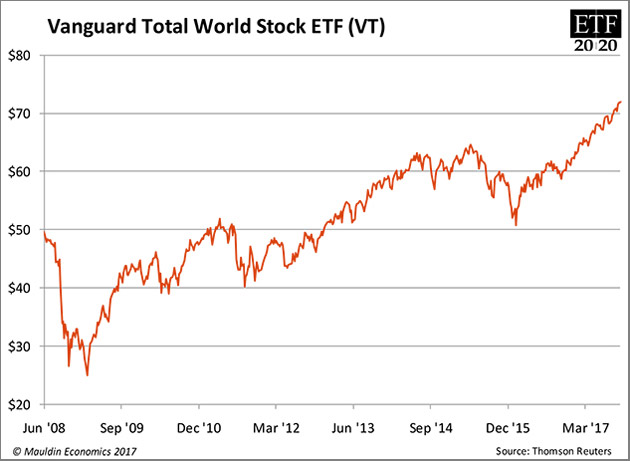

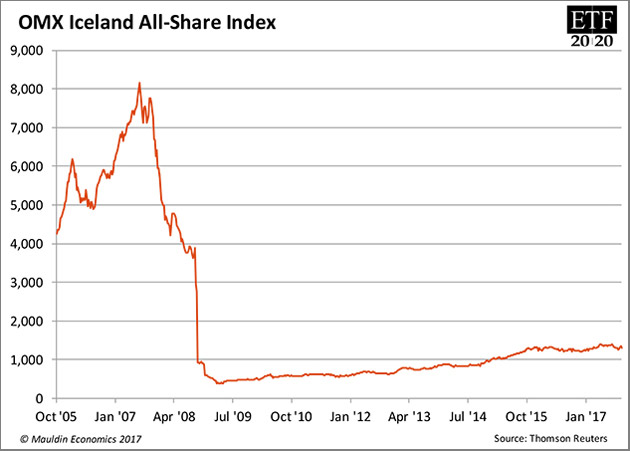

| -- | October 26, 2017 Long the World  I am going to melt your brain today. Vanguard has an ETF that allows you to get long world stock markets. The ticker: VT. This raises all sorts of interesting philosophical questions. You see, if you are long every stock in the world, you are basically long global economic growth. Which is weird! Who has an opinion on global economic growth? Well, if you got long the human race circa 1880 or so, you have done pretty well. It is hard work being short human ingenuity. But there have been some big drawdowns along the way! We had a huge depression in the 30s and a die-off in the 40s. Global stock markets have certainly not gone up in a straight line—although they are today.  I can’t see myself getting long the human race because there are pockets of humanity that I am very pessimistic about. I am pessimistic on Canada, Australia, and Sweden, with their giant credit bubbles. I am bullish on Chile, which is making positive political change. I am bullish on Bangladesh, which has incredible demographics. What I am essentially saying is that I am smart enough to pick and choose countries that are going to outperform. Which shouldn’t be super controversial—most national economic wounds are self-inflicted. It’s not hard to distinguish between good policy and crappy policy. So really the only reason you would buy VT and get long the world is if you think that efficient market hypothesis (EMH) applies to global stocks—the idea that you can’t beat the world market by picking and choosing countries. I have no idea if there has been any research to support that statement. I can tell you from personal experience that I have had no trouble beating VT by making targeted investments in individual countries (usually with ETFs). But if EMH doesn’t apply to countries, why would it apply to stocks? Short the World I told you I was going to melt your brain. I’m going to leave that question unanswered for now (partly because I am not smart enough to answer it)—and instead talk about the audacious idea that one might actually want to short human progress. Selling short VT is the ultimate act of pessimism—you are saying that things, in the general sense, are going to get worse. Looks like most of you think that is going to be the case.  I kinda feel like doing it just to make a point. Let’s dig deep into this. As I mentioned earlier, if you bought world stocks in 1880 and stayed long, even throughout the nasty bits, you are pretty happy. But in the grand scheme of all human history, that is a pretty small sample size. We had a stretch of several hundred years that was pretty dark. We called them the Dark Ages. What was the defining characteristic of the Dark Ages? Unreason. The opposite of the enlightenment. The use of physical force over mutually beneficial trade. Could we go back there? Maybe not all the way back. But whenever it looks like ignorance is making new highs and trade and capitalism are making new lows, I get anxious. None of this is quantifiable. But you might have noticed in the last political cycle that flat-earthers made a comeback(!) It should not come as a surprise that the flat-earthers were not too keen on global trade. The stock market has gone straight up under Trump, but it won’t forever—especially if he gets his way and starts a trade war with China (and everyone else). If you were wondering what I thought a global sell signal might be, that is it.  Three Steps Forward, Two Steps Back All of human progress is three steps forward, two steps back. We have had our three steps forward, and then some. I am not rooting for the Dark Ages, but we’re long overdue. For the optimists out there, by all means go out there and start lifting offers on VT. Never mind the fact that it trades at a 22 P/E. Never mind that it has all the dirtbag countries with the good countries. You just want to get long people. There you go. In my mind, if you buy an ETF like VT (and correspondingly, SPY) you have just given up. Given up picking stocks, yes, but also you have given up having an opinion on anything. It is a common misperception that stocks are going up forever, no matter where you are in the world. Maybe not—what about Iceland? If you dollar-cost-averaged there, you are still underwater.  Sometimes stocks go down, and sometimes stocks go down and stay down. People are pretty optimistic these days. Be careful. ETF 20/20 As you probably saw, the special offer for ETF 20/20 expired yesterday, so if you missed it, I can’t really help you out. But the good news is that, even at the regular price of $79 per year, it is still cheap! Subscribe here.

Jared Dillian

Editor, The 10th Man

| Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it's also truly addictive. Get it free in your inbox every Thursday. |

Jared's premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed books, Street Freak: Money and Madness at Lehman Brothers , and All the Evil of This World , shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freak an investment advisory like no other. Follow Jared on Twitter at @dailydirtnap. Share Your Thoughts on This Article

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.ggcpublishing.com/. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |