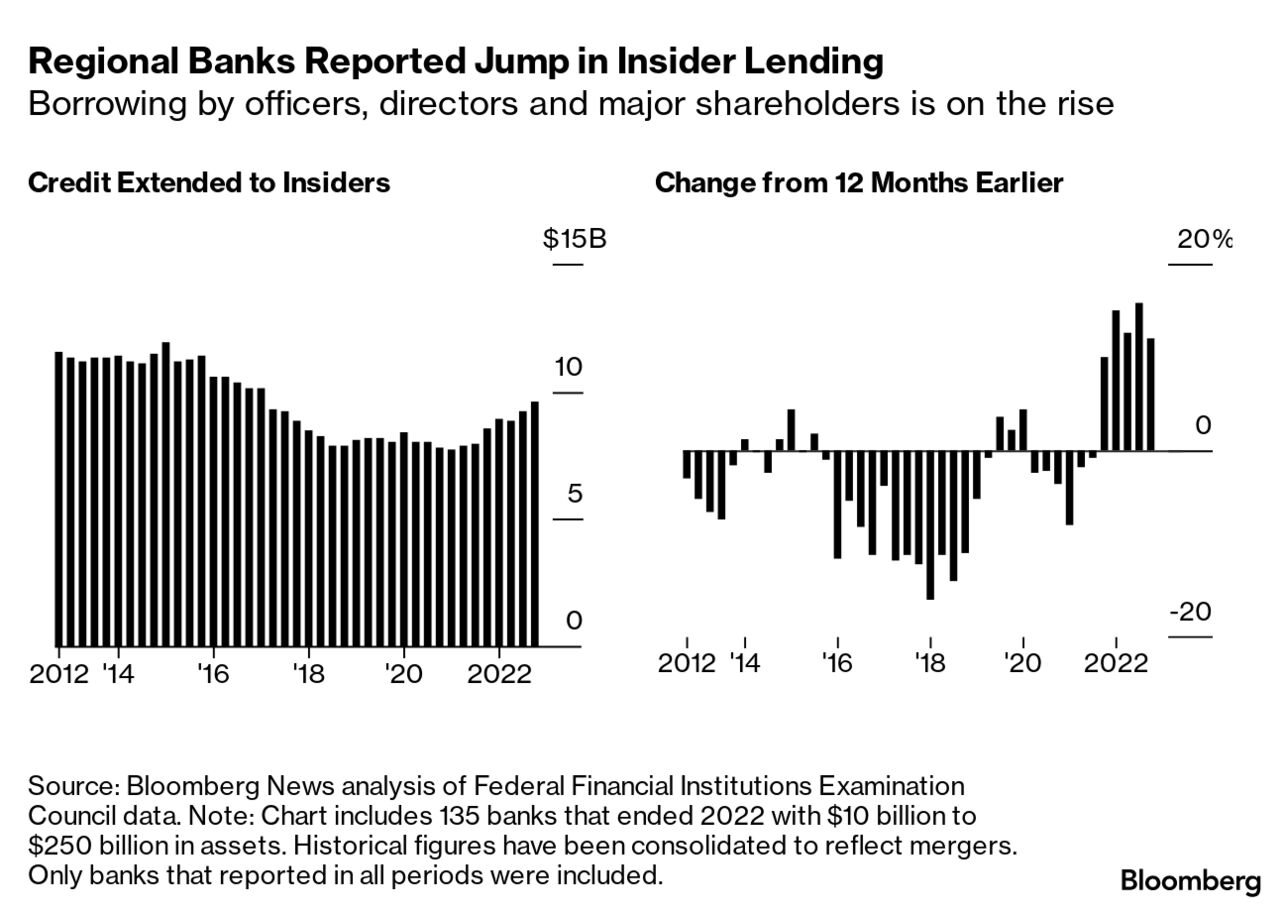

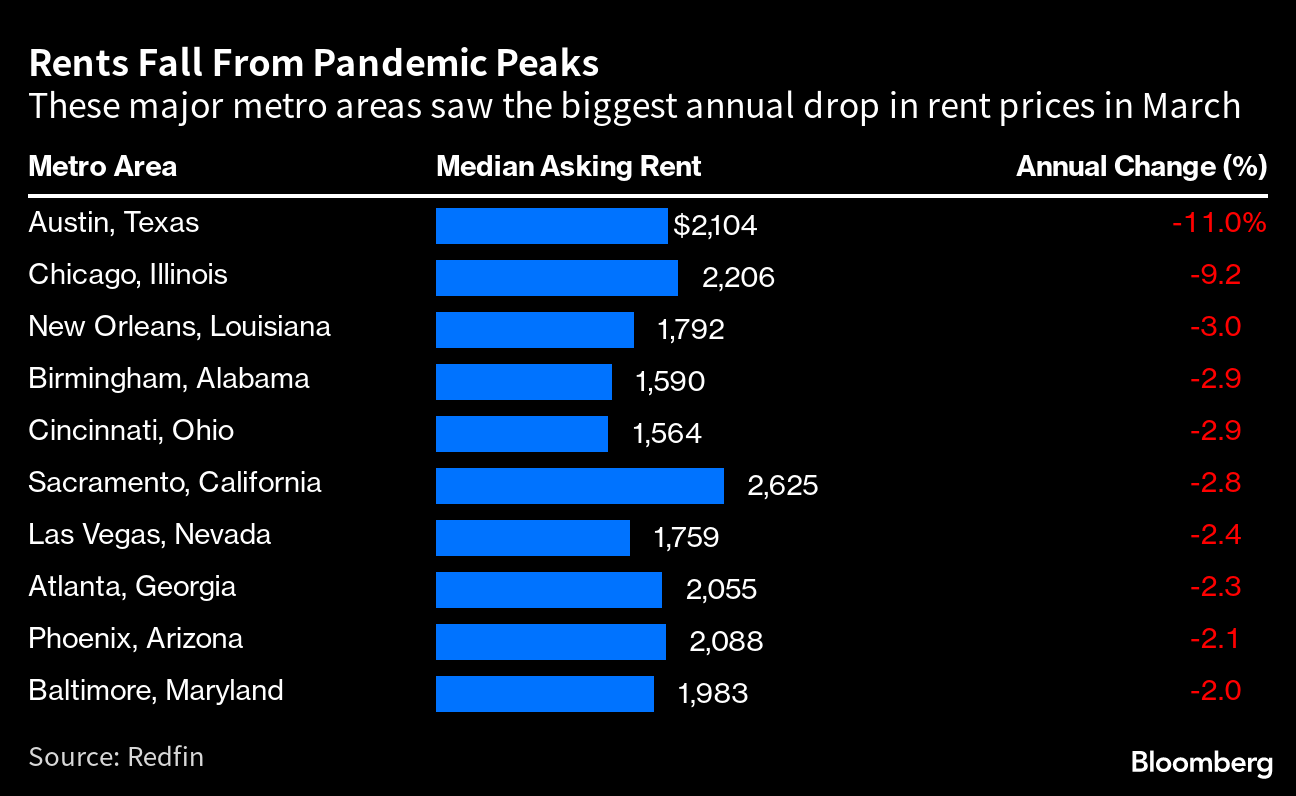

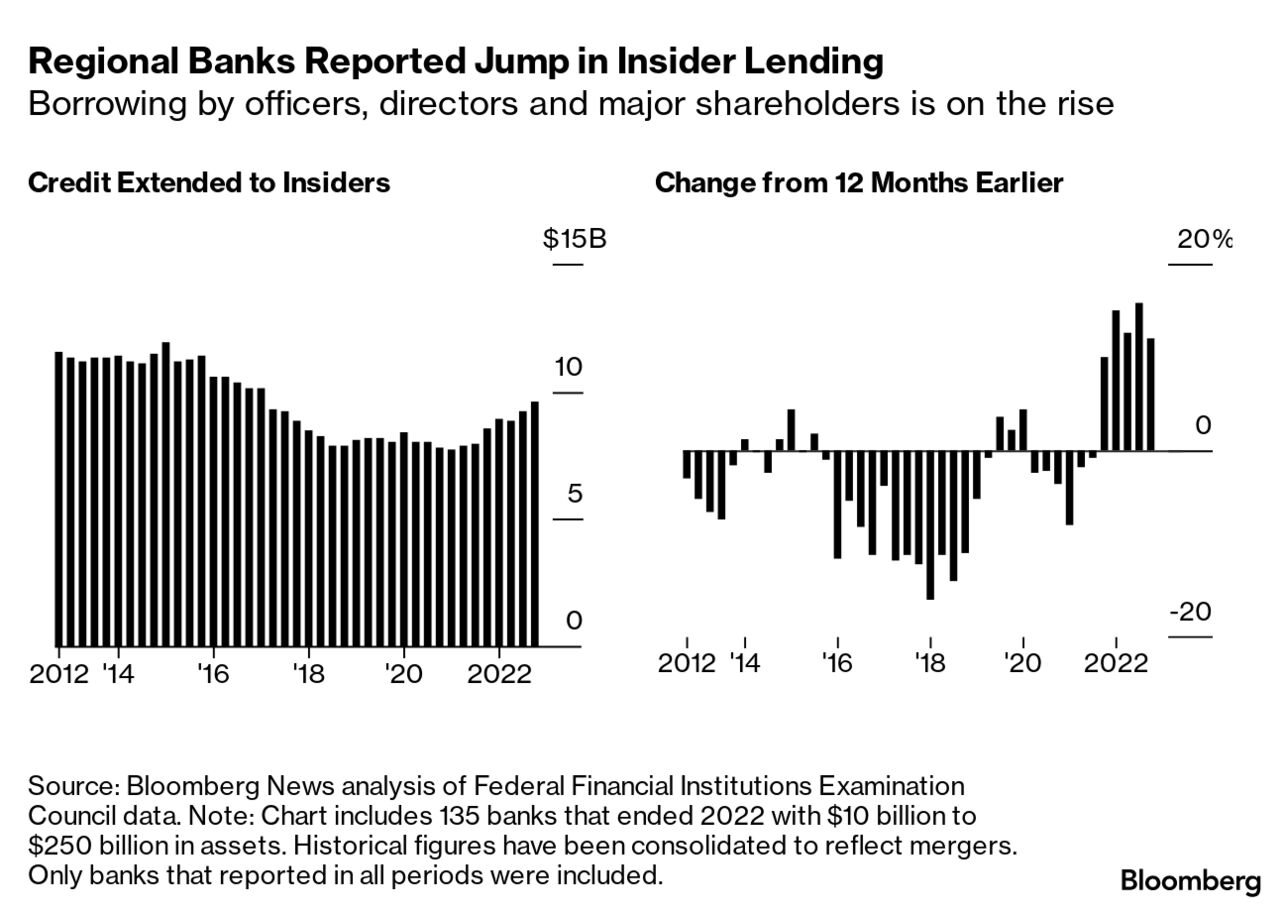

| Not long before the US Federal Reserve began lifting interest rates to tamp down inflation, regional banks across the US reported a surge in lending to a group of well-connected people: insiders. Their own directors, officers and major shareholders were getting a lot of cash. The trend continued through all of last year, reaching almost $10 billion by the end of 2022, according to a Bloomberg News analysis. That was 12% more than a year earlier and represented the largest annual jump in lending to insiders, along with their related interests, in at least a decade. As it turns out, some of the biggest increases were at firms that have recently collapsed or are struggling. Familiar names among the regional banks that more than doubled credit extended to insiders last year were Silicon Valley Bank, Western Alliance Bank and First Republic Bank.  None of the lenders or their officers, directors or major shareholders has been accused of wrongdoing, and the banks have said they extended credit on similar terms to insiders as they did to other clients. Still, the recent industry turmoil has put a spotlight on stock trading and borrowing by people with power over banks. William Black, an associate professor of economics and law at the University of Missouri, observes that when a board member or executive borrows from a bank he or she oversees, “you have an inherent conflict of interest. And, worse—if things get difficult—that conflict of interest becomes extremely acute.” —David E. Rovella The US economy moderated gradually as the first quarter drew to a close, with elevated inflation and borrowing costs restricting household spending and manufacturing activity. March retail sales slid by the most in four months, largely explained by a slump in receipts at gas stations and a slowdown at auto dealers. A drop in factory output exceeded expectations. The latest batch of data is consistent with a steady cooling of economic activity late in the quarter (rather than a more significant slump in light of stress in the banking sector). Traders still expect the Fed will opt for another quarter-point hike in rates at its next meeting, but some policymakers have recently hinted that they’d be open to a pause. You may recall that tectonic moment in 2019 when Charles Schwab slashed its trading commissions to zero, forcing competitors to adapt. It was a big bet that its bank, rather than its well-known discount brokerage, would keep driving profits. Well, for a while, it worked. The pandemic hit, interest rates touched historic lows, and Schwab raked in billions of dollars as the fees it had forsaken were offset by cash flowing in from its banking operation. But last month’s collapse of three US banks, the industry’s worst crisis since 2008, has turned that wager on its head. Fallout from Credit Suisse’s demise landed squarely on Mitsubishi UFJ Financial Group’s wealthy clients, who are said to have lost more than $700 million on the Swiss bank’s riskiest bonds. While MUFG is hardly the only firm to get caught up in the debacle, the loss tally offers one of the first glimpses into how badly clients of a major investment bank were burned by the writedown. Some of Ukraine’s European allies are increasingly skeptical its military will be able to make a decisive breakthrough this year because Russia has had time to dig in. The mood among Western officials marks a sharp departure from late last year, when Kyiv surprised its allies—as well as the Kremlin—with a pair of successful counteroffensives that recaptured large swathes of occupied land. Meanwhile Vladimir Putin is laying the groundwork for a new draft to backfill Russia’s massive losses while his forces continue to pound the destroyed city of Bakhmut.  Artillery shells at the Scranton Army Ammunition Plant in Pennsylvania on April 12, where the US is ramping up production for shipments to Ukraine. Photographer: Hannah Beier/Getty Images Some Republicans are defending the man accused of perpetrating the biggest leak of American secrets in decades. Far-right Representative Marjorie Taylor Greene said Jack Teixeria “told the truth” and is an enemy of President Joe Biden because he’s “white, male, christian, and antiwar.” Keith Kellogg, a retired lieutenant general and former national security adviser to then-Vice President Mike Pence, criticized Greene and other members of the GOP who have voiced praise for the suspect, who made his first court appearance Friday in Boston. “Those on the right who are lauding the leaker as a hero are sorely mistaken,” Kellogg said on social media. “There is nothing honorable about compromising our national security.” Teixeria has yet to enter a plea. Rent in the US fell last month for the first time since March 2020, when the pandemic first pushed much of the world into lockdown. The median asking rent fell by 0.4% year-over-year to $1,937, the lowest level in 13 months. It’s a dramatic shift from just one year earlier when prices surged almost 18% and some renters were faced with bidding wars. Apple is ramping up testing of fresh Macs with processors on par with the current M2 chip, making headway on key new machines that could help reverse a sales decline. Apple is counting on the new computers to entice shoppers after the worst Mac slump since the dot-com bust in 2000. Shipments plunged more than 40% in the first quarter. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Bloomberg Podcasts: How to get a 7% return without risky stocks.

