| July 30, 2020 No Dollar Shortage  A while back, there was a convoluted theory going around Twitter about how there was a dollar shortage. I didn’t understand the theory, no matter how hard I tried. These people seemed pretty sure that the dollar would get stronger. This was around the beginning of the coronavirus pandemic, and we were staring down the barrel of epic levels of money printing, so it didn’t seem possible that the dollar would appreciate. I kept quiet on it, though, because I don’t talk about things I don’t understand. I think FX trading is less about tangible things like flows and more about intangible things like confidence. And our maniacal attempts to reflate the economy in the wake of COVID-19 have undermined confidence in the dollar. | | | | | - | Talk to Jared Dillian and Ask Your Financial Questions  | Should you pay off your mortgage or put the money into interest-bearing investments? How much debt is too much debt? And how do you save and invest to become a millionaire by the time you retire? Listen to Jared’s syndicated radio show and ask him your personal-finance questions or discuss the economy and markets with him. |

Listen live Monday–Friday from 6–8 pm Eastern.

And call 1-844-305-7800 to talk to Jared in person. He would love to hear from you! | | | | | |

|

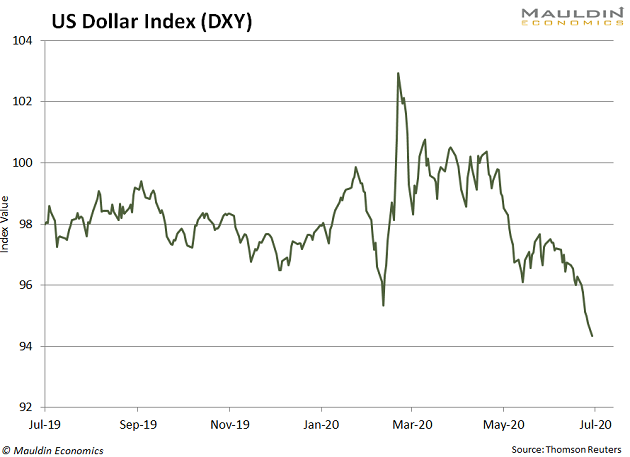

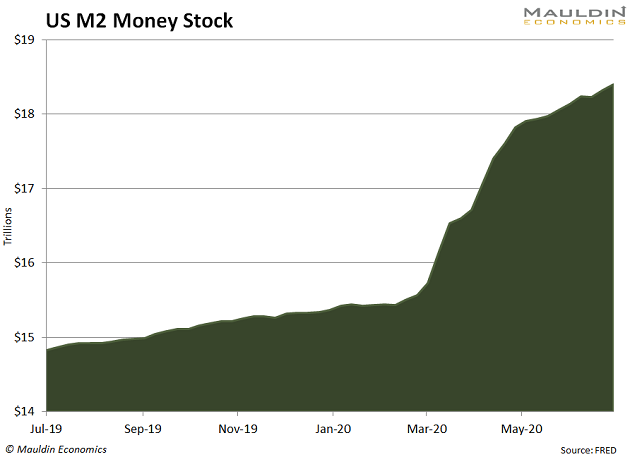

The Narrative It’s fun to watch the narrative shift in real time. We have been living in a long USD regime off and on since about 2013, and we have just shifted to a weak USD regime. A few months ago, we were talking about dollar shortages; a few months from now we will be talking about how the dollar is a threat to the global financial system. Here is a chart of the dollar index, if you had any doubt:  A currency is a medium of exchange, a unit of account, and a store of value. We are concerned with the last part. Of course, we’ve had quantitative easing before, so that’s not new. What’s new is the unprecedented level of fiscal stimulus, which is ongoing, and likely to get much bigger. This presents us with a bit of a problem. As the federal government goes further and further into debt, the assumption right now is that the Fed will end up buying all of it, as part of Yield Curve Control or MMT or whatever. We are more or less at the direct monetization phase. And the government has learned that it can issue more and more debt without consequence, which is to say without interest rates rising. This results in the money supply getting bigger and bigger:  There are two possible scenarios here: - The Fed buys all the debt with printed money, and we become Japan (or worse).

- Inflation begins to rise, which spooks Treasury bond holders, who sell and overwhelm the Fed’s efforts to control the yield curve.

It is the second scenario that I am worried about. Inflation A lot of people (myself included) were worried about inflation in 2008. There were a lot of inflation trades back then—some worked, some didn’t. But we never got inflation. There’s a reason to think things are different this time. Last time, we had inflation in asset prices (but nothing else), which caused all sorts of inequality and led to some of the civil unrest that we are seeing today. This time, we are getting a fiscal response as well as a monetary response, in the form of the stimulus checks and the additional unemployment benefits, as well as the PPP loans. This money is going to people who have a higher marginal propensity to consume. Sorry for the economist-speak—that means they are more likely to spend the money, which will push up prices. I’m pretty sure we will get inflation this time around. The Fed has been jawboning interest rates lower for a few months, threatening to do Yield Curve Control, and then not doing it. If they do it, they will probably only do it in short maturities, out to three or five years. This leaves the potential for the yield curve to steepen dramatically, with 30-year bonds being most sensitive to a rise in inflation expectations. The rates market has been downright somnolent in recent weeks, but that could change if inflation begins to rise rapidly. I’ve seen some claims that inflation could rise as high as 4% in 2021. Of course, this is essentially what the Fed wants, so they’re not likely to do anything about it. They want inflation to overshoot the 2% target, perhaps by a lot. It’s hard to say what level of inflation would actually compel the Fed to tighten policy. Perhaps there is no level. Hence, the decline in the dollar. Protection There is always gold. Gold, of course, is in a bull market, making new all-time highs. Luke Gromen commented the other day that everyone seems to think that everyone is bullish on gold, yet nobody has more than a 1–2% position in it (present company excepted, of course). Anyway, we will talk more about how to protect against inflation in due time. What we’ve just witnessed is a regime change—from a long USD regime to a short USD regime. Everything that worked will no longer work, and everything that didn’t work will start working. These sorts of things only happen every 7 years or so. The deflation trade is toast. Better get some butter and jam.

Jared Dillian  ETF 20/20: Your solution for intelligent ETF investing. Jared’s introductory service, helps investors use ETFs to make more money in the markets with less volatility. ETF 20/20 is a newsletter for every investor—order your subscription now | | Other publications by Jared Dillian: Street Freak: Jared’s monthly newsletter for self-directed stock pickers. Learn how to pick and trade trends, and master your inner instincts here. The Daily Dirtnap: Want to read Jared every day of the week? Hear his daily thoughts on the markets, investor sentiment, central banks, and a dose of dark wit. Thousands of sophisticated investors, Wall Street traders, and market participants read Jared’s premier service, The Daily Dirtnap. Get it here. |

Share Your Thoughts on This Article

Was this email forwarded to you?

Click here to get your own free subscription to The 10th Man.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES. |