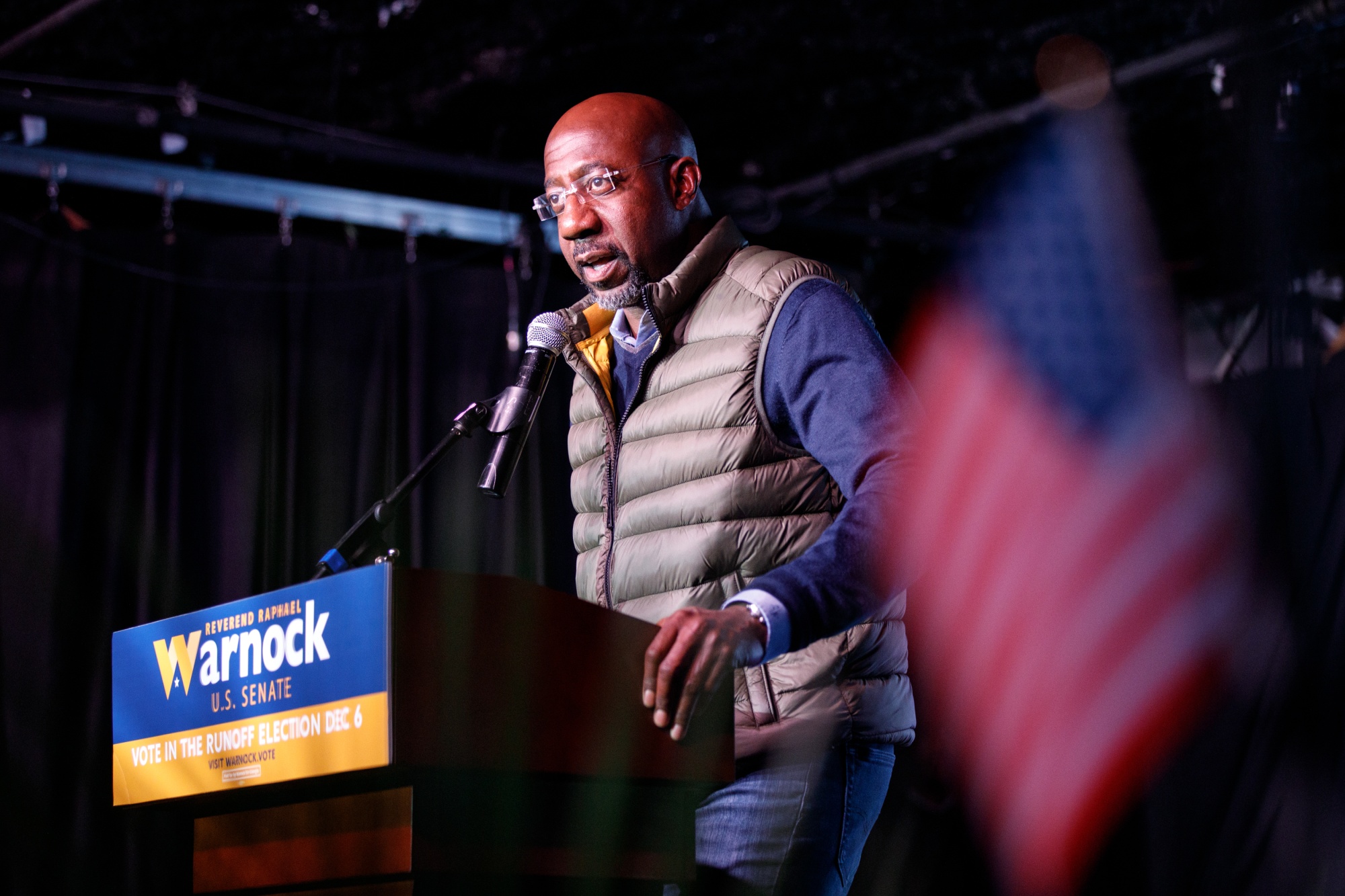

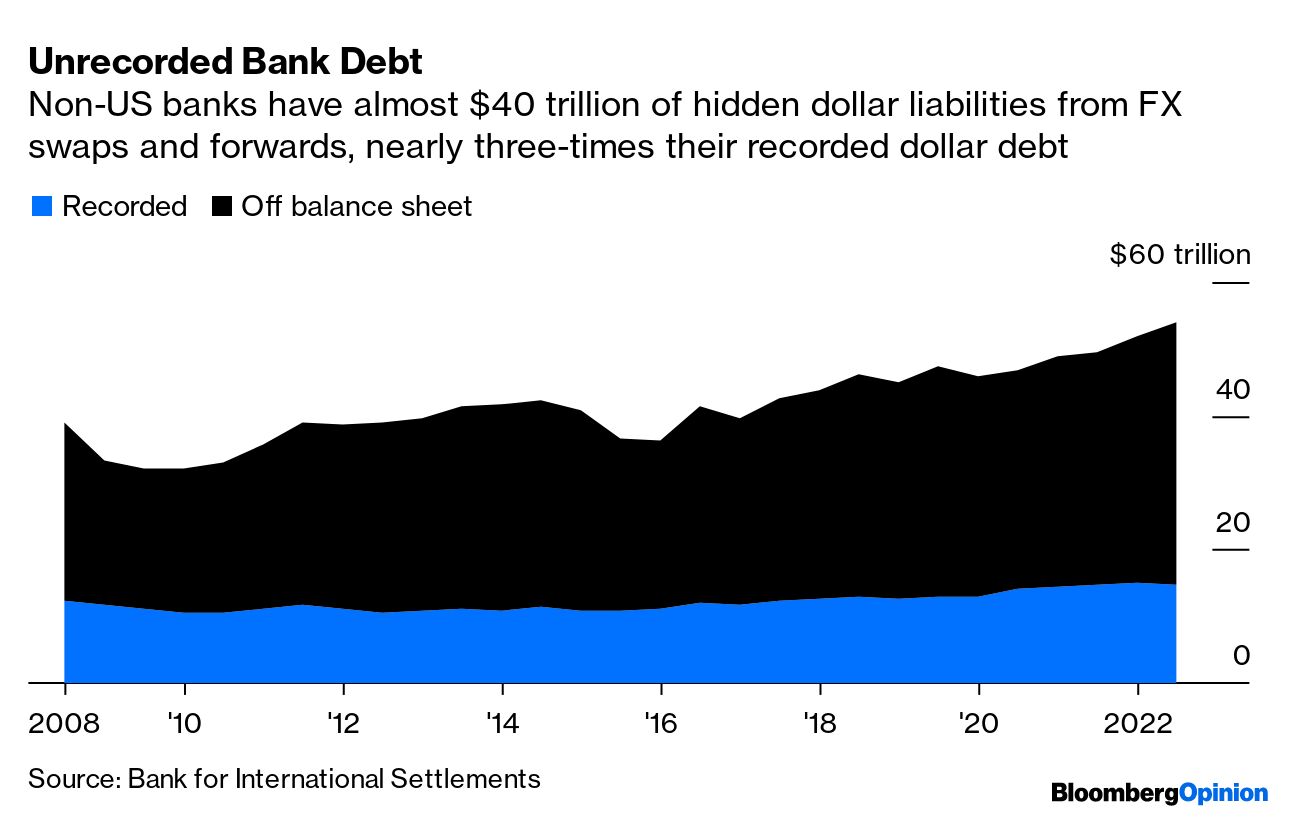

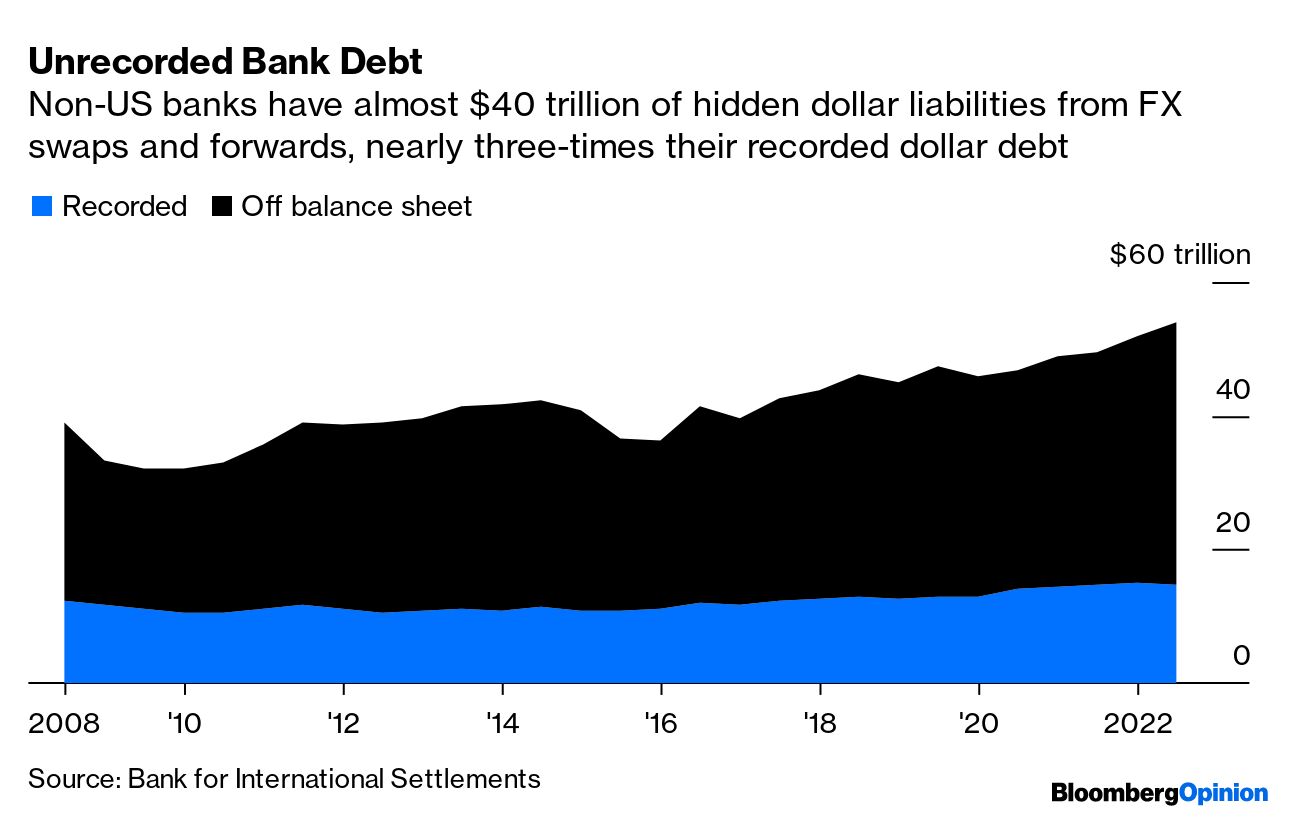

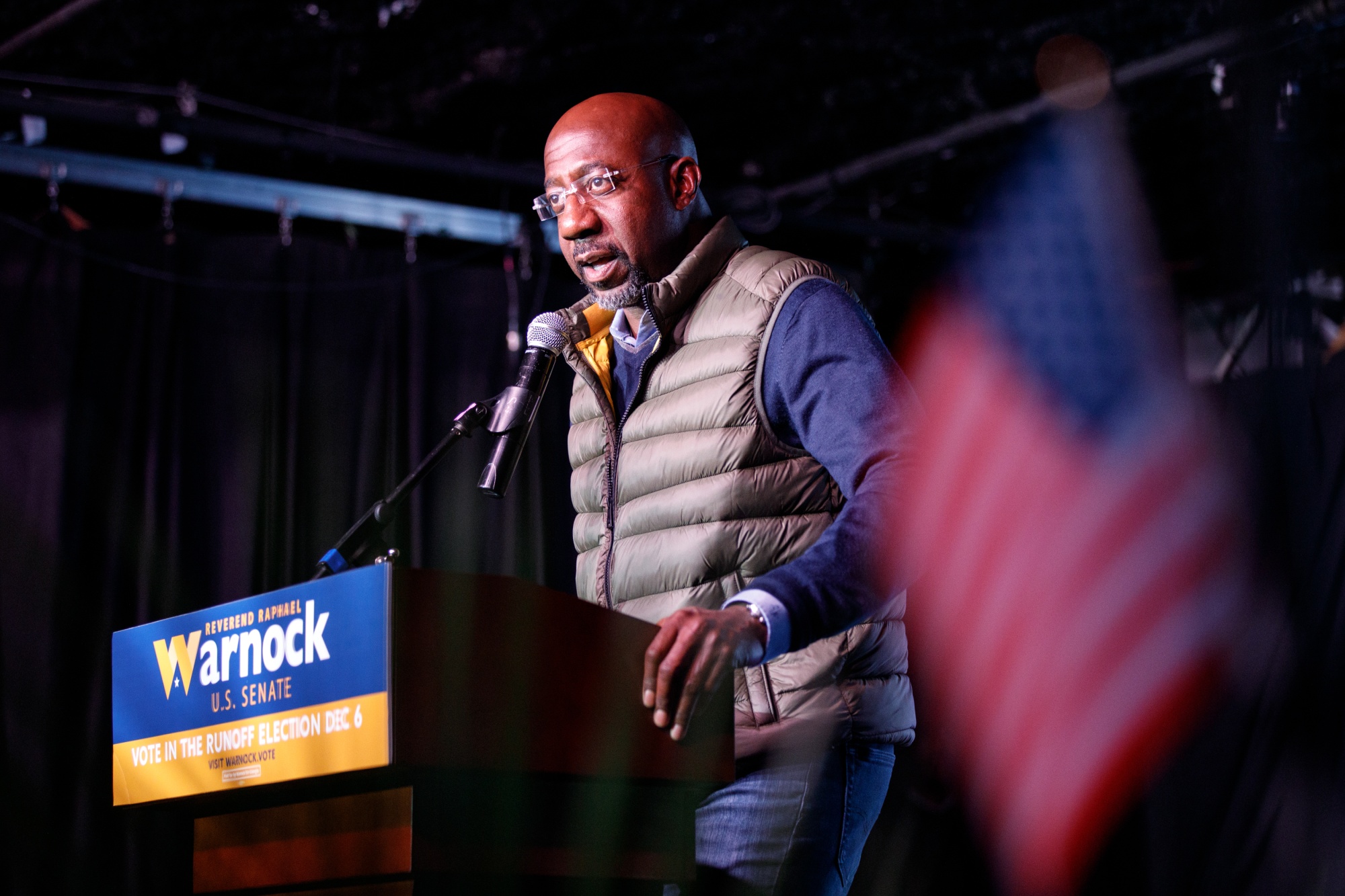

| There’s a hidden risk deep inside the global financial system, embedded within $65 trillion of “dollar debt” held by non-US institutions via currency derivatives, according to the Bank for International Settlements. Banks headquartered outside the US carry $39 trillion of this debt—more than double their on-balance sheet obligations and ten times their capital. Shadow banks—otherwise known as non-bank financial intermediaries—have increased their dollar swap and forward liabilities to $26 trillion, which is twice the size of their on-balance-sheet dollar debts.  Accounting conventions only require derivatives to be booked on a net basis, so the full extent of the cash involved isn’t recorded on a balance sheet. This is what’s keeping the BIS up at night. The resulting lack of information is making it harder for policymakers to anticipate the next financial