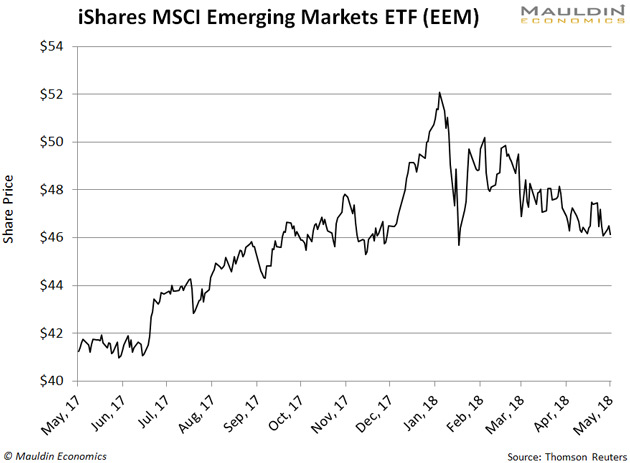

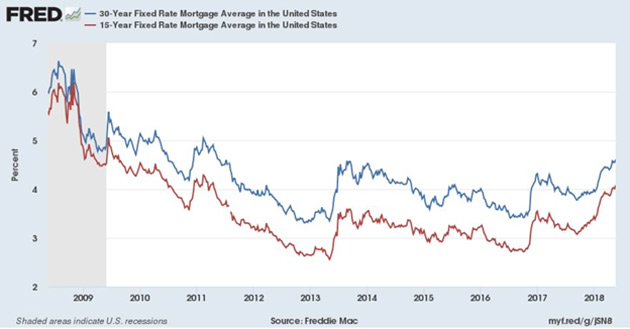

| -- | May 24, 2018 When Rates Go Up, Stuff Blows Up  I’ve said the title of this issue a few times before in The 10th Man, here and here. When rates go up sharply, stuff blows up, because lots of people are negatively exposed to higher rates. Households, corporates, and governments are all negatively exposed to higher rates, in different degrees. Back in 1994, we found that it was Mexico, Procter & Gamble, and Orange County, California who all suffered because of higher interest rates. Where does the risk live today? We will soon find out. There is a playbook for when interest rates go up. Rising interest rates do not necessarily cause a recession per se, but they are usually found at the scene of the crime. There was no recession in 1994, but the financial world shivered. Today, we have rising rates and a more-hawkish Fed which has shown no signs of letting up. As usual, emerging markets are puking their guts out. I was in Argentina last week and saw the carnage first-hand. I wrote about it in The Daily Dirtnap. The Argentine peso declined a smooth 20% in a week:  Meanwhile, Turkish President Recep ErdoÄan is calling himself an “enemy of interest rates.” He is an FX trader’s dream.  Of course, there are idiosyncratic things going on in Argentina and Turkey, but all EM currencies and stock markets have been getting hit hard. Emerging markets was a consensus pick at the beginning of 2018, so it is making some people look a bit foolish.  When interest rates rise in the US, it makes US securities more attractive relative to emerging markets, and capital flows reverse—which is exactly what is happening today. Emerging markets happen to be the most leveraged player when it comes to US rates. But let’s talk about some more obvious examples. Housing Market Duh. Everyone knows that when mortgage rates go up, it makes it more expensive to buy a house. The first thing people say to me is that the US housing market will crash. No. At least, not everywhere. Most places you go in the country, housing prices are quite affordable. But there are bubbles in some local markets. All of California is pretty much in a bubble. Seattle, Boulder, and Austin have blazing hot housing markets. They also have pretty compelling fundamentals. California is a special case—there is a huge amount of housing debt in California (more than you realize), and you can no longer deduct state taxes. If interest rates go up a bit more, and the demographics turn unfavorable, California housing could reprice 20%. Higher interest rates simply hinder economic activity. If the marginal house is too expensive to buy, then you also won’t be buying that paint, carpet, and furniture. Not everybody realizes that the housing market drives a lot of economic activity. Why do you think Canada is still afloat after just about every other sector of the economy has collapsed? We won’t get a housing crash in the US, but a slowdown could take a full percentage point off of GDP. Mortgage rates have risen to 4.61% nationwide. My mortgage is 3.75%. Look at me, I’m warm as toast.

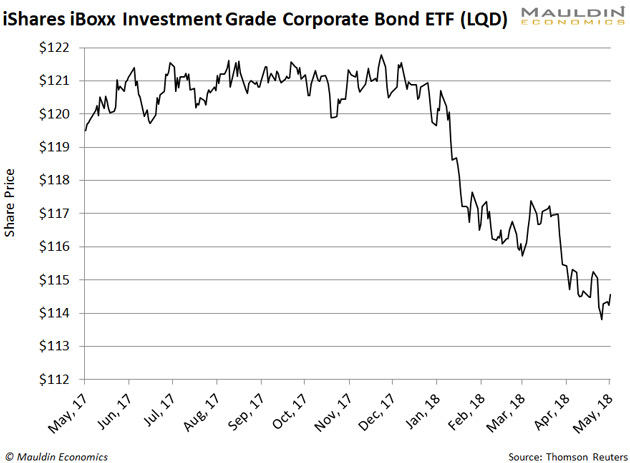

Source: St. Louis Fed On a $250,000 mortgage, your annual payments go up almost $2,000 a year for a 1% increase in mortgage rates. Loan officers are not going to make those numbers work for a certain class of borrowers. Of course, in the past, loan officers have been pretty creative about making the numbers work, but Dodd-Frank was supposed to put an end to that. Where the Risk Lives If we really do have a sustained bear market in bonds (which I am doubtful of), I think the risk is very first-order. The people who will suffer when bonds go down are bondholders. US households hold trillions of wealth in bonds and bond mutual funds. Treasury, corporate and municipal bonds. For the past thirty years, it has been easy to forget about duration—interest rates have only gone down. Now, people are starting to figure out that corporate bonds have duration, too, as you can see from the chart of LQD, which is being hit by… higher interest rates.  For the past ten years, people have needed income. They got it one of two ways: high-paying dividend stocks and investment grade or high yield bonds. Now dividend stocks are going down for the dirtnap (see Philip Morris) and corporate bonds are getting whacked on duration. People were pushed out the “risk curve” from 2010-2013 so they could try to harvest some kind of income from risky assets, and now the chickens have come home to roost. There may not be another Orange County or Procter & Gamble, but Ma and Pa Kettle may taste the lash yet again (after tasting it in stocks in 2002 and 2009). Individual investors have looked like geniuses for the past eight years because stocks and bonds have gone up together. Increased correlation has made a 60/40 portfolio look like magic beans. Now stocks and bonds are correlated the other way. People are going to be pretty frustrated when they put all that thought into asset allocation, and asset allocation doesn’t help. I know one asset class that works pretty well in a rising rate environment: cash. In case you missed it, check out my podcast with rates/inflation analyst Com Crocker of New Century Advisors. He’s an expert on all the stuff we talk about in this issue of The 10th Man. Check it out.

Jared Dillian

Editor, The 10th Man

| Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it's also truly addictive. Get it free in your inbox every Thursday. |

Jared's premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed books, Street Freak: Money and Madness at Lehman Brothers , and All the Evil of This World , shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freak an investment advisory like no other. Follow Jared on Twitter at @dailydirtnap. Share Your Thoughts on This Article

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, ETF 20/20, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.ggcpublishing.com/. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2018 Mauldin Economics | -- |