|

|

To investors,

Yesterday can only be described with one word — madness. The SEC’s account on Twitter/X posted the following message just after 4pm EST:

The market immediately went into euphoria. Bitcoin’s price went from approximately $46,600 to nearly $48,000 in less than two minutes. The internet lit up with celebratory messages, memes, and “I told you so!”

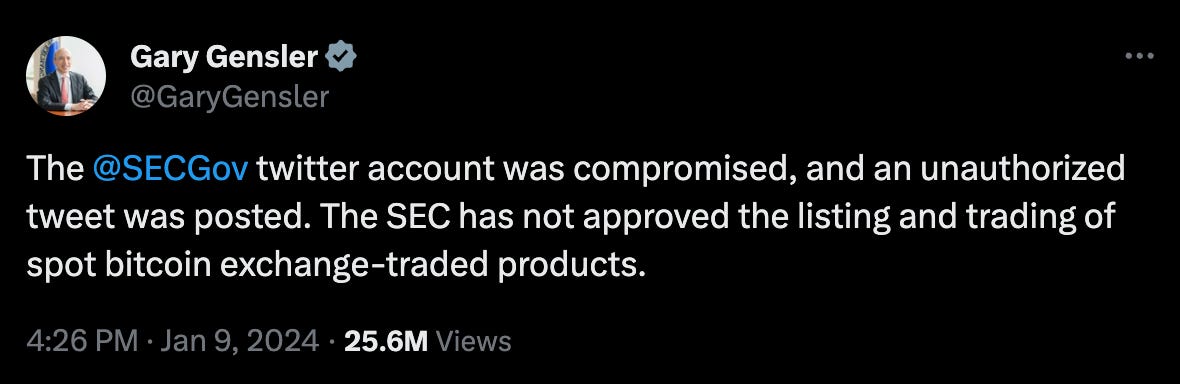

There was only one problem — the tweet from the SEC was inaccurate. Bitcoin spot ETFs have not yet been approved. SEC Chairman Gary Gensler quickly tweeted from his personal account the following clarification:

As I told you, yesterday was madness. The market quickly readjusted from bullish to bearish and Gensler’s tweet was followed by a quick sell-off within minutes to a level lower than it was pre-announcement.

So what exactly happened? That is still unclear. The SEC has not explicitly used the word “hacked” so far, but they have described a nefarious situation in the statement that followed later. It read:

“The SEC has determined that there was unauthorized access to and activity on the @SECGov x.com account by an unknown party for a brief period of time shortly after 4 pm ET. That unauthorized access has been terminated. The SEC will work with law enforcement and our partners across government to investigate the matter and determine appropriate next steps relating to both the unauthorized access and any related misconduct.”

Frankly, this is probably the worse case scenario for regulators at this moment. They have held up an ETF approval for years due to concerns around market manipulation, yet the day before a rumored approval the organization is compromised and someone is able to manipulate the price leveraging the SEC’s own account.

Many people on the internet are claiming that the SEC may have made a simple mistake of scheduling a tweet for the wrong date. Their logic is that the tweet from the SEC account is worded too closely to what the regulatory organization would actually say. While it could be possible, it appears that theory is not true.

X’s safety team tweeted the following statement last night:

“We can confirm that the account @SECGov was compromised and we have completed a preliminary investigation. Based on our investigation, the compromise was not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number associated with the @SECGov account through a third party. We can also confirm that the account did not have two-factor authentication enabled at the time the account was compromised. We encourage all users to enable this extra layer of security. More information and tips on how to keep your account secure can be found in our Help Center.”

We have to assume that there was foul play here until we hear otherwise. Another point that people have pointed out is that the lack of 2-factor authentication goes against prior warnings that the SEC Chairman had tweeted out as guidance for market participants.

Again, this entire situation is nightmare fuel for regulators. But what insights can we take away from this debacle as investors?

There seem to be three lessons at the moment:

The approval, which I expect to happen later this afternoon, will lead to short term euphoria and a multi-thousand dollar rally in price.

After the initial price surge, there will likely be a lot of selling that will fall in-line with the classic “buy the rumor, sell the news” phrase.

Traders will position themselves for the next speculative regulatory approval via an ETH ETF as they rotate out of bitcoin.

The first two are self-explanatory, but this third one is interesting. Everyone has been paying attention to bitcoin for the last few months. The digital currency is up 160% in the last 12 months. Ethereum’s token is only up 79% in the same time period.

But Reflexivity Research’s Will Clemente points out:

In a weird way, although yesterday seemed like a complete shit-show, it actually may have served as a dress rehearsal for the real show later today. Bloomberg is reporting that the ETF approval will likely happen after the market closes this evening, which would fall in-line with my expectations for the funds to be trading tomorrow (Thursday).

This industry is full of chaos and uncertainty. There is never a dull moment. Through it all, the people who can keep their head calm and focused are the ones likely to find an outsized financial return.

Hope you all have a great day. I’ll talk to you tomorrow.

-Anthony Pompliano

Mitchell Askew is an analyst in the bitcoin community.

In this conversation, we talk about volatility, bitcoin ETFs, institutions, inscriptions, miners, bitcoin halving, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

My Conversation with Mitchell Askew

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.