|

|

To investors,

The current economic situation is confusing to most investors. Many data points are pointing to an incoming recession, while the metrics that the Fed uses to gauge economic strength continue to show a hot economy with no signs of slowing down.

Below are a few charts that highlight these differences.

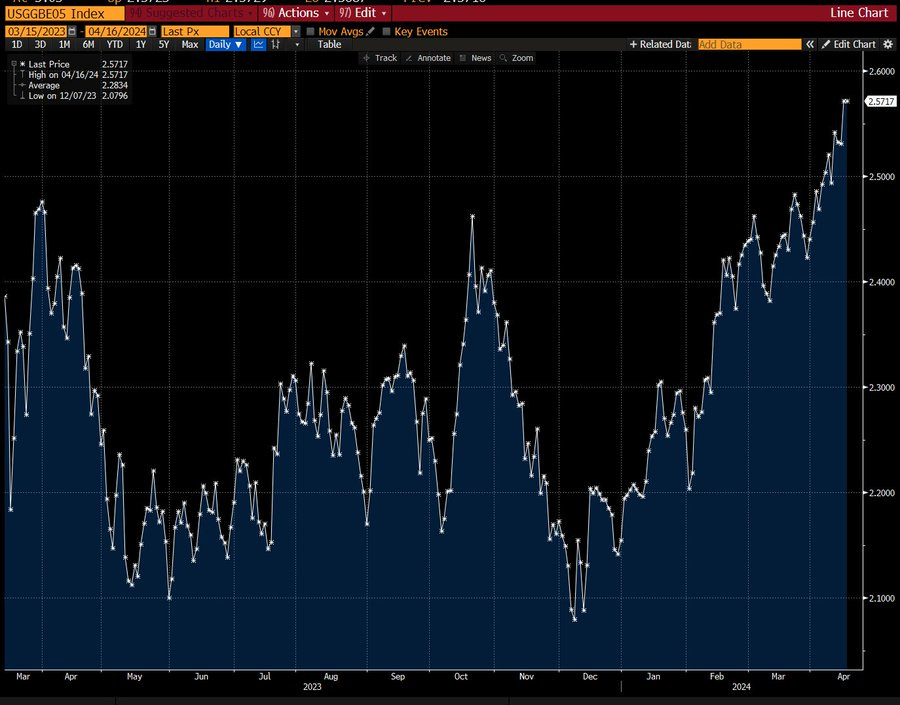

Bloomberg’s Lisa Abramowicz shows “longer-term inflation expectations are rising again. The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates.”

Inflation expectations rising usually leads to behavior from market participants that causes inflation to rise. Not a great sign of things to come if this becomes reality.

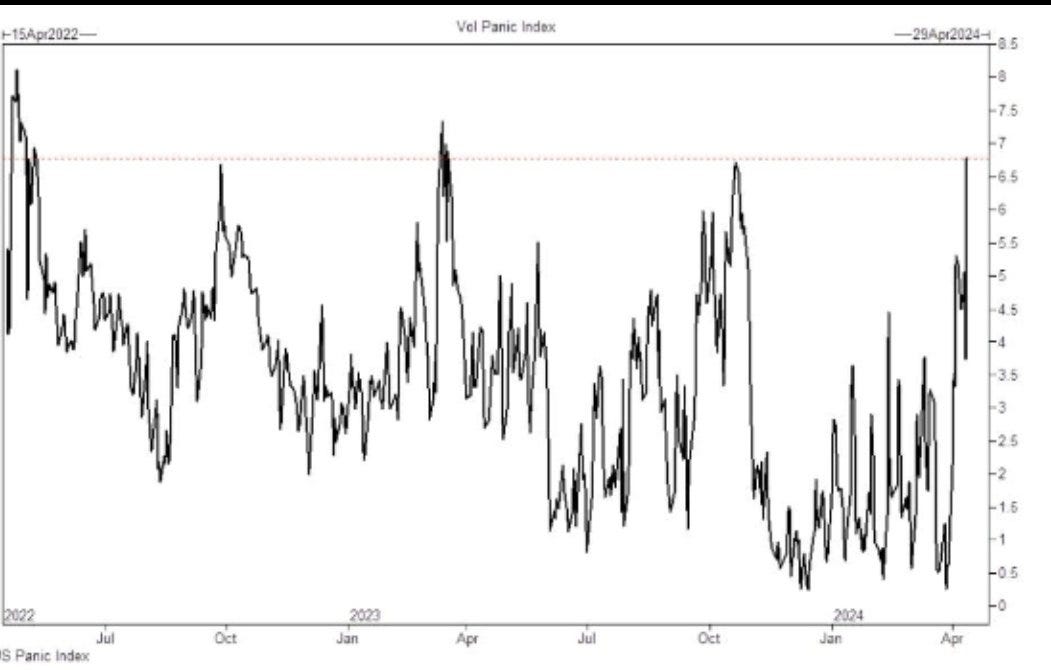

Will this cause investors to panic? Maybe. Winfield Smart explains that the “Goldman Sachs Panic Index soars to highest level since March 2023.”

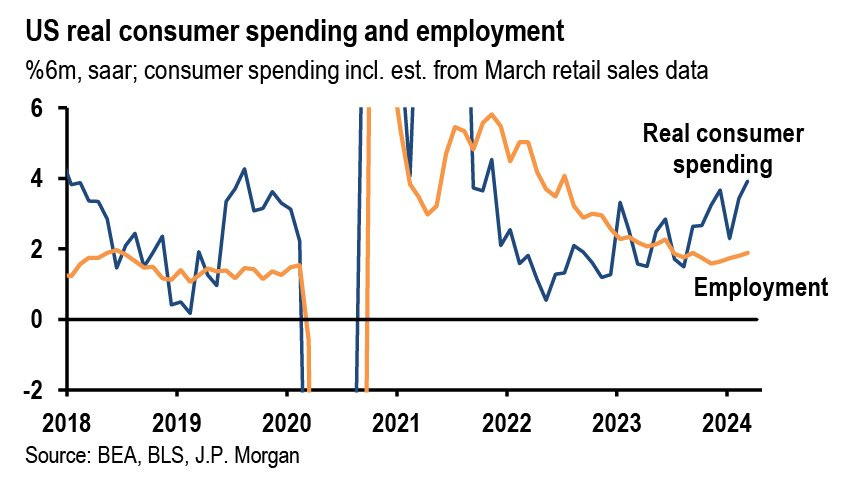

CNBC’s Carl Quintanilla points out an opposing viewpoint from JP Morgan, which stated the recent retail sales beat, “alongside upward revisions to previous months, suggests a strong 3.3% rise in 1Q real consumer spending and some upside risk to our 2.25% GDP forecast, as well as building momentum going into 2Q.”

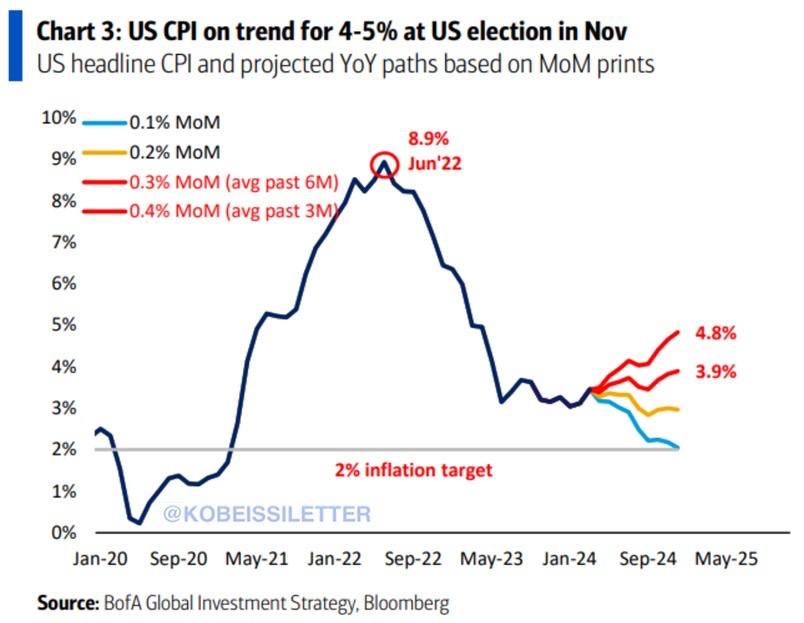

The Kobeissi Letter shared a shocking statistic: “US CPI inflation is on track to hit 4.8% by the 2024 election, according to Bank of America. Over the last 3 months, CPI inflation has averaged 0.4% on a month-over-month basis. If this trend continues it puts year-over-year inflation on pace to hit 4.8% by November, its highest since April 2023. That would be more than DOUBLE the Fed’s 2% inflation target. Inflation has been above the Fed's 2% long-term target for 37 straight months. Inflation is far from over.”

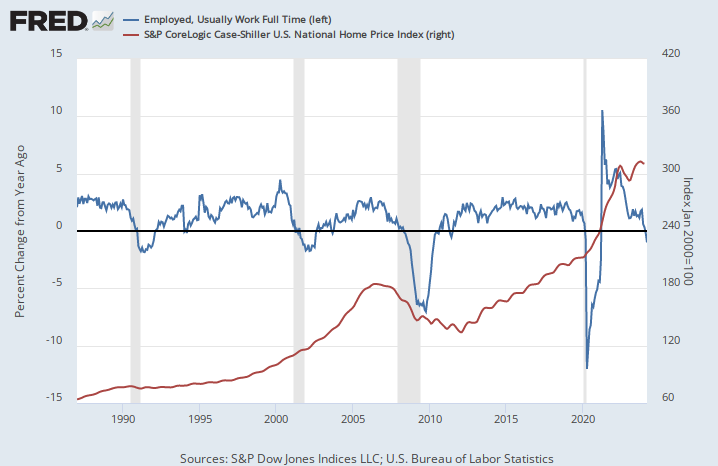

Lastly, the full-time employment situation in America is getting bad very quickly. This should lead to a major drag on US home prices in the future if the historical trends hold.

So what happens from here? How do we reach a conclusion based on the conflicting data points? The short answer is that I don’t know. It is an impossible situation to figure out.

Rather than focus on the short-term price movements of assets, I am spending all of my time focused on what I believe to be true over the next 5-10 years. Those trend lines appear to be easier to identify than what will happen in the US economy over the next 1-2 years.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Trevor Bacon is the Co-Founder & CEO of Parcl, a decentralized real estate trading platform.

In this conversation, we talk about where they are getting real estate data from, how they want to help you trade on real estate prices, the impact of real time real estate data, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Parcl Will Let You Trade Real Estate Prices Without Owning Real Estate

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra- Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.