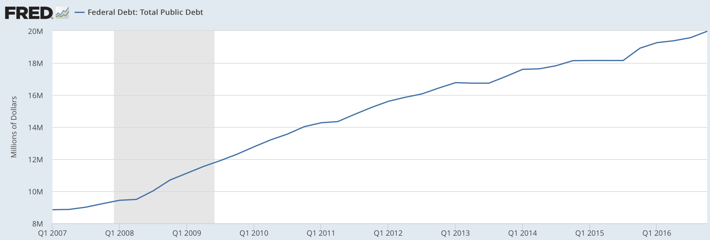

Dear Reader, If you have been reading my Thoughts from the Frontline over the past couple of months, you know I’ve been writing a lot about tax reform and what it could look like. Tax reform, which is hopefully going to include tax cuts, should come sometime in the next year. But in the not so distant future, taxes have to go up. Here’s why… Total federal debt is now $19.97 trillion—a 117% increase since 2007.

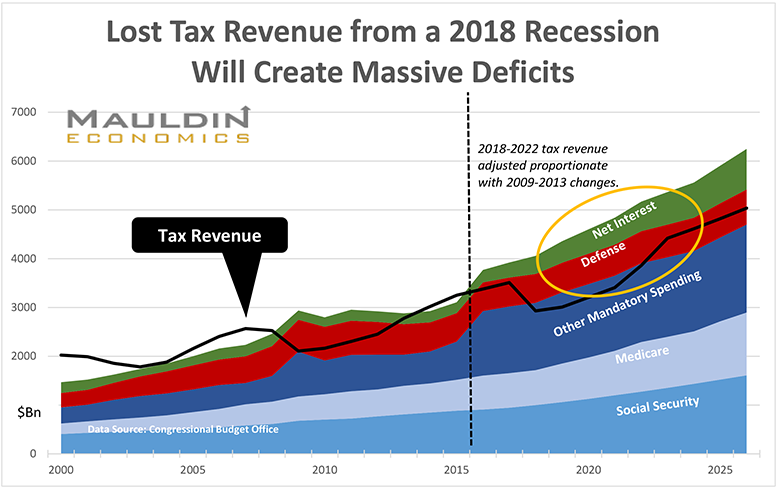

And unfortunately, it’s going to get worse… The nonpartisan Congressional Budget Office (CBO) projects $10 trillion will be added to the federal debt by 2027. That projection doesn’t account for a recession, during which revenues will drop sharply. As the US is now eight years into a recovery, I would say the possibility of a recession in the next decade is close to 100%. And based on CBO calculations, we could be running $2 trillion annual deficits when it comes.

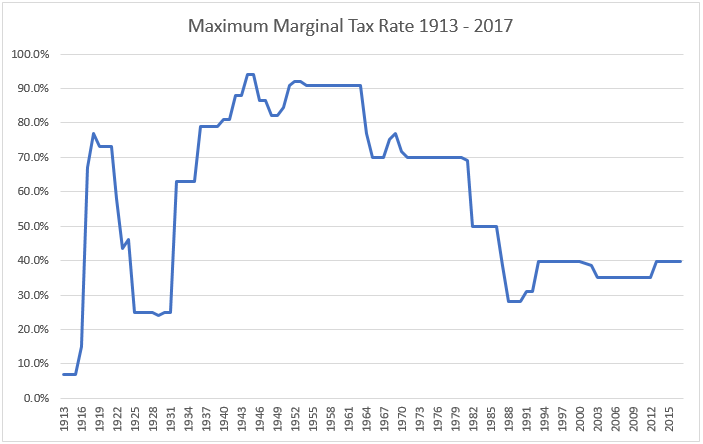

Here’s what that means for you and me. Since cutting Social Security, defense, and other federal spending is a political nonstarter, revenues will have to increase to plug the deficit. A method that has proven politically popular is raising taxes on ‘’the rich’’ and ‘’the wealthy’’ or anyone who has assets. Many of you fall into that category, or may soon. That’s the bad news. The good news is there are ways you can durably and legally shield your assets from taxes through proper estate planning. Estate planning is a hugely complex and broad topic. My readers often tell me of their need to create estate plans but that they have been putting it off because they simply don’t know where to begin. But the time to act is now. Upcoming tax reform may offer the last opportunity to move assets into tax-favored vehicles before they are eliminated or rates rise. If tax rates were to double from current levels, it wouldn’t be unprecedented… Between 1940 and 1980, the marginal income rate was above 70%. In fact, the average rate since 1913 has been 59%... that’s 20% higher than today.

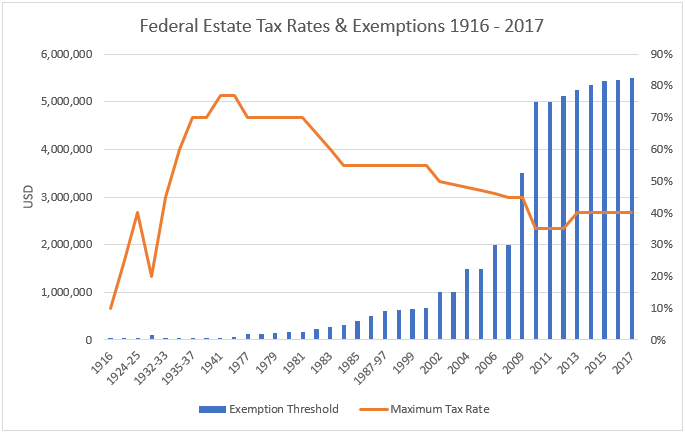

And it’s the same for estate tax… from 1934 to 2001, the marginal tax rate was above 55%.

If you act within this short window—when tax rates are still low—you can take full advantage of the tax-savings benefits that proper estate planning offers you. But implementing a proper plan won’t happen overnight, it can take a decade or more depending on your circumstances. The other reason to take action now is a little more sobering. That is, you just don’t know when your time will run out. To ensure your estate—what you have worked for your whole life—goes to those you want it to, proper estate planning is essential. Otherwise, it could all fall into the wrong hands. To help you get started, I am excited to announce a new special report written by my good friend Terry Coxon. Terry has put together a concise, “all-in-one” report on estate planning and asset protection exclusively for Mauldin Economics readers. Terry has been working in the business for over four decades, and he knows the ins and outs of estate planning and asset protection better than anybody else I know. My own CPA firm as well as a leading tax attorney who specializes in estate planning have reviewed the plan to ensure its accuracy and timeliness for you. Whether you know nothing about estate planning or already have a partial plan in place, this in-depth report is a great way for you to learn everything you need to know and shows you how to start this vital process right away. Sitting down with an estate attorney can be an expensive educational process. Terry’s Insiders Report will save you a lot of time and money (a few thousand dollars at least). In addition, it will help you formulate the best estate plan based on your personal situation because it details certain legal vehicles you can use to harbor your assets and lower your taxes… vehicles few people in the business are familiar with. This Insiders Report also addresses another major risk to your estate… and shows you how to control it.

Your excited about estate planning analyst,

| |||||||

| Copyright © 2017 Mauldin Economics. All Rights Reserved | |||||||

| Click here to unsubscribe from promotional mailings. |

![[John Mauldin]](http://d1v8wrjcw5hdn6.cloudfront.net/virtual-summit/jm-from-desk.jpg)