|

To investors,

I spoke this weekend at a conference focused on the intersection of economics and American leadership.

Those two topics rarely go together. Economics is reserved for the nerds and politics is reserved for the power hungry. But we must recognize that these two topics are more intertwined than we previously admitted.

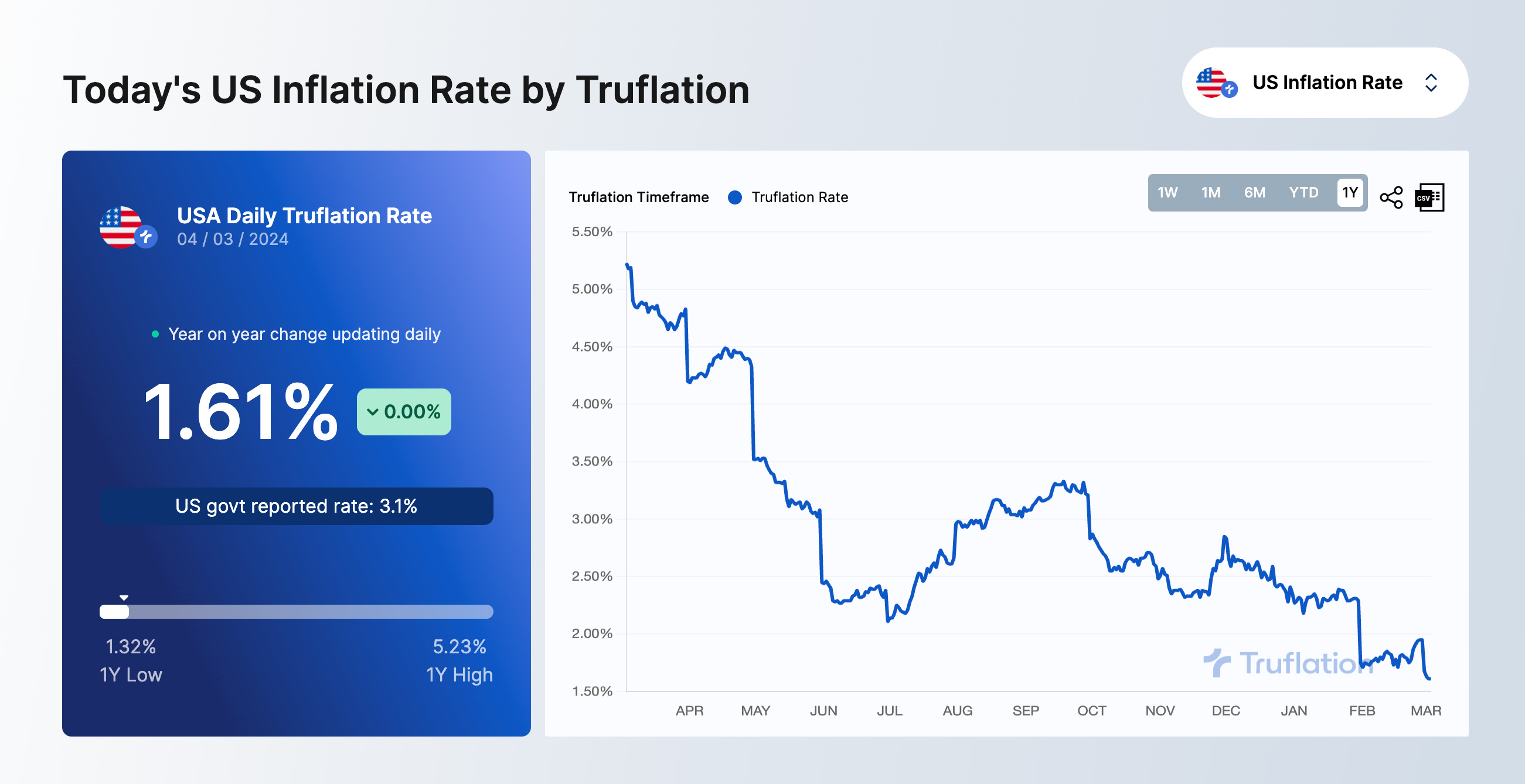

The American economy is in a precarious position. Asset prices are rocketing upwards, inflation won’t go away, and interest rates have already been increased at a record pace. The average consumer is pretending to hold it all together by spending unprecedented amounts on their credit cards and the dollar has been devalued nearly 20% since the start of 2020.

Great leadership is needed in times of turmoil.

We need incredible leaders in the White House, at the Fed, and in both Congress and the Senate. Some of you will say that great leadership is already in these positions, while others will explain how unfit the current leadership is for the moment.

Regardless of which side of the fence you fall on, it is obvious that it will take strong leadership to guide us out of this mess.

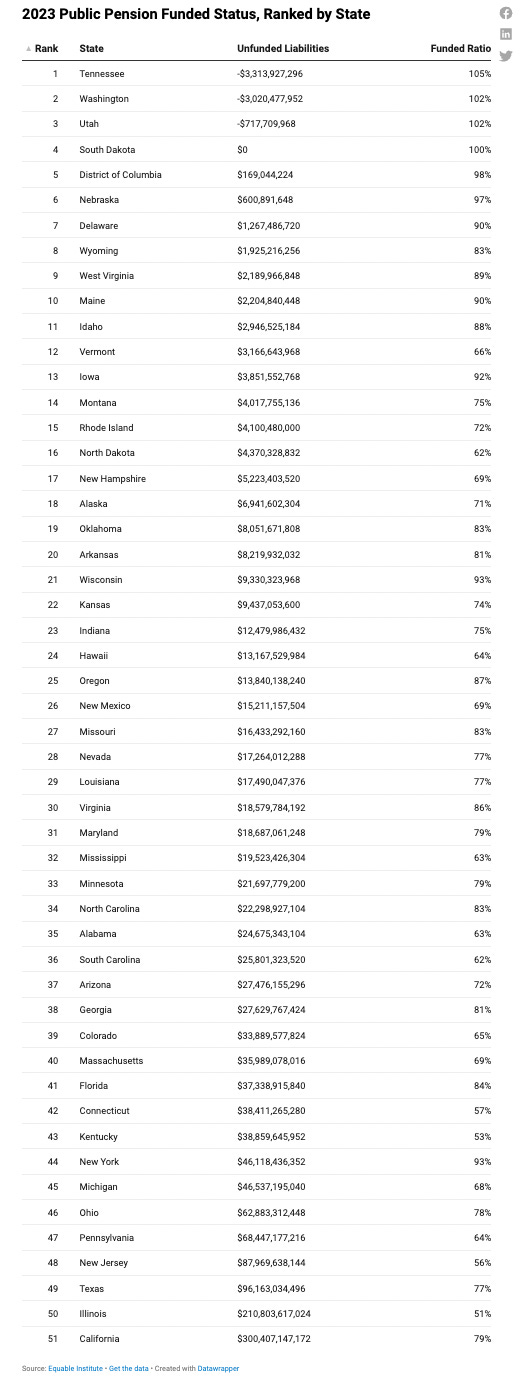

One area where we have seen crisis before is in the funding of US public pensions. According to Equable, here is how bad the situation has become:

“Public pension plans in the U.S. are available to a wide range of workers. Teachers, state and city employees, public safety officers, public utility staff, wildlife conservation officers, and more have the opportunity to collect a pension. The United States has promised at least $6.6 trillion in future retirement benefits to the members of the largest 228 public retirement systems. But nationally, the U.S. has only set aside $5.1 trillion to pay those benefits.

This means there is a national public pension funding shortfall of around $1.49 trillion, as of June 30, 2023 (formally this shortfall is called unfunded liabilities. Collectively that is just 77.4% of the money that should be in state and local pension funds today (and this percentage is called the funded ratio.”

This is a time-bomb waiting to go off in the economy. Millions of people are preparing to retire, yet the government won’t have the money to help when they are needed most.

Thankfully, a number of the CIOs at these public pensions realize they need to do something different. This includes allocating capital to areas that have been previously ignored — private equity, venture capital, bitcoin, etc.

In December 2018, I wrote to this group in a letter titled “Every Pension Fund Should Buy Bitcoin” with an explanation on why every public pension fund should purchase bitcoin. Here was my logic:

A potential solution to the pension crisis is for them to buy Bitcoin. Here is why:

Bitcoin is a non-correlated asset — This is the holy grail of any portfolio. Bitcoin’s current 180 day correlation to the S&P 500 is 0 and the correlation to the dollar index is near zero as well. Investing in non-correlated assets should reduce the risk and increase the returns of a portfolio according to modern portfolio theory.

Bitcoin has an asymmetric return profile — There is much more upside than downside in owning the asset. The downside (loss of capital) is capped at the total amount of capital invested, yet the upside is ~100X+ (if Bitcoin only becomes gold equivalent).

The modern portfolio theory argument for investing in Bitcoin is quite strong.

I continued in the same letter and explained that the pension funds only needed to put 1% of their assets into bitcoin to have a material impact:

Although I have deep conviction in Bitcoin’s future outlook, pensions should not put significant funds at risk in this investment opportunity. It is risky and speculative. They could lose 100% of the money that they invest. For that reason, each fund needs to evaluate their current situation, their goals, and the amount of capital they would be willing to lose.

If the thesis plays out how I anticipate though, an investment of 100 basis points or less would materially change the performance of each pension fund, which ultimately changes the future viability of retiring for hundreds of millions of people. These institutions have permanent, long-term capital which allows them to stomach more volatility than most investors.

Not many pension funds acted on my argument. Thankfully, there were two pension funds that did though — the Fairfax County Police Officers Retirement System and the Fairfax County Employees’ Retirement System. They were the first public pension funds to get exposure to bitcoin through a blockchain-dedicated fund that my partners and I managed. The CIOs of those pension plans, Katherine Molnar and Andrew Speller, will never get the credit they deserve for having the vision and courage to make a bitcoin allocation in 2018/2019.

The average purchase price of the Fairfax pension funds’ bitcoin position in early 2019 was under $6,000 per bitcoin. This means that the first public pension funds in America to get bitcoin exposure are up more than 10x on their bitcoin allocation.

Why is this important?

If every state pension fund had bought 1% exposure to bitcoin when I wrote the letter, the list of fully funded state pension funds would have jumped from only 4 to at least 14 state pension funds.

That is more than a 300% increase in the number of fully funded state pension funds. This doesn’t count the impact that would have occurred on the hundreds of other pension funds in America is they had all put a 1% allocation into bitcoin too.

We can’t change what has already happened, so we have to look forward. There are many people who will argue that pension funds shouldn’t buy bitcoin today because the returns have already been captured. I disagree with this thought process.

It is true that past performance does not indicate future performance, but the current fundamentals and market structure of bitcoin, specifically the drastic imbalance in supply and demand, should lead to a continued outperformance in the asset for the next few years.

The first public pension funds to invest in bitcoin are up more than 10x on their allocation to the digital currency. A few other public pension funds (Houston Firefighters, etc) have made small investments in bitcoin over the last three years. But we are nowhere near actual adoption by these asset allocators as a material percentage of their industry.

My expectation is that this under-allocation to the best performing asset of the last 15 years will change now that the bitcoin ETFs are available to these pension investment teams. Time will tell how impactful the allocation will be on performance returns. Regardless, there are tens of millions of Americans who may need bitcoin in their pension fund to ensure they are paid the amounts that have been promised them.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we look at their Weather Model and what it is telling us about stocks, bonds, bitcoin, we also talk about global liquidity, inflation, and impact of politics on financial markets.

Listen on iTunes: Click here

Listen on Spotify: Click here

Bitcoin Continues To Look Bullish Against Macro Backdrop

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.