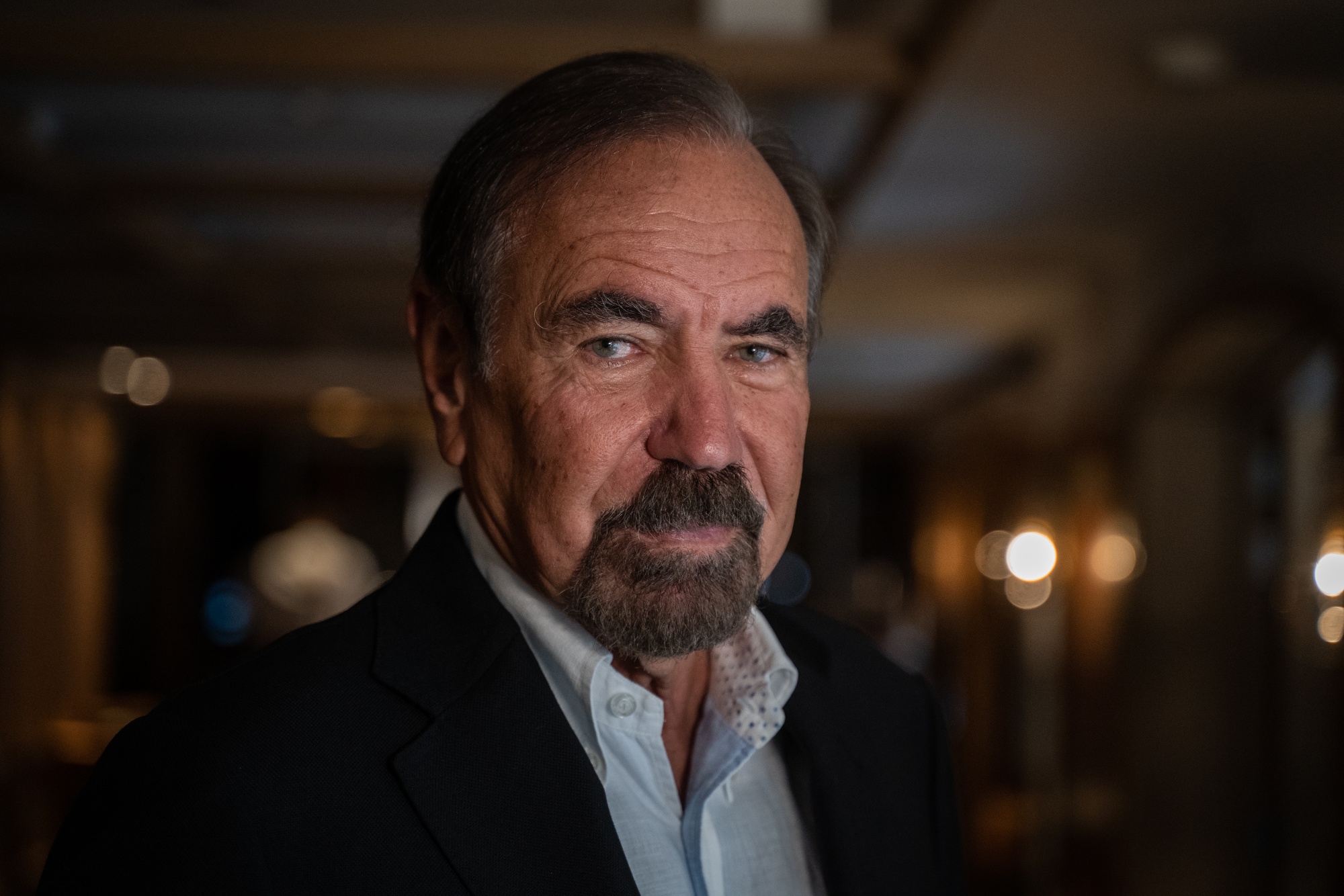

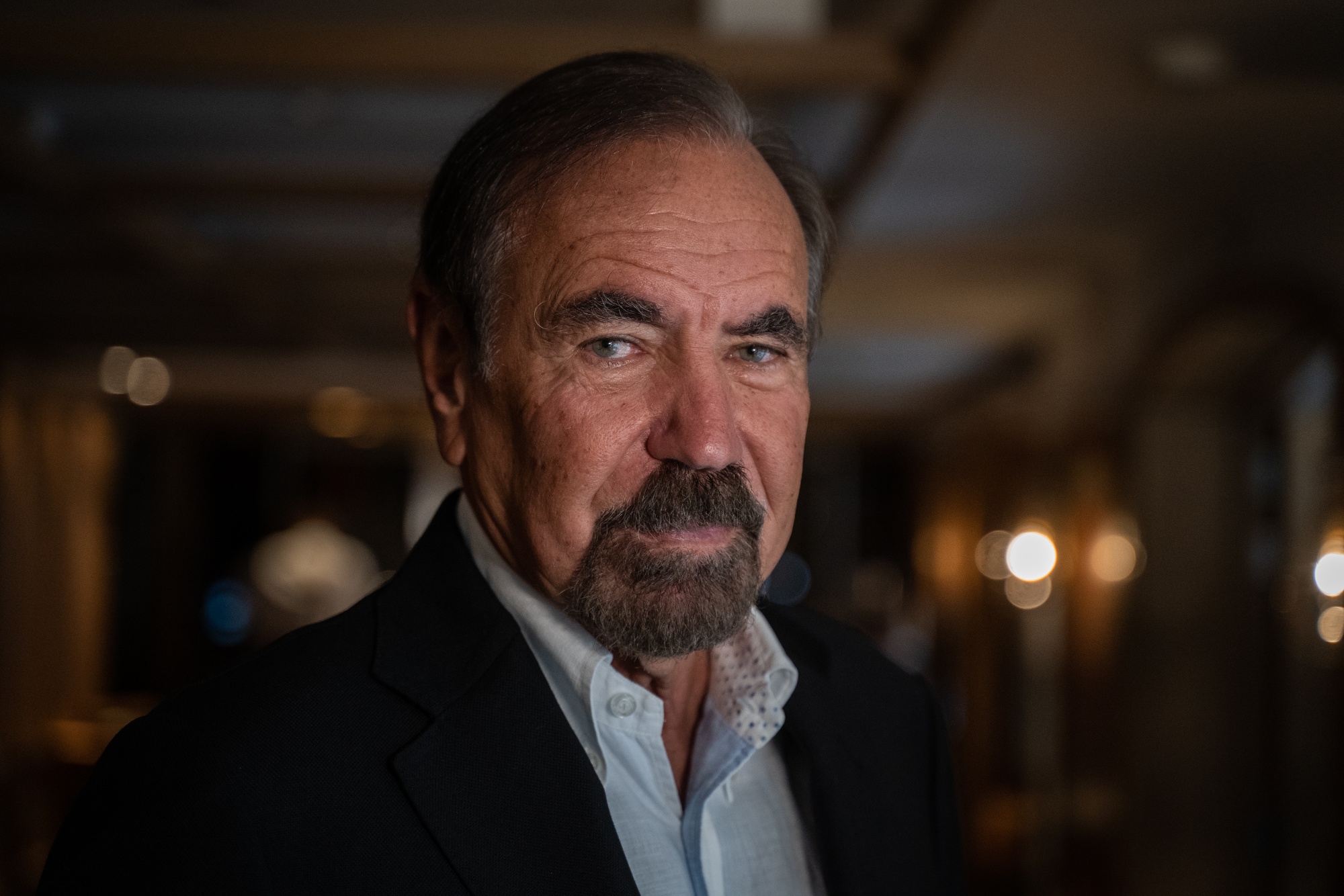

| New labor data added further evidence that the US jobs market is indeed slowing down. Companies hired workers at a more moderate pace in June and wage growth cooled as recurring claims for unemployment benefits rose for a ninth straight week, the longest stretch since 2018. Two reports coming ahead of Friday’s June employment data suggest weaker demand for workers. A separate measure published Wednesday showed that the US services sector contracted last month at the fastest pace in four years, another sign that the economy is losing steam. As the US Federal Reserve looks to time its pivot to rate cuts in a bid to cement a soft landing, it’s been hesitant to pull the trigger. New minutes from a recent meeting show why. Meanwhile stocks hit yet another record on Wednesday. Here’s your markets wrap. —David E. Rovella JPMorgan’s chief global market strategist and co-head of global research, Marko Kolanovic, is leaving the bank, according to an internal memo obtained by Bloomberg News. The move follows a disastrous two-year stretch of stock-market calls by Kolanovic. He was steadfastly bullish in much of 2022 as the S&P 500 Index sank 19% and strategists across Wall Street lowered their expectations for equities. He then turned bearish just as the market bottomed, missing last year’s 24% surge in the S&P 500 as well as the 14% gain in the first half of this year.  Marko Kolanovic Source: Bloomberg London’s rich private equity fund managers are getting ready to run. Why? Taxes of course. Apparently the prospect of paying more on their main source of compensation under a Labour government has them eyeing a trip to Italy. Labour leader Keir Starmer has pledged to take a tougher approach on the financial industry. Such a tack would come on the back of the UK decision to scrap preferential tax treatment for rich “non-domiciled” foreign residents. While it’s too early to say whether all of this— in tandem with a flood of UK inquiries to Italian law firms—will translate into an exodus, it does highlight how Italy has become a rising pick for the wealthy seeking to take advantage of Italy’s expat-friendly tax breaks. Russia’s reliance on China has gotten to the point where Beijing could end the war in Ukraine if it chose to, Finnish President Alexander Stubb said. His comments reflect the increasing frustration among Ukraine’s allies over what they say is China’s increasingly visible support for Russia’s war effort. They accuse Beijing of providing the Kremlin with technologies and parts for weapons and helping Moscow get around international trade restrictions. “Russia is so dependent on China right now,” Stubb, 56, said in an interview in Helsinki Tuesday. “One phone call from President Xi Jinping would solve this crisis.”  Xi Jinping, left, embraces Vladimir Putin after talks in Beijing on May 16 Photographer: Mikhail Metzel/AFP Nvidia Chief Executive Officer Jensen Huang unloaded stock worth almost $169 million in June, the most he’s netted in a single month. The sale of 1.3 million shares came during a month when Nvidia’s market value rose above $3 trillion for the first time. That briefly made it the world’s most valuable company and pushed Huang, 61, into the rarefied group of ultra-rich with fortunes above $100 billion. Ron Shaich may have created the now-famous Panera in the 1990s, but it’s his investment firm that made him a billionaire. The financial stake held by Shaich’s firm in Cava Group, a Mediterranean fast-casual chain whose shares have skyrocketed 330% since its 2023 IPO, is worth $970 million, giving him a total fortune of about $1.6 billion, according to the Bloomberg Billionaires Index, which is calculating his net worth for the first time. The owner of Saks Fifth Avenue is said to be close to acquiring Neiman Marcus Group for $2.65 billion—a deal that would unite America’s two largest high-end department-store chains in a bid to grab a bigger share of a slowing industry. Amazon and Salesforce will be helping facilitate the deal by Saks owner Hudson’s Bay. The tech companies will take minority stakes in a new company, to be called Saks Global. Billionaire Jorge Perez, the condo king of Miami, has spent hundreds of millions of dollars of his real estate fortune making the city a magnet for the arts. But it seems that one very powerful person is wiping all of that effort away: Ron DeSantis. The far-right Republican governor and failed presidential candidate is undoing Perez’s efforts with the stroke of a pen. Last month, DeSantis stunned the state’s arts community by axing all $32 million of funding for a state program that provides grants for music, theater and culture.  Jorge Perez Photographer: Nathalia Angarita/Bloomberg Dragons, faeries and happily-ever-after love stories are having a moment. Sales of romantasy novels—a genre that blends fantasy’s epic quests and mystical characters with romance’s swooning gestures and spicy sex scenes—are projected to jump to $610 million this year. The number of books sold reached 11 million in the first five months of 2024, almost double the same period last year. Their empowered female protagonists and cult followings may soon find these genre permanent shelf space in stores.  Illustration: Shira Inbar The Bloomberg Evening Briefing will return on Friday, July 5. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players: Bloomberg Power Players brings together industry leaders at the intersection of sports, business and technology. This half-day experience will be held at Bloomberg World Headquarters in New York on Sept. 5 in conjunction with the US Open Championships. Join us alongside the best in the business of sports and engage in forward-thinking conversations, forge strategic partnerships and gain insights that will help you stay ahead of the game. Get your discounted passes now. |