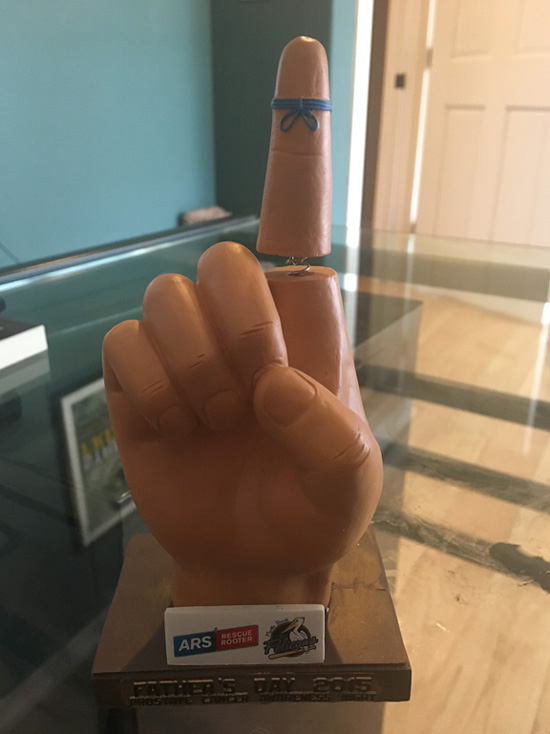

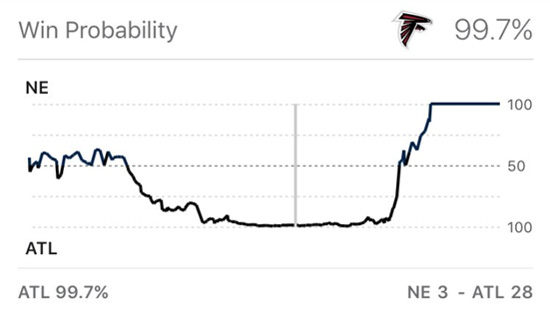

|  Puts for a Stink Football is over! What a game. That means baseball season will begin soon. I’m more of a baseball guy, myself. Every year, I get a ticket package to the Myrtle Beach Pelicans, the Advanced A minor league affiliate of the Chicago Cubs. There is nothing in the world that is better than minor league baseball. Like the time when the Pelicans gave out “bobblefingers” on Prostate Cancer Awareness Night.  Ah, minor league baseball. That’s not even the craziest thing that’s happened at a Pelicans game. You can probably find a video online of the team dog, Deuce, living up to his name in the middle of a game out in the outfield. I was there for that one. Where was I? Oh yes, the Super Bowl. During the game, a lot of people were passing around this chart of the odds of each team winning:

Source: @mattcascio The intragame probability of the Patriots winning had dropped to a fraction of 1% in the third quarter. Imagine if you could trade on that intragame probability. Imagine if you could buy the Patriots at 200-to-1 in the third quarter. Would you do it? Of course you would. It’s easy to say that in hindsight, but never mind hindsight—you probably would have done it in real time. It’s just obvious. I get 200-to-1 on the greatest quarterback and coach of all time? Done and done. So in reality, no bookmaker would ever offer you those odds. You would probably get offered 30-to-1 or 50-to-1. That represents the bookmaker’s edge. And the edge has to be pretty substantial when the house is laying heavy odds like that. It still would have been a hero trade at 30-to-1, but not quite as exciting. Teeny Puts I am old enough that I was trading in the markets before decimalization. If an option was trading for a quarter, we called it a “quack.” If it was trading for a sixteenth, we called it a “teeny” or a “stink.” Beware the teeny puts. If you were a market maker on the floor, you generally didn’t want to be short any teeny puts right before earnings. Just spend the money and buy them back. No reason to be short unbounded downside risk for just a couple hundred bucks1. The teeny puts have turned into nickel puts since decimalization, but the mythology is the same: everyone dreams of buying cheap options and falling ass-backwards into money. Problem is: it almost never happens. Just as the house is never going to give you 200-to-1 odds on a football game, nobody is going to give you 200-to-1 odds on a stock. Those teeny/nickel puts are almost always overpriced. Experienced option traders call them “wing options.” They are overpriced because nobody wants to be short unbounded downside units2. So the teeny option is a bit of an optical illusion. It is cheap, in dollar terms, but in valuation terms, it is very expensive. Theoretical Value Basically, how volatility traders make money is by determining a theoretical value for options. They sell options that trade rich to that theoretical value and buy options that trade cheap to that theoretical value. The theoretical value is indeed theoretical—it is derived from some estimate of future volatility for the stock. Sometimes, that estimate is wrong. But as a general rule, if you buy cheap things and sell rich things, you will make money in the long run.  So if you see a put or a call offered at five cents, you can bet that the theoretical value is much less than that. Perhaps less than a penny. All of trading is knowing the value of something. Many individual investors focus on things other than value when they invest. They focus on the technicals (is it going up?) or sentiment (is everyone bearish?) or macro (what will the Fed do?)—but not the actual value of a stock. Of course, it isn’t that simple to determine the value of a stock—it’s often a matter of opinion. But having a model is a good starting point. The fixed income investors are usually the first to get caned by big market moves, because they think bonds are mathematical and easily valued, when they actually are not. They have the illusion of being rational. Nothing could be further from the truth. Of all things, valuing options is actually pretty straightforward3. There is nothing complicated about Black-Scholes. Your estimate of future volatility is probably as good as the robot’s. And the reason options get mispriced is because there are plenty of people who are trading options for reasons other than value—like the covered call writers, or the stupid vol ETFs that just sell volatility in a blob. Buying call options on something simply because you think it will go up will probably set you up for big disappointment. There are a lot of other considerations. There has been a lot of discussion about how volatility is so preternaturally low after the inauguration. Trump is turning out to be plenty volatile, but the market is not. Is volatility cheap? I will have the answer to this in my next issue of Street Freak, but I’ll give you a hint: Not necessarily. One final thing—if you’re interested in Street Freak, you should know that Mauldin Economics is running a promotion right now where you get Street Freak, John Mauldin’s Over My Shoulder, and Patrick Watson’s Yield Shark for $199. So think of it as getting Street Freak plus two other publications for free. It’s an exploding offer, so sign up soon.

____________ 1 In my novel All the Evil of This World, one of the main characters ends up buying a bunch of teeny puts in Bed, Bath & Beyond right before earnings, and the stock craters, leaving him with a windfall profit.

2 Calls are similarly overpriced, but most stocks don’t gap up as much as they gap down.

3 It gets more complicated in deals, and really complicated with biotech.

Jared Dillian

Editor, The 10th Man

| Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it's also truly addictive. Get it free in your inbox every Thursday. |

Jared's premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed books, Street Freak: Money and Madness at Lehman Brothers , and All the Evil of This World , shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freak an investment advisory like no other. Follow Jared on Twitter at @dailydirtnap. Share Your Thoughts on This Article

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your fin ancial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics |