|

To investors,

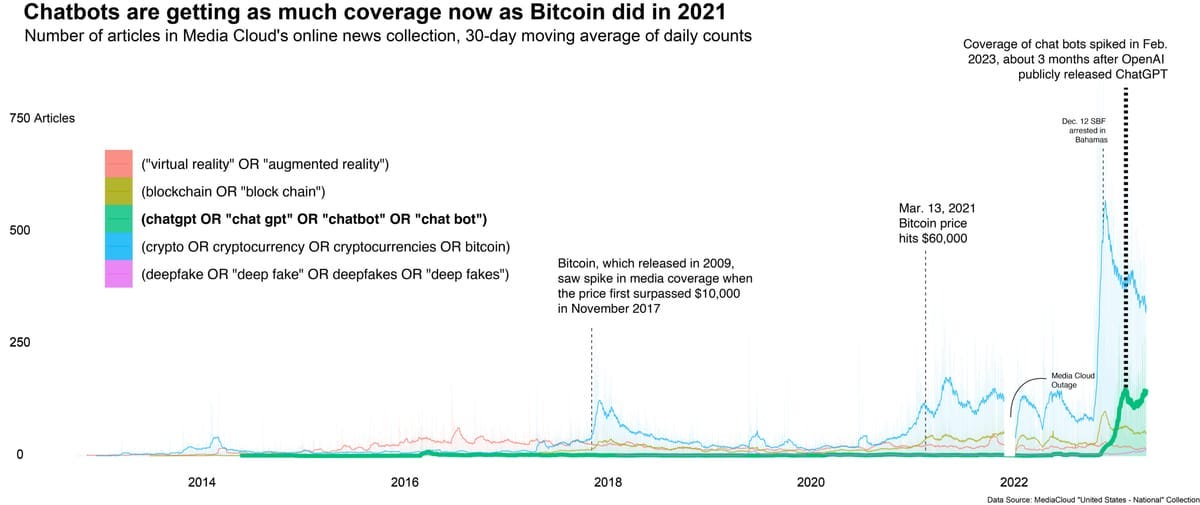

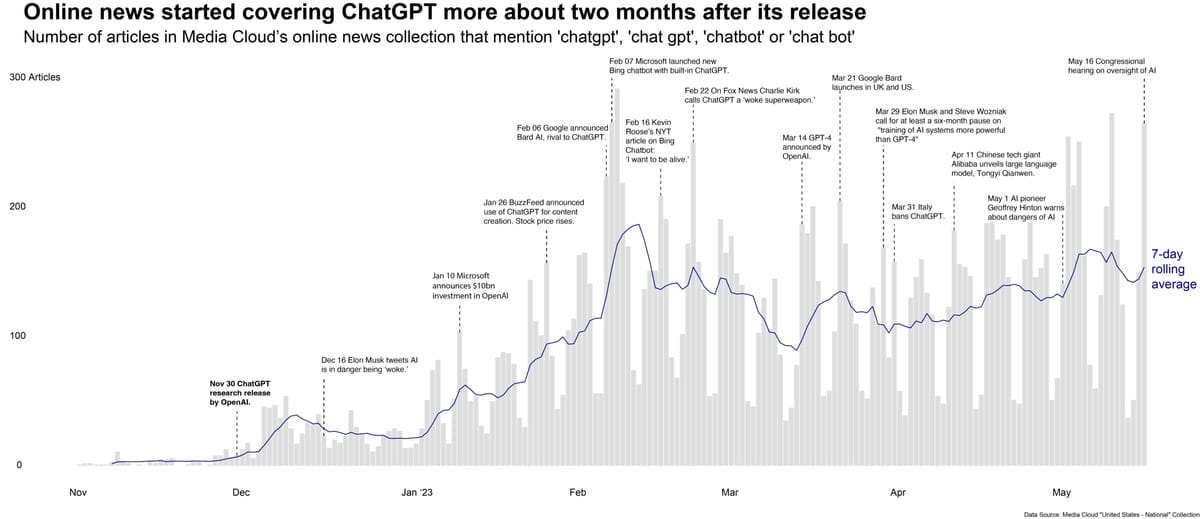

Artificial intelligence is now being talked about by the media as much as bitcoin was discussed during the all-time high run of 2021. This is noteworthy because the media’s coverage will only accelerate adoption, while also helping to solicit more investment dollars to the industry.

