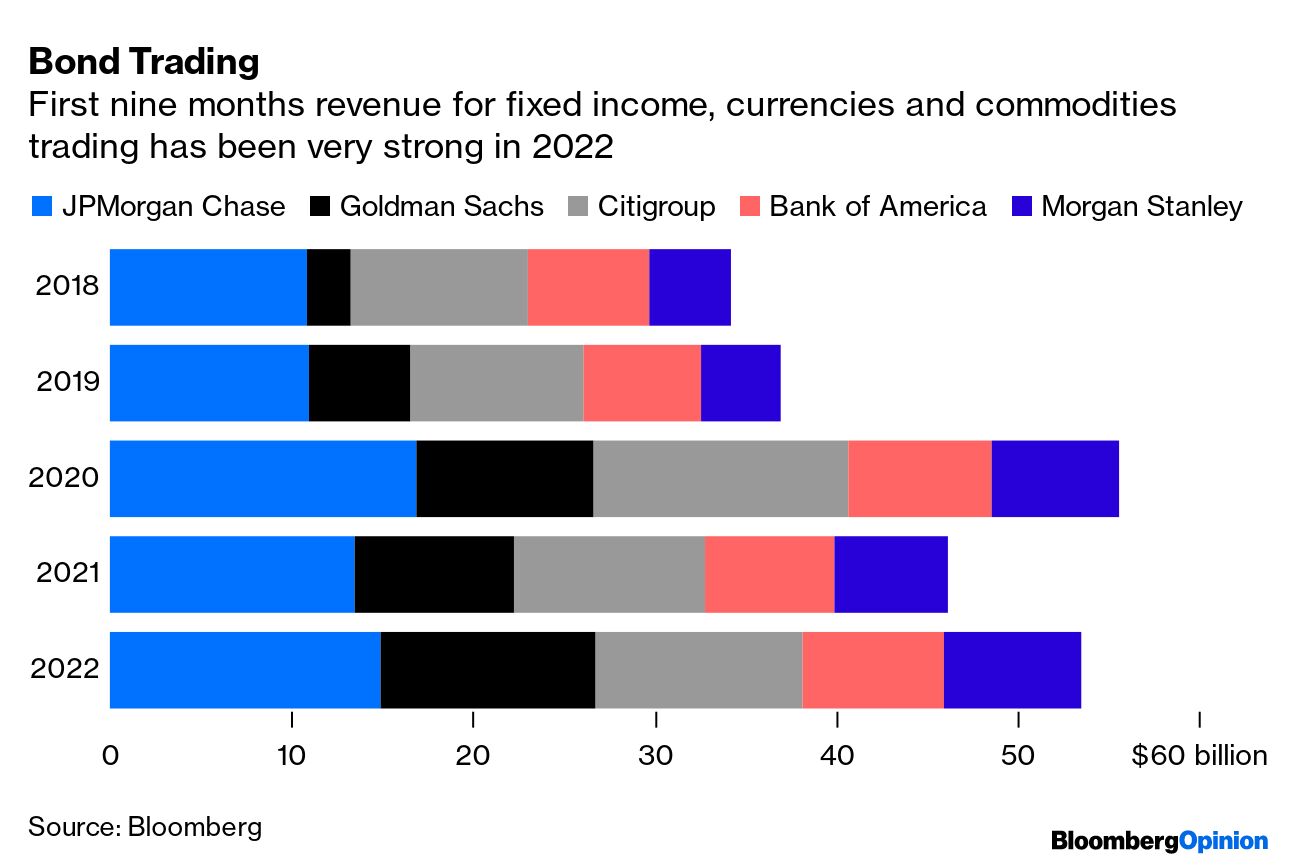

| Sam Bankman-Fried’s $30 million Bahamas penthouse looks like a dorm after the students have left for winter break. The dishwasher is full. Towels are piled in the laundry room. Bat streamers from a Halloween party are still hanging from a doorway. And then there are the shoes—dozens of sneakers and heels piled in the foyer, left behind by employees who fled last month when his cryptocurrency exchange imploded. “It’s been an interesting few weeks,” Bankman-Fried said on a muggy Saturday afternoon, eight days after FTX filed for bankruptcy. He’s shoeless, in white gym socks, a red T-shirt and wrinkled khaki shorts. Since then, he’s been making the rounds, giving his explanation of just how this calamity befell FTX, and apologizing for it profusely. Bloomberg headed to the islands to spend some time with the most famous man in crypto. This is what he had to say. —David E. Rovella The Fed still has a ways to go it seems. A new report shows US employers added more jobs than forecast last month and wages surged by the most in nearly a year, just as the Fed has made clear it wants to reduce the size of coming rate hikes. “The net read is that the labor market is still far too tight and cooling only very gradually,” Mizuho economists Alex Pelle and Steven Ricchiuto said in a note. “It suggests that the economy is resilient and can handle more rate hikes and restrictive policy for longer.” There’s still a month left, but nothing is likely to change the fact that many investors will remember 2022 as a hellscape. Still, just like casino denizens chasing their losses, investors are dialing up their risk appetites trying to win some of it back. Active stock managers are adding to positions. Option markets show a trend toward hedging (a sign professional traders are dipping back in). And demand for meme stocks springs eternal, with chat-room favorites like AMC posting big days. Here’s your markets wrap. Goldman Sachs traders, on the way to posting their biggest revenue haul in more than a decade, are in for a surprise as cost pressures force the firm’s leadership to cut their year-end bonuses. And they won’t be alone. Bankers who work on takeovers or fundraisings were always going to have a miserable time of it this bonus season, Paul J. Davies writes in Bloomberg Opinion. But traders of stocks, bonds, currencies and commodities who have been shooting the lights out must have assumed they’d be landing a nice fat check. Guess again. The Russian oil price cap has arrived. After months of hair-pulling