You Can Polish a Turd, But You Can’t Make It Shine In today’s issue, you’ll read how desperately Japan has been trying to shed the “deflationary curse” it’s been haunted by for decades. Well, the US doesn’t have that problem. In fact, I think our period of deflation has just ended. And I’m getting my Street Freak subscribers positioned to squeeze the most profit out of this inflationary opportunity. To get as many people into the fray as possible, the Mauldin team and I decided—for just two short weeks, and this is the second one—to offer The 10th Man readers a special price for the one-year subscription. Right now, you can prosper along with us for just $199 per year… that’s $100 off the regular price. But hurry, cutoff day is Thursday, July 21. After that, it’s back to the old price. And after this public service announcement, we go back to the issue at hand… Japan: It’s Getting Interesting. Shinzo Abe scored a decisive victory in the upper house elections a few nights ago. Let me explain why that is not boring. Abenomics was conceived in 2012 as a way to combat Japan’s never-ending deflation and pseudo-depression. It included a truly massive program of quantitative easing, which involved the printing of yen to buy all sorts of assets—including stocks! Abenomics has continued for four years, with mixed results. Stocks are up about 150%, interest rates are negative, and the yen is appreciably weaker. But there is still no economic growth.  Hence the title of this piece. So has Abenomics helped? It might have, if Japanese retail investors owned stocks. But they really don’t—foreign ownership of Japan’s equity market is quite high. Low interest rates might have sparked off a residential construction boom, but they didn’t—because there is nobody to build houses for. Japan suffers from chronic depopulation, as the birth rate is well below the replacement rate. The Economics of Depopulation I say this a lot, but I will say it quite explicitly here: the Earth has experienced explosive population growth for decades, but the rate of growth is slowing, and before long, we will have reached peak population, and the number of people on this planet will actually be declining. I imagine it will happen faster than people think. The Malthusians were discredited years ago, but they are really discredited now. What are they going to say when the planet is depopulating? That may be great for the environment, but the economics of the situation are not so clear. You see, the whole profession of economics was conceived and practiced during periods of rising population. It’s easy to get economic growth when your population is increasing. More people working produce more output. Let’s review, again, how you get economic growth: - More people working

- Same number of people working more hours

- Productivity increases

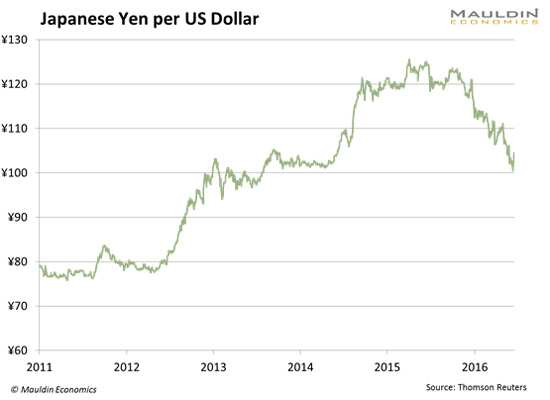

If you have fewer people working, the remaining people have to either work longer, harder, or more efficiently to get the same level of output. Ain’t happening in Japan. So economics as an academic discipline gets quite weird when the population drops, because declines in output, otherwise known as GDP, become the norm, rather than the recessionary exception. Japan is basically in recession all the time, except for brief intervals. On a per capita basis, they aren’t necessarily getting poorer—and perhaps that is what people should focus on—but strictly speaking, yes, as long as Japan’s population keeps going down, there is really no way to reverse the deflation. Enter Abenomics, which has caused the BOJ to print massive amounts of yen and to take all sorts of assets onto its balance sheet. With the trillions of extra yen floating around the banking system, you might think you would get inflation. But not yet—money velocity continues to plummet. So Japan is caught in this vicious cycle of deflation and QE. Meanwhile, the government debt continues to be effectively monetized (taking the primary dealers out of the equation would accomplish just that). Someone said on Twitter recently (and I am paraphrasing), “Japan is the biggest hyperinflation risk in the world, and USDJPY is only at 100?” Makes no sense. The One Currency That Could Go to Zero Remember The Dillian Loop as it applies to Japan: Japan does quantitative easing. - If it works, it is declared a success and they do more.

- If it doesn’t work, it means they need to do more.

Right now it’s not really working, so they’re going to do more. It is possible that the BOJ will print an infinite amount of yen. The helicopter drop is being seriously discussed. I don’t care what you think of the dollar or the euro or the pound or the Swiss franc—you print an infinite amount of a currency, it is going to decline in value. I was about to say that it was an easy trade, but it hasn’t been an easy trade over the last 12 months. The yen has rallied massively as the market had serious concerns over the political will in Japan to truly reflate. But after the election, there should be no doubt about the political will. They are going to reflate.  Full disclosure: I am short the yen and I own DXJ, and I have been in those positions since 2012. If you are a yen bull, you should be very, very nervous about these election results. Right now, predicting inflation is still an out-of-consensus view. But just about everything we do at Street Freak is out of consensus. It helps you avoid the big drawdowns that herd investing gets you sucked into. You can read more about my inflation thesis, and other high-conviction trade ideas, at the temporarily discounted rate of $199. You can sign up here—I’d love to have you aboard. Book Signing Just thought I’d mention—if you are in the NYC area, you might want to stop by my book signing in the city today, Thursday, July 14. It’s at Millesime, 92 Madison (at 29th Street), at 5pm. I’d love to meet you in person. I’ll have copies of All the Evil of This World for sale. If you can’t make it, you can do the next best thing—you can watch a video about it here. If you decide you still want to read it (you might not), you can get one here (warning: it’s not for everyone).

Jared Dillian

Editor, The 10th Man

Jared's premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed books, Street Freak: Money and Madness at Lehman Brothers , and All the Evil of This World , shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freak an investment advisory like no other. Follow Jared on Twitter at @dailydirtnap. Share this newsletter

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited. Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics web site, Yield Shark, Thoughts from the Frontline, Tony Sagami's Rational Bear, Stray Reflections, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Macro Growth & Income Alert, Transformational Technology Alert, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion. Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2016 Mauldin Economics |