As Bay Area Times explained, coverage of new product releases like ChatGPT have not slowed down months after the initial take-off.

These hype cycles around new technologies, whether AI or bitcoin, always get a bad name from critics. But the hype cycles are essential in seeing the technology flourish. You need excitement to get people to leave their old jobs and come build products or companies in the new industry. You need excitement for investors to part with their hard-earned money and invest in the new industry. And you need excitement to break through the noise and capture the attention of potential new users.

Think of the hype cycle as an industry-funded marketing campaign. The more people who get excited about a new technology, the more entrepreneurs, capital, and users will show up to help make dreams become reality.

Now it should go without saying, but unsubstantiated hype can be a negative thing. There has to be substance underlying the excitement. Historically, these hype cycles have been related to some major breakthrough. Smart people are getting excited about something new — the timing may be off, but the breakthroughs usually end up creating something valuable.

The internet bubble birthed the internet. The mobile bubble birthed the iPhone. The crypto bubble birthed bitcoin. And my guess is that the artificial intelligence bubble is going to birth a lot of compelling products as well.

Remember, humans are bad at predicting the future. People get ahead of themselves in these hype cycles. As Bill Gates famously said, “most people overestimate what they can do in one year and underestimate what they can do in ten years.” If you look back through history, the hype ended up being real — it just happened on a much longer timeframe than initially thought.