negotiations, the biggest sanction effort against Russian oil to date is about to take effect. On Friday afternoon, European Union officials clinched a deal to cap the price of Russian crude at $60 per barrel. Anyone wanting to access key services that the EU provides—especially insurance—will have to pay that price or less. The same goes for European tankers, especially the giant Greek fleet. The EU cap is part of a global process, with other Group of Seven industrialized countries set to follow suit. This is how it’s meant to work—but there are a lot of unanswered questions. A former Amazon vice president was paid more than $800,000 in 2021 to run Jeff Bezos’s preschool network, which, for most of that year, consisted of just one location with 13 students. The Turkish city of Gaziantep historically was a crossroads of ethnicities. Now, refugees are gradually transforming it again. Syrians fleeing the brutal civil war in which Bashar al-Assad laid siege to the cultural capital of Aleppo are building a new version of the city right next door.  The Independence mosque in the Turkish city of Gaziantep. Photographer: Ozan Kose/AFP/Getty Images Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Home sellers pull properties off the market since nobody’s buying.

- The prediction for the future of the US real estate industry? Pain.

- It’s not just Covid cases rising: US flu hospitalizations double in a week.

- Joe Biden says Herschel Walker doesn’t “deserve” to be in US Senate.

- Seizing Russian yachts and mansions just got a whole lot easier.

- Woman faking pregnancy caught smuggling computer chips into China.

- Trophy Rolex, Patek and Audemars Piguet prices skid to pre-boom levels.

Our idea of a year-end report at Bloomberg Pursuits means scrolling through tasting notes for the wines we would be happy to drink again—and that deliver quality at a seriously reasonable price. This year, there’s more good-value wine than ever—including red, white, rosé, orange and sparkling everywhere from Armenia to Uruguay. So where are the best wine buys of 2022? Right here.  From left, bottles of Bohigas Rosat Brut Cava, Miotto ProFondo Col Fondo Agricolo, Paula Kornell California Brut, Langlois Brut Crémant de Loire, Jansz Premium Cuvée Brut and Schramsberg Blanc de Blancs Brut. Source: Vendors. Background: Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Sustainable Business Summitis kicking off in New York on Dec. 7 with in-depth conversations on how companies can meet their ambitious ESG goals while driving business value. Register here. |