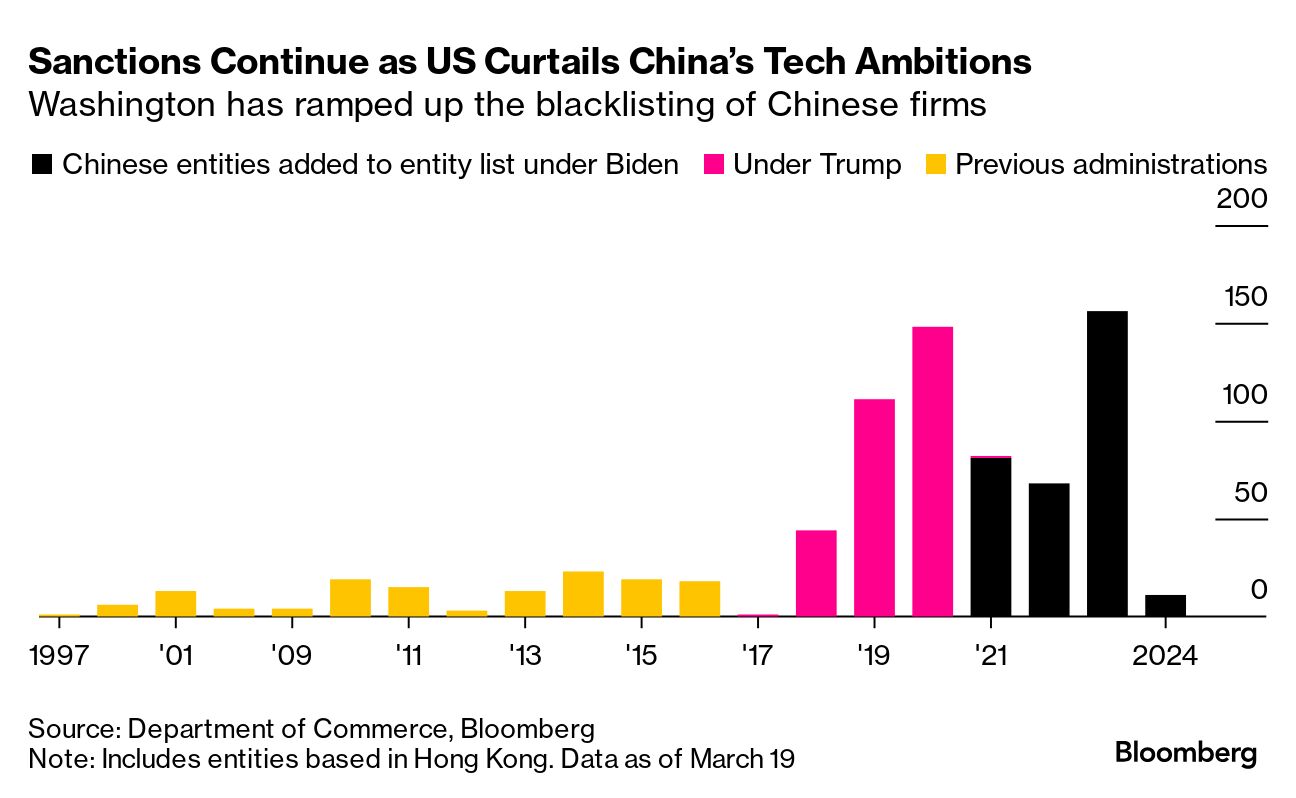

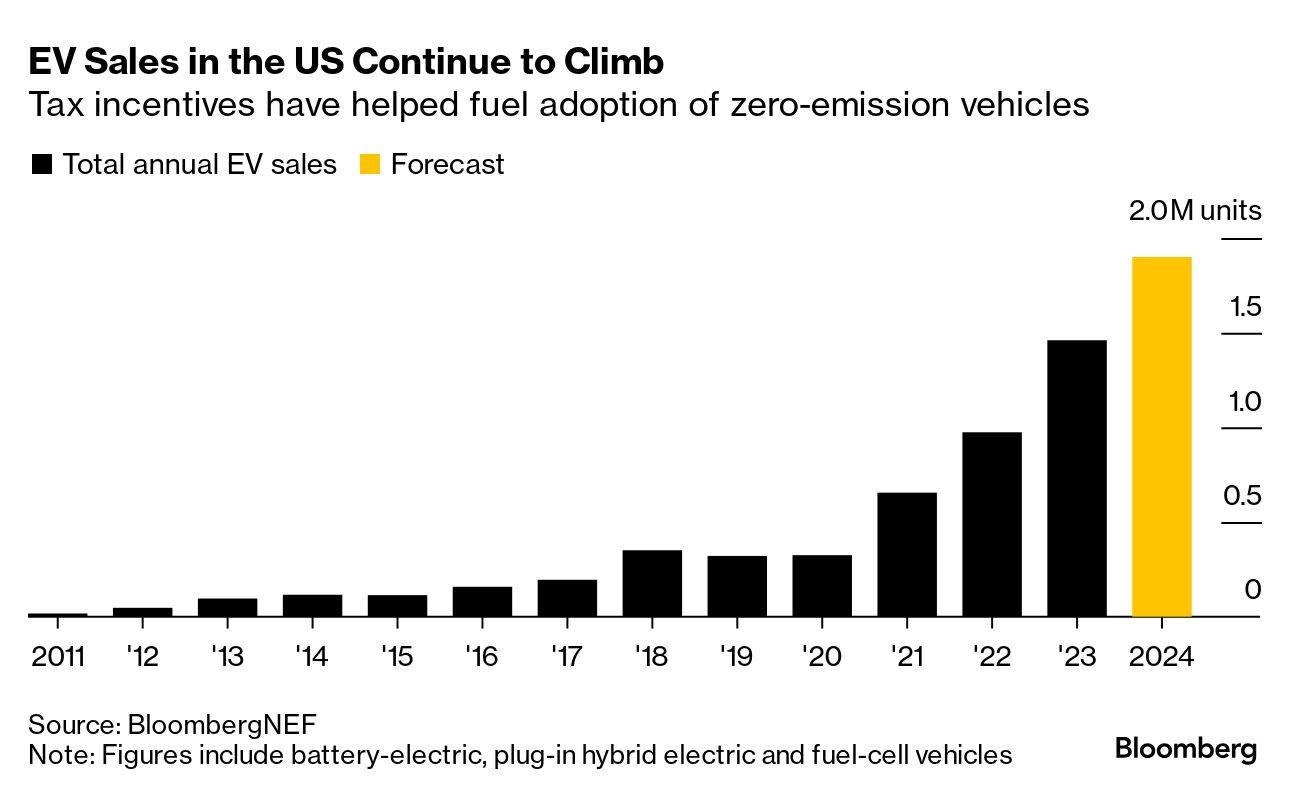

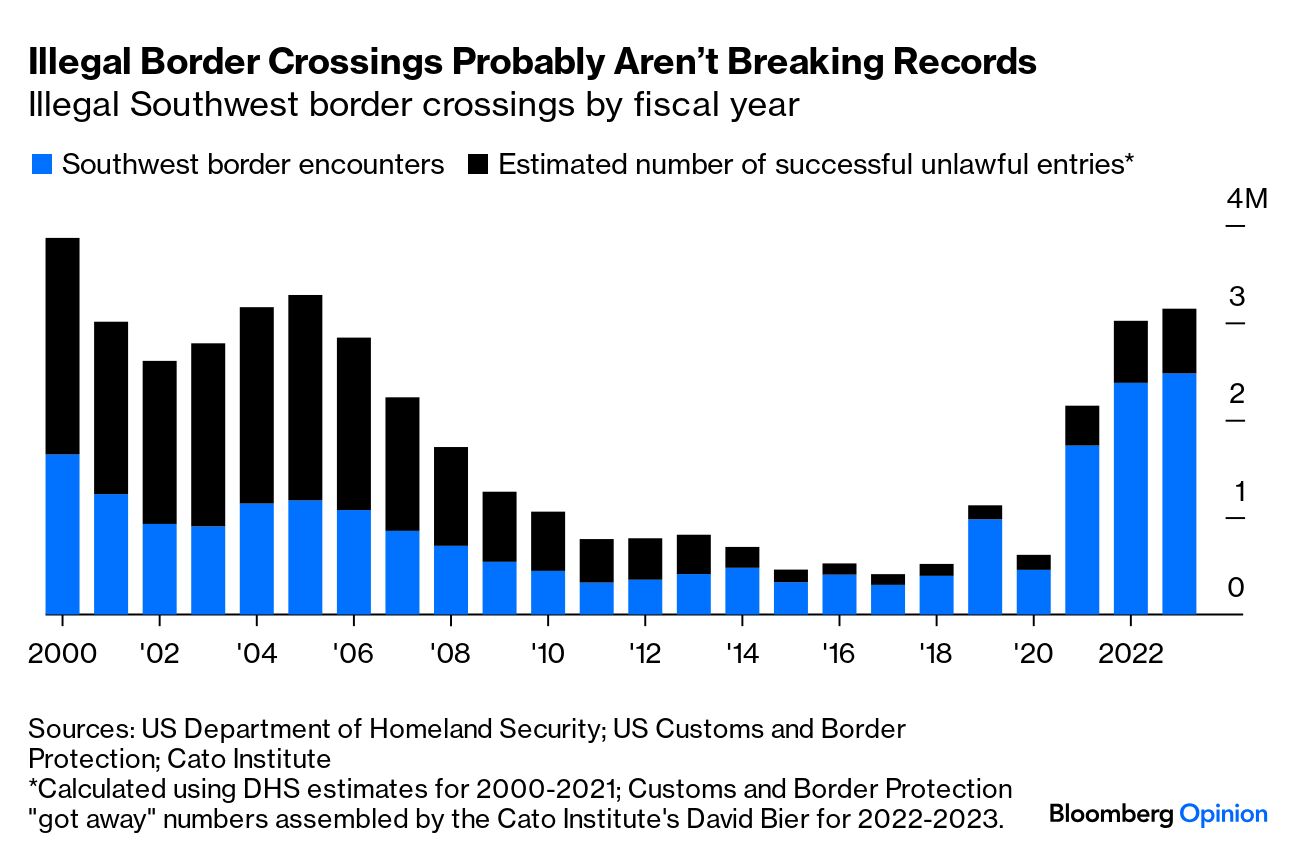

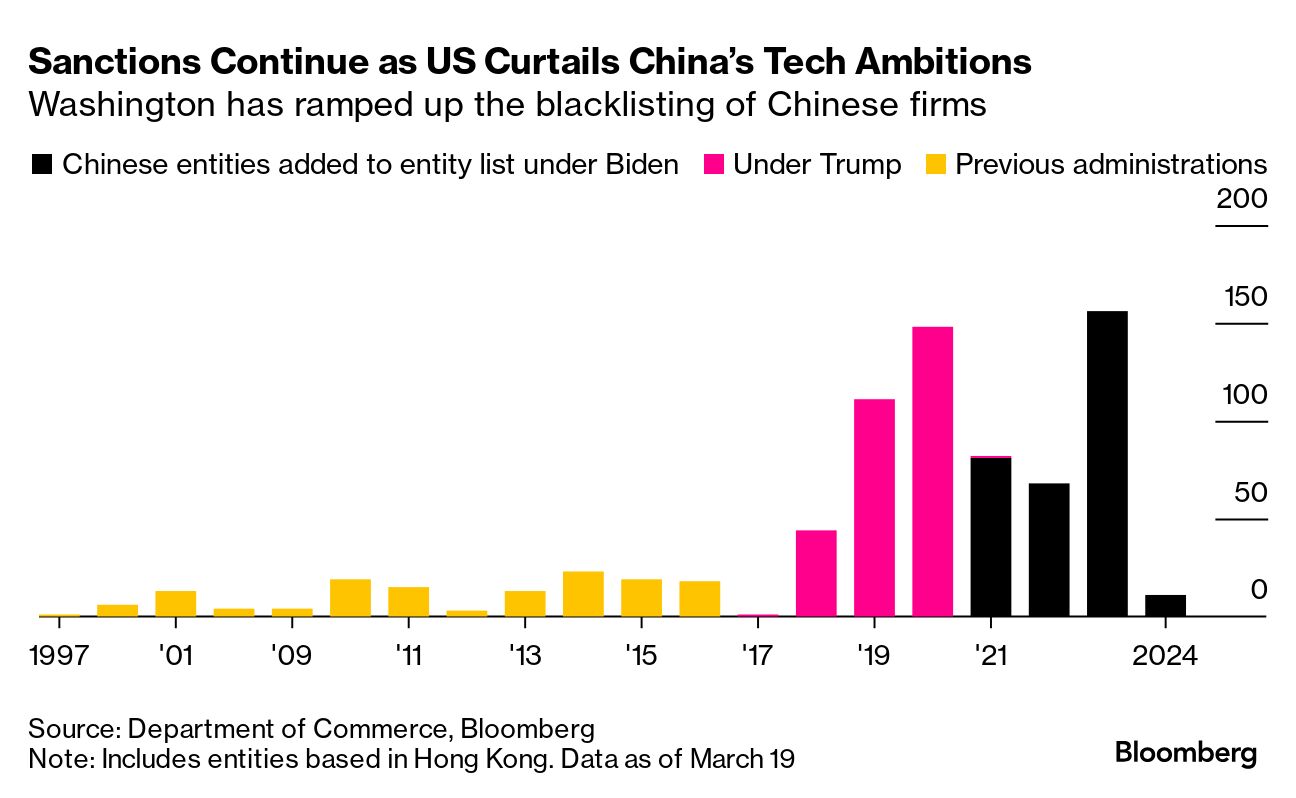

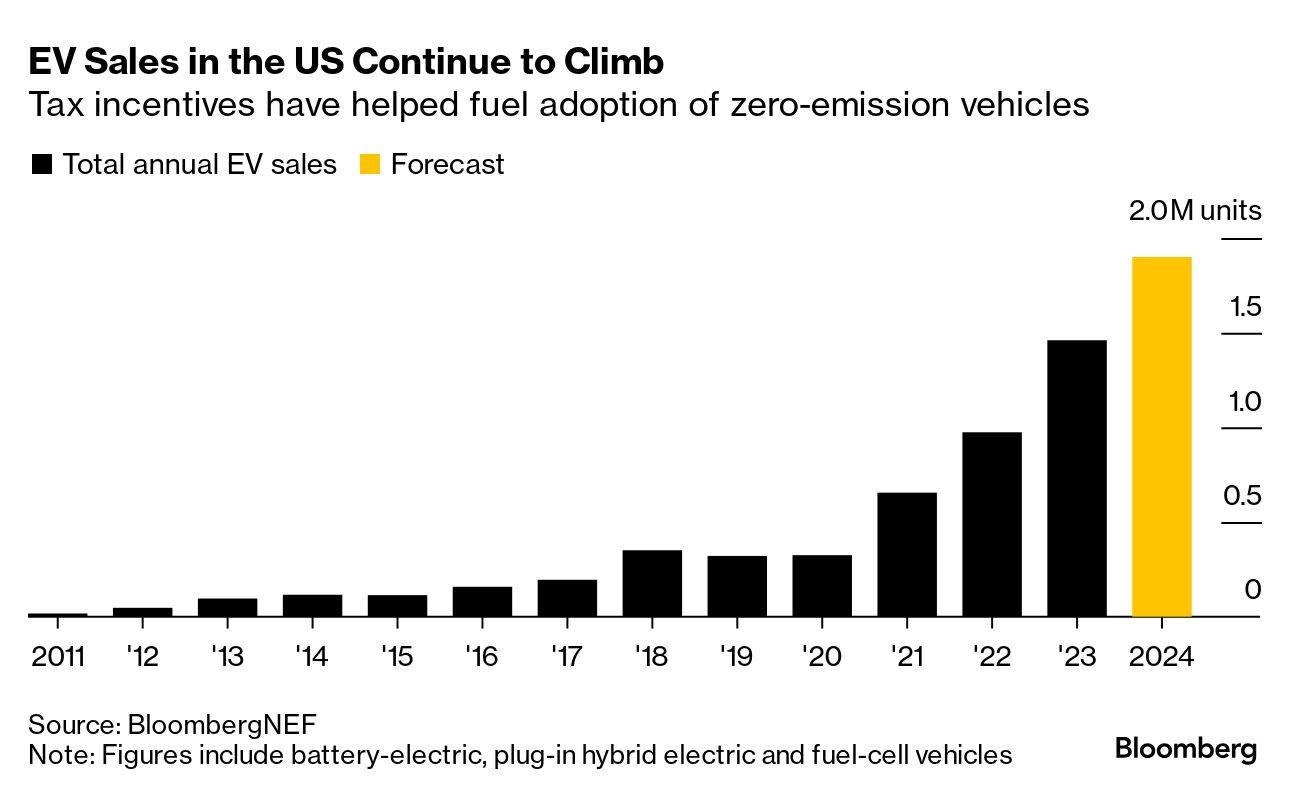

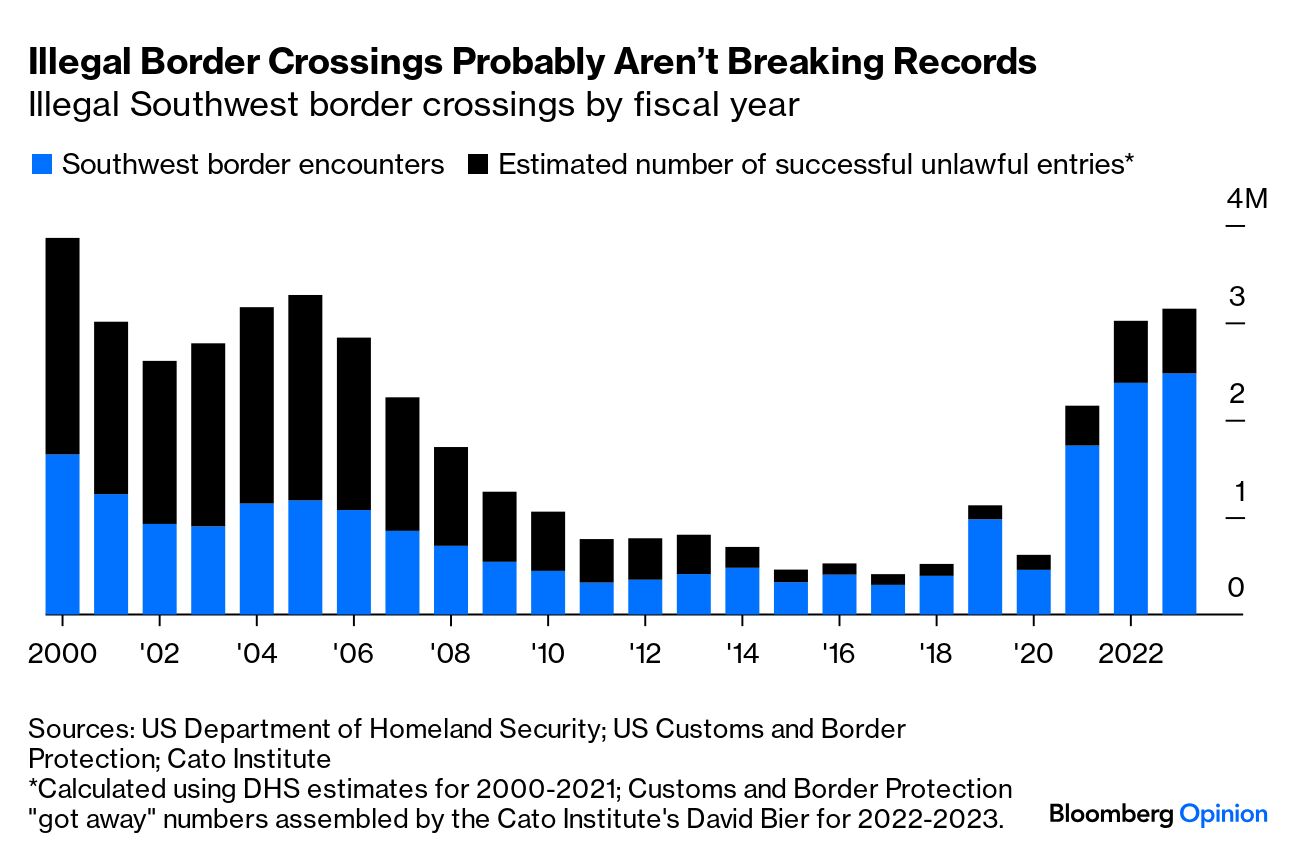

| The US Justice Department is poised to sue Apple as soon as Thursday, accusing the gadget giant of violating antitrust laws by blocking rivals from accessing hardware and software features of its iPhone. The lawsuit would intensify the Biden administration’s antitrust fight against most of the biggest US technology companies. The Justice Department is already suing Google for monopolization while the Federal Trade Commission is pursuing antitrust cases against Facebook-parent Meta and delivery behemoth Amazon. The coming case will mark the third time that the Justice Department has sued Apple for antitrust violations in the past 14 years, but it is the first case accusing the iPhone maker of illegally maintaining its dominant position. Apple shares fell as