| -- | July 6, 2017 People Should Know When They’re Conquered  Before we get started, go and check out Episode 7 of The Monthly Dirtcast! I’m interviewing Andy Milovich, general manager of the Myrtle Beach Pelicans. We get into the economics of minor league baseball, and some other really funny stuff. I was cracking up throughout the last half of the show. Two weeks ago, I took a shot and called the top of the stock market. If you are a newsletter writer and you aren’t trying to call major turns in the market, you are not really doing your job. If you missed that issue, I suggest you go back and take a look at it. My argument is that speculation is getting out of control. And not just on stocks—on bitcoin, comic books, all kinds of stuff. When you have one bubble, you usually have others, concurrently. But the one that people are most focused on is the bubble (if you want to call it that) involving Facebook, Amazon, Netflix, and Google. Throw in Apple and Tesla for good measure, and maybe a few more. A handful of tech stocks have gone bananas. So, let’s do some basic blocking and tackling. I actually spend almost no time on charts in The 10th Man, but I think technical analysis is really important. The quality of the analysis often depends on the abilities of the analyst, and one of the best is Frank Cappelleri at Instinet. He has pointed out that on a short-term basis, the NDX (which largely tracks large-cap tech stocks) has formed a head-and-shoulders top and is breaking trend.

Source: Instinet This is the first real weakness we’ve seen in tech in a really long time… Though Frank is quick to point out that on a longer time horizon, the trend is still firmly intact:

Source: Instinet I don’t think it is a coincidence that the short-term breakdown is happening concurrently with tumultuous times in Silicon Valley. Uber is disintegrating before our eyes. Unless they go public (which they can’t), they’re going to have to do a down round, and it’s not out of the question to think the company might cease to exist one day. That likely has implications for private valuations everywhere. Also, the news broke of some pretty big sexual harassment allegations recently in tech-land. This is significant because public opinion matters—I can foresee a time when tech executives are viewed about as favorably as Wall Street was in 2011, when Occupy Wall Street began. The Longest Bull Market… Ever Keep in mind that Silicon Valley never really had a recession like the rest of the country did in 2008. Sure, the VC business slowed down, but do you remember what was happening in 2008? Facebook had about a $15 billion private valuation, and it was spawning a whole ecosystem of tech startups that latched on to Facebook, like Zynga. Silicon Valley went down the cleantech path for a few years, which was a dead end, but moved on to apps like Yo!, which apparently was not. So Silicon Valley hasn’t had a real, honest-to-goodness downturn since the dot-com bust. That was 17 years ago! Probably less than a quarter of people currently working in the valley were even around when that happened. That’s the funny thing about cycles—they usually repeat when nobody remembers the last one. Most people have no idea the sorts of excesses that are happening in tech world. I don’t either, but I have spies. About a year ago, a friend of mind visited LinkedIn headquarters, went to their cafeteria, and told me of the incredible opulence there. The types of luxuries that are available to people in Northern California—you or I cannot even conceive of it. Quick story. I went to graduate school at the University of San Francisco, and took a Venture Capital class, which was basically a series of lectures from executives in the VC industry. These were very important people. I was surprised that they were taking time to come speak at USF. Stanford sure, but USF? It was April of 2000. The stock market had just crested. A very senior guy from New Enterprise Associates came to talk to the class about optical networking. He spoke of the great promise of optical networking. He drew a nearly vertical line shooting off into space, and called it “Moore’s Law Squared.” He might have been the most bullish person I have ever seen in my entire life. The next day I went out and bought a bunch of put spreads on optical networking stocks. They were some of the greatest trades I ever made. Nobody believes their own bullshit quite like venture capitalists. Having Said That I wrote a piece a year or two ago in The 10th Man about how tech was overpriced. Tech responded by going straight up. Plus, if you shorted tech when things started getting stupid a few years ago (think Yo!) you would have been carried out. But it’s hard to argue that things haven’t gotten excessive, especially in startup financing (seed and pre-seed). Seems like all you need is a pitch deck and a dream, and you have yourself a $10 million valuation. The old-timers know that’s not normal. The old-timers know there is a cycle. The Fed keeping interest rates at emergency levels has allowed this to go on a lot longer than it should have. The down part of this cycle will be instructive, for a lot of people. And I hate to pick on the FANG stocks, because at least they make money (more or less).

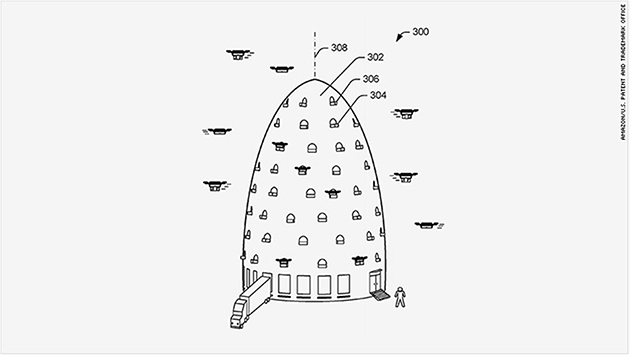

Source: CNN Money But dreams are always biggest on the highs. I’m sure some of you saw the patent application for Amazon’s drone beehive fulfillment center. Now, companies apply for patents for all kinds of crazy things, but come on. Even if you’re not bearish on the overall market, I would bet strongly on tech underperformance. It seems likely that value will strongly outperform growth, for the foreseeable future. That one is easy enough to implement.

Jared Dillian

Editor, The 10th Man

| Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it's also truly addictive. Get it free in your inbox every Thursday. |

Jared's premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed books, Street Freak: Money and Madness at Lehman Brothers , and All the Evil of This World , shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freak an investment advisory like no other. Follow Jared on Twitter at @dailydirtnap. Share Your Thoughts on This Article

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.ggcpublishing.com/. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |