government officials and bankers will discuss the future of insurance, real estate, mining, ESG and more. Join us as the biggest names in Canadian bonds, credit and commodities convene virtually Sept. 28-29. Sponsored by National Bank of Canada. Register here. |

| Follow Us | ||||

|

|

|