- Bloomberg Podcasts: The case for a coming 22% drop in the S&P 500.

- Bloomberg Opinion: Boeing just can’t seem to get out of its own way.

- Bloomberg CityLab: The pandemic’s “urban exodus” was overblown.

- Hermes sales jump as China and US shoppers snap up Kelly bags.

- Jeff Bezos’s $500 million superyacht is undergoing sea trials.

- How to fly to the Hamptons this summer for only $1 (sort of).

For the best odds of getting into New York’s most exclusive new restaurant, you need to be a very specific type of person: one who holds an American Express Centurion Card, otherwise known as the Black Card. Opened in mid-March, Centurion New York is effectively a dining club for those with the ultimate status symbol. It occupies the 17,000-square-foot 55th floor of the glossy new One Vanderbilt skyscraper, towering over Manhattan’s Grand Central Terminal. The constantly evolving menu is by Daniel Boulud, and the food delivers enough drama and decadence to pull your attention away from the knockout city views—a panoramic rarity in Midtown dining. But first you have to get in.  A private dining room at American Express’s Centurion New York restaurant Photographer: Gabby Jones/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Transformation in a Time of Uncertainty: Join us in a city near you for Bloomberg’s Intelligent Automation briefing. Top business and IT executives are gathering to explore ways to offset economic pressures and help organizations thrive by enhancing operational efficiencies. Roadshow cities include New York on May 4; San Francisco on June 20; London on Sept. 20; and Toronto on Oct. 19. Register here.

|