|

To investors,

We have entered the Era of Digital Catastrophes. The concept of a Digital Catastrophe is going to be important to understand over the coming years. I define it as a large, negative event that occurs in the analog world, which is accelerated by online action and conversation.

The first big example we have of this phenomenon is the fall of Silicon Valley Bank, the second largest bank failure in US history. The bank went from operational to insolvent in less than 48 hours. As soon as the internet got spooked and believed there was a potential problem at the bank, the Digital Catastrophe mechanism took over.

There was more than $42 billion withdrawn from the bank in a single day(!) and the nationalization of the bank was complete by the next morning. The size of the collapse, and the speed at which it happened, was breathtaking.

This is the new normal though.

Digital Catastrophes have two main components to them — (a) information and (b) action. As we saw with Silicon Valley Bank, millions of people were aware of the banks issues within hours, regardless of whether someone was a customer or not. But the customers didn’t need to leave their office, get in their car, drive to the local branch, and wait in line to withdraw their money.

They could simply navigate to a new tab in their browser, log in to their account, press a few buttons, and move their money.

It would have been physically impossible for Silicon Valley Bank to receive $42 billion in withdraw requests in 24 hours without the internet. People wouldn’t have even known that a bank run was underway, let alone had the time to get to the bank to make the request.

Silicon Valley Bank was the victim of a Digital Catastrophe.

The internet was weaponized by millions of people to create the second largest bank failure in the United States. Speed. Scale. Catastrophe.

My guess is that we will see many more of these in the coming years. The ability for information to move at the speed of light has already led to a lack of trust in institutions, an increase in independent thinking, and a faster velocity of content creation and consumption. Couple the speed of information with dissipating friction when it comes to taking action, and you can clearly see that people will use these newfound capabilities for both good and bad.

One way to think of the Silicon Valley Bank Digital Catastrophe is to see the withdrawals as a DDoS attack. Define as “a distributed denial-of-service (DDoS) attack occurs when multiple systems flood the bandwidth or resources of a targeted system, usually one or more web servers.” This is essentially what customers did to the bank — they withdrew so much money, and so quickly, that the bank ended up folding. Service denied.

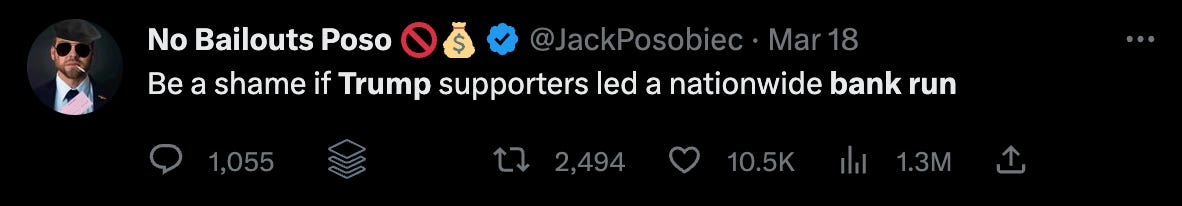

To take this analysis a step further, there have been a number of popular tweets suggesting political parties could weaponize the fragility of the banking system to express their views.

We shouldn’t condone this type of behavior, but we must also understand that we won’t be able to stop it. Digital Catastrophes are going to be a staple of society moving forward. We have seen throughout history that people will use tools of coordination to help their fellow citizen, while also using the very same tools to destroy the things they disagree with.

In this political example, citizens could easily be stopped from marching, protesting, or even gathering. The analog world has a response to various analog tactics. But what is the response if a large political group decides to log-in to their computer and withdraw their money from a single bank? This is no different than when a large group on the internet decided to target a single stock as part of the meme stock hysteria.

I don’t have the answers here. Frankly, it is hard to wrap my head around all the ramifications of Digital Catastrophes, but it feels obvious that this is where the world is headed. I would love to hear from each of you what you’re thinking on this.

What other Digital Catastrophes have occurred? How do you think governments or societies will respond to these in the future? Let me know in the comments below.

Hope you all have a great day. I’ll talk to you tomorrow.

-Pomp

Reader note: I write this letter every morning as a way to organize my thoughts and solicit feedback from smart individuals like yourself. The letter is sent for free once a week and to paid subscribers four times a week. If you would like to receive this letter every day, you can subscribe here for $100 per year. Hope you join us.

🚨Want A New Job? 🚨

My team and I have helped almost 2,000 people get a new job in the bitcoin and crypto industry. A big part of our success has been a training program we run, which teaches people the fundamentals of the industry and technology. If you are interested in transitioning into this new sector, I recommend you check out the training program for our April cohort.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.