| Tapering is here, rate hikes not so much. After announcing a start to reducing bond purchases made to prop up the U.S. economy, Fed Chair Jerome Powell said officials will nevertheless remain patient on raising interest rates, unless inflation forces their hand. Tapering “does not imply any direct signal regarding our interest rate policy,” Powell said. “If a response is called for, we will not hesitate.” The Federal Open Market Committee said on Wednesday it would scale back its monthly buying by $15 billion starting in November, part of a process that could be completed by mid-2022. Here’s your markets wrap. —David E. Rovella and Margaret Sutherlin

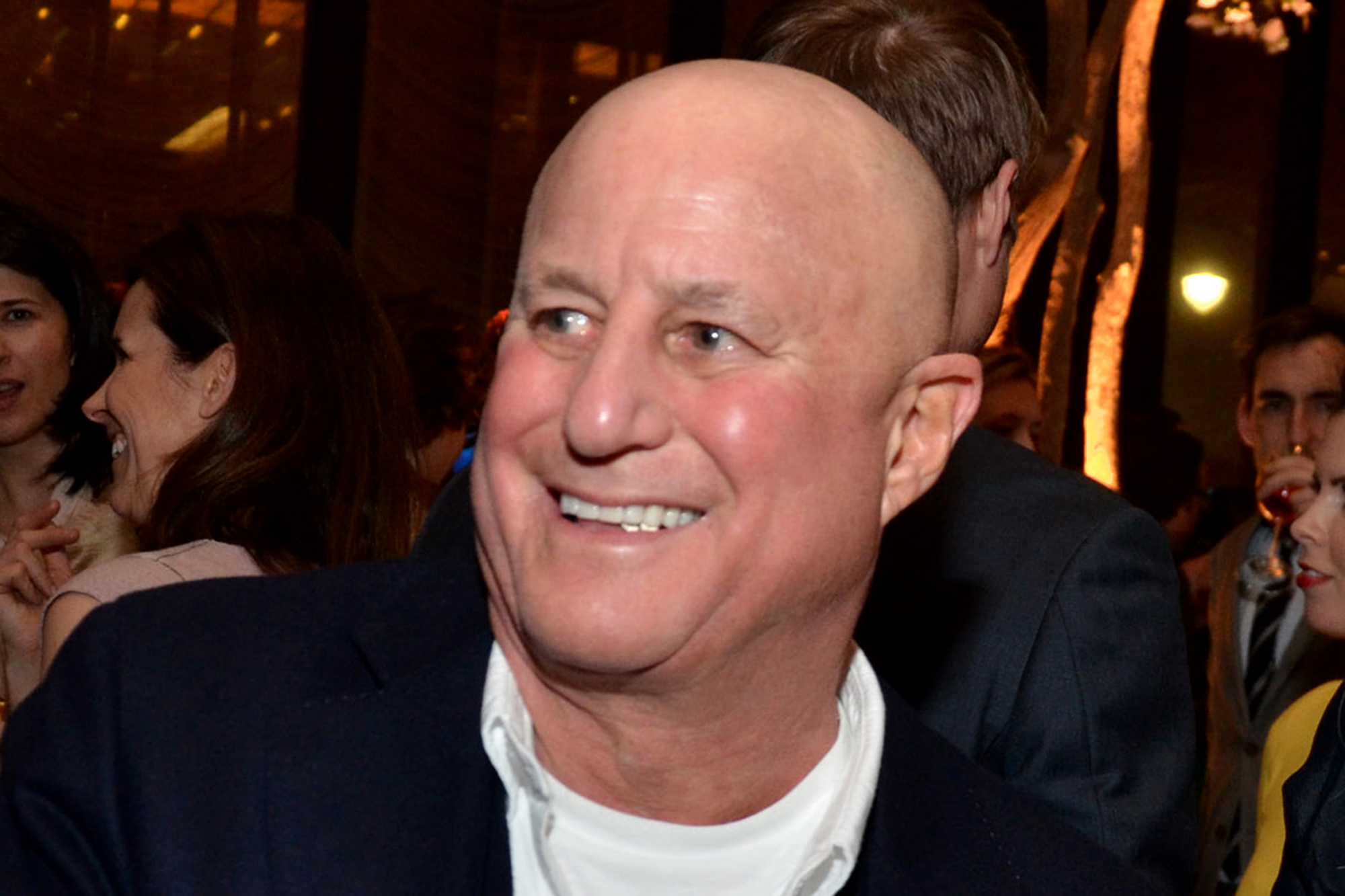

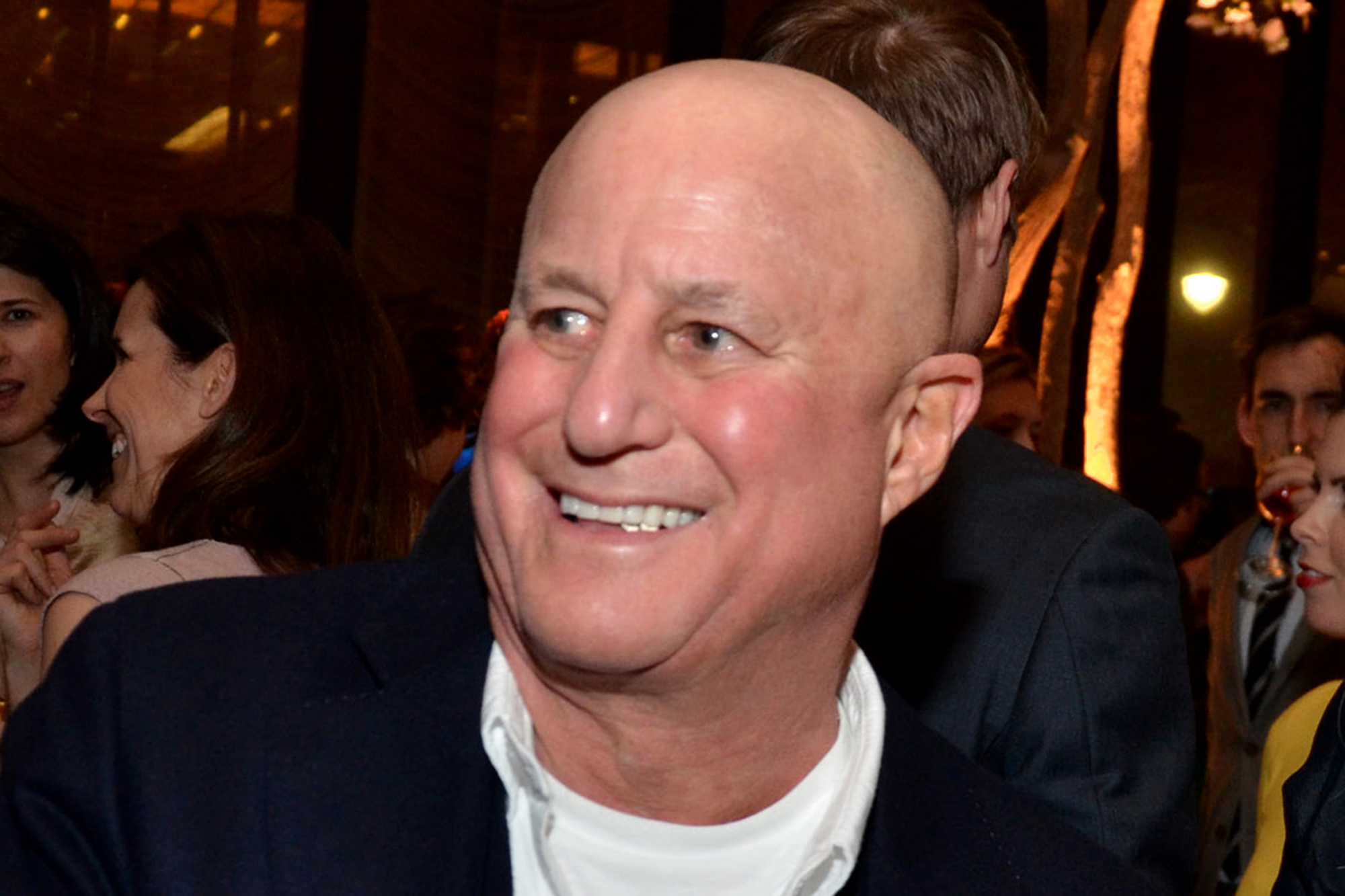

Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. By 2030, China will likely have 1,000 nuclear warheads, the Pentagon said. It’s a much faster pace of expansion than U.S. officials previously believed, and one that raises questions about Beijing’s ultimate intentions. But Beijing is making a show of quieting speculation that a conflict with Taiwan—and by extension the U.S.—may be imminent. The online chatter was fueled in part by the government’s call for citizens to stockpile food this winter.  China’s DF-17 Dongfeng medium-range ballistic missiles were featured in a military parade marking the 70th anniversary of the Chinese People’s Republic. Photographer: Zoya Rusinova\TASS/Getty Images On the economic front, China is blowing up one of the most lucrative bond bets out there, according to Bloomberg’s China Credit Tracker. The selloff that began with Evergrande Group five months ago is spreading rapidly as President Xi Jinping’s government continues its crackdown on a deeply indebted real estate sector. A high-profile loss in the Virginia gubernatorial race and the possibility of an even bigger defeat in New Jersey has national Democrats in fear of what’s coming in 2022. It may also serve to light a fire under Congress, where the party has been bickering