|

Read the end of today’s letter for information on Sidebar:

To investors,

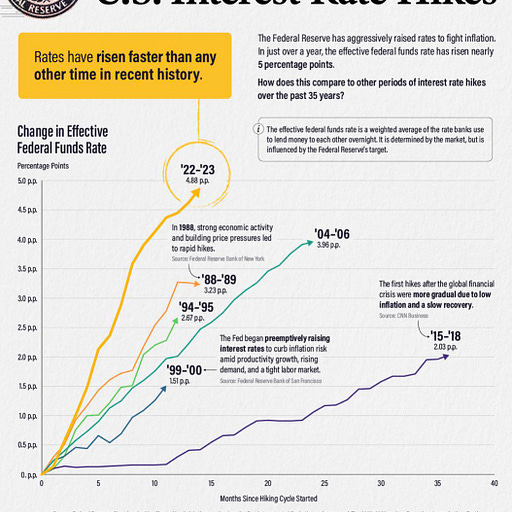

There are a few graphics and visuals that I came across over the weekend that tell a scary story for the US economy. First, we know that the Federal Reserve has been hiking interest rates aggressively. Most people have heard the Fed’s increase from 0% to 5%+ is the fastest in history, but it seems even crazier when you see the comparison visually.

The United States has never seen anything like this before — the Fed has raised rates faster and further than any time in history. We had three of the four largest bank failures in history as a result. Now everyone is waiting for the supposed incoming recession.

The Fed has not received the memo though. There is guidance from multiple members of the Fed that we should expect further rate hikes through the end of the year. The claim is that inflation needs to be snuffed out, the consumer is still strong, and the labor market is tight enough to handle the increased quantitative tightening.

Some of those data points are correct — it is not the full story though.

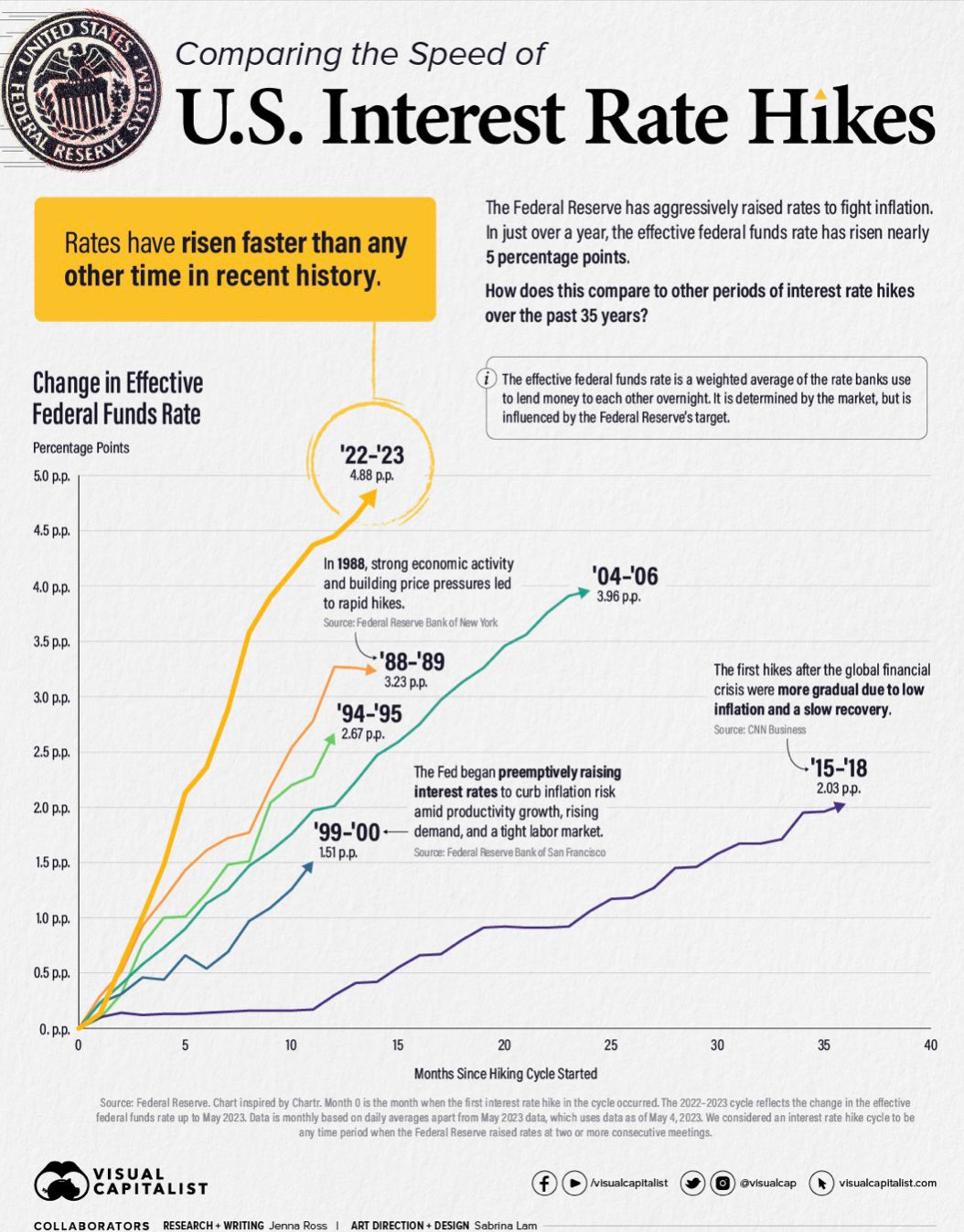

As @Gameoftrades_ on Twitter pointed out, “households' net worth is now contracting at the deepest levels since the 2008 Financial Crisis.”

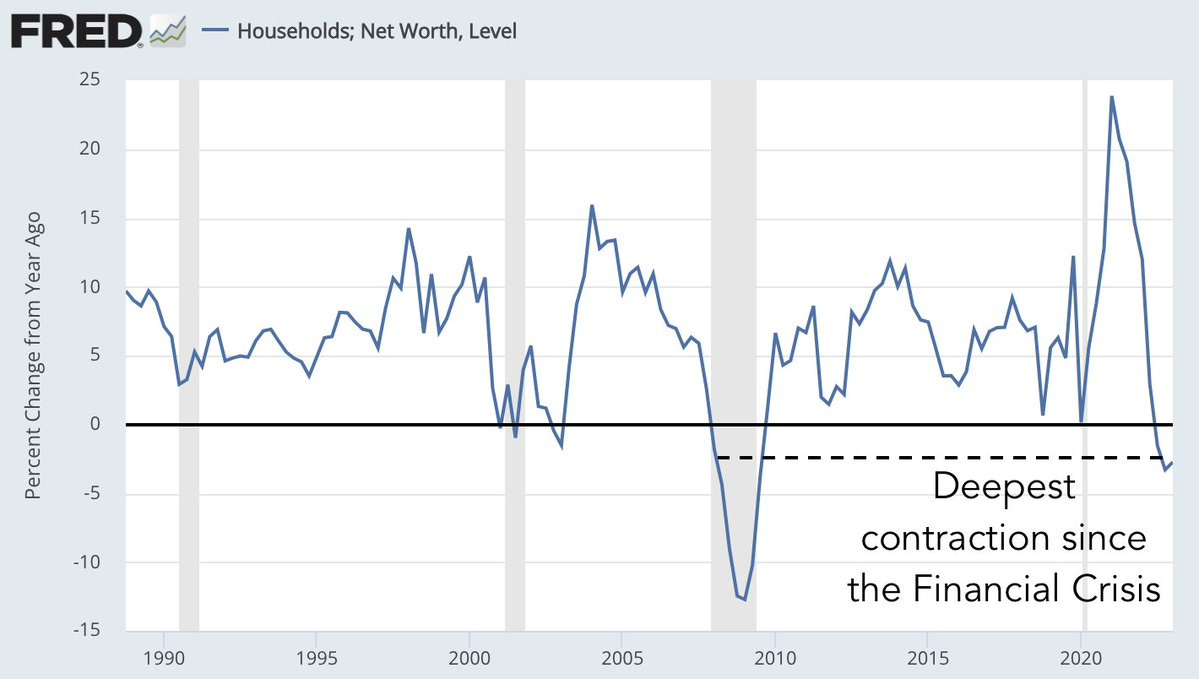

This is coinciding with retail money market funds rising at an alarming pace. Why is this important? This same development was seen before recessions related to the Dot Com bust, the Global Financial Crisis, and Covid-19.

These data points do not guarantee a recession is on the horizon, but they are definitely giving us a reason to pay close attention. In these past recessions, GDP growth has been negative, unemployment has risen, and stock prices have fallen.

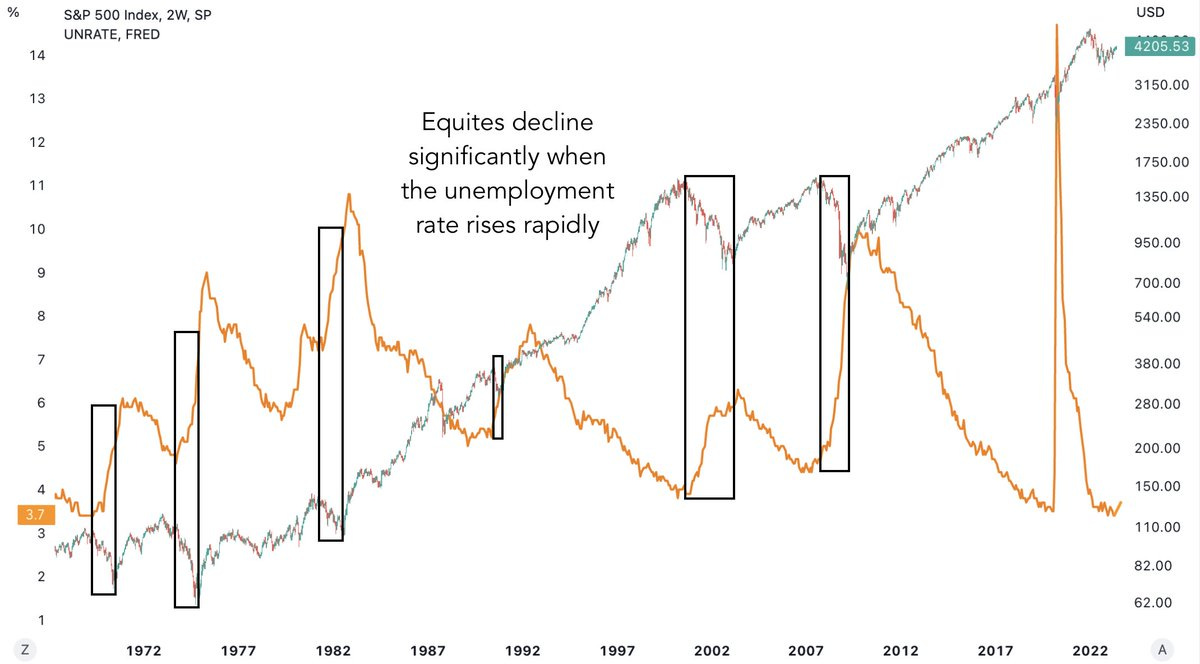

The same analyst goes on to point out that “markets tend to decline considerably when the unemployment rate rises rapidly.”

As you can see in this graphic, we had a drawdown in stock prices last year, yet the unemployment rate has remained stubbornly low. In recent months, we have seen a small creep up from 3.4% to 3.6% — that is not remotely close to past situations where the unemployment rate went up hundreds of basis points during market declines.

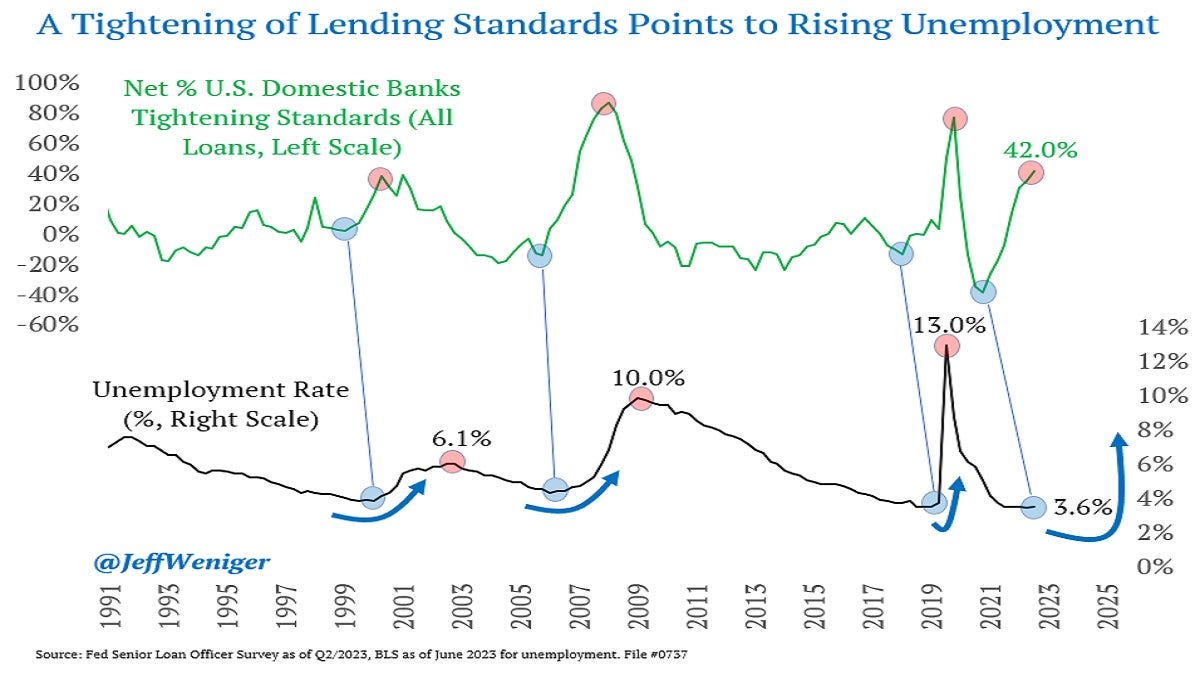

Maybe we should be worried that unemployment is going to accelerate though? WisdomTree’s Jeff Weniger made the point on Friday that “the Fed's Senior Loan Officer Survey is a leading indicator of what happens next. Credit tightens, labor markets weaken.”

Again, if these data points followed the historical trend then we are in for a lot of pain in the coming months.

No one knows what is going to happen in the future. The Fed doesn’t know. Investors don’t know. And talking heads in the media don’t know either. This is why you can see bulls and bears wagering capital in the market to express their view of the future.

With QQQ up 38% to start the year, and the SPY up 15% over the same timeframe, it is fairly clear that there are more buyers than sellers in the equities market through the first half of 2023. Add in the fact that bitcoin is up more than 80% from January to the first week of July and there is a compelling story that investors are plowing capital back into risk assets.

I chalk this up to the classic reminder — don’t listen to what people are saying, just watch what they do. You can find people across finance and tech that are convinced the bad times are just around the corner. Investors in equities and bitcoin are making a very different bet. And the Fed? They are playing chicken with a recession.

Narratives are cute, but they don’t pay the bills. The skin-in-the-game is where you want to keep your eye. Everything else is just noise. Markets are confusing and complex enough. If I had to boil down the only thing you needed to know in investing over the last 15 years, and still the single most important thing to know today, it would be “don’t fight the Fed.”

Hope you all have a great day. I’ll talk to each of you tomorrow.

-Pomp

🚨 Today’s Letter Is Brought To You By Sidebar 🚨

Land your next big career move with a Sidebar ‘Personal Board of Directors'

“Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed.” - Vice President, Roku

“You’re the average of the people you keep closest; Sidebar helps you raise that bar.” - Global Director, Reddit

“Tap into a new level of coaching support, professional development, and peer-driven accountability.” - Senior Director, Credit Karma

You can spend a decade finding your people, or apply to Sidebar and find them today.

Javier Ramírez Lugo is the founder of Cuota.

He has had an incredible experience doing sales at Zenefits, Rippling, and WeWork. He is one of the most experienced and insightful people I have ever talked to about sales, and I always learn something every time we speak. This conversation breaks down how you as a founder or a salesperson can get better, how you can drive revenue, processes, hiring, firing, how to manage, and other hacks & tricks.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Q2 Review of Bitcoin’s Performance & Health of Network

Get Better Crypto Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem: velowaitlist.com 🚨

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Note: Sidebar is a sponsor of today’s letter.