We had zero interest rates for the better part of a decade. And one of the reasons why was because of the prevailing narrative that the economy was so weak that it couldn’t handle higher interest rates.

Well, here we are with interest rates at almost 5%, and the economy is doing just fine.

There are three takeaways here:

- You should never underestimate the resilience of an economy.

Large, developed, interconnected economies are not accident-prone—they are accident-resistant. As long as they are free.

There are periods of overinvestment, which lead to malinvestment, which leads to a contraction, which leads to unemployment, and people improvise and figure out how to do something else. As long as this process isn’t interfered with, a large, interconnected economy can bounce back from just about anything. It doesn’t need zero interest rates for 10 years.

- There may be a natural limit to how much we can hike interest rates.

This is well-telegraphed. Every rando egg Twitter account thinks that the Fed will stop hiking rates because of the ever-larger interest expense on the national debt.

I assure you this is not a concern for the Fed. The Fed operates in a vacuum. And if it ever did become a concern, where the White House was truly influencing monetary policy, you would want to buy the ripsnot out of gold. But there is no indication of that yet.

- There might be something wrong with the transmission mechanism.

Are we experiencing rate hikes in a different way in 2023 than we were in 1980?

After explosive payroll and retail sales numbers, people are coming around to the idea that rates might be higher, and they might be higher for longer. To wit, all the rate cuts that were priced in through the end of 2023 are now gone.

And you know what the amazing part about that is? It was relatively painless. I thought for sure if those rate cuts got priced out, the stock market would be 10% lower.

This is all a long way of saying that things are not that bad. They never are.

The Bears

There are a lot of people rooting for the economy to fail.

For example, you might be long interest rate futures (giving you exposure to lower rates), and you might want to be the recipient of some weak economic data, so your contractionary thesis plays out.

Or you might just be a butthead who wants to watch the world burn. There are those people, too.

Learn How to Build “The Portfolio All Investors Should Have.”

In this time-sensitive training, we show you why it’s important to have an

elementary, foundational knowledge of this straightforward and easy-to-understand asset class—BONDS. Click here to learn more. (From our partners at Jared Dillian Money.) |

Everyone said that the soft landing was impossible. Well, this walks and talks like a soft landing. Of course, the final chapters have not been written. Inflation could come back, in which case we would get a repeat of 2022. The labor market might gag one day. Everyone seems to be expecting it, so it probably won’t happen. The housing market might gag. Everyone seems to be expecting that, too, so that probably won’t happen.

Honestly, as I look around, I don’t see too many ways in which the economy will fail, at least in the short term. The question is: How does the Fed respond to that? After already having hiked rates about 500 basis points with virtually no ill effects on the real economy, does it hike rates more?

Well, one argument that has been put forth by some people on the Federal Open Market Committee (FOMC) is that it should pause and see the effects of the rate hikes already performed as they work their way through the system. That is a reasonable argument.

There are others who want to keep hiking simply because the economy is strong and they have the ability to. The yield curve is telling a different story, though, namely that the Fed has already done too much. But the bond market has been pretty dumb so far and has had to print a couple of retractions. Very tough to bet on the bond market being wrong, but that’s how you’ve made money in fixed income this year.

Growth Stocks

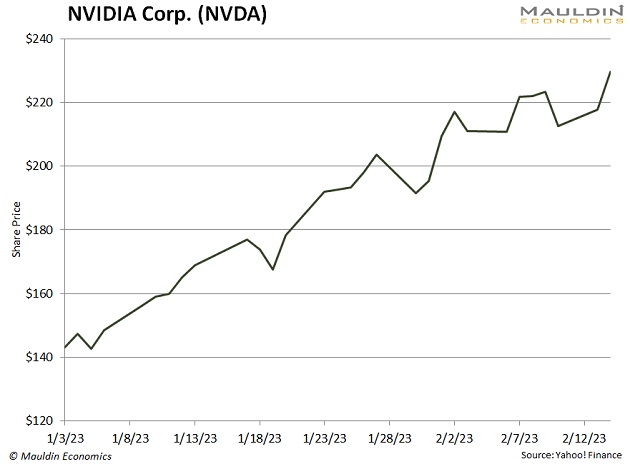

Concurrent to all of this is the fact that growth stocks are ripping once again. Seen a chart of NVIDIA Corp. (NVDA) lately?

Wow. Higher lows and higher highs. I checked my portfolio yesterday, and the two growth stocks that I owned were the only things that were up.

I’m a newsletter writer who doesn’t have all the answers, but one thing I have been right about is the direction, going back to last October.

In 2022, we had a mass panic liquidation of stocks, particularly growth stocks. The bear market has ended, and a new bull market has begun. One or two more 25-basis-point rate hikes out of the Fed won’t change the shape of the earth.

Jared Dillian

Suggested Reading...