crisis. Foreign-exchange swaps, you may remember, were a flashpoint during both the 2008 global financial crisis and the pandemic crash of 2020, when dollar funding stress forced central banks to step in to help struggling borrowers. —Natasha Solo-Lyons Blasts at two air bases in Russia killed three people and injured seven, Russian news services said on Monday. Russia claimed it shot down two Ukrainian drones over one of the bases. Meanwhile, the Kremlin launched new missile strikes on Ukraine. Kyiv claimed it shot most of them down. Russia’s crude oil shipments to Europe are shrinking fast. A European Union ban on seaborne imports from the country is now in effect, shutting off a market that was taking more than 1.5 million barrels a day before Moscow’s forces invaded Ukraine in late February.  A tanker moored in a gas and oil dock at the Port of Constanta in Romania on March 22. Photographer: Nathan Laine/Bloomberg Stocks kicked off the week with losses and bond yields climbed as a US services gauge unexpectedly rose, fueling speculation the Federal Reserve will keep its policy tight to tame stubborn inflation. The central bank, however, has been making clear in the past few weeks that it will be shrinking the size of its rate hikes. Here’s your markets wrap. The digital gold rush in Texas is losing its luster as Bitcoin miners grapple with financial woes, leaving behind what some fear will be a wasteland of unfinished sites and abandoned equipment. Donald Trump plans to hold a telephone rally for Herschel Walker ahead of Georgia’s US Senate run-off vote Tuesday, opting not to campaign in-person. A few members of the Republican Party have become bolder of late in criticizing Trump, the party’s long-time leader, for hurting the GOP’s midterm election efforts. This weekend, Trump fanned the flames by calling for the elimination of the US Constitution. Some Republicans criticized the former president’s demand (tied to his falsehoods about the 2020 election) that the laws underpinning America’s founding be erased. Other Republicans refused to condemn Trump for attacking the Constitution, and said they would vote for him if he is the 2024 nominee.  