Click here for full report and disclosures

â Annalena after Angela? The German Greens are riding high in opinion polls. They will almost certainly be part of the next German government. We see a 40% probability that Annalena Baerbock, the new face of the Greens, will succeed Angela Merkel as German chancellor after the 26 September election.

â But would the rise of the Greens lead to a major shift in policies? Probably less so than most outside observers seem to believe. Germany often works by consensus. In response to climate change, Germany is going green anyway. The Greensâ move into office in Berlin would merely accentuate the trend.

â The end of prudence? Not really. The Greens want to modestly ease the constitutional brake on German public debt and favour a bigger EU budget and more risk-sharing in the Eurozone. But the room for change is tightly constrained by the need for at least one coalition partner, by the veto that the CDU/CSU could wield in the upper house of parliament against major changes and by the bounds of the German constitution and the hawkish inclinations of its ultimate arbiter, the constitutional court (page 7).

â In-depth look at German politics. In this report, we explain why the uncharismatic leader of the CDU, Armin Laschet, is still more likely (55%) than Baerbock to follow Merkel (page 3). We go through potential coalition options (pages 4-5), examine the key ideas of the major parties (pages 6, 9-11) and discuss what is at stake (page 8).

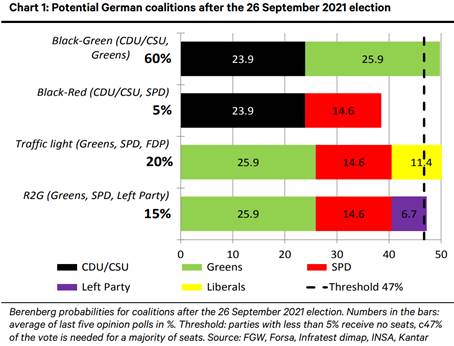

â What really matters: The key question for Germany – and investors – is not the name of the next chancellor but the colour of the next coalition. If the âblackâ CDU/CSU or the âyellowâ liberal FDP are part of the next coalition, they should prevent a major turn to economically damaging policies. Apart from new faces and some sector themes, investors may not notice much of a change. Chart 1 gives our probabilities for these options. Taken together, they add up to 85%.

â The real risk is a leftist coalition between the Greens, the SPD and the hard-left Left Party. In such a tie-up, the more radical bases of the Greens and the SPD would likely reinforce each other and prevail over the leanings of their top candidates, who are more pragmatic than their party manifestos. Reform reversals and a wave of regulations in the labour and housing markets could harm German trend growth significantly over time (page 8). This is the tail risk to watch (15%) – Chart 1.

Holger Schmieding

Chief Economist

+44 7771 920377

holger.schmieding@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.