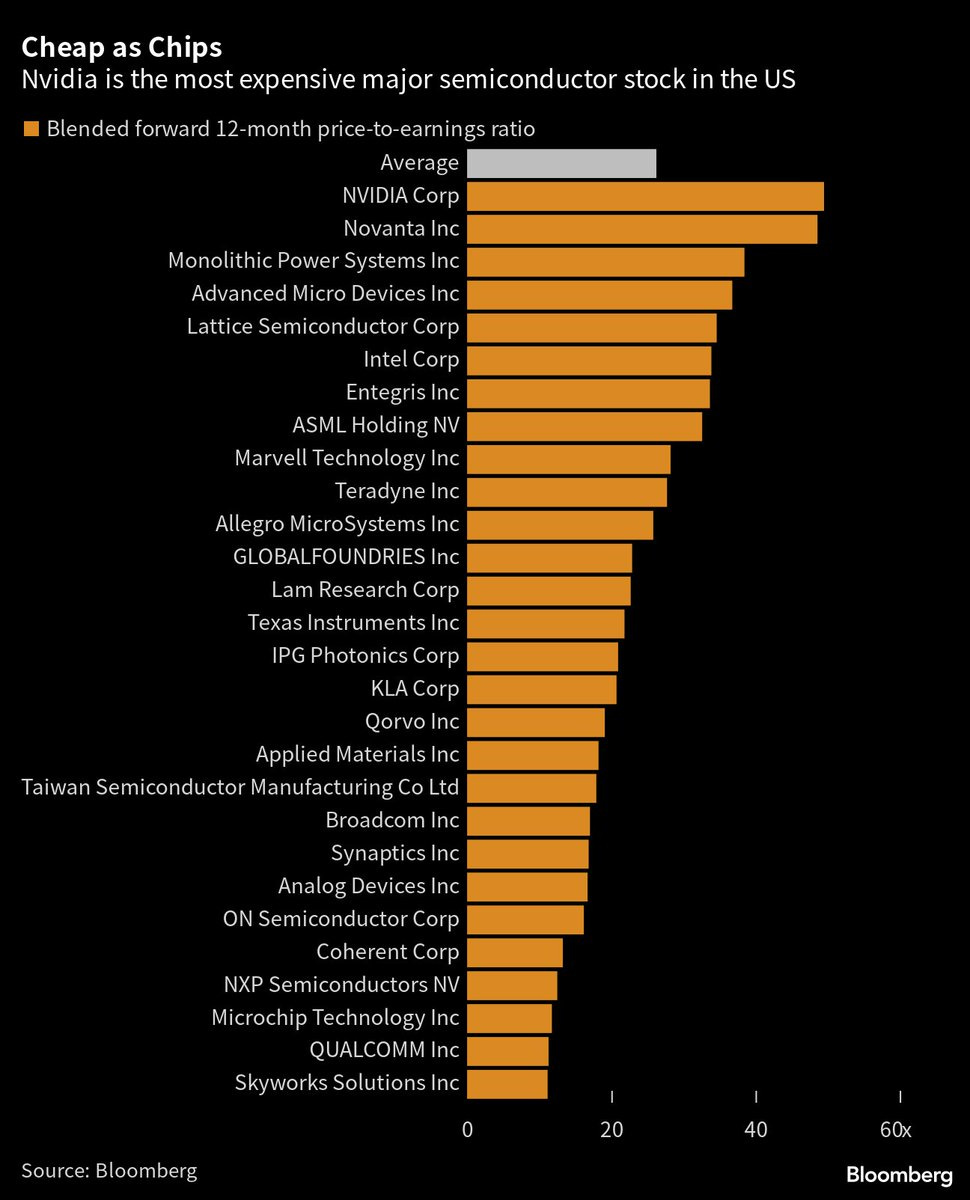

This brings me to the current hype cycle of AI. There is plenty of craziness that can already be identified. For example, Nvidia has the highest forward P/E of semiconductor stocks in the U.S.

As this Twitter user pointed out, now would be a good time to remember the famous Scott McNealy (former CEO of Sun Microsystems) statement to Bloomberg just after the dot-com collapse:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

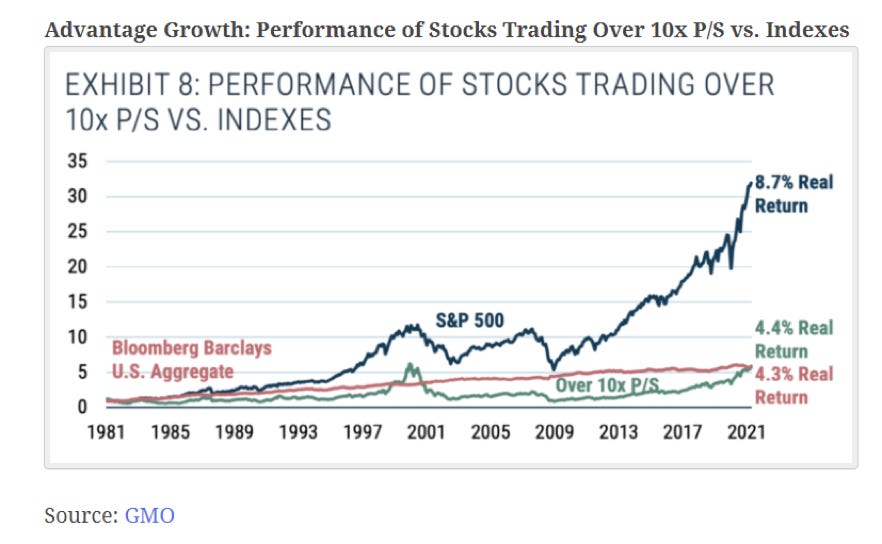

So what has happened in the past to stocks trading at more than 10x sales? It hasn’t gone very well. According to GMO, stocks trading in this range have suffered against the S&P 500 index.

The hype cycle is a necessary part of building out new technologies and industries. The capital shows up, but you need to be very cautious of how you choose to participate. Things will become overvalued incredibly quickly — don’t be the person buying at the top of a market.

I have no clue if the AI bubble is going to peak this week, next week, next month, or next year. Timing markets is a fools game. But I do think it is important to identify bubbles as they form. People will make a lot of money through the full hype cycle, and thankfully real products and services will be built, but you have to be careful that you don’t follow the herd into a losing proposition.

Contrary to popular belief, we need more hype cycles. That would be a sign that innovation and new technologies are coming to market. It also means that billions of dollars will trade hands, which will print massive winners and losers. Frankly, this is a story as old as time. Learn from history and try to avoid some of the mistakes that others already made.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Pomp

🚨 I am hosting a private, invite-only conference for 500+ founders later this year 🚨

It is completely free to founders. I want to invite a few people outside my immediate circle. If you're a founder, apply here & our team will be in touch if accepted:

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.