Senator Raphael Warnock, a Democrat from Georgia, speaks during a campaign event in Atlanta on Dec. 3. Republican Herschel Walker is challenging him for a US Senate seat. Photographer: Dustin Chambers/Bloomberg Speculators cleaving to the view that the crypto rout is mostly over are at risk of a rude awakening in 2023, according to Standard Chartered. A further Bitcoin plunge of about 70%—down to $5,00—next year is among the “surprise” scenarios that markets may be “under-pricing,” the bank’s Global Head of Research Eric Robertsen wrote in a note. The attacks that left two electrical substations in North Carolina riddled with gunfire and knocked out power to about 45,000 homes and businesses underscores the fragility of US grids, experts said Monday. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Putin makes an appearance on his damaged bridge to Crimea.

- Bloomberg Opinion: Russian oil price cap will please the US, no one else.

- Bonds get a meme moment as Reddit crowd drifts over from stocks.

- Ex-Starbucks executive aims to build the “Starbucks of vertical farming.”

- New York City spars with hosts over new Airbnb rental laws.

- Weed shops switch to cash after cashless ATM crackdown.

- The club with a 60,000-woman waitlist.

|

Tourism is roaring back to the Caribbean in a big way: A handful of destinations, such as the Dominican Republic and Jamaica, rank among the most visited countries in the world so far this year. Caribbean hotels and resorts have used the pandemic downtime to improve their products and services, including staff training. The region’s most iconic properties, such as Frenchman’s Reef and Bitter End Yacht Club, are also making a comeback via remarkable rebuilds after Category 5 hurricanes in 2017 destroyed them. Here are the nine resort openings in the Caribbean that we’re most excited about this winter.  People snorkel in the water in Saint Croix, US Virgin Islands in March 2021 Photographer: Ivan Valencia/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. |