much as 1.4% to $176.10 in late trading. They had been down 7.2% this year through Wednesday’s close. —David E. Rovella Nope, no rate cuts yet. The US Federal Reserve maintained its outlook for three interest-rate cuts later this year and moved toward slowing the pace of reducing its bond holdings. Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5% for a fifth straight meeting. Policymakers signaled they remain on track to cut rates this year for the first time since March 2020, but they now see just three reductions in 2025, down from four forecast in December. Chair Jerome Powell, speaking after the Fed’s decision Wednesday, demurred when asked whether officials would lower rates at their coming meetings in May or June. The Biden administration is said to be considering blacklisting a number of Chinese semiconductor firms linked to Huawei Technologies after the telecom giant notched a significant technological breakthrough last year. Such a move would mark another escalation in a US campaign to curtail Beijing’s artificial intelligence and semiconductor ambitions. It would also ratchet up the pressure on a Chinese national champion that’s made advances despite existing sanctions, including producing a smartphone processor last year many in Washington thought beyond its capabilities.  China is building its military and nuclear arsenal on a scale not seen by any country since World War II and all signs suggest it’s sticking to ambitions to be ready to invade Taiwan by 2027, a top US admiral told Congress Wednesday. Beijing’s official defense budget has increased by 16% over recent years to more than $223 billion, said Admiral John Aquilino, leader of the Indo-Pacific Command. The Chinese military has also been rehearsing other types of military action against Taiwan including maritime and air blockades, he said. “All indications point to the PLA meeting President Xi Jinping’s directive to be ready to invade Taiwan by 2027,” Aquilino warned. The US government moved Wednesday to cut pollution from the nation’s