We are at the breaking point in the market.

I am going to share WHY the market could see a major sell-off… and… HOW investors can prepare for it.

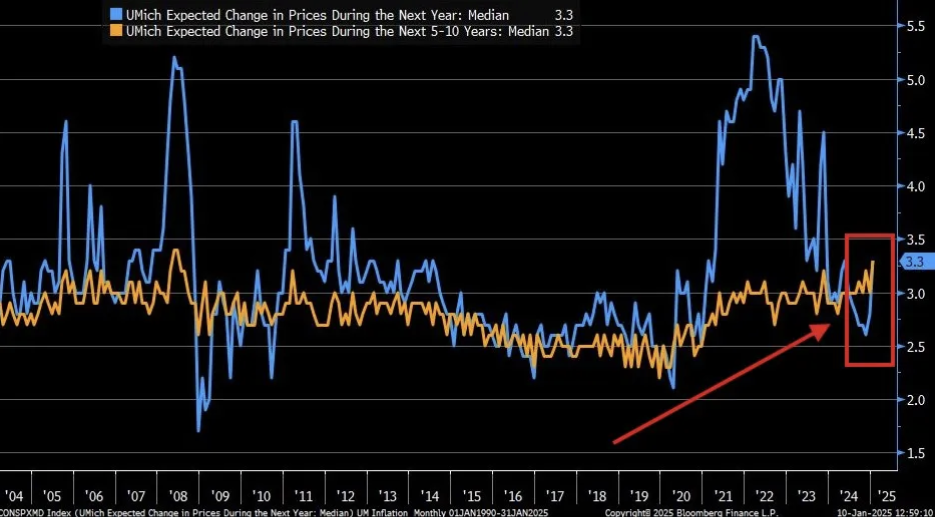

Now, there’s no doubt that inflation is back.

Consumer inflation expectations jumped to 3.3% from 2.6% in a matter of weeks.

(Source: Bloomberg)

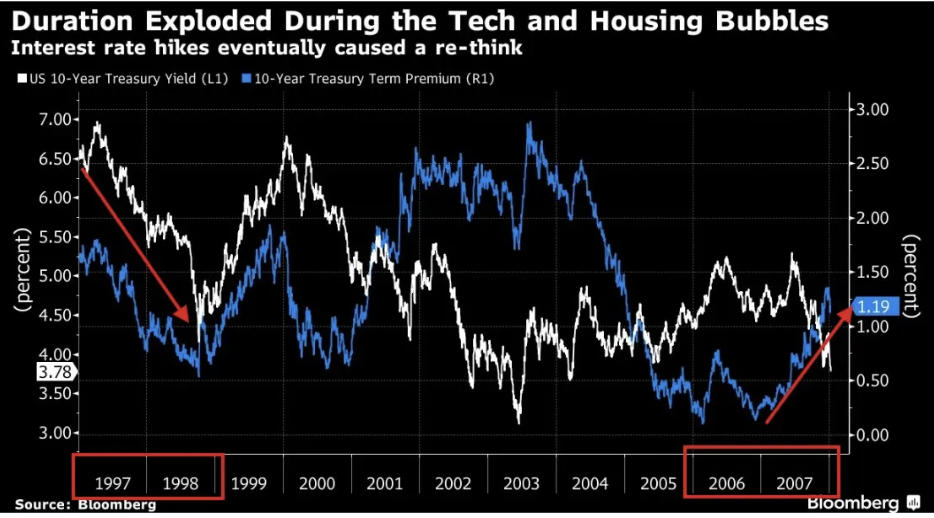

This has resulted in a SURGE in term premiums.

Term premiums are what investors demand for the risk of taking on long-term debt. Uncontrollable inflation = higher risk.

Naturally, investors demand higher yields.

Indeed, rates have skyrocketed since the Fed’s first interest rate cut.

Why is it important? A surge in terms premiums can often lead to a major bear market.

We witnessed it at the end of the dot-com bubble and just before the 2007-09 financial crisis.

(Source: Bloomberg)

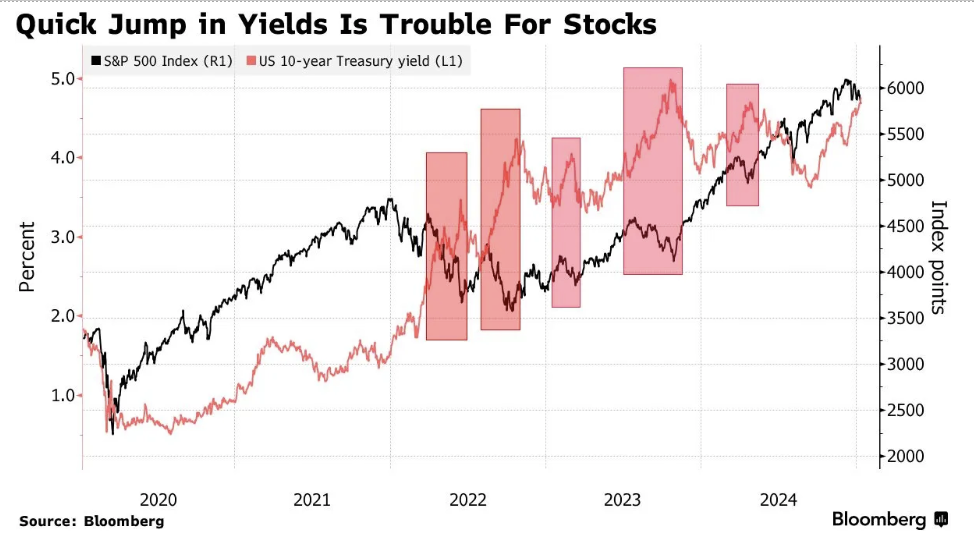

Speaking of surging Treasury yields…

Historically, a “quick jump” in yields tended to lead to a sell-off in stocks:

(Source: Bloomberg)

And guess what?

According to Bank of America, fund managers’ cash allocation fell to a RECORD low.

(Source: BoA)

Meaning?

Investors might be incentivized to sell if they feel bearish because they’re overweight in stocks.

What’s the bottom line? The market is poised to experience a “perfect storm” that could lead to an epic sell-off.

So, what to do now?

Traders NEED top-of-the-line tools to be prepared to seize major opportunities during a market sell-off.

TradeAlgo has developed a NEW AI tech called “Dark Flow AI.”

It tracks secretive exchanges called dark pools to see where Smart Money is buying and selling.

Then, it alerts TradeAlgo subscribers of stocks with the most unusual activity.

So, the tool may be CRITICAL as the market turns volatile.

Want to start receiving “Dark Flow AI” SMS alerts? Simply click this link to sign up for FREE.

This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above.

Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

33 SE 4th St, Suite 100, Boca Raton, FL 33432 USA

W: 877.6.STOCKS

StockEarnings.com

Today's Bonus Content: Must Read: The Art of Discovering Little-Known Companies

By clicking this link, you are subscribing to receive messages from Fierce Investor