*The Fed kept monetary policy unchanged at its September 15-16 FOMC meeting, revised up its economic forecasts in its Summary of Economic Projections (SEPs), and linked its forward guidance on the Federal funds rate to an inflation threshold. It aligned its Policy Statement to reflect the thrust of its new strategy framework, which provides the Fed significant flexibility in interpreting inflation and its employment mandate (Fed Shifts to “Flexible Form of Average Inflation Targeting” and September FOMC preview). The Fed projected that anchoring the Fed funds rate to zero would be appropriate through year-end 2023.

*In its Official Policy Statement, the Fed said that it will continue its large-scale asset purchases (LSAPs) at least at the current pace – $80 billion per month in Treasury securities and $40 billion per month in mortgage-backed securities (MBS) – to sustain smooth market functioning and help foster accommodative financial conditions.

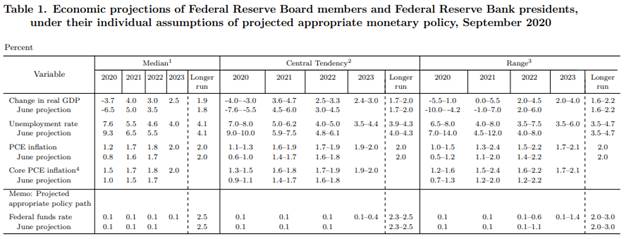

*Fed members lifted their real GDP and inflation forecasts in light of the stronger-than-expected rebound in economic activity and lowered their unemployment rate forecasts. They now expect real GDP to return to its Q4 2019 level by the end of 2021 and the unemployment rate to near its pre-pandemic level by the end of 2023. The median Fed forecast is for headline and core PCE inflation to rise to, but not exceed, 2% at the end of 2023.

*Dallas Fed President Kaplan and Minneapolis Fed President Kashkari both dissented at this FOMC meeting.

The Fed revised its official Policy Statement to reflect its longer-run strategy shift to “a flexible form of average inflation targeting (AIT)” and a maximum employment goal that is broad-based and inclusive, reinforcing monetary ease for a prolonged period:

“With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

The Fed also enhanced its forward guidance by linking it to an undefined inflation threshold somewhere around its 2% longer-run objective:

“The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

In its updated quarterly SEPs, in response to the stronger-than-expected recovery, the Fed revised up its economic forecasts and lowered its unemployment rate forecasts. The median FOMC forecast for real GDP was revised up significantly for 2020 (Q4/Q4) to a 3.7% decline from June’s forecast of a 6.5% decline, and it lowered its forecasts for 2021 and 2022 to 4.0% and 3.0%, respectively (Figure 1). Combined, this represents a significant overall upgrade of economic prospects, indicating that the Fed now expects real GDP to attain its Q4 2019 level in 2021. Fed officials project real GDP growth to moderate to 2.5% in 2023, above its 1.9% estimate of longer run real GDP growth.

Reflecting the sharper-than-expected decline in the unemployment rate to 8.4% in August, the median Fed forecast for the unemployment rate at year-end 2020 declined to 7.6% from 9.3% previously. The Fed expects the unemployment rate to drop to 4.0% at year-end 2023, nearing its pre-pandemic rate of 3.5%.

With headline and core PCE inflation already edging up in July to 1.0% and 1.3%, respectively, the median FOMC forecasts for headline and core inflation were raised to 1.2% and 1.5% at year-end 2020. The median FOMC member projects headline and core PCE inflation to rise to 2% by the end of 2023. It is noteworthy that the Fed is not projecting inflation to actually exceed 2%, despite its new flexible AIT strategy in which it favors inflation above 2%. Does this imply that the Fed does not believe its policy tools will be effective in lifting realized inflation above 2%?

As we emphasized in Fed Shifts to “Flexible Form of Average Inflation Targeting,” while the Fed has finally acknowledged that the Phillips Curve is flat – implying the unreliability of unemployment as a predictor of inflation – the Fed has not replaced the Phillips Curve with any model or framework to predict inflation. Accordingly, all of its nuanced language regarding its flexible AIT provides little guidance as to what level of inflation above 2% the Fed would be comfortable with, or for how long, or what its strategy is to lift inflation to its 2% longer-run average.

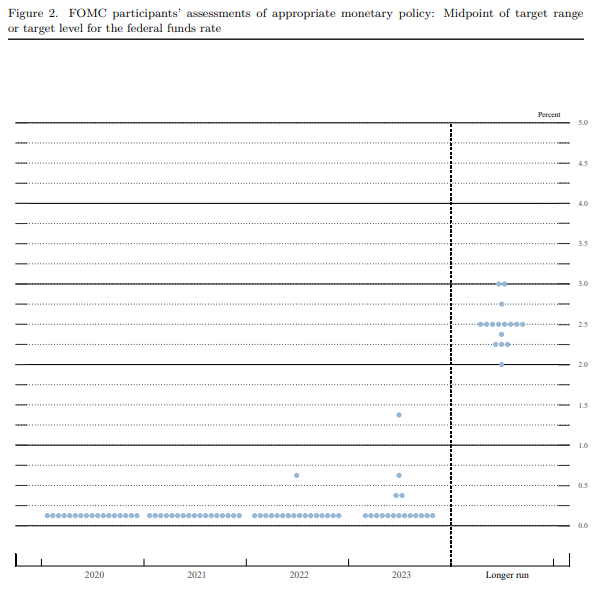

In the Fed’s “dot plot”–the plots of each FOMC member’s estimate of the year-end Fed funds rate target most appropriate with their individual economic and inflation forecasts –only four (out of 17) members estimated that it would be appropriate to raise rates from its current level of 0%-0.25% by year-end 2023.

Figure 1:

Source: Federal Reserve Board

Figure 2:

Source: Federal Reserve Board

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com