cars and light trucks, imposing tailpipe emission limits so stringent they will compel automakers to rapidly boost sales of battery-electric and plug-in hybrid models. Though the near-term requirements were eased after pushback from automakers, the Environmental Protection Agency’s mandates would nevertheless require manufacturers to make a rapid shift toward zero-emission vehicles. The rule delivers the “strongest-ever vehicle pollution” standards in US history, EPA Administrator Michael Regan said. Court challenges are expected.  Barclays is getting ready to slash hundreds of employees, following in the footsteps of Wall Street giants from Citigroup to JPMorgan that have combined to fire thousands of workers recently. Losing their jobs at Barclays are said to be people in the bank’s global markets, research and investment banking arm. The terminations are expected to take place in the coming months and said to be part of the firm’s annual cutting of low performers. It keeps getting worse for Boeing. The embattled planemaker predicted a massive cash drain for the first quarter as regulatory scrutiny and slower output of its 737 Max jetliner following a January mid-air accident take their toll on its finances. Cash outflow will reach $4 billion to $4.5 billion in the first quarter, Boeing Chief Financial Officer Brian West told a Bank of America conference in London. For the full year, free cash flow will be in the low-single-digit billions of dollars, West said. Analysts expected $5 billion, according to data compiled by Bloomberg. The number of people who are apprehended by US Border Patrol agents or voluntarily surrender to them at or near the border with Mexico has skyrocketed recently, setting records in each of the past three fiscal years— and exceeding last year’s numbers in each of the first four months of the fiscal year that started in October. This is usually interpreted to mean that illegal immigration is also setting records, Justin Fox writes in Bloomberg Opinion. But that’s probably not the case.  Ukraine’s fight against Russia’s invasion has entered a new phase, pitting homegrown drone technology against a 2,000 kilometer (1,200 mile) swathe of largely Soviet-era oil facilities. At least nine major refineries have been successfully attacked this year, currently taking offline 11% of the country’s total capacity by some estimates. As the conflict at the front lines has shifted in Moscow’s favor, the drone campaign is becoming a key plank of Ukraine’s defense—both in its symbolism and its strategic aims. “Russia is a gas station with an army, and we intend on destroying that gas station,” Francisco Serra-Martins, co-founder and chief executive officer of drone manufacturer Terminal Autonomy, said in an interview. “We are going to focus on where it hits the hardest, and that’s financial resources.”  Long-range Ukrainian drones that can be used to hit targets in Russia, in a photograph released by Terminal Autonomy. Source: Terminal Autonomy Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |