| It was almost a year ago when the US regional banking sector fell into turmoil. This year, there may be more rough sledding thanks to a commercial real estate market that hasn’t been the same since the pandemic struck. New York Community Bancorp and Japan’s Aozora Bank just delivered a reminder that some lenders are only beginning to feel the pain. The former’s decision to slash its dividend and stockpile reserves sent its stock plummeting to a 23-year low by Thursday. The selling had bled overnight into Europe and Asia, where Aozora plunged more than 20% after warning of US commercial-property losses. The twin dives reflect the ongoing slide in commercial property values coupled with the difficulty of predicting which loans might unravel. Banks are facing roughly

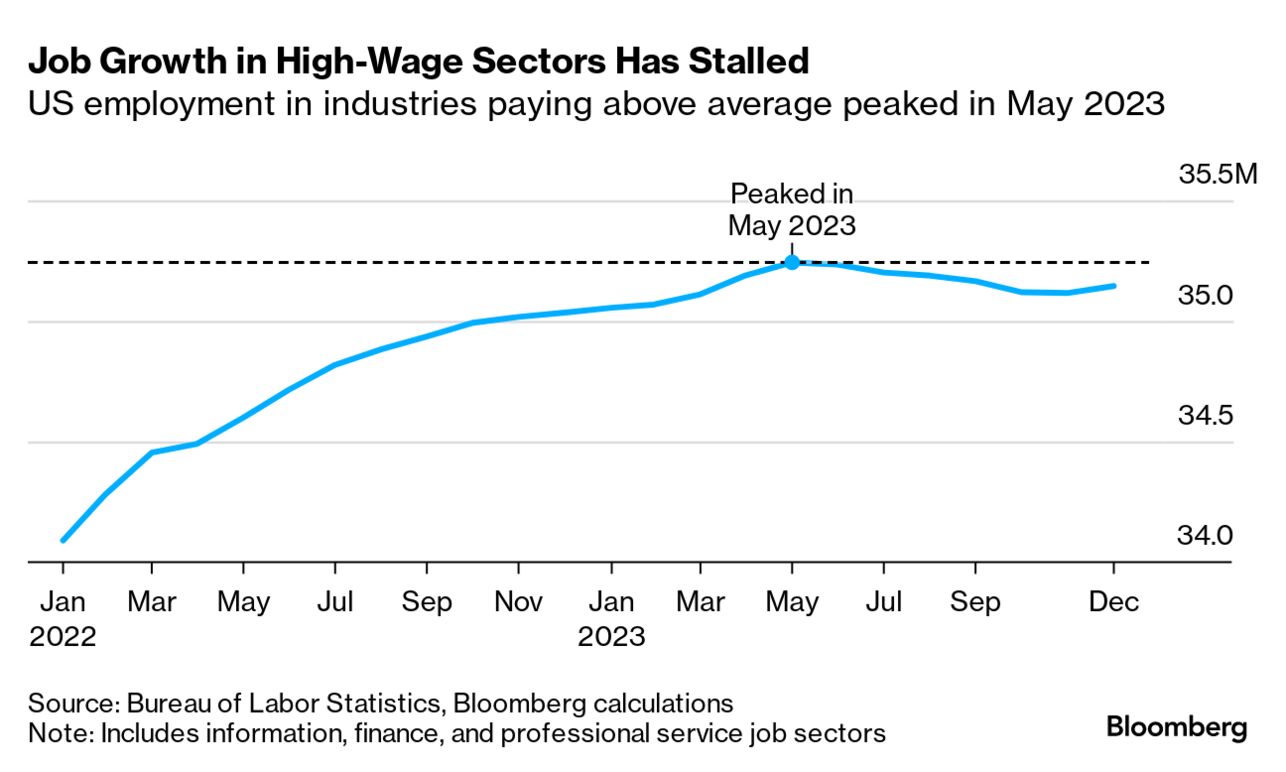

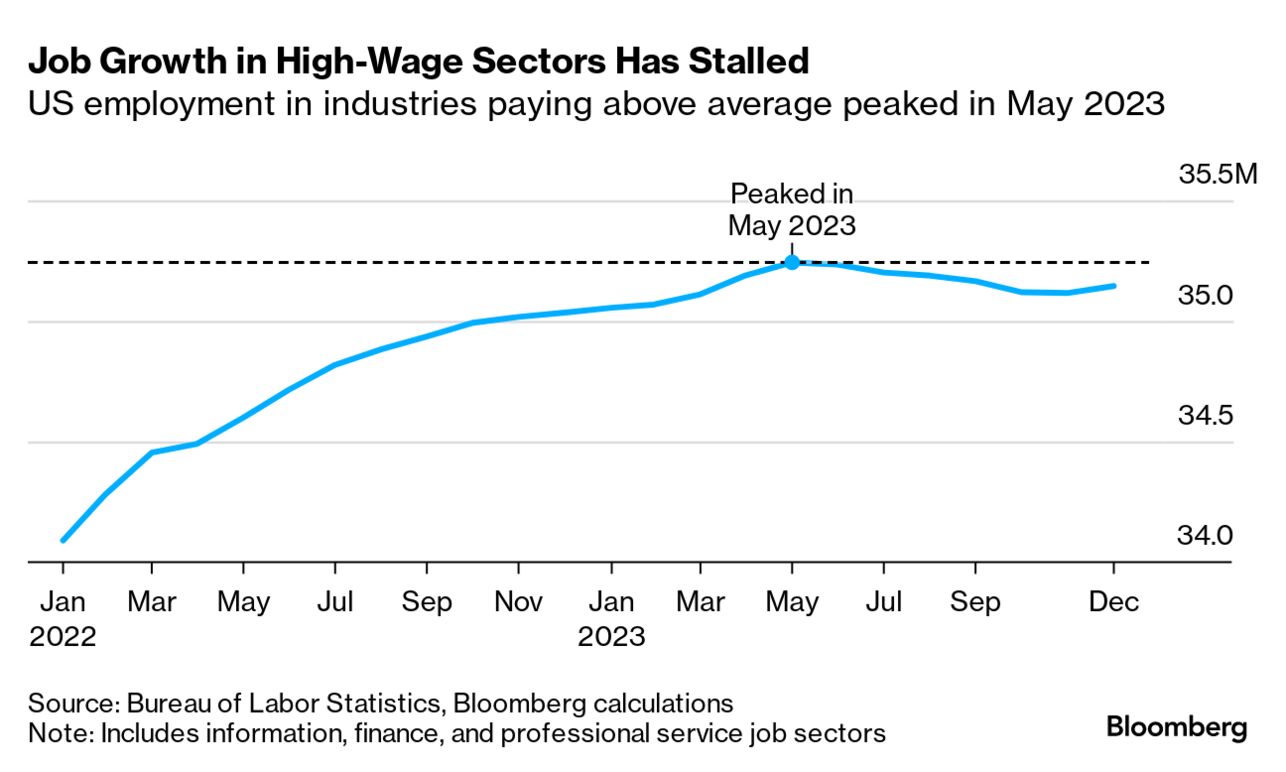

$560 billion in commercial real estate maturities by the end of 2025, representing more than half of the total property debt coming due over that period. And commercial real estate loans account for 28.7% of assets at small banks. “It’s clear that the link between commercial property and regional banks is a tail risk for 2024,” said Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place. “And if any cracks emerge, they could be in the commercial, housing and bank sector.” —David E. Rovella Wall Street banks including JPMorgan and Bank of America are in talks to provide as much as $8 billion in financing for a buyout of DocuSign that’s said to value the company at around $13 billion. Jefferies Financial Group and Deutsche Bank are also among the lenders considering a role in funding what would be the largest leveraged buyout of the year so far. Deutsche Bank says it plans to cut 3,500 jobs over the coming years. The lender detailed the reductions on Thursday as it raised its mid-term revenue target and said it will return €1.6 billion ($1.74 billion) to investors in the first half of this year, including through a €675 million share buyback. Chief Executive Officer Christian Sewing is stepping up efforts to lift a share price that’s been largely treading water since he took over. After benefiting from rising interest rates over the past year, Sewing now has to contend with a slowdown in trading, high inflation and investments to fix flawed controls.  Christian Sewing Photographer: Stefan Wermuth/Bloomberg Russia is turning its sights on prominent anti-war critics of Vladimir Putin who’ve fled following the Kremlin’s unprecedented crackdown on domestic opponents of his war on Ukraine. The Foreign Ministry in Moscow has told its diplomats to pursue Russian artists and celebrities who speak out against Putin and in support of Ukraine from so-called “friendly” countries that have avoided taking sides over the war. European Union leaders clinched a deal on a €50 billion ($54 billion) financial aid