This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 155,000 other investors today.

To investors,

The response to Will Clemente’s on-chain analysis last week was great. We are going to turn this into a weekly column that will be published every Friday. Below is this week’s analysis.

Happy Friday everyone! Welcome back to the newsletter’s weekly on-chain update. At the time of writing, Bitcoin sits at $63,500 following a long-awaited breakout above $60,000 on Wednesday, which had served as a major price resistance over the last few weeks. This comes as no surprise, with last week’s letter describing a very bullish setup on-chain and was just a waiting game until price broke out of consolidation. Let us take a look at some of the current on-chain trends worth noting, both short and long term. Let us first start by looking at where we are in the broader macro cycle and then zoom in to current trends towards the end of the newsletter. As always, the data used in this writing is derived from Glassnode, one of the leading data providers in the Bitcoin industry. Hope you enjoy.

Long Term Metrics

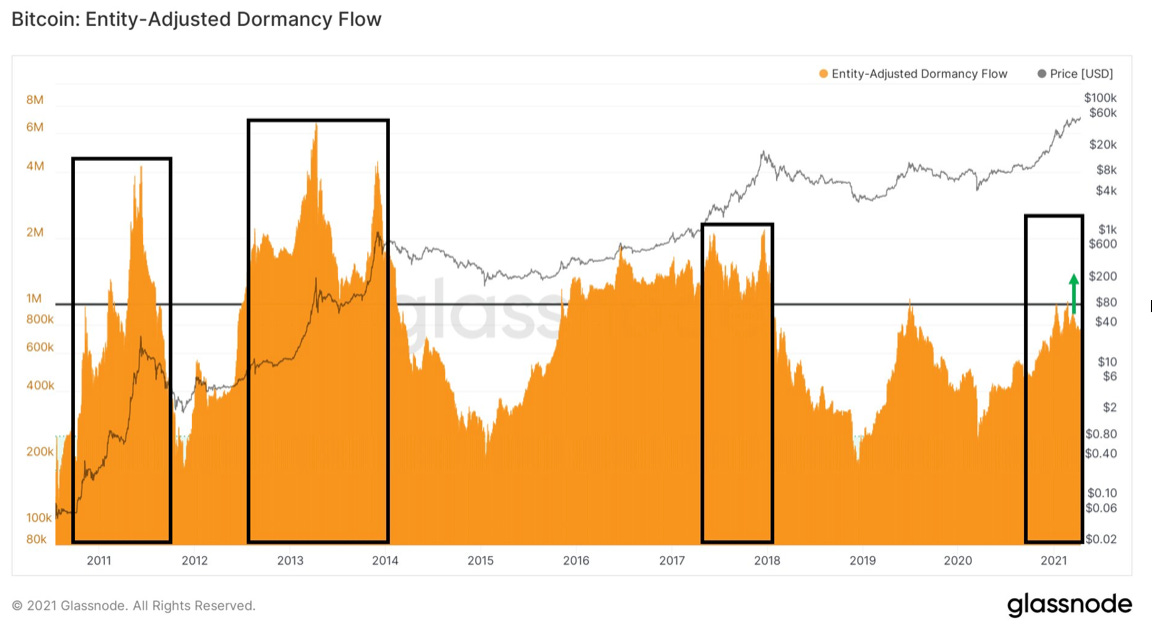

One of the most useful ways to analyze where Bitcoin price is in the broader bull/bear cycle is by looking at the behavior of long-term holders. At the end of bull cycles, we see long-term holders (smart money) begin to sell off into strength during the final parabolic pushes of the run. The data shows that we are no where near that stage. One of the best metrics to illustrate this is dormancy. In on-chain terms, older coins (coins that have not moved) hold more dormancy. The dormancy metric illustrates the amount of dormancy in the coins being sold onto the market. In bear markets we see lower dormancy, as long-term investors scoop up cheap coins without selling. However, higher prices incentivize those holders to sell, and as the bull market goes higher, dormancy rises. In the chart below you can see the historical peaks of dormancy that Bitcoin has reached in previous bull cycles. In comparison, the current trend still has a lot of room to run upwards.

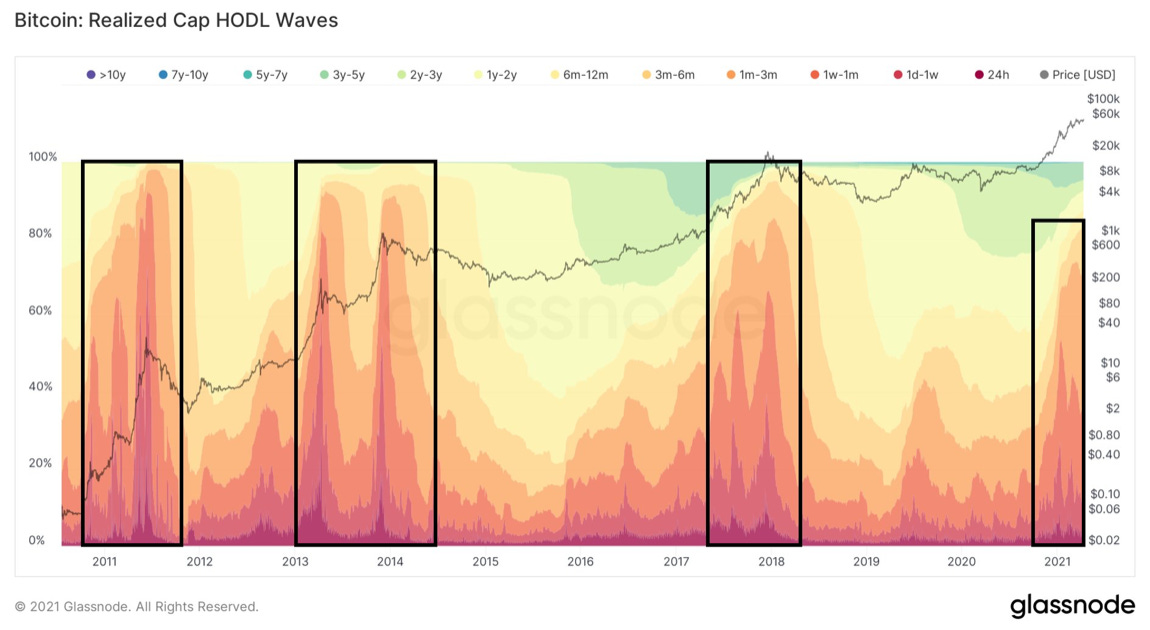

Another metric that can be used to follow holding behavior is HODL Waves, a metric that analyzes the behavior of different “aged” coins. Each colored band shows the percentage of Bitcoin in existence that was last moved within a specific time period. In bear markets, short-term speculators leave, and long-term holders (smart money) take up a larger portion of supply as they accumulate. In bull market, particularly as they come to an end, short-term holders (retail) take up a larger portion of supply as long-term holders sell off. In comparison to Bitcoin’s history, HODL Waves also shows a lot of room upwards for this bull cycle.

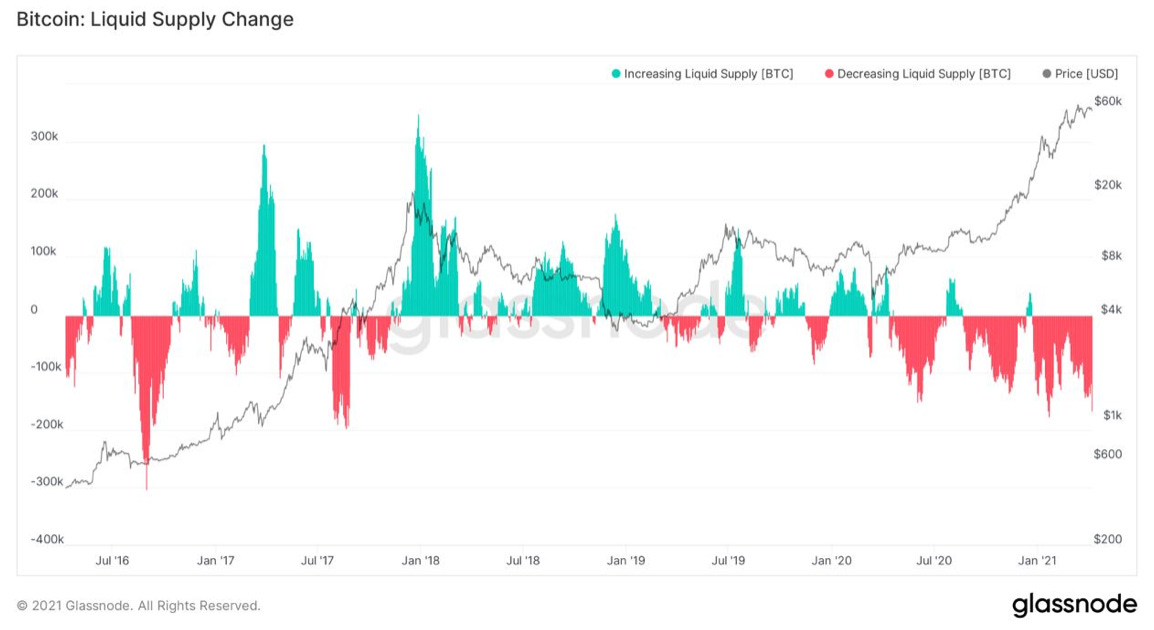

To close out with long-term metrics, let us take a look at illiquid supply. According to Glassnode, illiquid supply is considered supply in wallet addresses that has not been moved for at least 6 months. This means that the huge down draw we are currently seeing is representative of coins purchased back in November/December, as they cross the “illiquid” threshold now. Aside from the current massive down draw, supply has consistently become illiquid throughout the entire bull market. In other words, throughout the entire bull market coins continue to be scooped up by strong hand wallets with no intention of selling for short term gains. These levels of illiquidity are unprecedented in terms of Bitcoin’s historical data.

Short-Term Metrics

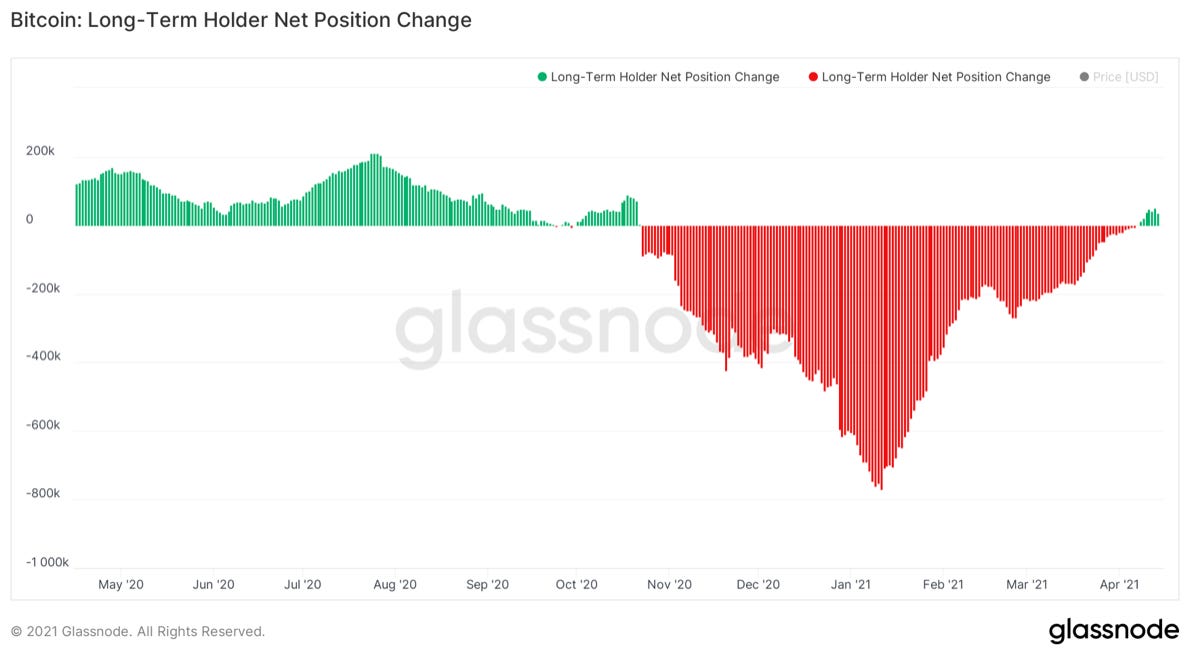

One metric we touched on last week was long-term holder net position change. Since that time, the metric has actually flipped green, a very bullish sign. This metric uses a 155 day threshold to consider supply “long-term”. According to Glassnode, the metric flips green when more coins mature across the 155-day age threshold than old coins being spent. Although we did see some selling following ATH around $27k-$32k (to be expected), this flip green suggests long-term holders are now expecting more upside to come.

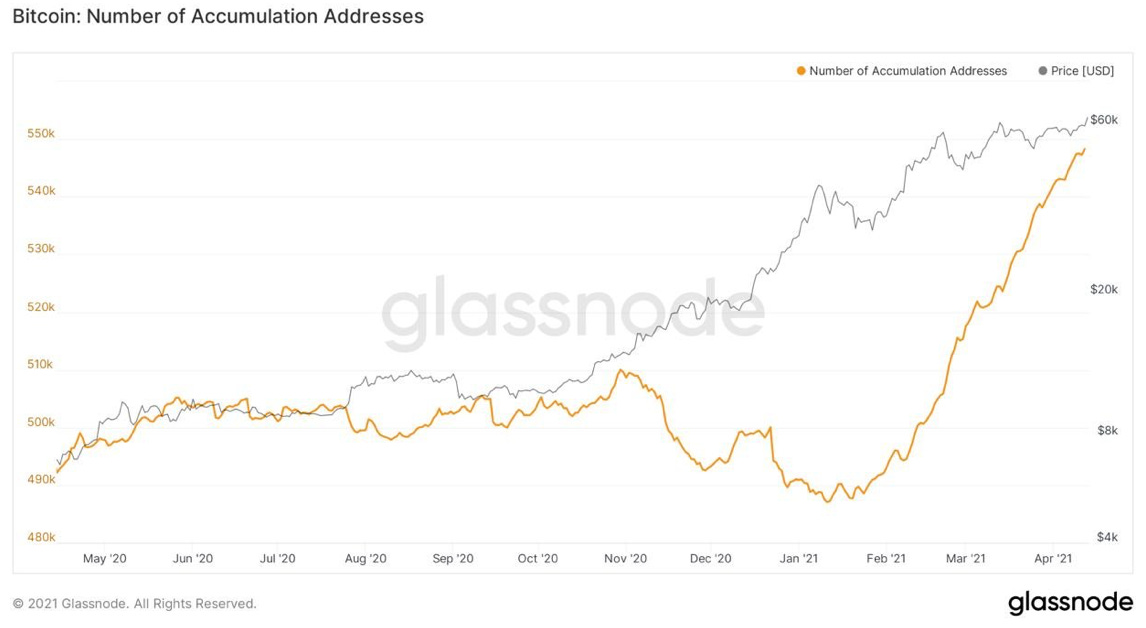

Another metric that has caught my eye lately is accumulation addresses. This measures the number of Bitcoin addresses that have received at least two transactions but have never spent funds. (filters out major entities such as exchanges) This illustrates a large number of new Bitcoin holders that have emerged through the year, as we saw the metric go parabolic in mid-February.

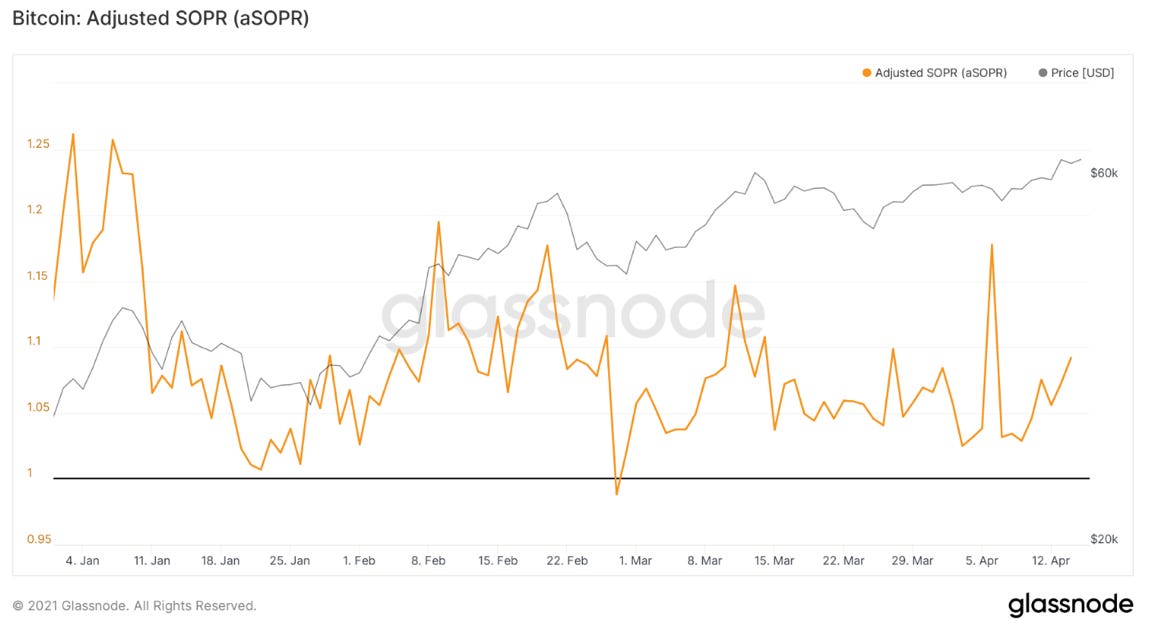

In conclusion, a lot of metrics do point to further upside, but here are two to keep in mind: funding rates and SOPR. Funding rates can be used to gage sentiment from traders in the market. Prolonged high funding rates are a bearish sign, as there is excessive leverage in the market and therefore is very fragile and subject to a cascade of liquidations. SOPR measures profit taking and is mostly used to time bottoms of corrections but can also serve as a rough gage of how overheated price rallies are. SOPR shows some more room for price to rally from here but will definitely be something to keep a close eye on in coming weeks along with funding rates.

Will keep an eye on all of these trends and update you guys on market structure next week. I really hope you enjoy and gain some value from these. Till next time, Cheers.

- Will

SPONSORED: Why do 84% of ultra-high-net-worth individuals collect art? For decades, the top 1% have used art to generate outsized investment returns with virtually no correlation to the stock market. From 1995 to 2020, contemporary art prices outperformed the S&P by 172%. But unless you have an extra $10 million lying around to buy an entire painting, you've been locked out of this private $1.7 trillion asset class. Until now.

Masterworks an exclusive community that lets its members invest in blue-chip art by artists like Basquiat and KAWS. Recently, Masterworks sold their first Banksy work for a 32% annualized return. They even have a secondary market so you can get liquidity anytime.

The best part?

They've hooked up Pomp Letter Subscribers with a fast pass to skip their 15,000 person waitlist with this special link.

THE RUNDOWN:

Brevan Howard’s Hedge Fund to Start Buying Cryptocurrencies: Brevan Howard Asset Management is preparing to start investing in digital assets, becoming the latest money manager seeking to exploit the cryptocurrency boom. The firm led by Aron Landy will begin by investing up to 1.5% of its $5.6 billion main hedge fund in digital assets, according to a person with knowledge of the matter. The initial allocation will be overseen by Johnny Steindorff and Tucker Waterman, co-founders of crypto investment firm Distributed Global, the person said, asking not to be identified because the information is private. Read more.

Ark Investment Boosts Coinbase Holdings While Cutting Stake in Square: New York-based Ark Investment Management has upped its holdings in the shares of cryptocurrency exchange Coinbase, which debuted in Nasdaq trading on April 14. Headed by well-known crypto bull Cathie Wood, ARK Investment purchased 341,186 shares, worth about $110 million on Thursday, having bought 749,205 shares the day before, the firm's daily trade summary shows. Read more.

Bitcoin Price Drops as Turkey Bans Crypto Payments Amid Currency Crisis: Billionaire investor Ray Dalio’s fears of governments outlawing bitcoin to preserve their monopoly over currencies have come partly true in Turkey. The currency crisis-riddled country announced a ban on cryptocurrencies as a means of payment early Friday, souring the mood in the bitcoin market. The ban is to take effect April 30.Read more.

Reddit Forum WallStreetBets Allows Crypto Conversation, Immediately Re-Bans It: The Reddit forum famous for making GameStop’s stock price a household topic has banned all discussion of cryptocurrencies less than 24 hours after tentatively allowing a daily discussion thread, with restrictions. Read more.

Wouter Witvoet is the CEO at DeFi Technologies (NEO.DEFI) and previously founded SecFi. I really enjoyed this conversation with Wouter. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Remote makes it easy for companies of all sizes to employ global teams. We take care of international payroll, benefits, taxes, company stock options, and local compliance, so you can focus on growing your business. Learn more about Remote and their new Remote for Startups program at remote.com.

Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen. Will Trump launch a new social media platform? Will NFT trading volume continue to skyrocket? Head over to polymarket.com and make an account today with the referral code “Pomp.” Every Monday until May 10th, you can win $500 by participating in the #PolyWhale Twitter giveaway. Click on the link for more info.

If you own crypto in a lot of places like me you know how difficult it can be to keep track of it all. Whether you keep your crypto on hardware wallets, mobile wallets, exchanges, liquidity pools, or somewhere else, CoinStats lets you track it all in one place on your iPhone, Android, Apple Watch, or computer. Try it for free or go to coinstats.app/pomp and get 40% off your premium subscription.

OKEx is a leading crypto exchange known for providing the most options for crypto traders and investors. Whether you want to trade spot, futures, options or swaps, OKEx gives you institutional-grade tools and a best-in-class trading engine. The platform offers credit and debit card funding options and supports 40 different fiat currencies, including EUR, CAD, GBP, TRY, INR and RUB, to name just a few. You can invest, trade, and earn yield, all within one place at okex.com. OKEx is not available to customers in the United States.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains makes crypto easier by replacing your address with [AnyName].crypto. They allow you to send and receive over 70 cryptocurrencies, including BTC, ETH, and LINK with a single blockchain domain. Go to unstoppabledomains.com and get [YourName].crypto to make your crypto life easier.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Public Rec is where indoor comfort meets outdoor style. Their best-selling All Day Every Day Pant is a more stylish alternative to sweatpants, and a more comfortable alternative to jeans. From the couch to the gym to the grocery store, and everywhere in between, Public Rec has you covered. Comfort starts with a better fit. Free shipping. Free returns. Visit www.publicrec.com/pomp and use POMP10 at checkout to get 10% off.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.