for months over the details of President Joe Biden’s economic agenda. But any newfound urgency would still face two big obstacles to passage, one each from West Virginia and Arizona. Here’s the latest on the election. What was expected to be a wave of U.S. exchange-traded funds tied to Bitcoin futures has all but dried up—for now—after off-the-charts demand for the first one rattled Wall Street’s all-important middlemen. The unlikely star of the cryptocurrency world these days is Shiba Inu, named after the same breed of dog that inspired the market’s former meme-coin darling Dogecoin. The total market value of the token soared to more than $51 billion last week, leapfrogging Dogecoin to put it among the top 10 cryptocurrencies in existence. This despite the fact that its provenance as a meme leaves it without much of a reason to thrive. He was once America’s richest man and a fixture in tabloids. Now he’s selling his empire, and his family foundation has made some mysterious loans. What’s going on with Ron Perelman’s family trust?  Ron Perelman Photographer: Amanda Gordon/Bloomberg Former U.S. vice president and environmental advocate Al Gore said the world is witnessing a sustainability revolution—and warned that investors caught on the wrong side of history will face losses. Big losses. Why’s that? “An absurd assumption that all of those carbon fuels are going to be burned,” he told Bloomberg Television while at the COP26 summit in Glasgow, Scotland. In other words, there’s a lot of red ink in the ground.  Al Gore Photographer: Emily Macinnes/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg Financial Innovation Summit: From disruptions in payment systems and mobile banking to social media-driven retail investing and crypto, financial technology has grown exponentially. On Nov 4-5, we’ll explore how innovations make their way from the drawing board to mainstream technologies that shape our financial future. Speakers include the CEOs of Betterment, H&R Block, and eToro. Register here. |