package for Ukraine after Hungarian Prime Minister Viktor Orban caved to their demands. The agreement proves “we stand by Ukraine and I think it will be an encouragement for the US also to do their fair share,” European Commission President Ursula von der Leyen said, alluding to the refusal of House Republicans to aid Ukraine. The EU agreement was salvaged in a morning gathering including Orban, German Chancellor Olaf Scholz, French President Emmanuel Macron and Italian Prime Minister Giorgia Meloni.  Ursula von der Leyen Photographer: Ksenia Kuleshova/Bloomberg China’s Geely is preparing more funding for struggling electric vehicle maker Polestar as a way to relieve financial pressure on another company it owns, Volvo Car AB. The proposed deal would see Volvo Car transfer some of its 48% stake in Polestar to Zhejiang Geely Holding Group. The move follows a slower-than-expected ramp up at Polestar that, together with a broadening EV slowdown, has dragged shares to a record low. Apple reported a deepening slump in China during the holiday quarter, even as total iPhone sales were stronger than expected and the company returned to revenue growth. Sales in China dropped 13% to $20.8 billion in the fiscal first quarter, which ended Dec. 30, the company said. That fell far short of the $23.5 billion predicted by analysts and was Apple’s weakest December quarter in the Asian nation since the first period of 2020. America’s wildly resilient labor market in the aftermath of the pandemic put employees in the workplace driver’s seat. Now those days may be over. Even as predictions of recession and high unemployment fall flat, the cooling economy the Federal Reserve prefers for its soft landing isn’t necessarily great news for workers. The economy is expected to hold up well again this year, as is the job market. But Americans may face dwindling options to change positions, with many holding multiple jobs to make a decent living. “It’s still a good labor market for wages and for finding a job, but it’s getting back into balance, and that’s what we want to see,” Fed Chair Jerome Powell said Wednesday. Well maybe not everyone.  At Bloomberg Pursuits, we love to travel. And we always want to make sure we’re doing it right. So we’re talking to road warriors to get the latest tips. These are the Distinguished Travel Hackers. Today’s subject is David Alwadish, founder and chief executive of ItsEasy, which specializes in expediting travel-related paperwork such as passports and visas. His schedule—back and forth from New York’s Long Island to Florida every other week or so—means he racks up around 60,000 miles per year, and more if he and his wife and two sons venture overseas on a trip or two. It also means he has some neat hacks for you when it comes time to fly.  David Alwadish Courtesy: David Alwadish Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |