On track. After an unprecedented plunge in March and April, economic activity has rebounded strongly since May across the advanced world. By and large, the backward-looking hard data and the co-incident as well as forward-looking surveys are in line with our late-March call for a tick-shaped recovery. After a strong but not fully V-shaped initial rebound when supply was switched on again, the pace of recovery is now flattening. Helped by a big base effect as the dismal April depressed the Q2 average, most economies look set to recoup between half and two thirds of the Q2 drop in Q3 even as the pace of monthly increases in activity slowed down over the course of the summer.

Of course, the rebound is uneven across countries and sectors. As to major countries, activity can get back to its pre-pandemic level in early 2022 in the US (huge fiscal stimulus) as well as in Germany, France and many other Eurozone countries. Held back by structurally weak Italy, theEurozone average will probably reach its pre-pandemic level of activity only in mid-2022. The Brexit-stricken UK is lagging Eurozone and may return to its late-2019 GDP only in early 2023.

Despite these differences, we look for a roughly similar sectoral pattern across most of the advanced world. We expect the upswing to unfold in four stages.

Stage 1: consumer spending on goods (May to July 2020)

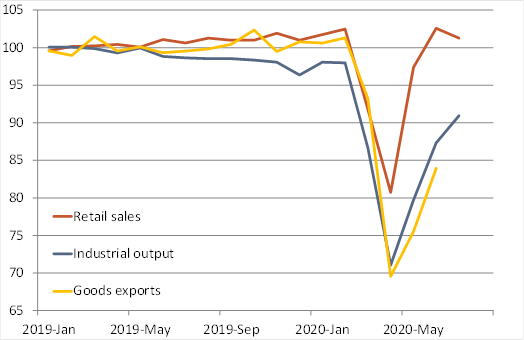

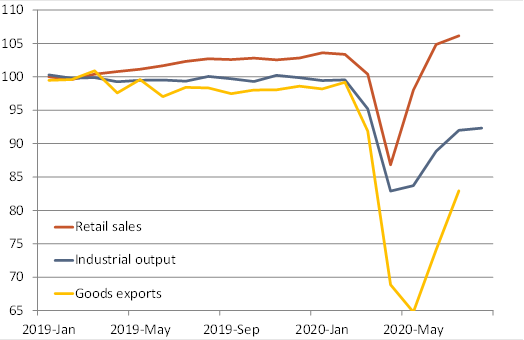

When non-essential shops and factories re-opened from late April or May onwards, consumer spending on most goods recovered fast – see charts 1 and 2. Helped by still-buoyant internet and mail-order sales, retail sales even surpassed their year-ago levels in many countries in mid-2020. Surprised by the strength of the rebound and still scarred by the lockdown experience, many shops apparently reduced inventories, ordering less than they were selling.

Stage 2: manufacturing and international trade (2H 2020)

The first stage ended roughly in July. For the next few months, we expect modest gains in consumer spending on goods at best. In countries with a new significant rise in infections, consumer confidence and spending on goods may well recede temporarily.

Instead, the continuing but less spectacular upswing is now being driven more by manufacturing. Having lagged well behind the early rebound in sales of goods, the production of and international trade in goods has room to recover further even if sales growth slowed down or even stalls for a while – see charts 1 and 2. The record low inventories-to-sales ratio at US retailers reported by the BEA is among the data to suggest a need to replenish inventories. As in stage 1, governments dole out generous dollops of survival support, augmenting incomes, limiting dismissals and helping companies to survive. However, business investment is likely to remain soft in the second half of 2020 as firms have sufficient spare capacity and remain cautious.

Stage 3: business investment and fiscal stimulus (2021-2022)

As long as key tail risks (second wave of harsh nationwide lockdowns, big US political mess) do not materialise, we expect the recovery in confidence and activity to continue. Over the course of next year, a rebound in business investment should help to drive further if more modest gains in activity, led by the more healthy firms that do not have to prioritise balance sheet repair as they did not take on too much debt in the 2020 mega-recession.

In stage 3, the role of fiscal policy will change. With firming labour markets and less depressed corporate revenues, demand for survival support will diminish. Instead, the standard fiscal stimulus will kick in with more public investment and, in many cases, the hiring of additional public sector workers. While this fiscal stimulus is being planned now, it will take time to hit the ground.

Stage 4: growth modestly above the pre-Covid trend (2023-2025?)

After returning to pre-pandemic levels, growth will continue at a rate modestly above the previous trend. While the lagged impact of monetary and fiscal stimuli supports demand, business investment will stay firm as companies restructure supply chains: In addition, a faster dispersion of cutting-edge technologies will enhance supply. While residual slack in labour markets will be absorbed gradually, core inflation rates will rise above the pre-pandemic levels – see inflation: low for longer is not forever.

During the first three stages, the combination of solid growth, low inflation and rock-bottom central bank rates will likely support financial markets. During the early phases of a new cycle, forward-looking markets can often outperform the real economy. Of course, the sweet spot of the new cycle may not last beyond roughly two years. If and when inflation hits or surpasses central bank targets in stage 4 of the upturn, a more meaningful rise in bond yields ahead of potential rate hikes later on could eventually weigh on markets.

For the full set of our calls, see Forecasts at a Glance.

Chart 1: The uneven rebound – in the Eurozone |

|

Q1 2019 = 100. Sources: Eurostat, Berenberg. |

Chart 2: The uneven rebound – in the US |

|

Q1 2019 = 100. Sources: BEA, Fed, Census Bureau , Berenberg. |

Holger Schmieding

+44 7771 920377

holger.schmieding@berenberg.com

www.berenberg.com

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html